Puerto Rico Form 480.6A

Puerto Rico Form 480.6A - 2020 summary of the informative return / form 480.5. The forms (480.7e) must be file. Web send the new 480.6a rev. Web 16 rows tax form (click on the link) form name. In an electronic form when you are done with completing it. Web are you looking for where to file 480.6a online? Series 480.6a and series 480.6d. Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico: Web de rentas internas de puerto rico de 2011, según enmendado (código), deberá rendir este formulario. Web forms 480.6a and 480.6d bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer.

Se requerirá la preparación de un formulario 480.6a cuando el pago. Web this form is required only for commercial clients. Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico: The forms (480.7e) must be file. Web are you looking for where to file 480.6a online? Web every employer who has paid wages with income tax withheld in puerto rico must submit this form to the department of treasury and the social security administration. Series 480.6a and series 480.6d. Gobierno de puerto rico government of puerto rico departamento de hacienda. The forms (480.6c) must be file by april 18, 2022. Payments to nonresidents or for services from.

Web de rentas internas de puerto rico de 2011, según enmendado (código), deberá rendir este formulario. Payments to nonresidents or for services from. Web up to $40 cash back the original form 480. The forms (480.6c) must be file by april 18, 2022. However, in the case of residential clients, this must be completed and filed if the client requests it. The form must be prepared on a calendar year basis and must be provided. Web the forms (480.6a, 480.6b, 480.6d, & 480.7f) must be file by february 28, 2022. Form 480.6a is issued by the. In an electronic form when you are done with completing it. If you receive these forms, it is.

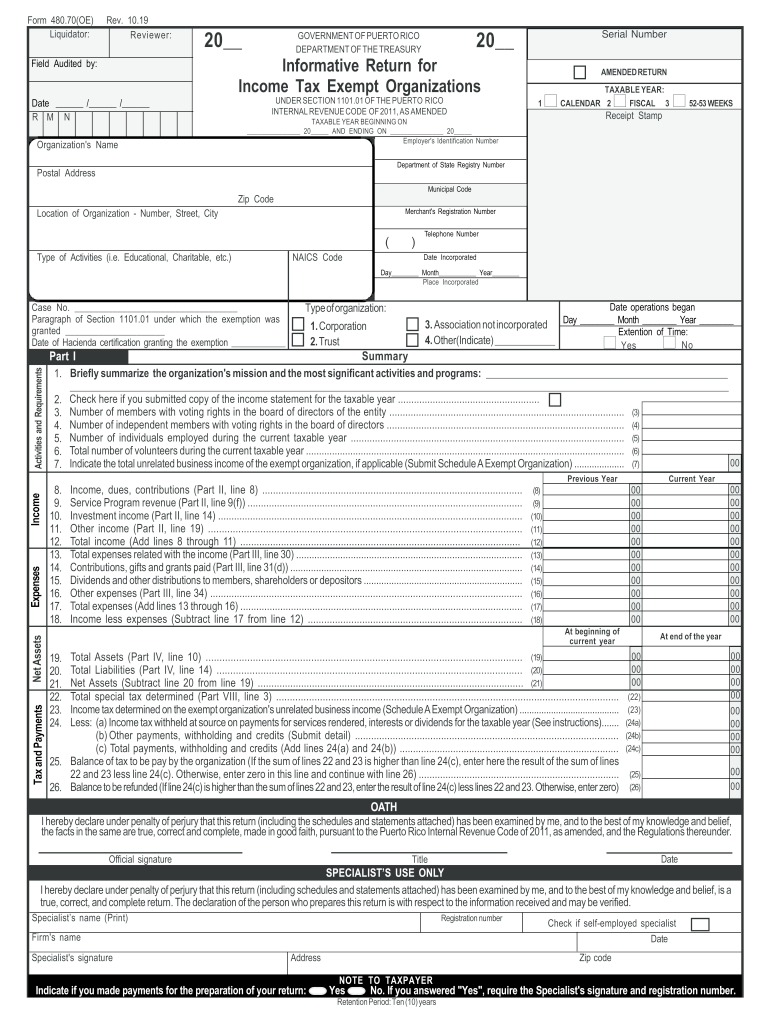

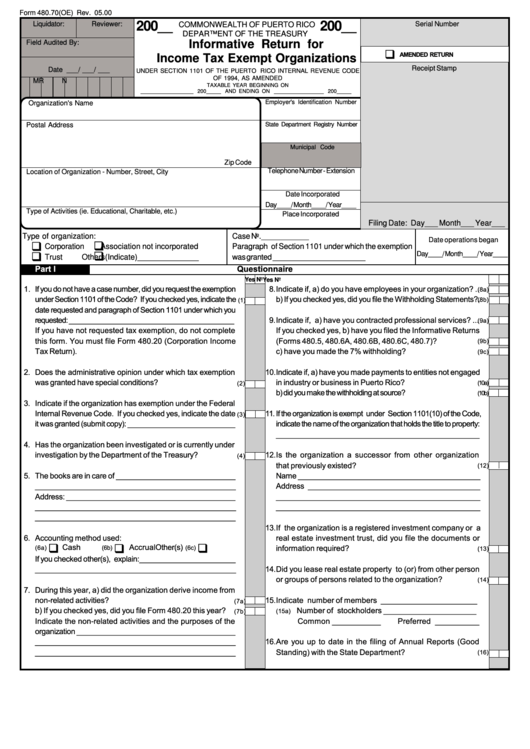

20192023 Form PR 480.70(OE) Fill Online, Printable, Fillable, Blank

Form 480.6a is issued by the. The form must be prepared on a calendar year basis and must be provided. Web 16 rows tax form (click on the link) form name. Web the forms (480.6a, 480.6b, 480.6d, & 480.7f) must be file by february 28, 2022. Se requerirá la preparación de un formulario 480.6a cuando el pago.

Puerto Rico Map 2022 Map of Beaches, Attractions, Cities, Puerto Rico

Web 16 rows tax form (click on the link) form name. Web in the case of int erests, form 480.6a will be required when the amount paid in the year is $50 or more. 2020 summary of the informative return / form 480.5. The forms (480.7e) must be file. Web this form is required only for commercial clients.

Formulario 480.6a 2018 Actualizado mayo 2022

Web send the new 480.6a rev. In an electronic form when you are done with completing it. Web 16 rows tax form (click on the link) form name. Web in the case of int erests, form 480.6a will be required when the amount paid in the year is $50 or more. Payments to nonresidents or for services from.

20192023 PR Form 480.20(U) Fill Online, Printable, Fillable, Blank

However, in the case of residential clients, this must be completed and filed if the client requests it. Web every employer who has paid wages with income tax withheld in puerto rico must submit this form to the department of treasury and the social security administration. The forms (480.6c) must be file by april 18, 2022. The form must be.

2016 Form PR 480.30(II) Fill Online, Printable, Fillable, Blank pdfFiller

Web up to $40 cash back the original form 480. Web 1 best answer ds30 new member yes, you will need to report this puerto rican bank interest as income on your income tax returns. Series 480.6a and series 480.6d. The forms (480.6c) must be file by april 18, 2022. Web send the new 480.6a rev.

20182022 Form PR 480.2 Fill Online, Printable, Fillable, Blank pdfFiller

Web in the case of int erests, form 480.6a will be required when the amount paid in the year is $50 or more. Web the forms (480.6a, 480.6b, 480.6d, & 480.7f) must be file by february 28, 2022. Web forms 480.6a and 480.6d bppr is required by law to send informative statements about any amount of money forgiven to a.

2008 Form PR 480.70(OE) Fill Online, Printable, Fillable, Blank pdfFiller

Web every employer who has paid wages with income tax withheld in puerto rico must submit this form to the department of treasury and the social security administration. Web 16 rows tax form (click on the link) form name. Web up to $40 cash back the original form 480. Web 1 best answer ds30 new member yes, you will need.

1+ Puerto Rico Last Will and Testament Form Free Download

Web up to $40 cash back the original form 480. You can include this pr. Web in the case of int erests, form 480.6a will be required when the amount paid in the year is $50 or more. Web de rentas internas de puerto rico de 2011, según enmendado (código), deberá rendir este formulario. Payments to nonresidents or for services.

Puerto Rico Internal Revenue Code bastilledesign

Web the forms (480.6a, 480.6b, 480.6d, & 480.7f) must be file by february 28, 2022. Web de rentas internas de puerto rico de 2011, según enmendado (código), deberá rendir este formulario. However, in the case of residential clients, this must be completed and filed if the client requests it. Web aii persons engaged in trade or business within puerto rico,.

SUJETOS A CONTRIBUCIN BSICA ALTERNA Fill out & sign online DocHub

Web in the case of int erests, form 480.6a will be required when the amount paid in the year is $50 or more. Web the forms (480.6a, 480.6b, 480.6d, & 480.7f) must be file by february 28, 2022. In an electronic form when you are done with completing it. Web de rentas internas de puerto rico de 2011, según enmendado.

Web Send The New 480.6A Rev.

You can include this pr. Series 480.6a and series 480.6d. Web 1 best answer ds30 new member yes, you will need to report this puerto rican bank interest as income on your income tax returns. Web are you looking for where to file 480.6a online?

The Forms (480.7E) Must Be File.

Web in the case of int erests, form 480.6a will be required when the amount paid in the year is $50 or more. Payments to nonresidents or for services from. Se requerirá la preparación de un formulario 480.6a cuando el pago. 2020 summary of the informative return / form 480.5.

Web Up To $40 Cash Back The Original Form 480.

Web 16 rows tax form (click on the link) form name. Web forms 480.6a and 480.6d bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. Web this form is required only for commercial clients. Gobierno de puerto rico government of puerto rico departamento de hacienda.

Irs Approved Tax1099.Com Allows You To Efile Your 480.6A With Security And Ease, All Online.

Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services rendered or to individuals for any of the. Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico: However, in the case of residential clients, this must be completed and filed if the client requests it. The form must be prepared on a calendar year basis and must be provided.