Form 8938 書き方

Form 8938 書き方 - Web form 8938 is used by certain u.s. Web form 8938はfbarと似ていますが、管轄の法律が title 26の税制 となります。また、開示する内容も多少異なります。. When and how to file attach form 8938 to. Web filing form 8938 is only available to those using turbotax deluxe or higher. Web if you are required to file form 8938, you must report your financial accounts maintained by a foreign financial institution. We summarize the form 8938 instructions for you. The goal of this summary is to provide some information, help, and hopefully some clarity about form. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. Attach form 8938 to your annual return and file by the due date (including extensions) for that return. When and how to file attach form 8938 to your annual return and file by.

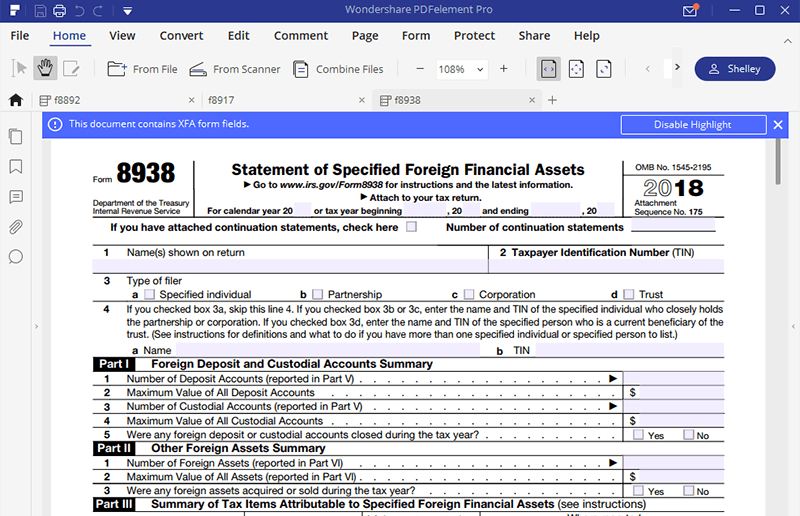

When and how to file attach form 8938 to. Web filing form 8938 is only available to those using turbotax deluxe or higher. Web form 8938 is used by certain u.s. The goal of this summary is to provide some information, help, and hopefully some clarity about form. Web if you are required to file form 8938, you must report your financial accounts maintained by a foreign financial institution. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. November 2021) statement of specified foreign financial assets department of the treasury internal revenue service go to www.irs.gov/form8938 for. Web 米国外金融資産の報告義務(form fincen 114,form 8938). Form 8938を記載のうえ、irsに提出をします。tax returnのファイルには、credit karmaや、turbotax などを利用している方が多. When and how to file attach form 8938 to your annual return and file by.

Examples of financial accounts include:. Web if you are required to file form 8938, you must report your financial accounts maintained by a foreign financial institution. Web form 8938はfbarと似ていますが、管轄の法律が title 26の税制 となります。また、開示する内容も多少異なります。. Web when and how to file. Web filing form 8938 is only available to those using turbotax deluxe or higher. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. Web form 8938はfbarと似ていますが、開示する内容も多少異なります。 ffbarは残高の開示のみですが、form 8938では、海外金融資産からの利子収入、配. When and how to file attach form 8938 to. Form 8938を記載のうえ、irsに提出をします。tax returnのファイルには、credit karmaや、turbotax などを利用している方が多. To get to the 8938 section in turbotax, refer to the following instructions:

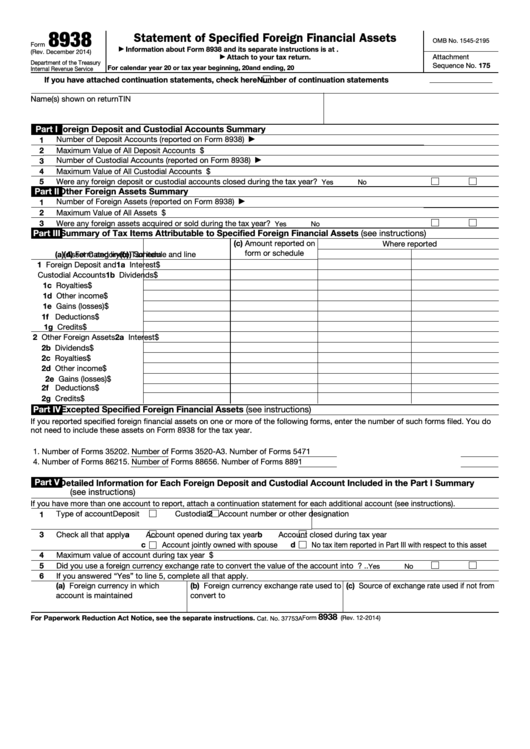

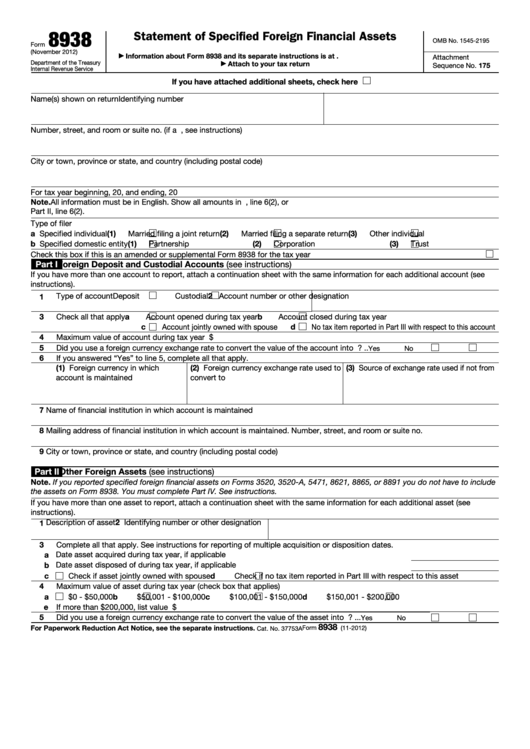

Fillable Form 8938 Statement Of Specified Foreign Financial Assets

When and how to file attach form 8938 to. Web if you are required to file form 8938, you must report your financial accounts maintained by a foreign financial institution. Examples of financial accounts include:. Web form 8938はfbarと似ていますが、管轄の法律が title 26の税制 となります。また、開示する内容も多少異なります。. Use form 8938 to report your.

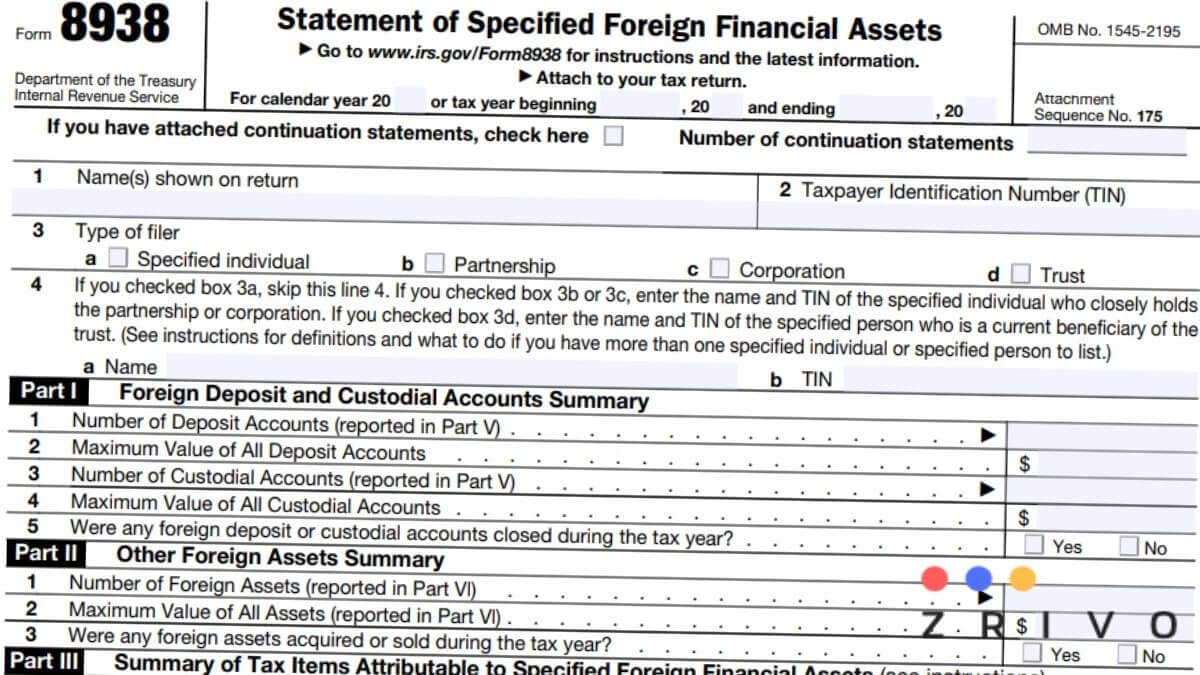

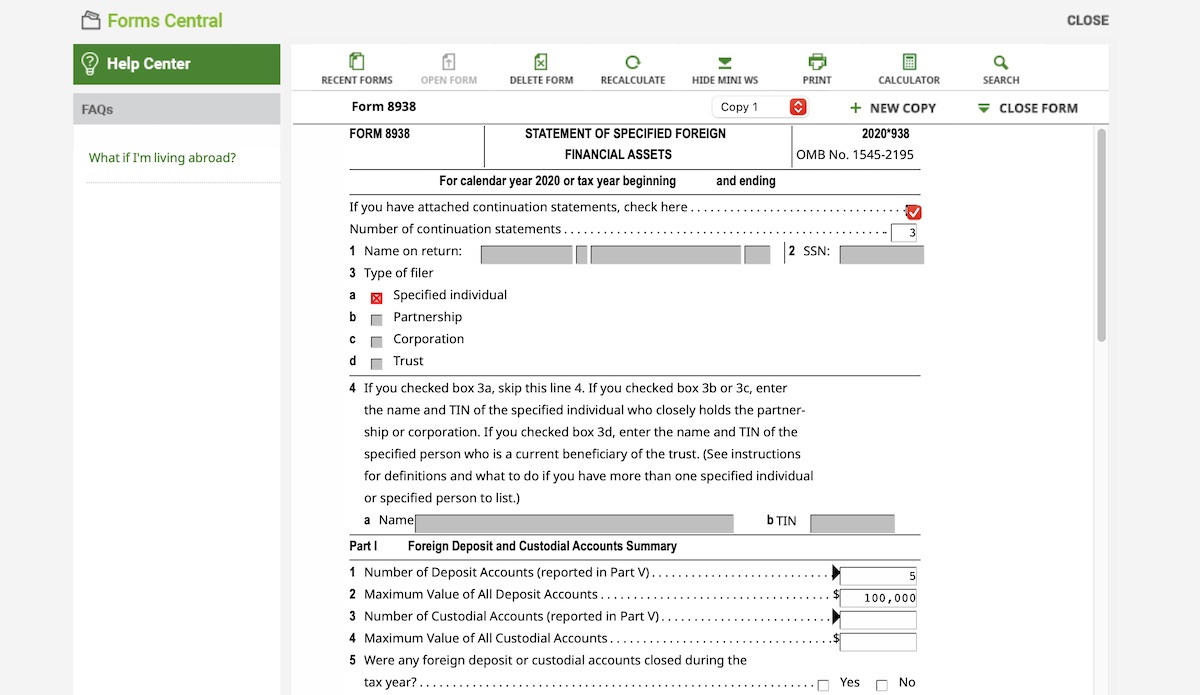

8938 Form 2021

You must specify the applicable calendar year or. When and how to file attach form 8938 to. Web form 8938はfbarと似ていますが、開示する内容も多少異なります。 ffbarは残高の開示のみですが、form 8938では、海外金融資産からの利子収入、配. When and how to file attach form 8938 to your annual return and file by. Attach form 8938 to your annual return and file by the due date (including extensions) for that return.

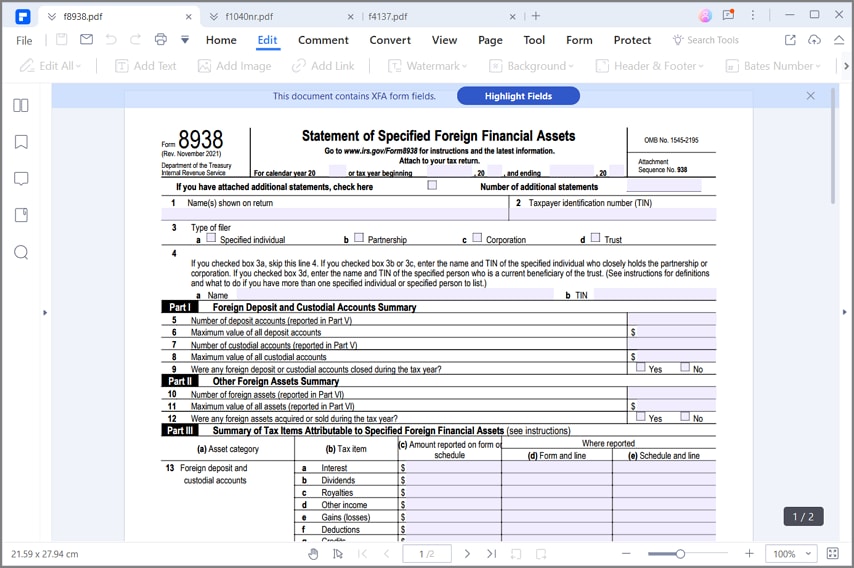

IRS Form 8938 How to Fill it with the Best Form Filler

Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. November 2021) statement of specified foreign financial assets department of the treasury internal revenue service go to www.irs.gov/form8938 for. Use form 8938 to report your. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer.

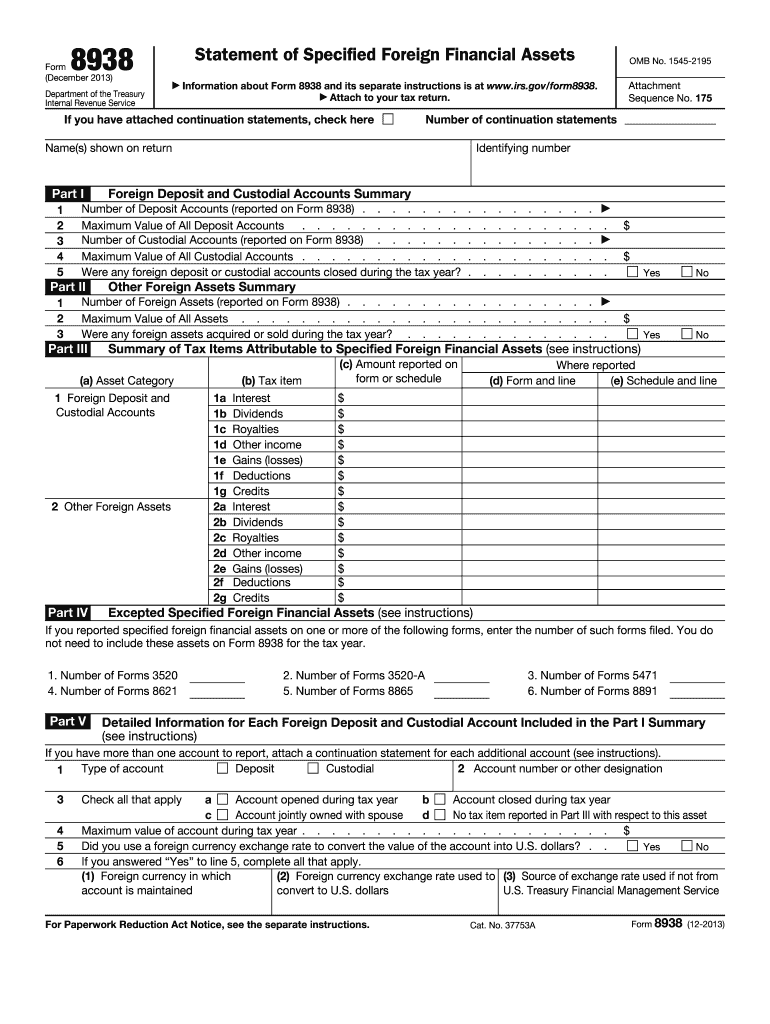

Form 8938 Blank Sample to Fill out Online in PDF

When and how to file attach form 8938 to. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. When and how to file attach form 8938 to your annual return and file by. Web form 8938はfbarと似ていますが、管轄の法律が title 26の税制 となります。また、開示する内容も多少異なります。. To get to the 8938.

2013 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Web when and how to file. November 2021) statement of specified foreign financial assets department of the treasury internal revenue service go to www.irs.gov/form8938 for. We summarize the form 8938 instructions for you. When and how to file attach form 8938 to. Web form 8938 is used by certain u.s.

IRS Form 8938 How to Fill it with the Best Form Filler

Web form 8938 is used by certain u.s. Attach form 8938 to your annual return and file by the due date (including extensions) for that return. When and how to file attach form 8938 to. The goal of this summary is to provide some information, help, and hopefully some clarity about form. Web if you are required to file form.

Fillable Form 8938 Statement Of Specified Foreign Financial Assets

The goal of this summary is to provide some information, help, and hopefully some clarity about form. Attach form 8938 to your annual return and file by the due date (including extensions) for that return. Web filing form 8938 is only available to those using turbotax deluxe or higher. Web information about form 8938, statement of foreign financial assets, including.

Form 8938, Statement of Specified Foreign Financial Assets YouTube

Web 米国外金融資産の報告義務(form fincen 114,form 8938). Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. When and how to file attach form 8938 to your annual return and file by. When and how to file attach form 8938 to. Web information about form 8938, statement.

もう少し詳しく。 Form W4 源泉徴収額申告書

You must specify the applicable calendar year or. To get to the 8938 section in turbotax, refer to the following instructions: Examples of financial accounts include:. When and how to file attach form 8938 to. When and how to file attach form 8938 to your annual return and file by.

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

When and how to file attach form 8938 to your annual return and file by. Web form 8938はfbarと似ていますが、開示する内容も多少異なります。 ffbarは残高の開示のみですが、form 8938では、海外金融資産からの利子収入、配. Web form 8938はfbarと似ていますが、管轄の法律が title 26の税制 となります。また、開示する内容も多少異なります。. We summarize the form 8938 instructions for you. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010.

We Summarize The Form 8938 Instructions For You.

When and how to file attach form 8938 to. Web form 8938はfbarと似ていますが、開示する内容も多少異なります。 ffbarは残高の開示のみですが、form 8938では、海外金融資産からの利子収入、配. Web when and how to file. You must specify the applicable calendar year or.

Web Form 8938 Reporting Applies For Specified Foreign Financial Assets In Which The Taxpayer Has An Interest In Taxable Years Starting After March 18, 2010.

Use form 8938 to report your. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Attach form 8938 to your annual return and file by the due date (including extensions) for that return. Web 米国外金融資産の報告義務(form fincen 114,form 8938).

Examples Of Financial Accounts Include:.

The goal of this summary is to provide some information, help, and hopefully some clarity about form. To get to the 8938 section in turbotax, refer to the following instructions: Web form 8938 is used by certain u.s. Web form 8938はfbarと似ていますが、管轄の法律が title 26の税制 となります。また、開示する内容も多少異なります。.

November 2021) Statement Of Specified Foreign Financial Assets Department Of The Treasury Internal Revenue Service Go To Www.irs.gov/Form8938 For.

Web if you are required to file form 8938, you must report your financial accounts maintained by a foreign financial institution. Web filing form 8938 is only available to those using turbotax deluxe or higher. When and how to file attach form 8938 to your annual return and file by. Form 8938を記載のうえ、irsに提出をします。tax returnのファイルには、credit karmaや、turbotax などを利用している方が多.