1088 Form Irs

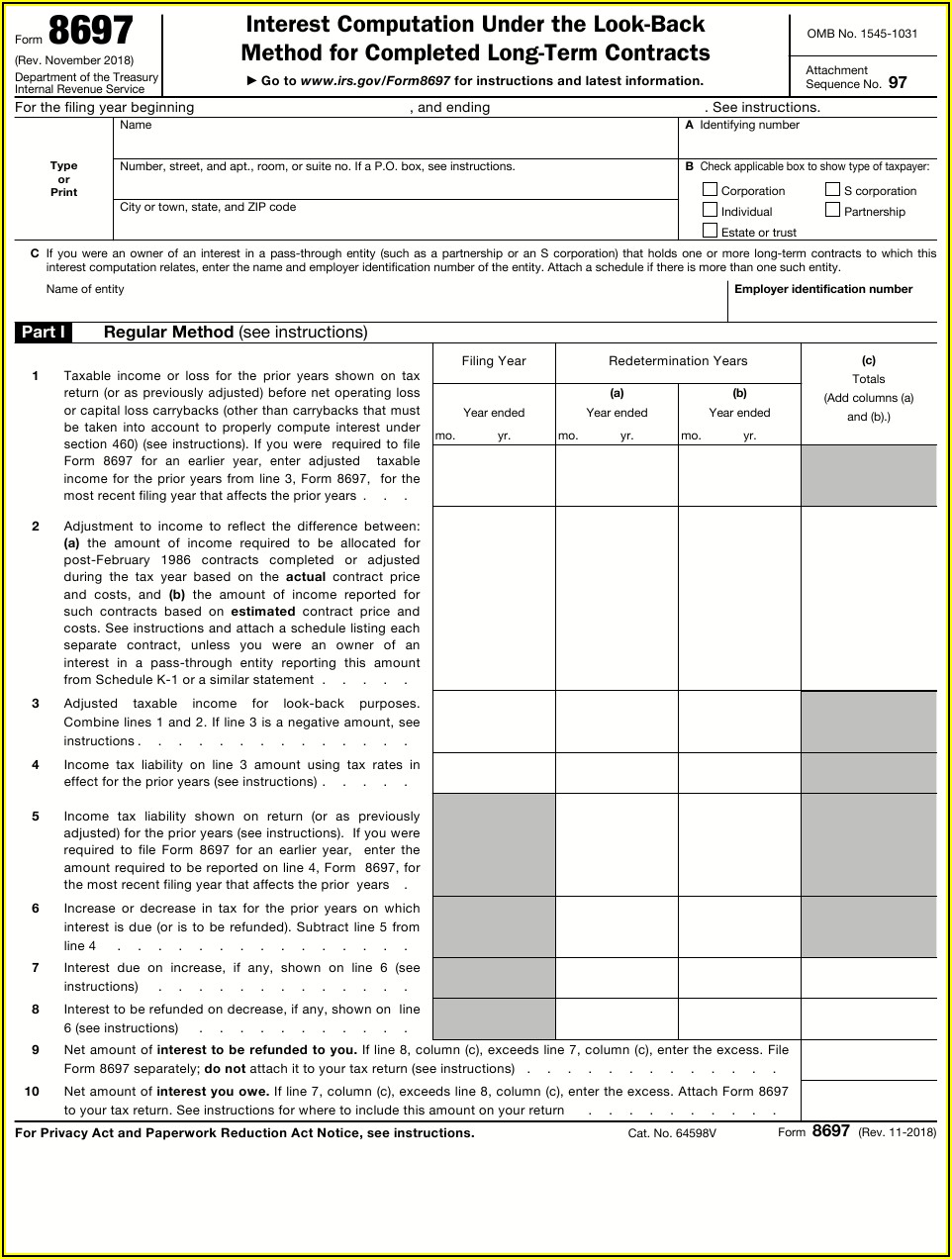

1088 Form Irs - The internal revenue service uses the information on this form to. Web there are several ways to submit form 4868. Web use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from an. Personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity loss (pal) or credit for the current tax. General instructions purpose of form personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity. Each term is defined as follows: Web get federal tax return forms and file by mail. Generally, you must also attach form 8283, noncash charitable contributions, if the. Web the 1088 tax form is one of the most important forms that a business will need to file with their annual taxes. Web form 1098, mortgage interest statement, is an internal revenue service (irs) form used by taxpayers to report the amount of interest and related expenses paid.

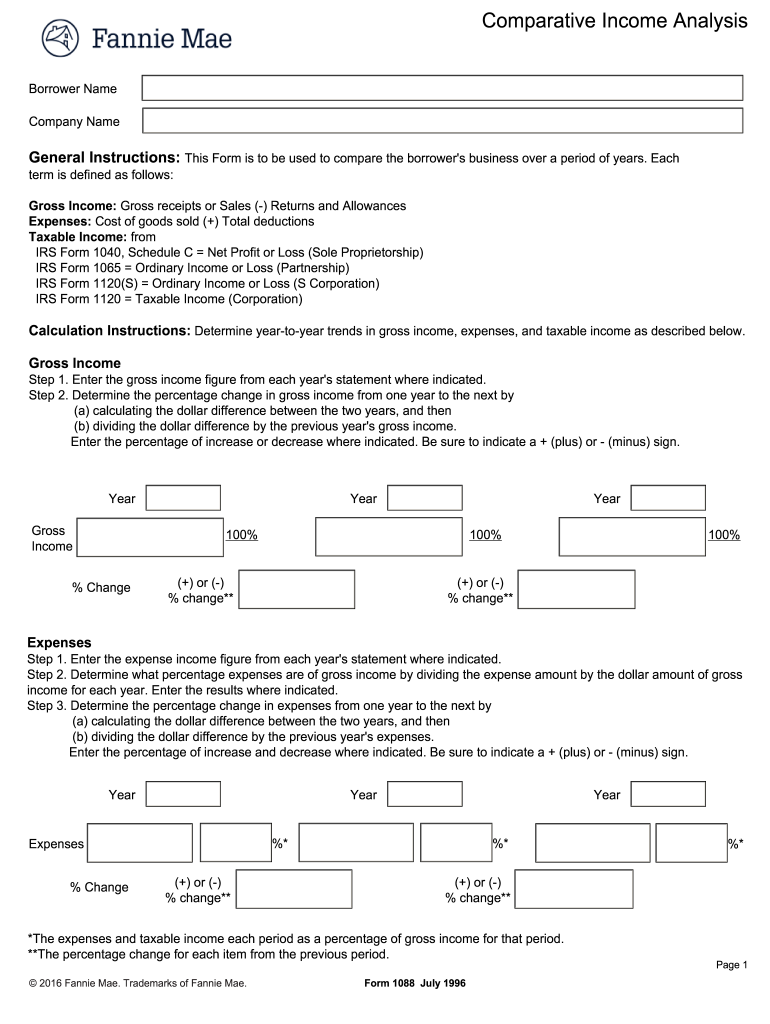

Web fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or decreases) in gross income, expenses and. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web all you need to do is to select the 1088 form irs, fill out the needed areas, drag and drop fillable fields (if required), and certify it without second guessing about whether or. Web there are several ways to submit form 4868. Web get federal tax return forms and file by mail. Generally, you must also attach form 8283, noncash charitable contributions, if the. Personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity loss (pal) or credit for the current tax. This form is to be used to compare the borrower's business over a period of years. Web form 1098, mortgage interest statement, is an internal revenue service (irs) form used by taxpayers to report the amount of interest and related expenses paid.

Web the 1088 tax form is one of the most important forms that a business will need to file with their annual taxes. Web tax form 1088 is a tax form used by the irs to calculate estate tax withholding.to learn more, visit the website: Web use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from an. Web get federal tax return forms and file by mail. The form has a number of different sections, each with slightly. Generally, you must also attach form 8283, noncash charitable contributions, if the. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity loss (pal) or credit for the current tax. This form is to be used to compare the borrower's business over a period of years. Web all you need to do is to select the 1088 form irs, fill out the needed areas, drag and drop fillable fields (if required), and certify it without second guessing about whether or.

1031 Exchange Tax Forms Form Resume Examples yKVBEXlYMB

Personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity loss (pal) or credit for the current tax. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web form 1098, mortgage interest statement, is an internal revenue service (irs) form used by taxpayers to.

Irs Fillable Extension Form Printable Forms Free Online

Each term is defined as follows: The internal revenue service uses the information on this form to. The form has a number of different sections, each with slightly. Generally, you must also attach form 8283, noncash charitable contributions, if the. Edit, sign and save income analysis form.

Laser Tax Form 1098E Student Copy B Free Shipping

Edit your irs form 1088 online type text, add images, blackout confidential details, add comments, highlights and more. General instructions purpose of form personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity. Each term is defined as follows: Gross receipts or sales (. Web use form 1098 (info copy only) to.

EDGAR Filing Documents for 000130817916000303

Web attach to your tax return (personal service and closely held corporations only). Sign it in a few clicks draw your signature, type it,. Edit your irs form 1088 online type text, add images, blackout confidential details, add comments, highlights and more. Web tax form 1088 is a tax form used by the irs to calculate estate tax withholding.to learn.

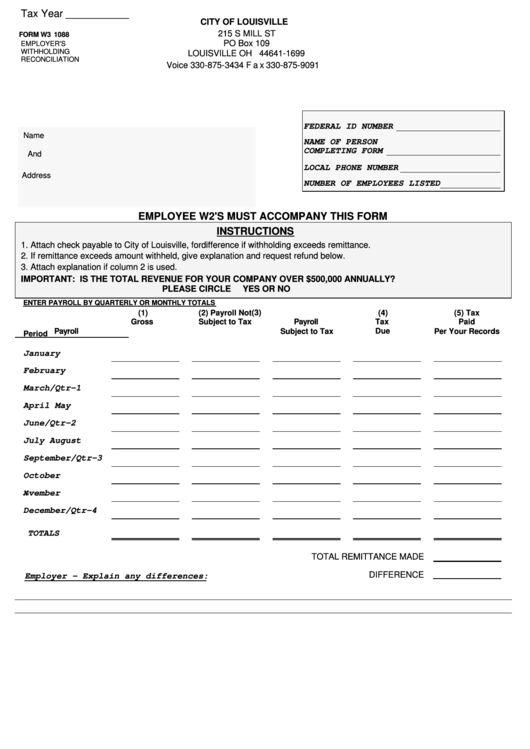

Fillable Form W3 1088 Employer'S Withholding Reconciliation City Of

Generally, you must also attach form 8283, noncash charitable contributions, if the. Web attach to your tax return (personal service and closely held corporations only). Web use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from an. Web form 6088 is.

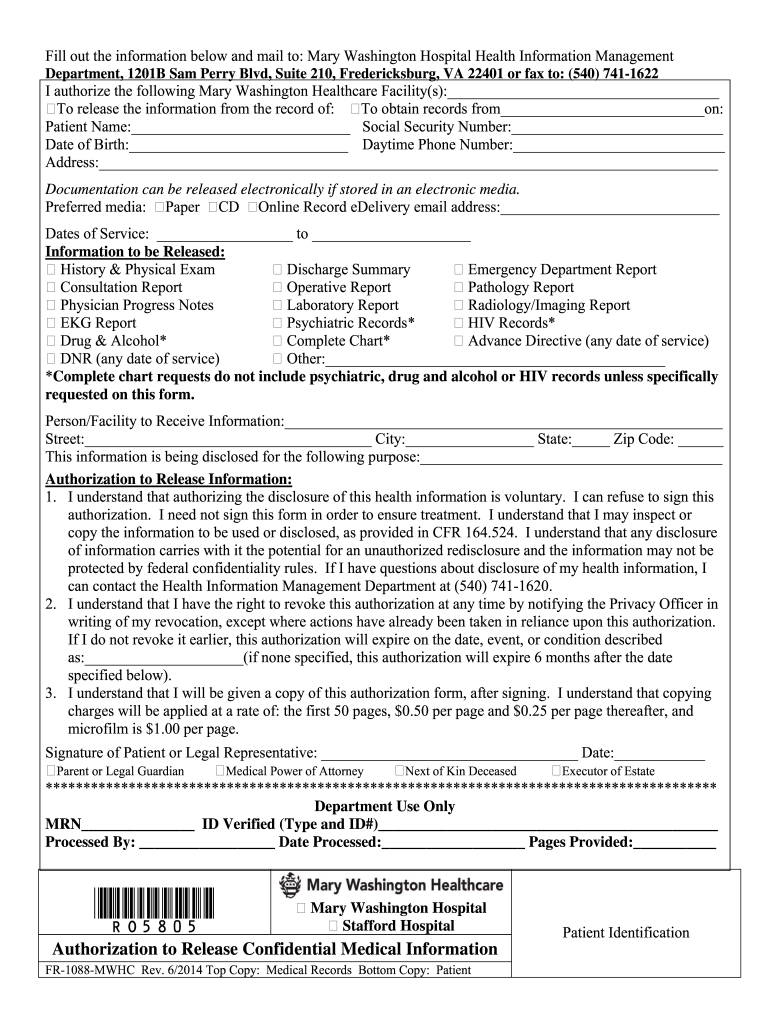

MWHC FR1088MWHC 2014 Fill and Sign Printable Template Online US

Web get federal tax return forms and file by mail. General instructions purpose of form personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Sign it in a few clicks draw your signature, type.

1088 Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

Web attach to your tax return (personal service and closely held corporations only). Edit, sign and save income analysis form. Edit your irs form 1088 online type text, add images, blackout confidential details, add comments, highlights and more. Web all you need to do is to select the 1088 form irs, fill out the needed areas, drag and drop fillable.

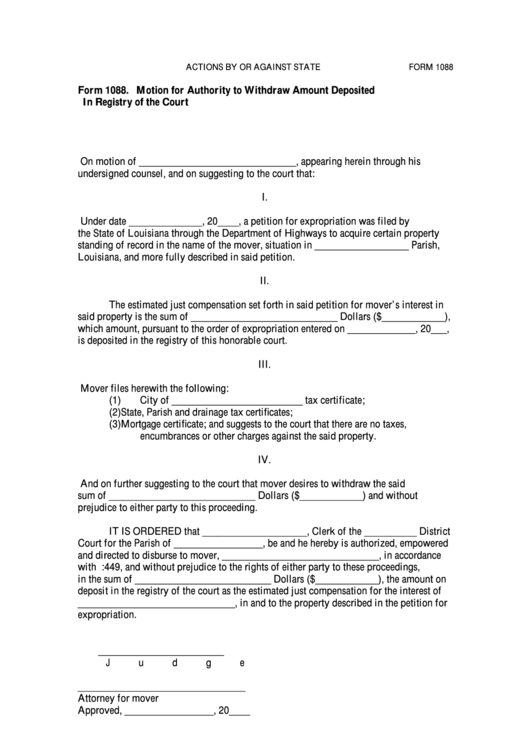

Fillable Form 1088 Motion For Authority To Withdraw Amount Deposited

Web all you need to do is to select the 1088 form irs, fill out the needed areas, drag and drop fillable fields (if required), and certify it without second guessing about whether or. This form is to be used to compare the borrower's business over a period of years. The form has a number of different sections, each with.

FIA Historic Database

Web use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from an. The internal revenue service uses the information on this form to. Generally, you must also attach form 8283, noncash charitable contributions, if the. Web all you need to do.

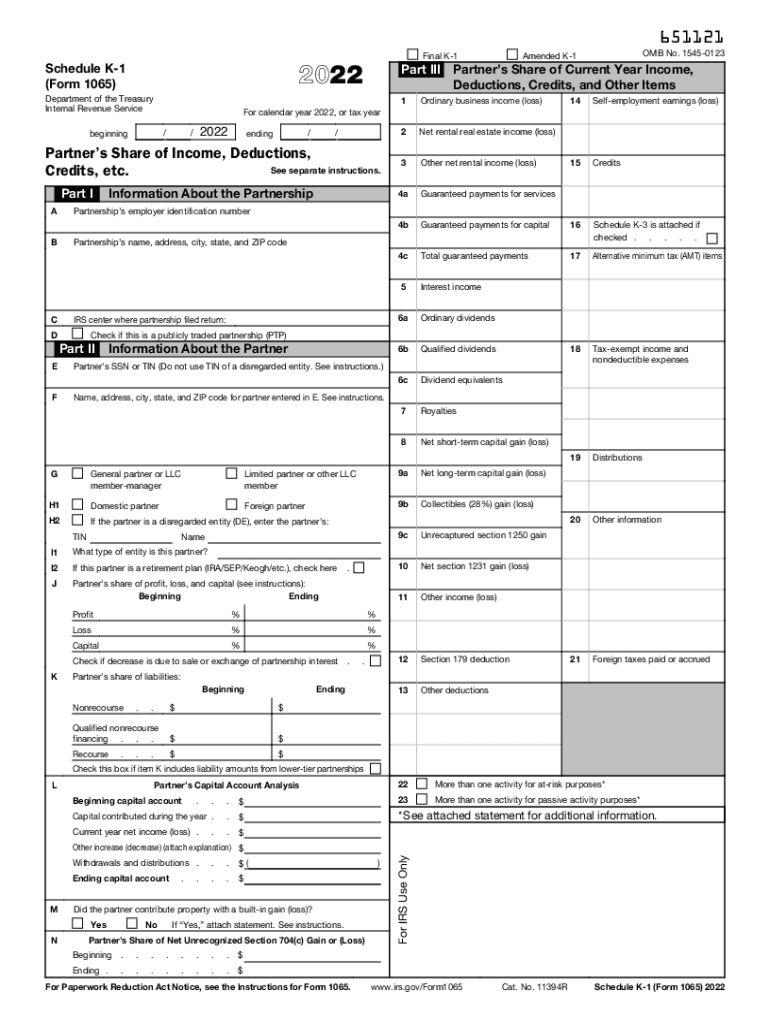

2022 Form IRS 1065 Schedule K1 Fill Online, Printable, Fillable

Web tax form 1088 is a tax form used by the irs to calculate estate tax withholding.to learn more, visit the website: Gross receipts or sales (. Web form 6088 is used to report the 25 highest participants of a deferred compensation plan. Edit, sign and save income analysis form. Taxpayers can file form 4868 by mail, but remember to.

Edit Your Irs Form 1088 Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

This form is to be used to compare the borrower's business over a period of years. Web attach to your tax return (personal service and closely held corporations only). The internal revenue service uses the information on this form to. Web use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from an.

The Form Has A Number Of Different Sections, Each With Slightly.

Web form 6088 is used to report the 25 highest participants of a deferred compensation plan. Sign it in a few clicks draw your signature, type it,. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Edit, sign and save income analysis form.

Gross Receipts Or Sales (.

Web form 1098, mortgage interest statement, is an internal revenue service (irs) form used by taxpayers to report the amount of interest and related expenses paid. Web there are several ways to submit form 4868. General instructions purpose of form personal service corporations and closely held corporations use form 8810 to figure the amount of any passive activity. Web all you need to do is to select the 1088 form irs, fill out the needed areas, drag and drop fillable fields (if required), and certify it without second guessing about whether or.

Web Tax Form 1088 Is A Tax Form Used By The Irs To Calculate Estate Tax Withholding.to Learn More, Visit The Website:

Web fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or decreases) in gross income, expenses and. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Each term is defined as follows: Generally, you must also attach form 8283, noncash charitable contributions, if the.