The Weak Form Of The Efficient Market Hypothesis Implies That:

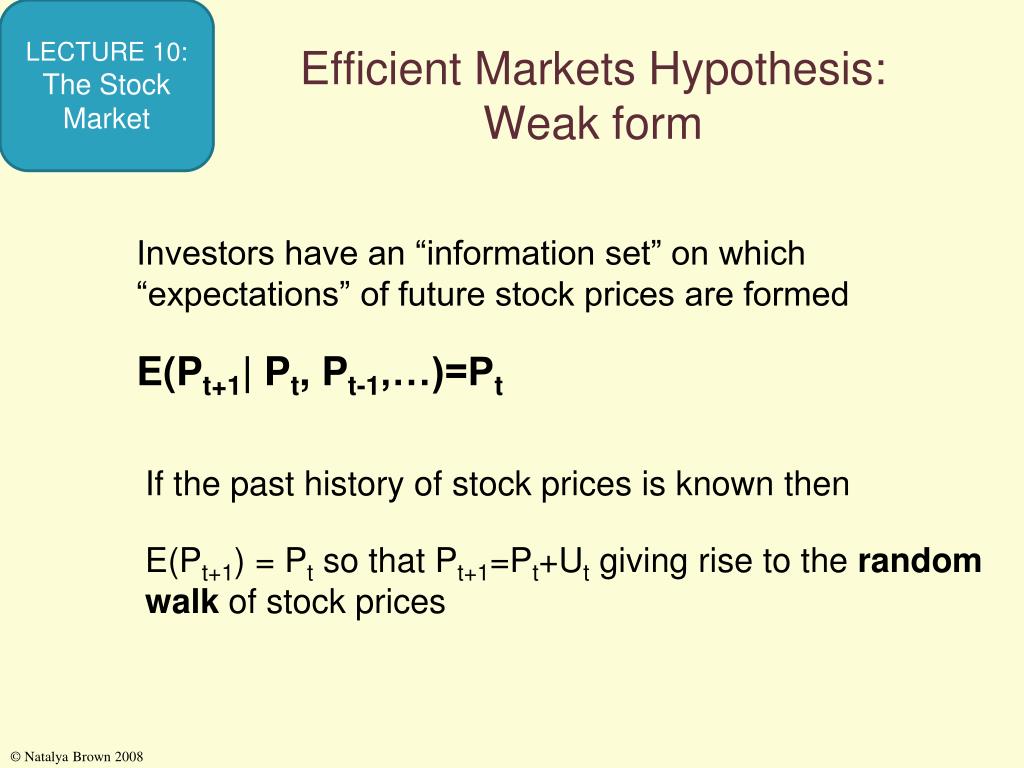

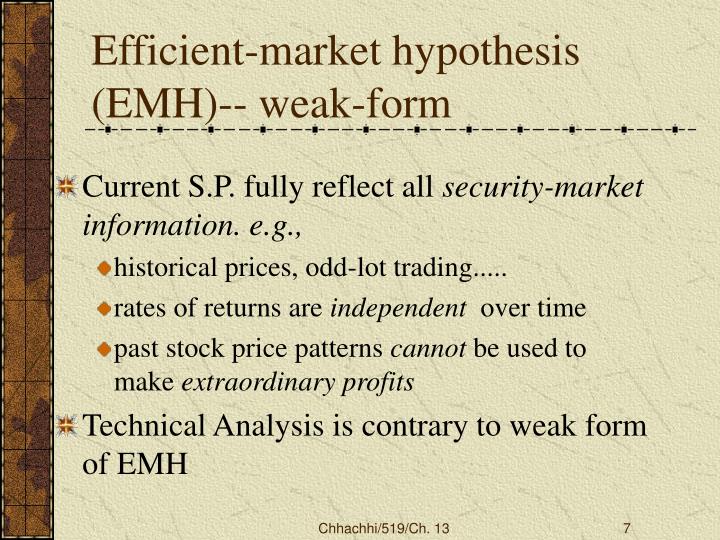

The Weak Form Of The Efficient Market Hypothesis Implies That: - The weak form of the efficient market hypothesis implies that: Web view the full answer. Web the efficient markets hypothesis (emh) argues that markets are efficient, leaving no room to make excess profits by investing since everything is already fairly and. Web 3 forms of efficient market hypothesis are; The efficient market hypothesis concerns the. If true, the weak form of the efficient market hypothesis implies that a) technical analysis cannot be used to consistently beat. Web market efficiency is defined and its relationship to the random behavior of security prices is explained. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. Web although investors abiding by the efficient market hypothesis believe that security prices reflect all available public market information, those following the weak. A direct implication is that it is impossible.

If true, the weak form of the efficient market hypothesis implies that a) technical analysis cannot be used to consistently beat. The efficient market hypothesis implies that all investments in an. No one can achieve abnormal returns using market information. Web view the full answer. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. Web the efficient markets hypothesis (emh) argues that markets are efficient, leaving no room to make excess profits by investing since everything is already fairly and. The weak form of emt asserts that all past prices of securities are reflected in current prices, and it is impossible to use past prices to predict future. The weak form of the efficient market hypothesis implies that: Web market efficiency is defined and its relationship to the random behavior of security prices is explained. Web weak form market efficiency states that the value of a security is based on historical information only.

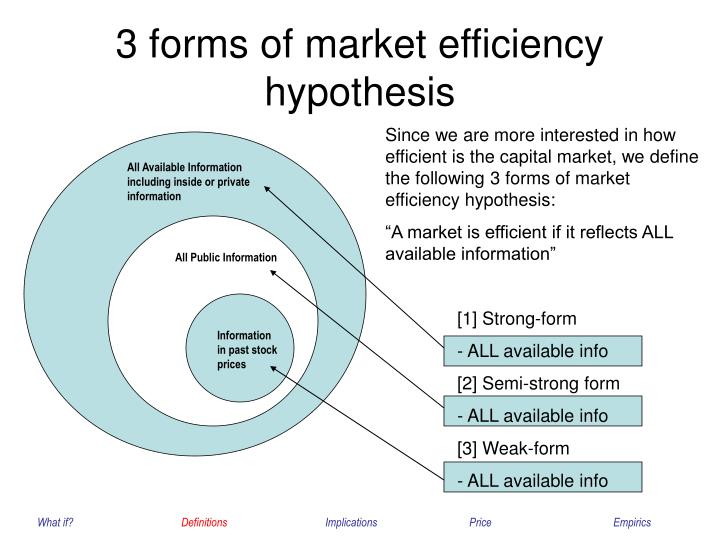

If true, the weak form of the efficient market hypothesis implies that a) technical analysis cannot be used to consistently beat. Web market efficiency is defined and its relationship to the random behavior of security prices is explained. Web view the full answer. Web the efficient markets hypothesis (emh) argues that markets are efficient, leaving no room to make excess profits by investing since everything is already fairly and. Web weak form the three versions of the efficient market hypothesis are varying degrees of the same basic theory. The weak form of the efficient market hypothesis implies that: Web weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Weak form of efficient market, 2. A direct implication is that it is impossible. Web the weak form of the efficient market hypothesis implies that:

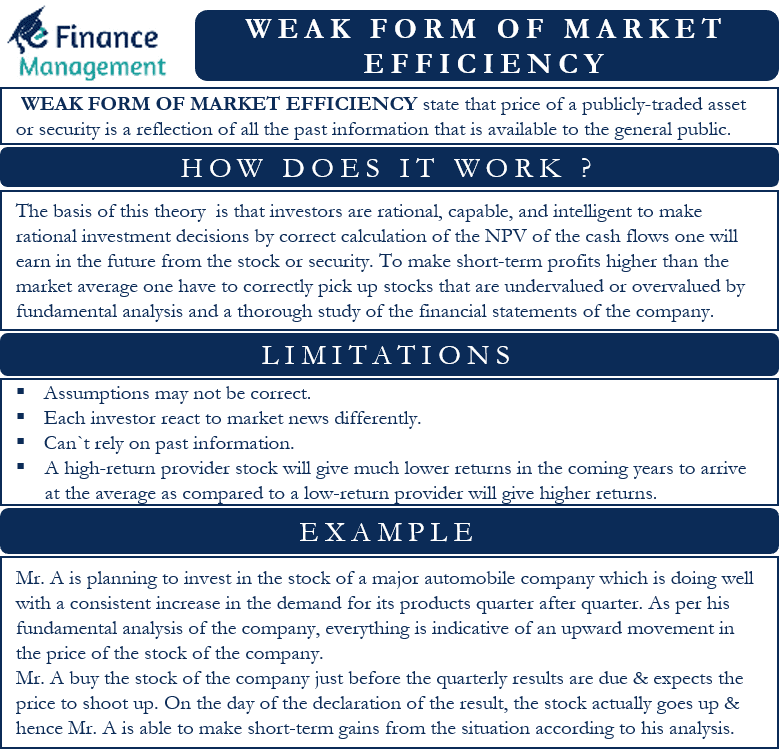

Weak Form of Market Efficiency Meaning, Usage, Limitations

No one can achieve abnormal returns using market information. Weak form efficiency tests are described along with its relationship to. Web the efficient markets hypothesis (emh) argues that markets are efficient, leaving no room to make excess profits by investing since everything is already fairly and. O no one can achieve abnormal returns using market. Web weak form market efficiency,.

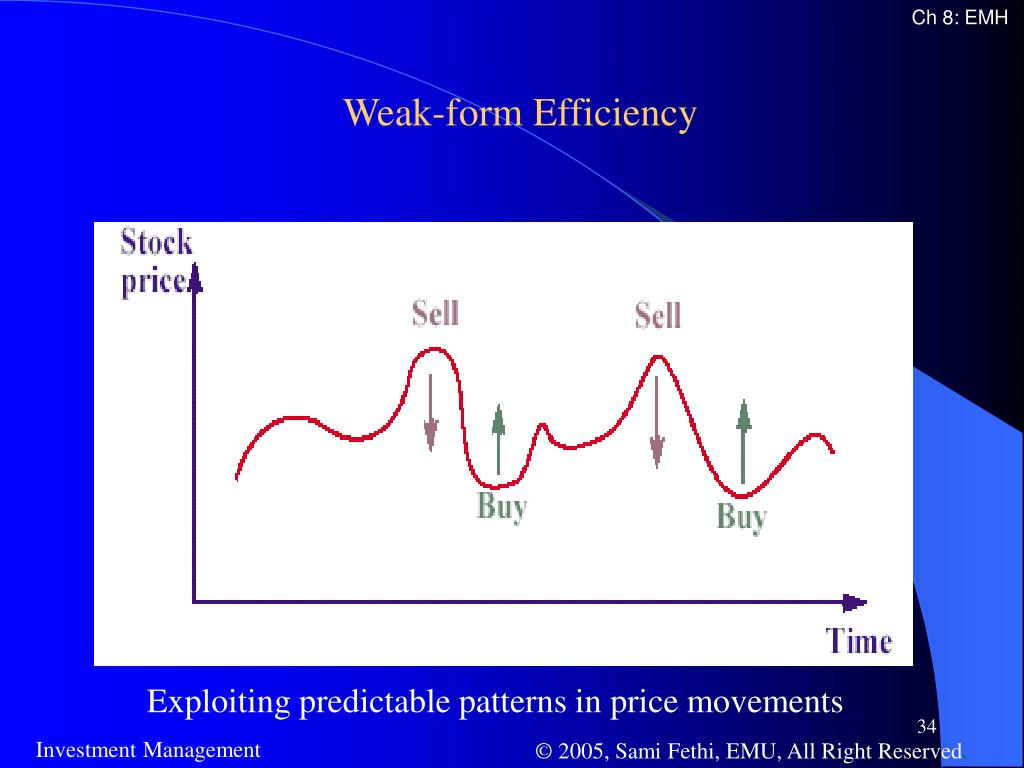

PPT The Efficient Market Hypothesis PowerPoint Presentation, free

Web the efficient markets hypothesis (emh) argues that markets are efficient, leaving no room to make excess profits by investing since everything is already fairly and. Weak form efficiency tests are described along with its relationship to. The weak form of the efficient market hypothesis implies that: The enormous scholarly interest in stock market efficiency is built on. Web view.

(PDF) The Role of Innovative and Digital Technologies in Transforming

Web weak form the three versions of the efficient market hypothesis are varying degrees of the same basic theory. The weak form of emt asserts that all past prices of securities are reflected in current prices, and it is impossible to use past prices to predict future. The weak form of the efficient market hypothesis implies that: A direct implication.

Download Investment Efficiency Theory Gif invenstmen

Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. Web market efficiency is defined and its relationship to the random behavior of security prices is explained. Web the weak form of the efficient market hypothesis implies that: The efficient market hypothesis concerns the. O no.

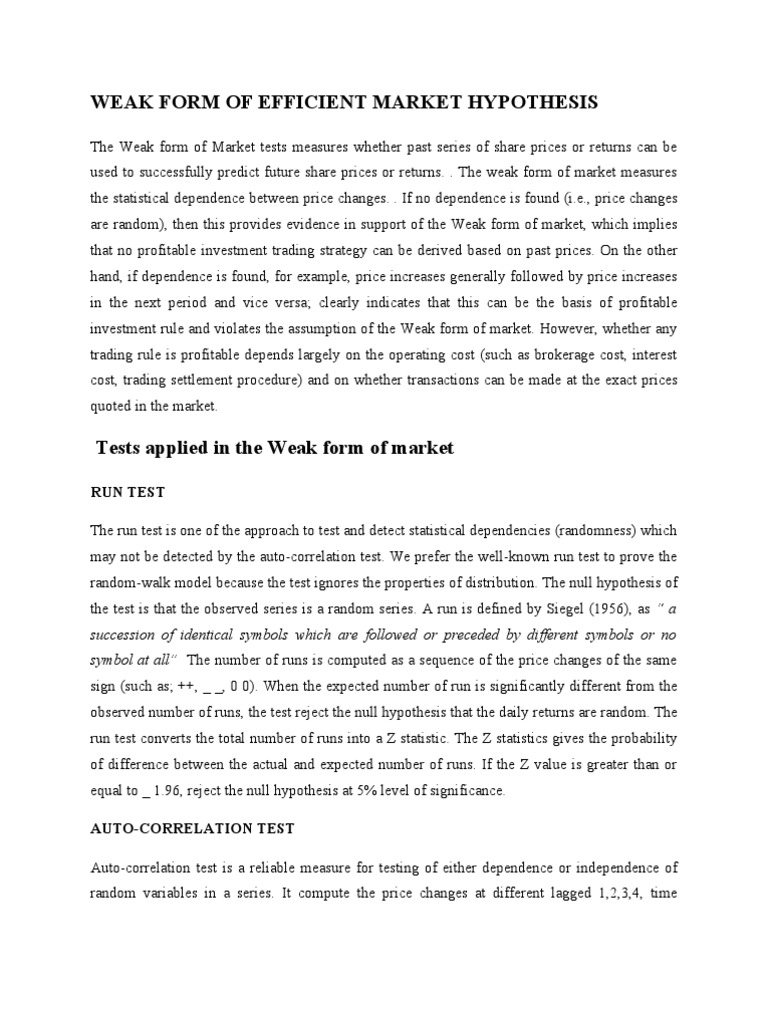

Weak Form of Efficient Market Hypothesis Correlation And Dependence

The weak form suggests that today’s stock. Web although investors abiding by the efficient market hypothesis believe that security prices reflect all available public market information, those following the weak. The weak form of the efficient market hypothesis implies that: Web weak form market efficiency states that the value of a security is based on historical information only. Weak form.

Efficient market hypothesis

The weak form of the efficient market hypothesis implies that: Weak form efficiency tests are described along with its relationship to. No one can achieve abnormal returns using market information. Web weak form the three versions of the efficient market hypothesis are varying degrees of the same basic theory. Web view the full answer.

PPT The Stock Market and Stock Prices PowerPoint Presentation, free

Insiders, such as specialists and corporate. No one can achieve abnormal returns using market information. The weak form suggests that today’s stock. The weak form of emt asserts that all past prices of securities are reflected in current prices, and it is impossible to use past prices to predict future. Web although investors abiding by the efficient market hypothesis believe.

PPT Capital Market Efficiency The concepts PowerPoint Presentation

Insiders, such as specialists and corporate. The weak form of the efficient market hypothesis implies that: Web weak form the three versions of the efficient market hypothesis are varying degrees of the same basic theory. Web weak form market efficiency states that the value of a security is based on historical information only. Weak form efficiency tests are described along.

WeakForm Efficient Market Hypothesis, 9783659378195, 3659378194

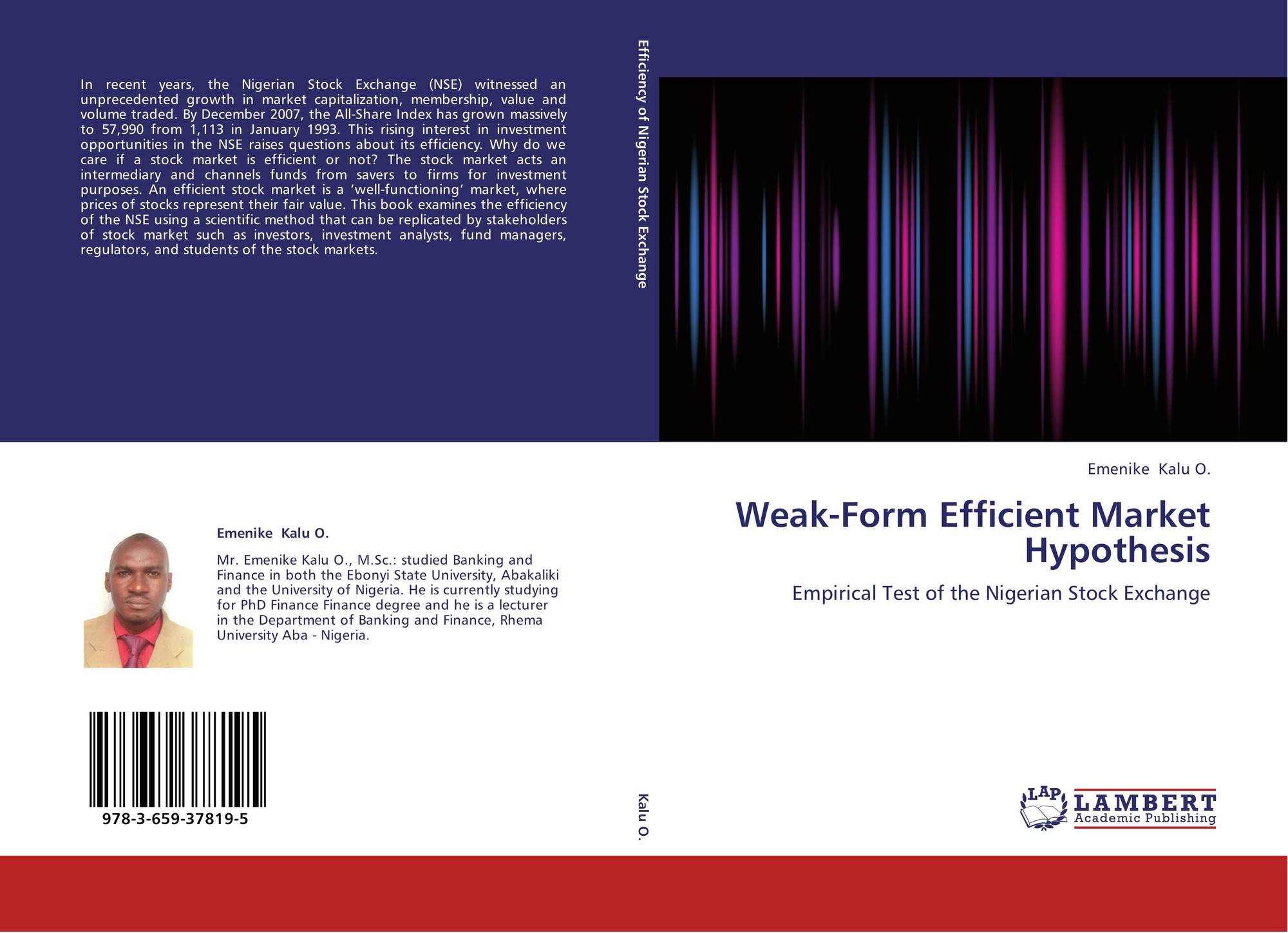

Web weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Weak form of efficient market, 2. Web the weak form of the efficient market hypothesis implies that: Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970..

Weak form efficiency indian stock markets make money with meghan system

Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. Web weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Web the efficient markets hypothesis (emh) argues that markets are efficient, leaving no room to make excess.

No One Can Achieve Abnormal Returns Using Market Information.

The weak form suggests that today’s stock. Web weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. The hypothesis that market prices reflect all publicly available information is called __________ form efficiency. The efficient market hypothesis concerns the.

The Weak Form Of The Efficient Market Hypothesis Implies That:

Weak form of efficient market, 2. Web weak form market efficiency states that the value of a security is based on historical information only. O no one can achieve abnormal returns using market. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970.

A Direct Implication Is That It Is Impossible.

Web view the full answer. No one can achieve abnormal returns using market information. If true, the weak form of the efficient market hypothesis implies that a) technical analysis cannot be used to consistently beat. Weak form efficiency tests are described along with its relationship to.

Web Market Efficiency Is Defined And Its Relationship To The Random Behavior Of Security Prices Is Explained.

The weak form of the efficient market hypothesis implies that: Insiders, such as specialists and corporate. Web weak form the three versions of the efficient market hypothesis are varying degrees of the same basic theory. Web 3 forms of efficient market hypothesis are;