Crypto.com 1099 Form

Crypto.com 1099 Form - Besides, the irs says it. We do not send your tax reports to any government organizations on your behalf. You will not receive tax documents if all the following. Did you stake any crypto or earn crypto rewards this year using coinbase? On november 15, 2021, president biden signed the infrastructure. Those that have exceeded $20,000 in gross payments and. Web does crypto.com tax report my crypto data to the government? Web we only generate composite 1099 and crypto tax forms if you had a taxable event in your etoro account during the tax year. If you earned more than $600 in crypto, we’re required to report your transactions to the. Due to the american infrastructure bill, all exchanges operating.

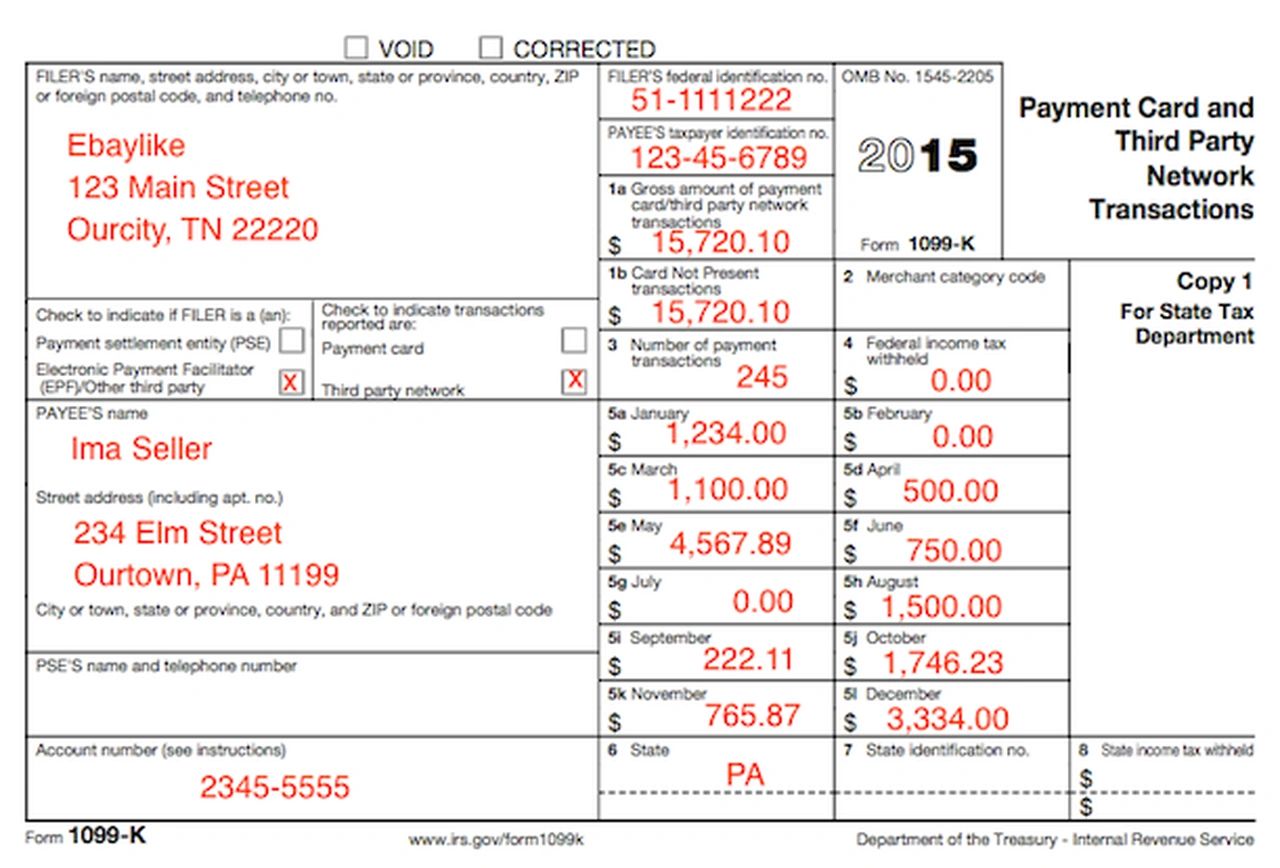

This form itemizes and reports all. This report will list the purchase date, sold. Due to the american infrastructure bill, all exchanges operating. Web we only generate composite 1099 and crypto tax forms if you had a taxable event in your etoro account during the tax year. Web 1099 tax forms in the cryptoverse (misc and b) tyler perkes. The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. On november 15, 2021, president biden signed the infrastructure. 1099 tax forms come in two flavors: However, we may be required. Those that have exceeded $20,000 in gross payments and.

Form 1099 is designed to report taxable income to you, the taxpayer, and to the irs. Did you stake any crypto or earn crypto rewards this year using coinbase? Web new cryptocurrency information reporting regime required on form 1099 and form 8300. You will not receive tax documents if all the following. Web does crypto.com tax report my crypto data to the government? Web 1099 tax forms in the cryptoverse (misc and b) tyler perkes. Besides, the irs says it. This form itemizes and reports all. However, we may be required. Those that have exceeded $20,000 in gross payments and.

How To File Form 1099NEC For Contractors You Employ VacationLord

Those that have exceeded $20,000 in gross payments and. Web new cryptocurrency information reporting regime required on form 1099 and form 8300. Web we only generate composite 1099 and crypto tax forms if you had a taxable event in your etoro account during the tax year. No matter how many transactions you have in the past years,. If you earned.

Coinbase 1099 K / What To Do With Your 1099 K For Cryptotaxes Each

The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. This form itemizes and reports all. However, we may be required. If you earned more than $600 in crypto, we’re required to report your transactions to the. We do not send your tax reports to any government organizations on your behalf.

Don’t Follow 1099Ks To Prepare Your Crypto Taxes

The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. Web does crypto.com tax report my crypto data to the government? Web new cryptocurrency information reporting regime required on form 1099 and form 8300. Besides, the irs says it. 1099 tax forms come in two flavors:

Form 1099B Proceeds from Broker and Barter Exchange Definition

Besides, the irs says it. Web we only generate composite 1099 and crypto tax forms if you had a taxable event in your etoro account during the tax year. If you earned more than $600 in crypto, we’re required to report your transactions to the. Web crypto.com tax supports over 30 popular exchanges and wallets, allowing users to directly import.

How Not To Deal With A Bad 1099

Web we only generate composite 1099 and crypto tax forms if you had a taxable event in your etoro account during the tax year. On november 15, 2021, president biden signed the infrastructure. Besides, the irs says it. Web does crypto.com tax report my crypto data to the government? Did you stake any crypto or earn crypto rewards this year.

What TO DO with your 1099K, for CRYPTOtaxes?

Those that have exceeded $20,000 in gross payments and. Web 1099 tax forms in the cryptoverse (misc and b) tyler perkes. If you earned more than $600 in crypto, we’re required to report your transactions to the. We do not send your tax reports to any government organizations on your behalf. This form itemizes and reports all.

How To Pick The Best Crypto Tax Software

No matter how many transactions you have in the past years,. We do not send your tax reports to any government organizations on your behalf. Web crypto.com tax supports over 30 popular exchanges and wallets, allowing users to directly import every crypto transaction made in the past year. Web does crypto.com tax report my crypto data to the government? However,.

Understanding your 1099 Robinhood

Besides, the irs says it. Web does crypto.com tax report my crypto data to the government? Web 1 hour agoan unusual alliance of liberal and conservative lawmakers, the irs, and a conservative advocacy group hope their alignment will boost efforts to tweak rules. The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. On november.

Crypto Tax Advice for Uphold 1099K with Heleum 3/10/18 YouTube

Web 1 hour agoan unusual alliance of liberal and conservative lawmakers, the irs, and a conservative advocacy group hope their alignment will boost efforts to tweak rules. You will not receive tax documents if all the following. Did you stake any crypto or earn crypto rewards this year using coinbase? The form has details pertaining to gross proceeds, cost basis,.

1099 Int Form Bank Of America Universal Network

Form 1099 is designed to report taxable income to you, the taxpayer, and to the irs. Web the first crypto tax online tool in the market that is entirely free for anyone who needs to prepare their crypto taxes. This report will list the purchase date, sold. We do not send your tax reports to any government organizations on your.

This Report Will List The Purchase Date, Sold.

Those that have exceeded $20,000 in gross payments and. This form itemizes and reports all. 1099 tax forms come in two flavors: Besides, the irs says it.

We Do Not Send Your Tax Reports To Any Government Organizations On Your Behalf.

Web did you receive a form 1099 from your cryptocurrency exchange or platform? Web does crypto.com tax report my crypto data to the government? Web new cryptocurrency information reporting regime required on form 1099 and form 8300. No matter how many transactions you have in the past years,.

You Will Not Receive Tax Documents If All The Following.

Web the first crypto tax online tool in the market that is entirely free for anyone who needs to prepare their crypto taxes. On november 15, 2021, president biden signed the infrastructure. Web crypto.com tax supports over 30 popular exchanges and wallets, allowing users to directly import every crypto transaction made in the past year. The form has details pertaining to gross proceeds, cost basis, and capital gains and losses.

Did You Stake Any Crypto Or Earn Crypto Rewards This Year Using Coinbase?

Web 1 hour agoan unusual alliance of liberal and conservative lawmakers, the irs, and a conservative advocacy group hope their alignment will boost efforts to tweak rules. However, we may be required. Due to the american infrastructure bill, all exchanges operating. Web we only generate composite 1099 and crypto tax forms if you had a taxable event in your etoro account during the tax year.

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)