1023 Ez Form Instructions

1023 Ez Form Instructions - Web in order to be exempt from tax as an irc § 501(c)(3) organization, an entity’s organizing documents must establish that it is “organized and operated exclusively” for one of eight. Web you have everything needed to apply for tax exemption using form 1023 , application for recognition of exemption under section 501(c)(3) of the internal revenue code, and its. The following types of organizations may be considered tax exempt under. Web follow the simple instructions below: If you are not eligible to file. Part i identification of applicant 1a. Ad get ready for tax season deadlines by completing any required tax forms today. January 2018) streamlined application for recognition of exemption under section 501(c)(3) of the internal revenue code department of the. Part i identification of applicant 1a full name of organization 1c. First, let's talk about what the forms have in common.

If you are not eligible to file. First, let's talk about what the forms have in common. When the tax season started unexpectedly or maybe you just forgot about it, it could probably create problems for you. Complete, edit or print tax forms instantly. (on the hphl website as 1023ez eligibility. Web in order to be exempt from tax as an irc § 501(c)(3) organization, an entity’s organizing documents must establish that it is “organized and operated exclusively” for one of eight. January 2018) streamlined application for recognition of exemption under section 501(c)(3) of the internal revenue code department of the. Organizations not required to obtain recognition of exemption. Part i identification of applicant 1a. Web follow the simple instructions below:

Part i identification of applicant 1a full name of organization 1c. Web follow the simple instructions below: When the tax season started unexpectedly or maybe you just forgot about it, it could probably create problems for you. Part i identification of applicant 1a. Web in order to be exempt from tax as an irc § 501(c)(3) organization, an entity’s organizing documents must establish that it is “organized and operated exclusively” for one of eight. Organizations not required to obtain recognition of exemption. The following types of organizations may be considered tax exempt under. First, let's talk about what the forms have in common. Complete, edit or print tax forms instantly. Web you have everything needed to apply for tax exemption using form 1023 , application for recognition of exemption under section 501(c)(3) of the internal revenue code, and its.

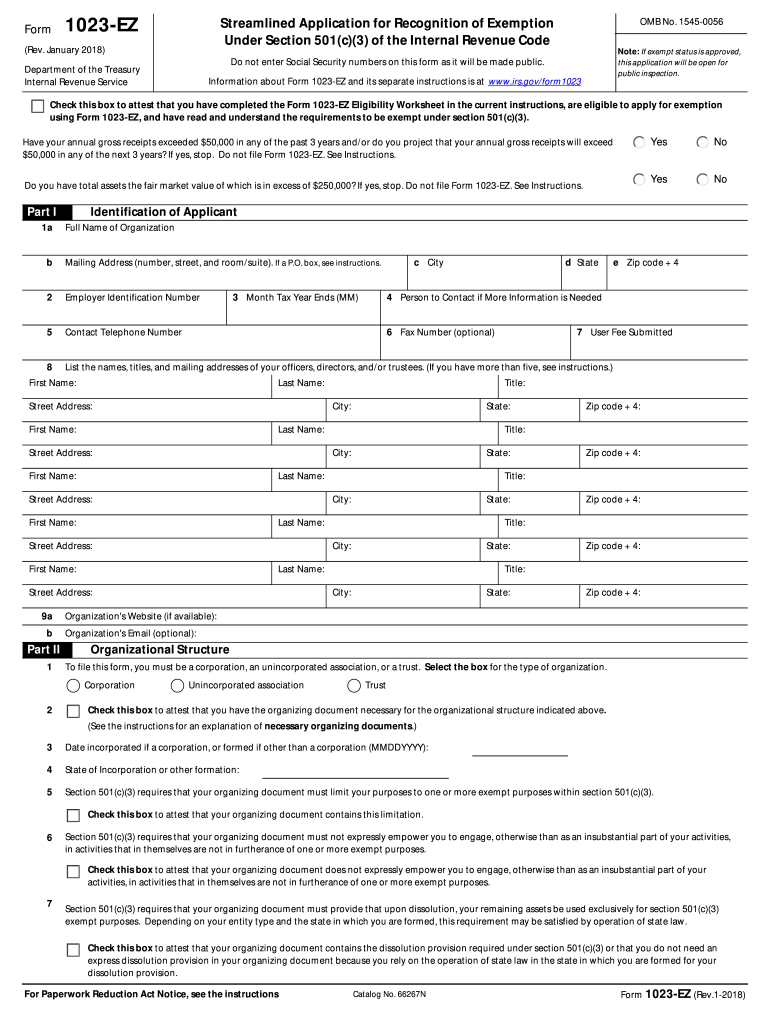

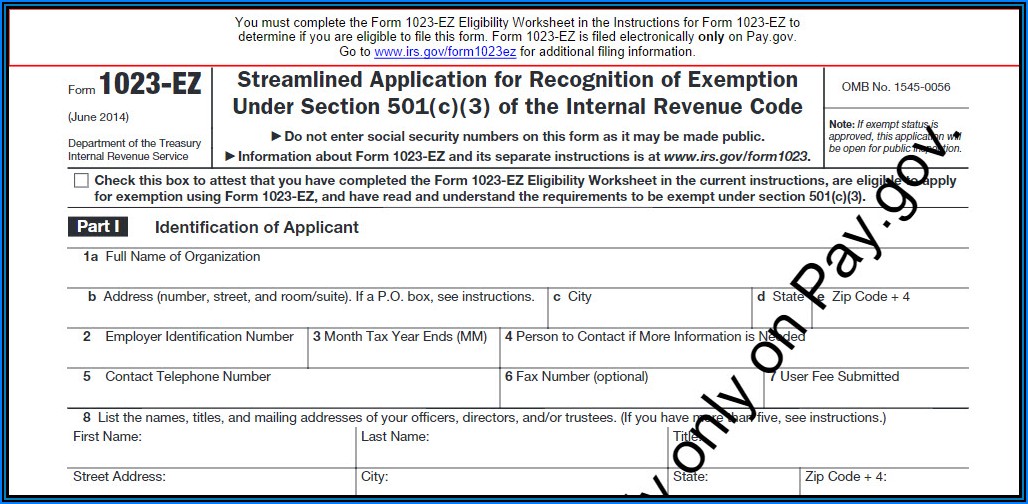

Form 1023EZ Streamlined Application for Recognition of Exemption

If you are not eligible to file. First, let's talk about what the forms have in common. When the tax season started unexpectedly or maybe you just forgot about it, it could probably create problems for you. Web in order to be exempt from tax as an irc § 501(c)(3) organization, an entity’s organizing documents must establish that it is.

Should Your Charity Submit IRS Form 1023EZ?

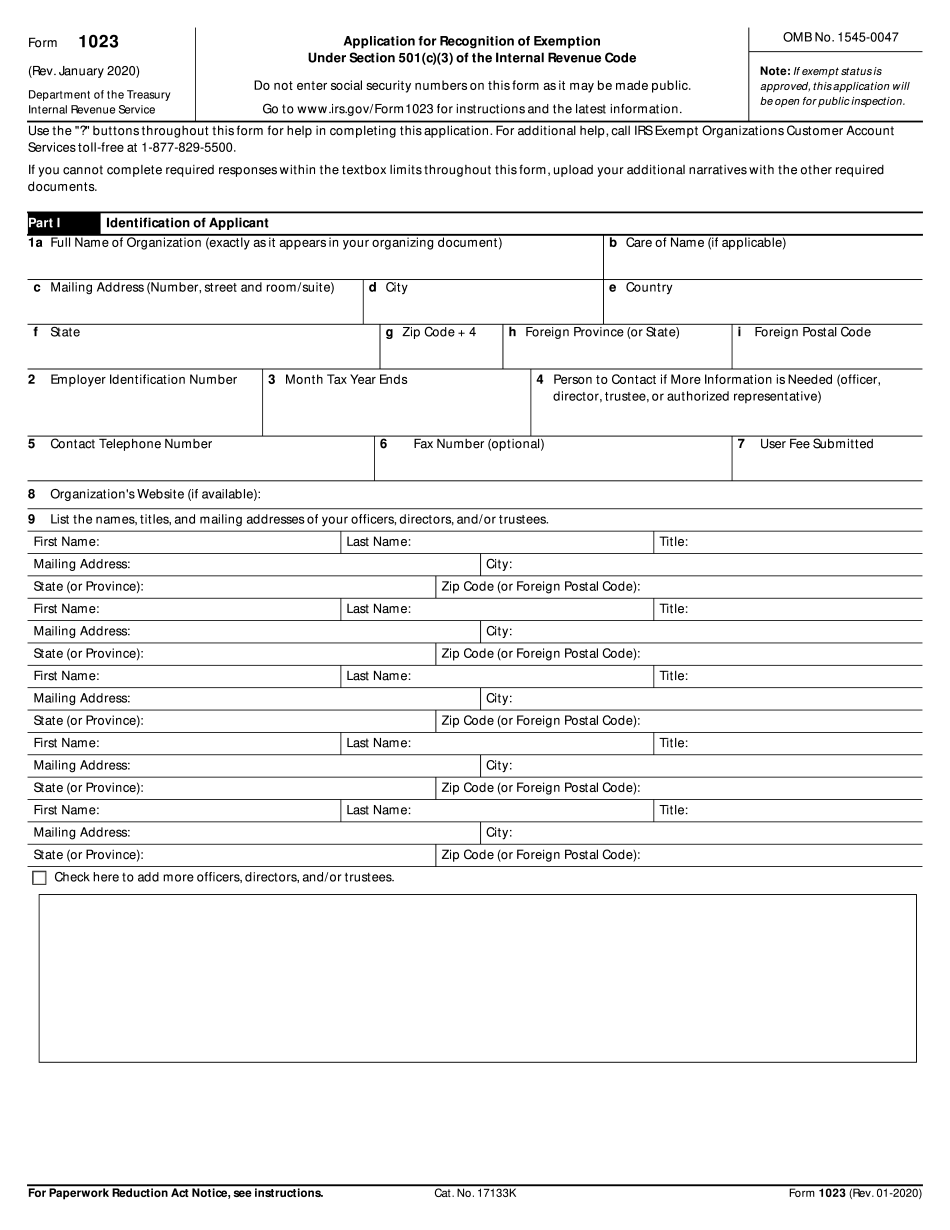

Web you have everything needed to apply for tax exemption using form 1023 , application for recognition of exemption under section 501(c)(3) of the internal revenue code, and its. Part i identification of applicant 1a. January 2018) streamlined application for recognition of exemption under section 501(c)(3) of the internal revenue code department of the. Complete, edit or print tax forms.

1023 ez form Fill out & sign online DocHub

If you are not eligible to file. Ad get ready for tax season deadlines by completing any required tax forms today. When the tax season started unexpectedly or maybe you just forgot about it, it could probably create problems for you. The following types of organizations may be considered tax exempt under. Web you have everything needed to apply for.

How to Fill Out Form 1023 & Form 1023EZ for Nonprofits Step by Step

(on the hphl website as 1023ez eligibility. When the tax season started unexpectedly or maybe you just forgot about it, it could probably create problems for you. Web you have everything needed to apply for tax exemption using form 1023 , application for recognition of exemption under section 501(c)(3) of the internal revenue code, and its. Organizations not required to.

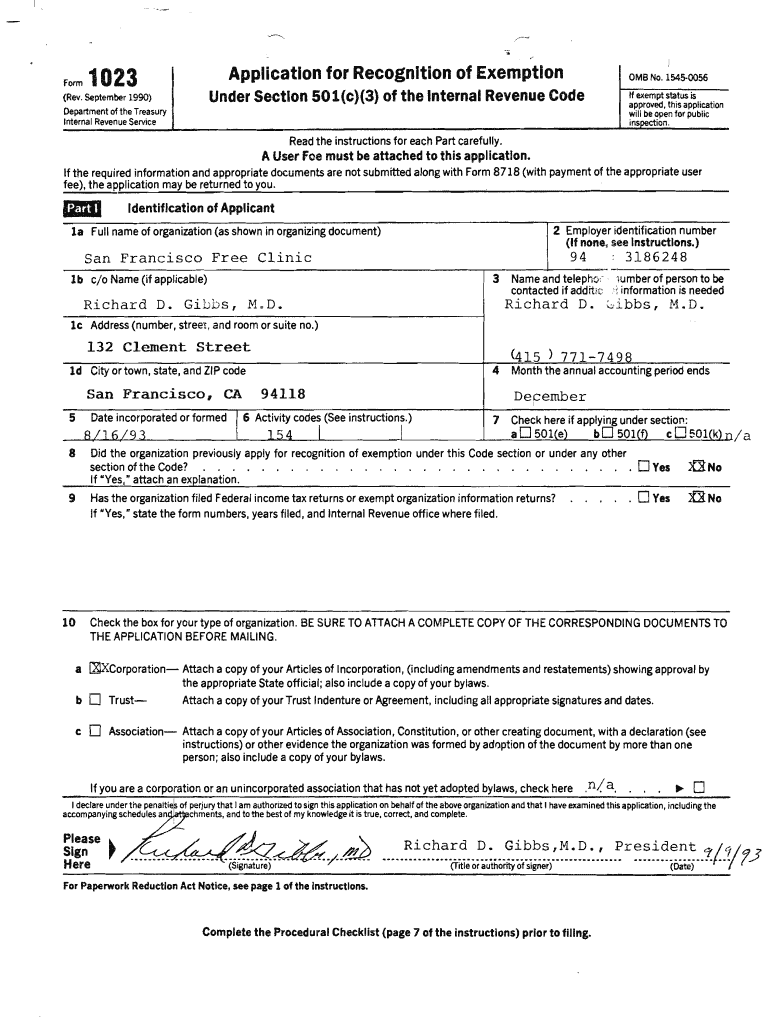

Form 1023 Fill out & sign online DocHub

Web in order to be exempt from tax as an irc § 501(c)(3) organization, an entity’s organizing documents must establish that it is “organized and operated exclusively” for one of eight. If you are not eligible to file. Ad get ready for tax season deadlines by completing any required tax forms today. When the tax season started unexpectedly or maybe.

Irs Tax Exempt Form 501c3 Form Resume Examples 86O78MakBR

Part i identification of applicant 1a full name of organization 1c. When the tax season started unexpectedly or maybe you just forgot about it, it could probably create problems for you. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. Web you have everything needed to apply for.

501(c)(3) Form 1023 Form Resume Examples 76YG3pDYoL

The following types of organizations may be considered tax exempt under. Ad get ready for tax season deadlines by completing any required tax forms today. Organizations not required to obtain recognition of exemption. January 2018) streamlined application for recognition of exemption under section 501(c)(3) of the internal revenue code department of the. Part i identification of applicant 1a.

15 Printable Irs Form 1023 Ez Templates Fillable Samples In Pdf Word

January 2018) streamlined application for recognition of exemption under section 501(c)(3) of the internal revenue code department of the. Part i identification of applicant 1a full name of organization 1c. If you are not eligible to file. The following types of organizations may be considered tax exempt under. Ad get ready for tax season deadlines by completing any required tax.

IRS Proposes Form 1023EZ

Web follow the simple instructions below: Part i identification of applicant 1a. Ad get ready for tax season deadlines by completing any required tax forms today. Web you have everything needed to apply for tax exemption using form 1023 , application for recognition of exemption under section 501(c)(3) of the internal revenue code, and its. Part i identification of applicant.

irs form 1023ez Fill Online, Printable, Fillable Blank

Web you have everything needed to apply for tax exemption using form 1023 , application for recognition of exemption under section 501(c)(3) of the internal revenue code, and its. Ad get ready for tax season deadlines by completing any required tax forms today. Web in order to be exempt from tax as an irc § 501(c)(3) organization, an entity’s organizing.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Organizations not required to obtain recognition of exemption. (on the hphl website as 1023ez eligibility. Web you have everything needed to apply for tax exemption using form 1023 , application for recognition of exemption under section 501(c)(3) of the internal revenue code, and its. Part i identification of applicant 1a full name of organization 1c.

When The Tax Season Started Unexpectedly Or Maybe You Just Forgot About It, It Could Probably Create Problems For You.

If you are not eligible to file. The following types of organizations may be considered tax exempt under. January 2018) streamlined application for recognition of exemption under section 501(c)(3) of the internal revenue code department of the. Part i identification of applicant 1a.

First, Let's Talk About What The Forms Have In Common.

Web follow the simple instructions below: Web in order to be exempt from tax as an irc § 501(c)(3) organization, an entity’s organizing documents must establish that it is “organized and operated exclusively” for one of eight. Complete, edit or print tax forms instantly.