1099 Corrected Form

1099 Corrected Form - Web the issuer will prepare a form 1099 in the correct amount and check a “corrected” box on the form. Web prepare a new information return. If this form is incorrect or has been issued in error, contact the payer. The reipient copy can be printed on blank paper if you have purchased the laser generation option and have an hp laserjet compatible printer. Before the irs breaks down your door, go to tax1099.com > forms > new form. Include date, which is optional. When do businesses issue a form 1099? Web how to correct 1099 forms. The corrected form is supposed to cancel out the first one in the irs system, once you give. You may make a mistake on a 1099 form, but what happens then?

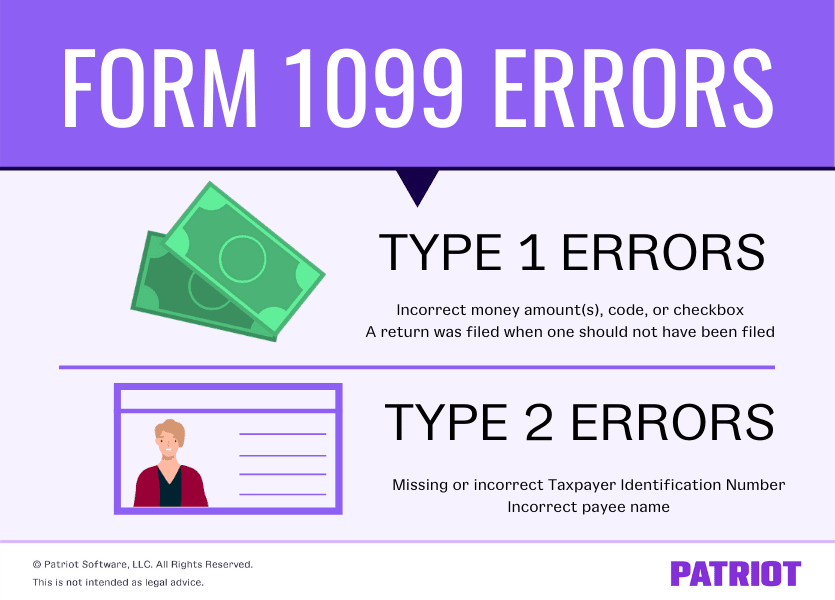

The way you correct your 1099 form depends on the type of mistake. Web all you need to do is fill in the correct information on a 1099 form and check the corrected box at the top of the form. Web to correct a type 2 error, you should do the following. Web file with form 1096. Type 1 errors and type 2 errors. Enter the information about the payer, recipient and account number that you have entered in the incorrect original return. Web prepare a new information return. Not filing a form when a form is needed. For examples, see 12.3 list c documents that establish employment authorization. Make a new information return.

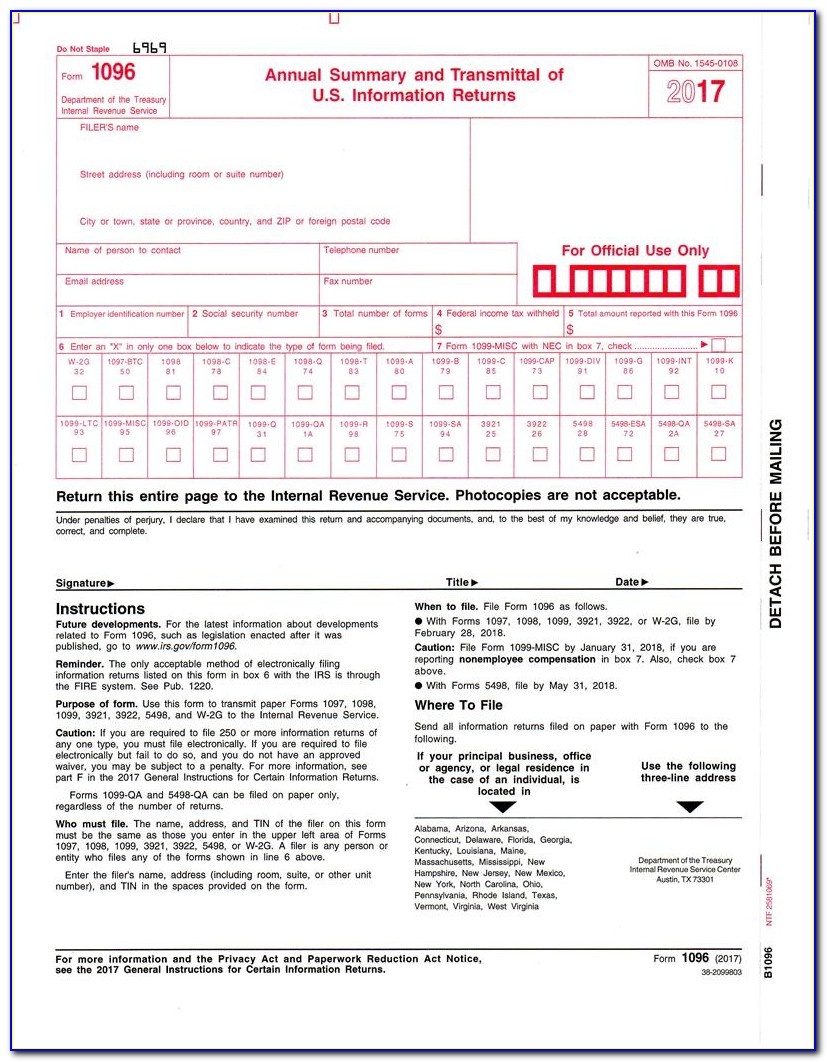

Web how to generate a corrected form 1099 or 1096 in easyacct. For privacy act and paperwork reduction act notice, see the. For examples, see 12.3 list c documents that establish employment authorization. Make a new information return. Web prepare a new information return. 1099 form mistakes are categorized into two types: Employment authorization document issued by the department of homeland security. A corrected 1099 form means your broker made a mistake. Web tax planning how to file a corrected 1099 march 7, 2023 corrected 1099s typically mean there's been an income reallocation. Submit up to 100 records per upload with csv templates.

Fillable Form 1099 S Form Resume Examples v19xKBO27E

Enter zero amounts in the relevant boxes. When do businesses issue a form 1099? Tax planning by geoff curran, wealth advisor cpa/abv, cfa®, cfp® published on 03/25/2016 learn more about geoff it’s tax season, and like last year, you received a corrected 1099 in the mail from your account’s custodian, such as charles schwab. Small businesses issue several types of.

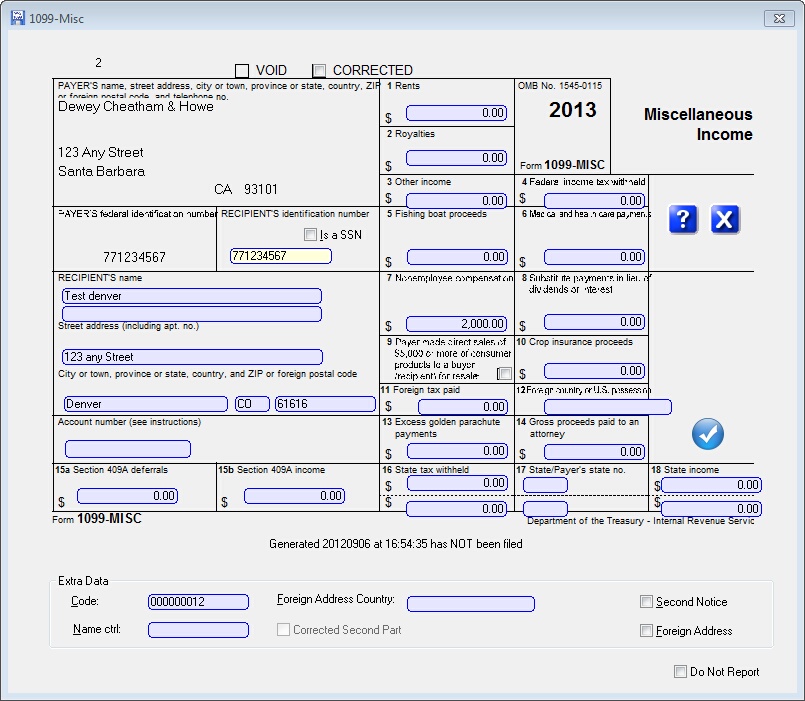

Entering & Editing Data > Form 1099MISC

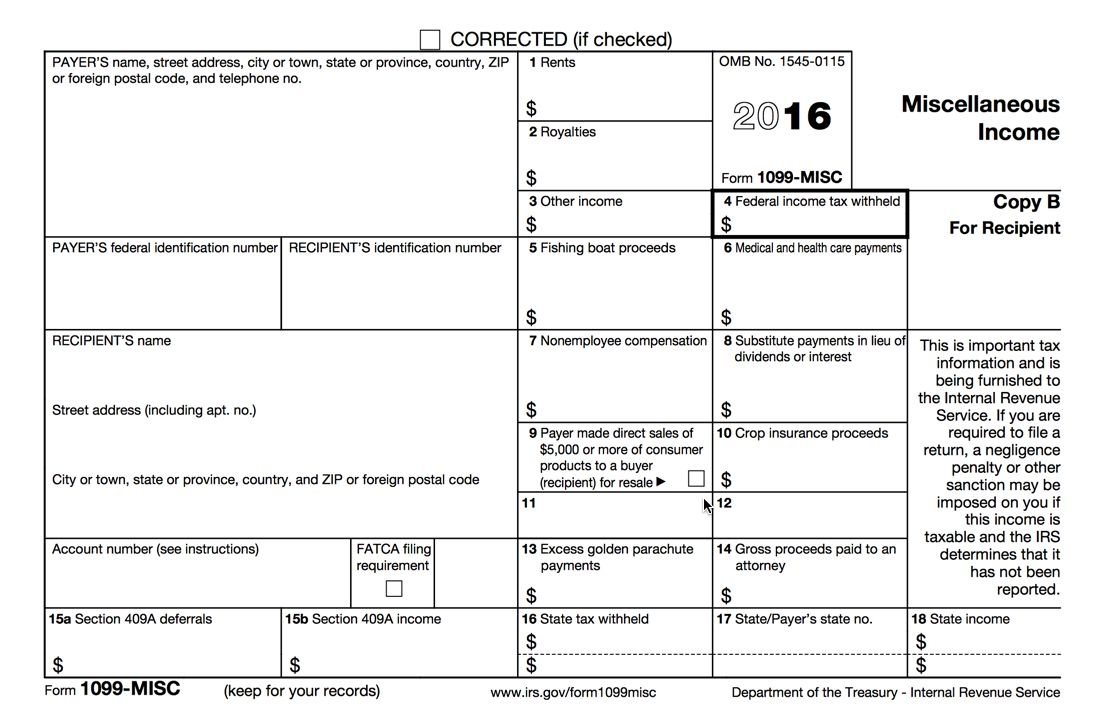

Web how to correct 1099 forms. Web tax planning how to file a corrected 1099 march 7, 2023 corrected 1099s typically mean there's been an income reallocation. Web if you filed 1099 forms electronically, you must correct them electronically. Not filing a form when a form is needed. Prepare a new form 1099 enter an x in the “corrected” box.

Corrected 1099 Issuing Corrected Forms 1099MISC and 1099NEC

Enter the payer, recipient, and account number information exactly as it appeared on the original incorrect return; Enter zero amounts in the relevant boxes. A corrected 1099 form means your broker made a mistake. Before the irs breaks down your door, go to tax1099.com > forms > new form. These 1099 form mistakes are considered type 1 errors:

Form 1099NEC Instructions and Tax Reporting Guide

Enter the payer, recipient, and account number information exactly as it has appeared on the original incorrect form. You can mail corrections on paper forms if you originally filed them by mail. You’ll check the “corrected” box at the top of the page. The biggest mistake we see is that taxpayers make is neglecting to file an information return when.

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

Web all you need to do is fill in the correct information on a 1099 form and check the corrected box at the top of the form. Find out the incorrect return that is transmitted to the irs. If this form is incorrect or has been issued in error, contact the payer. The reipient copy can be printed on blank.

Irs Form 1099 R Corrected Universal Network

The biggest mistake we see is that taxpayers make is neglecting to file an information return when one is required. Downloading easyacct and information return system from my account. Web tax planning how to file a corrected 1099 march 7, 2023 corrected 1099s typically mean there's been an income reallocation. 1099 form mistakes are categorized into two types: Type 1.

W4 Form Ri 2018 Fresh 813Plycoval Forms Form Unbelievable 1096 Free

Web how to generate a corrected form 1099 or 1096 in easyacct. Here's why it happens and what you need to do to update your tax filing and keep the irs happy. You may make a mistake on a 1099 form, but what happens then? There's a special box on the form to show it is correcting a prior 1099.

Corrected 1099 Issuing Corrected Forms 1099MISC and 1099NEC

There's a special box on the form to show it is correcting a prior 1099 to ensure the irs. Before the irs breaks down your door, go to tax1099.com > forms > new form. Downloading easyacct and information return system from my account. For privacy act and paperwork reduction act notice, see the. Click save at the bottom.

Free Printable 1099 Misc Forms Free Printable

For privacy act and paperwork reduction act notice, see the. Before the irs breaks down your door, go to tax1099.com > forms > new form. Enter the information about the payer, recipient and account number that you have entered in the incorrect original return. If you cannot get this form corrected, attach an explanation to your tax return and report.

What If My Doordash 1099 is Wrong? EntreCourier

Web all you need to do is fill in the correct information on a 1099 form and check the corrected box at the top of the form. Web to correct a type 1 error, you must: For privacy act and paperwork reduction act notice, see the. Downloading easyacct and information return system from my account. There's a special box on.

Enter Zero Amounts In The Relevant Boxes.

Enter an “x” in the “corrected” box (and date optional) at the top of the form. Employment authorization document issued by the department of homeland security. Enter the payer, recipient, and account number information exactly as it appeared on the original incorrect return; Web to correct a type 1 error, you must:

Click Save At The Bottom.

Downloading easyacct and information return system from my account. Here's why it happens and what you need to do to update your tax filing and keep the irs happy. Include date, which is optional. Web what’s with the corrected 1099s?

Enter “X ” In The “Corrected” Box At The Top Of The Form.

For examples, see 12.3 list c documents that establish employment authorization. For paper forms, see part h in the current year general instructions for certain information returns; Web click on the small pencil icon next to the payer's name. Before the irs breaks down your door, go to tax1099.com > forms > new form.

Enter The Information About The Payer, Recipient And Account Number That You Have Entered In The Incorrect Original Return.

There's a special box on the form to show it is correcting a prior 1099 to ensure the irs. Web if the payer has already dispatched the incorrect form to the irs, ask the payer to send a corrected form. The reipient copy can be printed on blank paper if you have purchased the laser generation option and have an hp laserjet compatible printer. Not filing a form when a form is needed.