What's A 1099A Form

What's A 1099A Form - Remuneration is anything of value given in exchange for labor or services, including food and lodging. Box 11 includes any reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes, from an individual or corporation who is engaged in catching fish. An hsa is a special. If it’s marked “no,” you have a nonrecourse loan. What is a 1099 form? Those returns are processed in the order received. Medical and health care payments. Being aware of tax terms as well as both 1040 and 1099 rules is beneficial. The irs sometimes treats a foreclosure like you sold your property. Employment authorization document issued by the department of homeland security.

The 1099 form provides information needed to complete a tax return, while the 1040 form is used to file the actual taxes due. Web payroll tax returns. You can get the general instructions from general instructions for certain information returns at irs.gov/ 1099generalinstructions or go to irs.gov/form1099a or irs.gov/form1099c. The form’s purpose is to show you—and the irs—how much money you spent from your account. As of july 12, 2023. You might receive this form if your mortgage lender foreclosed on your property and canceled some or all of your mortgage, or sold your property in a short sale. This includes payments for services, dividends, interest, rents, royalties. 1099 tax forms report retirement distributions, government payments like unemployment. Employers may continue using the prior edition of. For internal revenue service center.

However, hang on to this form and keep it with your tax records. Web what is a 1099 form? Web payroll tax returns. Your mortgage lender will give one to you if your home is foreclosed upon because you'll need it to prepare your tax return. You can get the general instructions from general instructions for certain information returns at irs.gov/ 1099generalinstructions or go to irs.gov/form1099a or irs.gov/form1099c. For privacy act and paperwork reduction act notice, see the. For internal revenue service center. As of july 12, 2023. If the box is marked “yes,” you have a recourse loan. There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is.

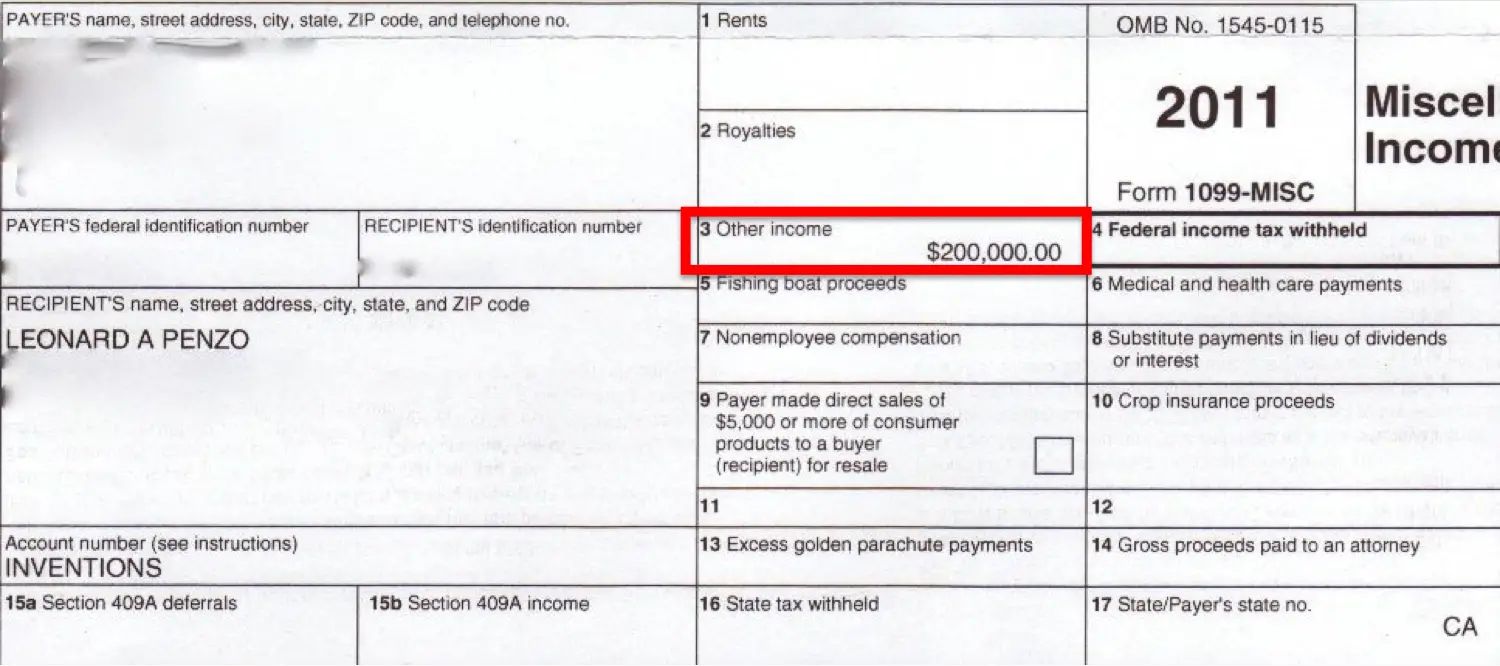

I Earned HOW Much Last Year? The 6Figure Mistake on My 1099 Form

The payer fills out the form with the appropriate details and sends copies to you and the irs, reporting payments made during the tax year. You might receive this form if your mortgage lender foreclosed on your property and canceled some or all of your mortgage, or sold your property in a short sale. Employment authorization document issued by the.

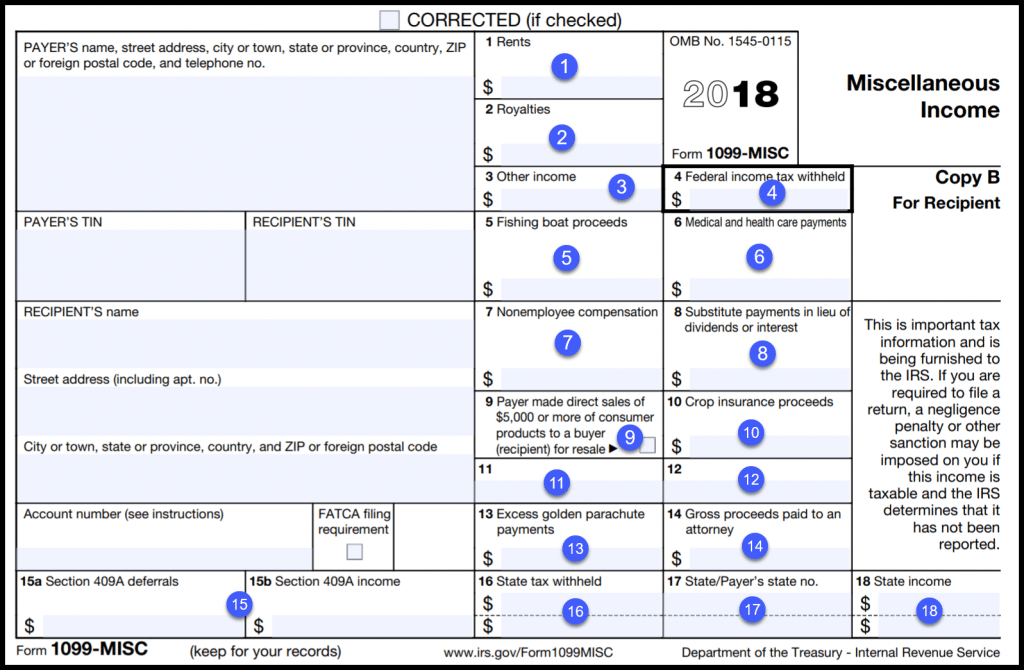

Forms 1099 The Basics You Should Know Kelly CPA

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web a 1099 form is a document that businesses use to report various types of government payments to both the irs and payees. Your mortgage lender will give one to you if.

What is a 1099Misc Form? Financial Strategy Center

If it’s marked “no,” you have a nonrecourse loan. Remuneration is anything of value given in exchange for labor or services, including food and lodging. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. You might receive this form if your.

1099 Contract Template HQ Printable Documents

As of july 12, 2023. For privacy act and paperwork reduction act notice, see the. Employment authorization document issued by the department of homeland security. If the box is marked “yes,” you have a recourse loan. Those returns are processed in the order received.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Medical and health care payments. Being aware of tax terms as well as both 1040 and 1099 rules is beneficial. If you persuaded a credit. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. This includes payments for services, dividends, interest,.

Now is the Time to Start Preparing for Vendor 1099 Forms Innovative

Those returns are processed in the order received. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer msa), or medicare advantage medical savings account (ma msa). Acquisition or abandonment of secured property. Investing stocks bonds fixed income. This revised form and condensed instructions streamline the materials and reduce the employer.

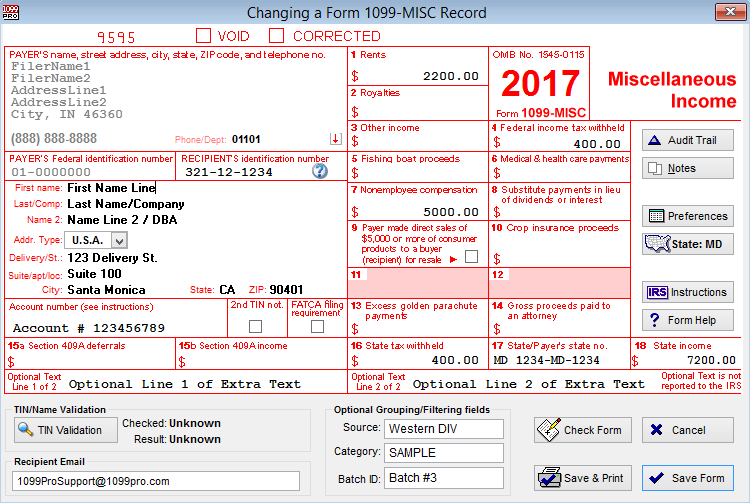

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

Web a 1099 form is a document that businesses use to report various types of government payments to both the irs and payees. Supports filing of 1099 misc, int, div, k, s, & b. Employers can begin using the new edition on august 1, 2023. If you persuaded a credit. The irs sometimes treats a foreclosure like you sold your.

IRS Form 1099 Reporting for Small Business Owners

For privacy act and paperwork reduction act notice, see the. Being aware of tax terms as well as both 1040 and 1099 rules is beneficial. Web payroll tax returns. Investing stocks bonds fixed income. Web | edited by barri segal | march 29, 2023, at 9:49 a.m.

1099NEC Software Print & eFile 1099NEC Forms

Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer msa), or medicare advantage medical savings account (ma msa). Web what is a 1099 form? As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Acquisition or abandonment of secured property. 1099 tax forms.

Form 1099A Acquisition or Abandonment of Secured Property Definition

As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer msa), or medicare advantage medical savings account (ma msa). There are more than a dozen different varieties of 1099 forms, and the reporting requirements.

The Form’s Purpose Is To Show You—And The Irs—How Much Money You Spent From Your Account.

Employment authorization document issued by the department of homeland security. Web payroll tax returns. The payer fills out the form with the appropriate details and sends copies to you and the irs, reporting payments made during the tax year. Medical and health care payments.

For Examples, See 12.3 List C Documents That Establish Employment Authorization.

Web | edited by barri segal | march 29, 2023, at 9:49 a.m. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Supports filing of 1099 misc, int, div, k, s, & b. Investing stocks bonds fixed income.

This Revised Form And Condensed Instructions Streamline The Materials And Reduce The Employer And Employee Burden Associated With The Form.

Web form 1099 is an irs tax form known as an information return, meaning you fill out the form as a source of information about your business. Box 11 includes any reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes, from an individual or corporation who is engaged in catching fish. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer msa), or medicare advantage medical savings account (ma msa). If it’s marked “no,” you have a nonrecourse loan.

However, Hang On To This Form And Keep It With Your Tax Records.

Those returns are processed in the order received. There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is. If the box is marked “yes,” you have a recourse loan. 1099 tax forms report retirement distributions, government payments like unemployment.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.57.19PM-35858ecdbcb34072ba0d8da6aaf87b8a.png)