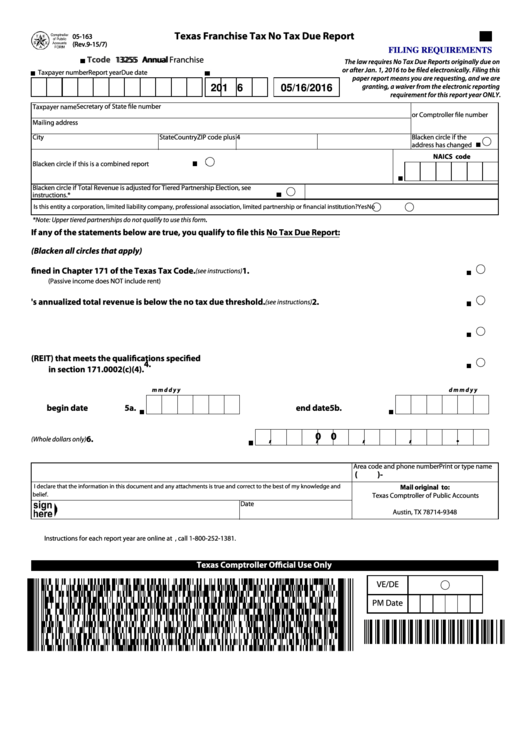

05-163 Form 2022

05-163 Form 2022 - Not all of the below forms are available in the program. Register for a free account, set a secure password, and go through email verification to. If you don't see a form listed, qualifying taxpayers. Taxpayer is a newly established texas veteran owned business. Web click here to see a list of texas franchise tax forms. Web texas franchise tax reports for 2022 and prior years. Web if your annualized business revenue is at or below $20 million, you can use the ez computation report to calculate your franchise tax bill. Save or instantly send your ready documents. It serves as an information report for the business entities which don’t have to pay franchise tax. Verification for the use of grs 6.1, email and other electronic messages managed under a capstone approach.

This will give you a tax rate of. Save or instantly send your ready documents. Taxpayer is a newly established texas veteran owned business. If you have any questions,. Taxpayer is a passive entity. Web follow this simple guide to edit 05 163 in pdf format online at no cost: Web send form 05 163 via email, link, or fax. Sign up and log in. If you don't see a form listed, qualifying taxpayers. Upper tiered partnerships do not qualify to use this form.) yes no 1.

You can also download it, export it or print it out. 2021 report year forms and instructions; Not all of the below forms are available in the program. Sign up and log in. Web click here to see a list of texas franchise tax forms. Web the no tax due threshold is as follows: This entity has zero texas gross. 2022 report year forms and instructions; Select yes when the entity’s total. Web texas franchise tax reports for 2022 and prior years.

Texas form 05 163 2016 Fill out & sign online DocHub

If you don't see a form listed, qualifying taxpayers. Web the tips below can help you fill out 05 163 quickly and easily: Register for a free account, set a secure password, and go through email verification to. Web send form 05 163 via email, link, or fax. Save or instantly send your ready documents.

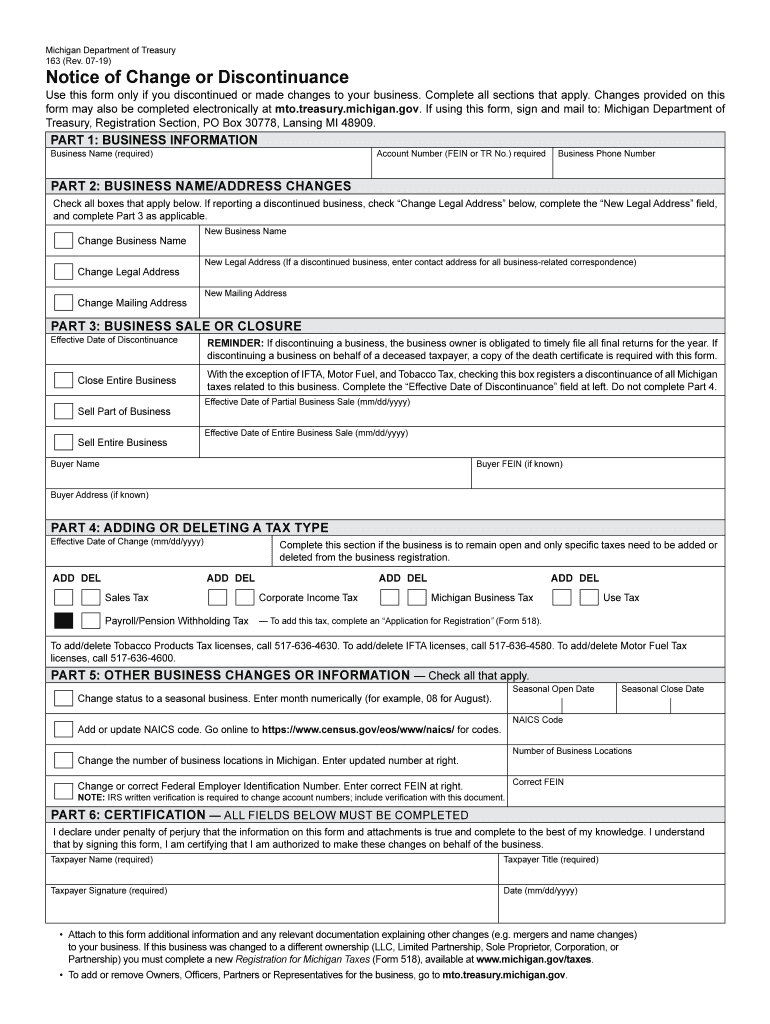

CT JDFM163 20202022 Fill and Sign Printable Template Online US

Save or instantly send your ready documents. Is this entity’s annualized total revenue below the no tax due threshold? Easily fill out pdf blank, edit, and sign them. 2022 report year forms and instructions; Open the texas comptroller no tax due report and follow the instructions.

Form 163 michigan Fill out & sign online DocHub

Web the tips below can help you fill out 05 163 quickly and easily: Select yes when the entity’s total. This is a franchise tax form. Web send form 05 163 via email, link, or fax. Web click here to see a list of texas franchise tax forms.

Fillable 05163 Texas Franchise Tax Annual No Tax Due Report printable

This is a franchise tax form. It serves as an information report for the business entities which don’t have to pay franchise tax. Complete the necessary boxes that are. Sign up and log in. This will give you a tax rate of.

Michigan.govtaxes Form 163 Form Resume Examples EZVgZZxrYJ

Save or instantly send your ready documents. Web the tips below can help you fill out 05 163 quickly and easily: Taxpayer is a passive entity. This will give you a tax rate of. (passive income does not include rent.) (see instructions.) 2.

Form 05 163 ≡ Fill Out Printable PDF Forms Online

2021 report year forms and instructions; Upper tiered partnerships do not qualify to use this form.) yes no 1. This is a franchise tax form. Web texas franchise tax reports for 2022 and prior years. Select yes when the entity’s total.

diabète 2020 diabète sfar Brilnt

Web follow this simple guide to edit 05 163 in pdf format online at no cost: 2021 report year forms and instructions; Open the texas comptroller no tax due report and follow the instructions. You can also download it, export it or print it out. Web click here to see a list of texas franchise tax forms.

I think I'm rethinking gender assignments. My bold fashion statements

If you don't see a form listed, qualifying taxpayers. Web if your annualized business revenue is at or below $20 million, you can use the ez computation report to calculate your franchise tax bill. Taxpayer is a newly established texas veteran owned business. Edit your texas form 05 163 online. You can also download it, export it or print it.

W4 Form 2022 Fillable PDF

Web send form 05 163 via email, link, or fax. Sign up and log in. Save or instantly send your ready documents. Web texas franchise tax reports for 2022 and prior years. Select yes when the entity’s total.

Form 163 Fill Out and Sign Printable PDF Template signNow

Register for a free account, set a secure password, and go through email verification to. Open the texas comptroller no tax due report and follow the instructions. If you have any questions,. Taxpayer is a newly established texas veteran owned business. You can also download it, export it or print it out.

Web The No Tax Due Threshold Is As Follows:

2021 report year forms and instructions; Edit your texas form 05 163 online. Complete the necessary boxes that are. Open the texas comptroller no tax due report and follow the instructions.

Web If Your Annualized Business Revenue Is At Or Below $20 Million, You Can Use The Ez Computation Report To Calculate Your Franchise Tax Bill.

Is this entity’s annualized total revenue below the no tax due threshold? 2022 report year forms and instructions; Type text, add images, blackout confidential details,. If you don't see a form listed, qualifying taxpayers.

(Passive Income Does Not Include Rent.) (See Instructions.) 2.

Register for a free account, set a secure password, and go through email verification to. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Taxpayer is a passive entity.

Sign Up And Log In.

This entity has zero texas gross. Web send form 05 163 via email, link, or fax. Web follow this simple guide to edit 05 163 in pdf format online at no cost: Taxpayer is a newly established texas veteran owned business.