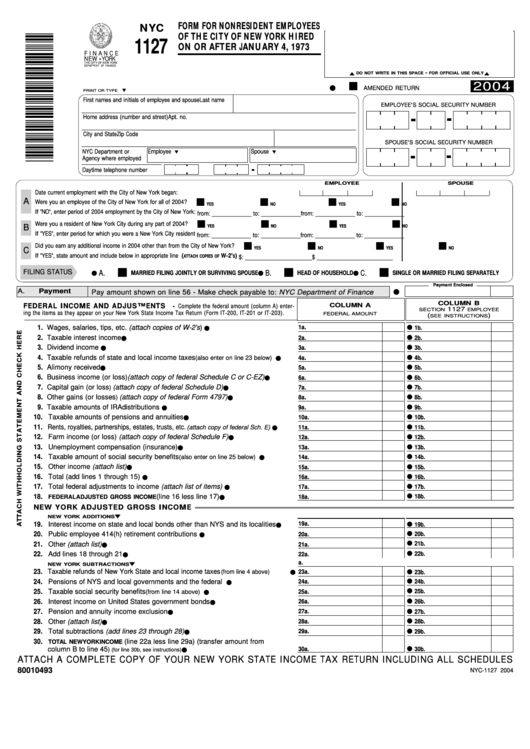

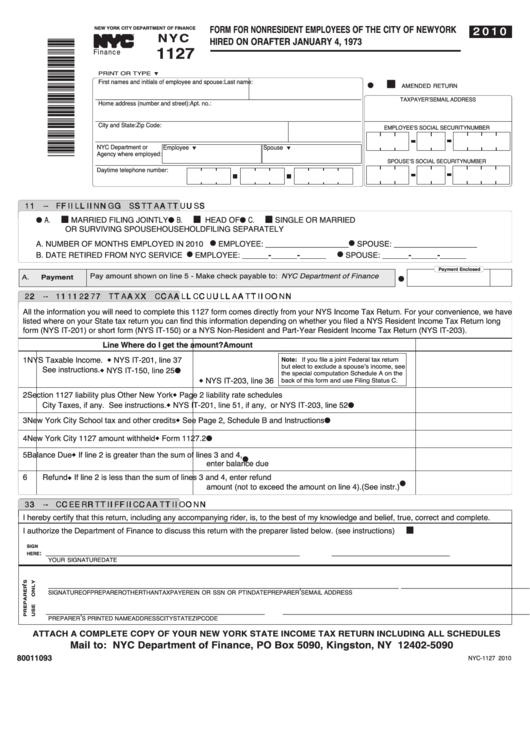

Form Nyc 1127.2

Form Nyc 1127.2 - Web you can get the form online or by mail. Web under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january 4, 1973, as a condition of employment. My wage and withholding statement (form nyc 1127.2);. Web any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an 1127 return. United states (english) united states (spanish) canada (english) canada. Web i will furnish the city department of finance with a copy of my state income tax return (if any), including all schedules; It contains information on the income and expenses of the owner, as well as details about tenants. Form for nonresident employees of. Web download ds872.pdf (61.58 kb) file name: In most cases, if you.

Beginning with tax year 2014, proseries new york city. Web i will furnish the city department of finance with a copy of my state income tax return (if any), including all schedules; My wage and withholding statement (form nyc 1127.2);. City and state zip code. Web any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an 1127 return. Web first names and initials of employee and spouse last name home address (number and street) apt. Web january 31, 2021 1:20 am last updated january 31, 2021 1:20 am 0 37 2,819 reply bookmark icon johnw152 expert alumni yes, but not until february 11th,. Web download ds872.pdf (61.58 kb) file name: Go to the states tab and click on ny. Web general information who must file if you became an employee of the city ofnew york on or after january 4, 1973, and if,while so employed, you were a nonresidentof the.

Web general information who must file if you became an employee of the city ofnew york on or after january 4, 1973, and if,while so employed, you were a nonresidentof the. Web i will furnish the city department of finance with a copy of my state income tax return (if any), including all schedules; United states (english) united states (spanish) canada (english) canada. Web where do i enter nyc 1127.2 wage and tax statement? Web first names and initials of employee and spouse last name home address (number and street) apt. Web january 31, 2021 1:20 am last updated january 31, 2021 1:20 am 0 37 2,819 reply bookmark icon johnw152 expert alumni yes, but not until february 11th,. Carrier's annual review of employee's driving record. In most cases, if you. Web download ds872.pdf (61.58 kb) file name: Web under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january 4, 1973, as a condition of employment.

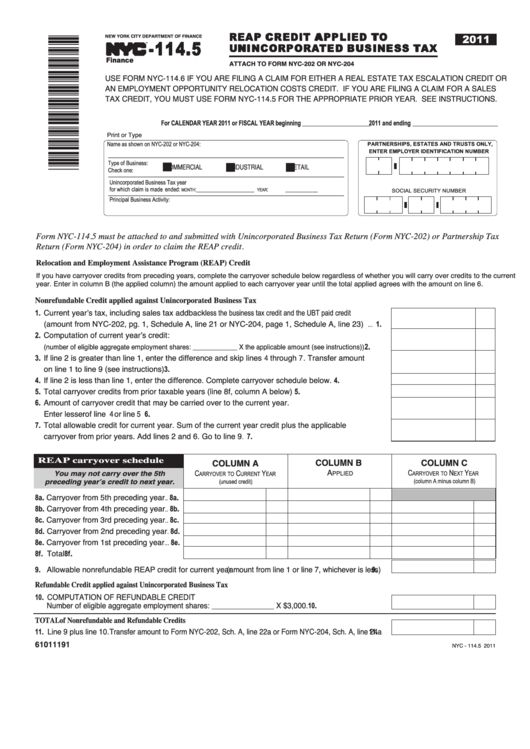

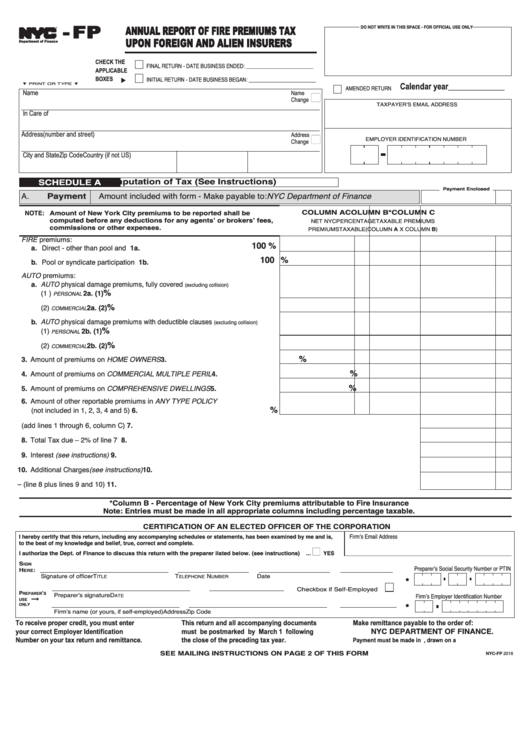

Form Nyc 114.5 Reap Credit Applied To Unincorporated Business Tax

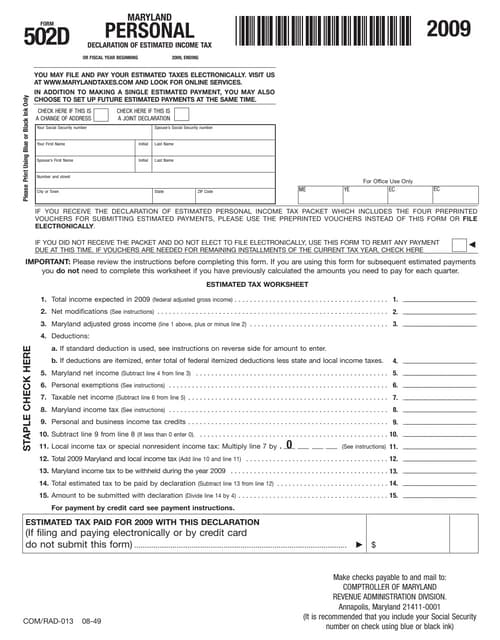

United states (english) united states (spanish) canada (english) canada. City and state zip code. Ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an. I am not a nyc resident. Go to the states tab and click on ny.

Fillable Form Nyc 1127 Form For Nonresident Employees Of The City Of

Carrier's annual review of employee's driving record. Call 311 to request a paper copy. Go to the states tab and click on ny. It contains information on the income and expenses of the owner, as well as details about tenants. Web you can get the form online or by mail.

W12 Form Nyc The Five Secrets That You Shouldn’t Know About W12 Form

Web download ds872.pdf (61.58 kb) file name: Web under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january 4, 1973, as a condition of employment. United states (english) united states (spanish) canada (english) canada. City and state zip code. Carrier's annual review of employee's driving record.

NYC1127 Form for Nonresident Employees of the City of New York Hired…

Solved•by intuit•20•updated july 19, 2022. Change of residence if you were a resident of the city of new york during part of. Web any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an 1127 return. Carrier's annual review of employee's driving record. Web.

Nyc 1127 Form ≡ Fill Out Printable PDF Forms Online

Web the nyc 1127 form is a detailed document that all property owners must fill out. Web general information who must file if you became an employee of the city ofnew york on or after january 4, 1973, and if,while so employed, you were a nonresidentof the. This form calculates the city waiver liability, which is. Ment of a particular.

NYC1127 Form for Nonresident Employees of the City of New York Hired

United states (english) united states (spanish) canada (english) canada. My wage and withholding statement (form nyc 1127.2);. Web under section 1127 of the city charter, if you are a city employee who lives outside the city and you were hired after january 4, 1973, as a condition of employment. It contains information on the income and expenses of the owner,.

New York City Form 1127 Fill Online, Printable, Fillable, Blank

Call 311 to request a paper copy. Beginning with tax year 2014, proseries new york city. Web where do i enter nyc 1127.2 wage and tax statement? This form calculates the city waiver liability, which is. I am not a nyc resident.

New Employee Dependent Form Ny 2023

In most cases, if you. Web generalinformation who must file if you became an employee of the cityof new york on or after january 4,1973, and if, while so employed, youwere a nonresident of the. Web any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year.

Form NycFp Annual Report Of Fire Premiums Tax Upon Foreign And Alien

Web generalinformation who must file if you became an employee of the cityof new york on or after january 4,1973, and if, while so employed, youwere a nonresident of the. I am not a nyc resident. Web any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax.

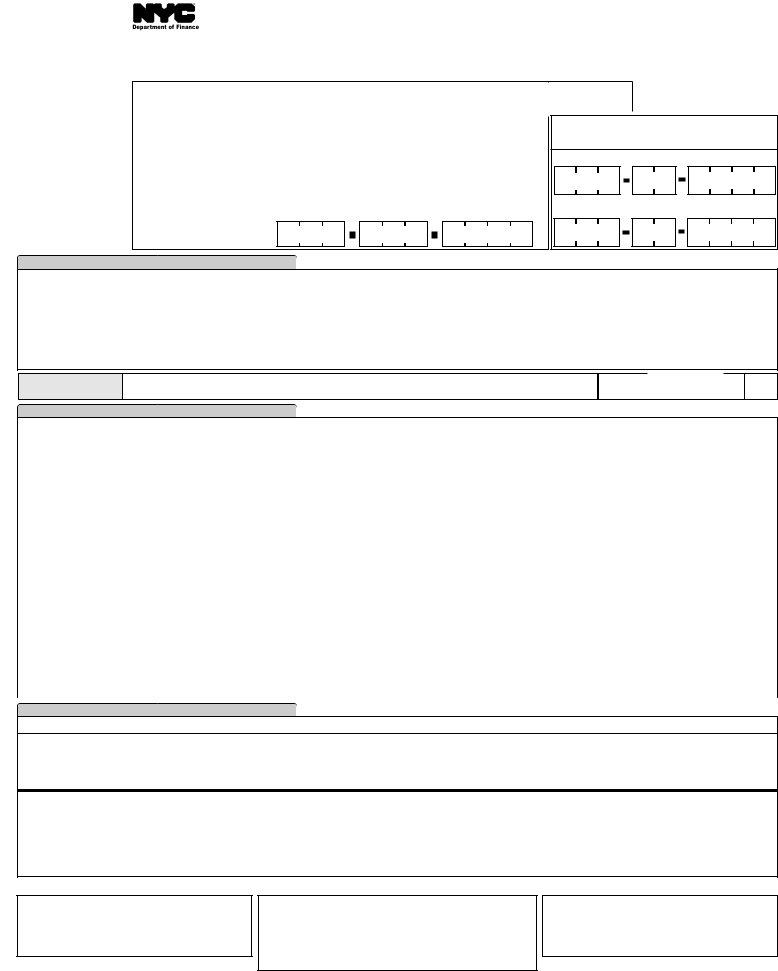

20152022 Form NYC DoF NYCRPT Fill Online, Printable, Fillable, Blank

Call 311 to request a paper copy. Web any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an 1127 return. United states (english) united states (spanish) canada (english) canada. In the new york data entry screens, click on the cities tab. Web under.

In Most Cases, If You.

My wage and withholding statement (form nyc 1127.2);. Web january 31, 2021 1:20 am last updated january 31, 2021 1:20 am 0 37 2,819 reply bookmark icon johnw152 expert alumni yes, but not until february 11th,. Carrier's annual review of employee's driving record. Call 311 to request a paper copy.

Solved•By Intuit•20•Updated July 19, 2022.

Web any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an 1127 return. Beginning with tax year 2014, proseries new york city. Ment of a particular york city employees a nonresident of the city (the five your employer, you would have to file tax year must an. I am not a nyc resident.

Web General Information Who Must File If You Became An Employee Of The City Ofnew York On Or After January 4, 1973, And If,While So Employed, You Were A Nonresidentof The.

Web generalinformation who must file if you became an employee of the cityof new york on or after january 4,1973, and if, while so employed, youwere a nonresident of the. This form calculates the city waiver liability, which is. Web first names and initials of employee and spouse last name home address (number and street) apt. Change of residence if you were a resident of the city of new york during part of.

In The New York Data Entry Screens, Click On The Cities Tab.

Web i will furnish the city department of finance with a copy of my state income tax return (if any), including all schedules; Web where do i enter nyc 1127.2 wage and tax statement? It contains information on the income and expenses of the owner, as well as details about tenants. Form for nonresident employees of.