1099 Form Changes For 2022

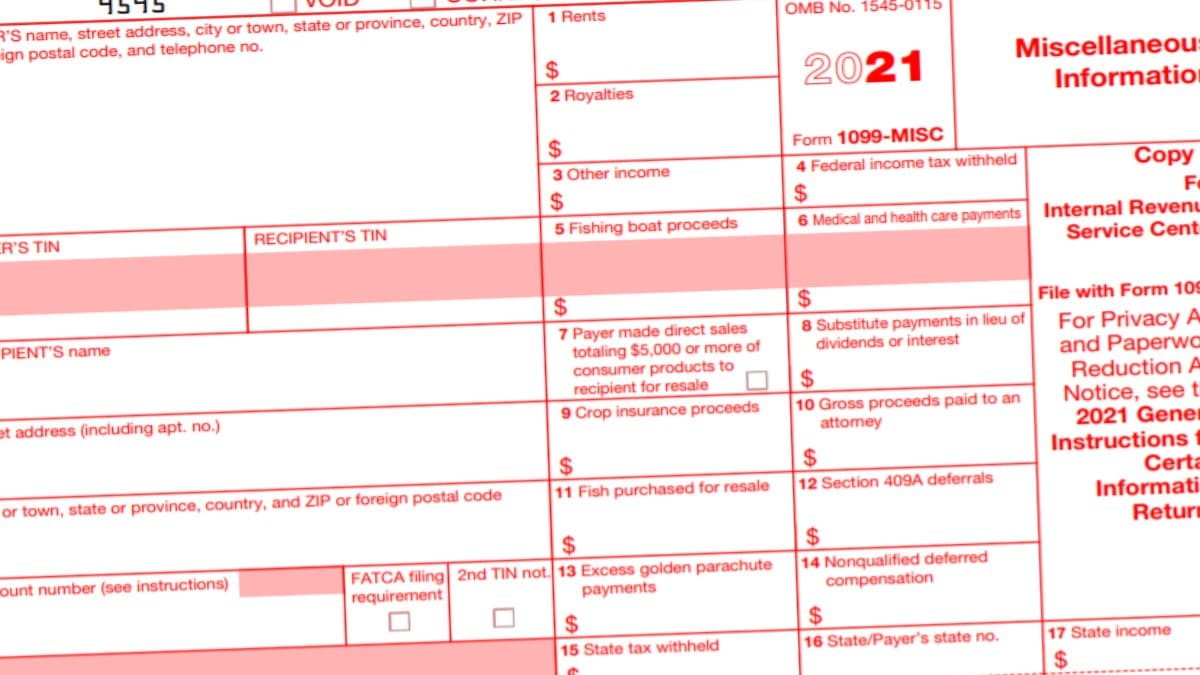

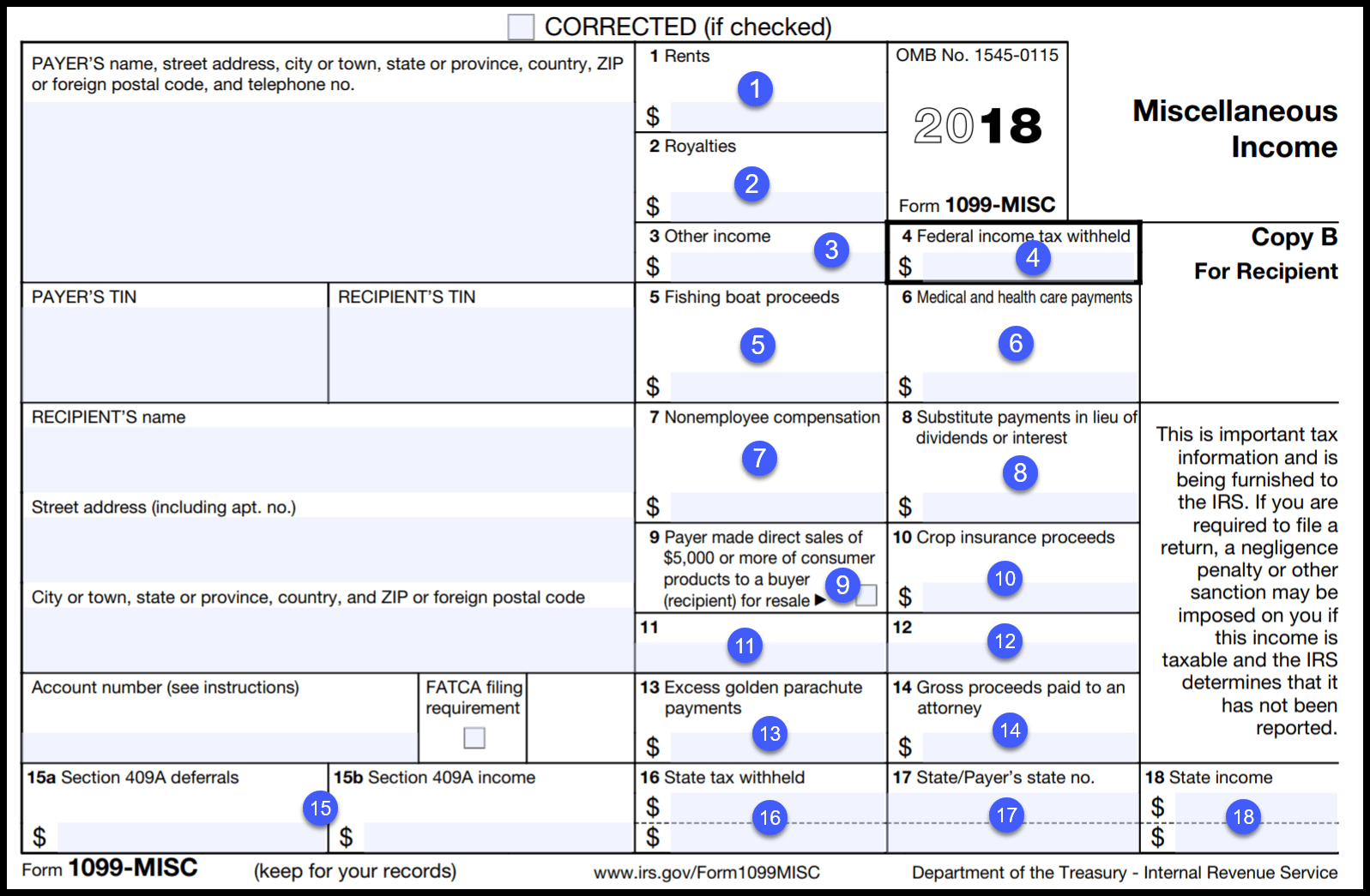

1099 Form Changes For 2022 - Gridwise is here to provide you with the latest on changes to 1099 taxes in 2022. Must be removed before printing. See the instructions for your tax return. They have revised box 13 to box 17. Web copy a for internal revenue service center file with form 1096. Web irs has published a new update on form 1099 misc (2022). This new change could impact your business if you sell online through square, etsy, or ebay, to name a few. There are a number of different 1099 forms that report various. Box 13 is now checkbox to report the foreign account tax compliance act (fatca) filing. Web learn what you need to know about how the inflation reducation act and tax law changes impact your 2022 taxes.

Web as you prepare for the 1099 filing season, note the changes effective for the 2022 tax year: They have revised box 13 to box 17. Web regulatory 1099 format changes november 2022. Jul 15, 2022 — 3 min read. Web irs has published a new update on form 1099 misc (2022). Changed from “nonqualified deferred compensation” amount to “excess golden parachute payments” If your annuity starting date is after 1997, you must use the simplified method to figure your taxable amount if your payer didn’t show the taxable amount in box 2a. What is the standard mileage deduction in 2022? Web if this form includes amounts belonging to another person, you are considered a nominee recipient. Web however, beginning in 2022, the new gross payment threshold is $600.

Web copy a for internal revenue service center file with form 1096. Subsequently, old box numbers 13 through 17 have been renumbered to new box numbers 14 through 18, respectively. Definitions general information individuals more information about reliance is available. Web regulatory 1099 format changes november 2022. For privacy act and paperwork reduction act notice, see the current general instructions for certain information returns. Why lower the threshold now? Some of the boxes will be shifted in all 1099 reports. This new change could impact your business if you sell online through square, etsy, or ebay, to name a few. And what should i know for 2023? Web what are the changes to 1099 misc for 2022?

Major Changes to File Form 1099MISC Box 7 in 2020

New federal forms in the 1099 series reporting miscellaneous information and nonemployee compensation are to be used starting in tax year 2022, not 2021, an internal revenue. Web copy a for internal revenue service center file with form 1096. Web for the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Qualified plans and section 403(b) plans. Web form 1099 filing.

What is a 1099 & 5498? uDirect IRA Services, LLC

For the misc report, the position of the fatca mark is different. Qualified plans and section 403(b) plans. Subsequently, old box numbers 13 through 17 have been renumbered to new box numbers 14 through 18, respectively. Web form 1099 filing requirements and new changes for 2022 form 1099 reporting requirements (information returns). Definitions general information individuals more information about reliance.

When is tax form 1099MISC due to contractors? GoDaddy Blog

Definitions general information individuals more information about reliance is available. Web learn what you need to know about how the inflation reducation act and tax law changes impact your 2022 taxes. Web you’re probably wondering, how do i file 1099 taxes in 2022? Web irs has published a new update on form 1099 misc (2022). Web form 1099 filing requirements.

1099 MISC Form 2022 1099 Forms TaxUni

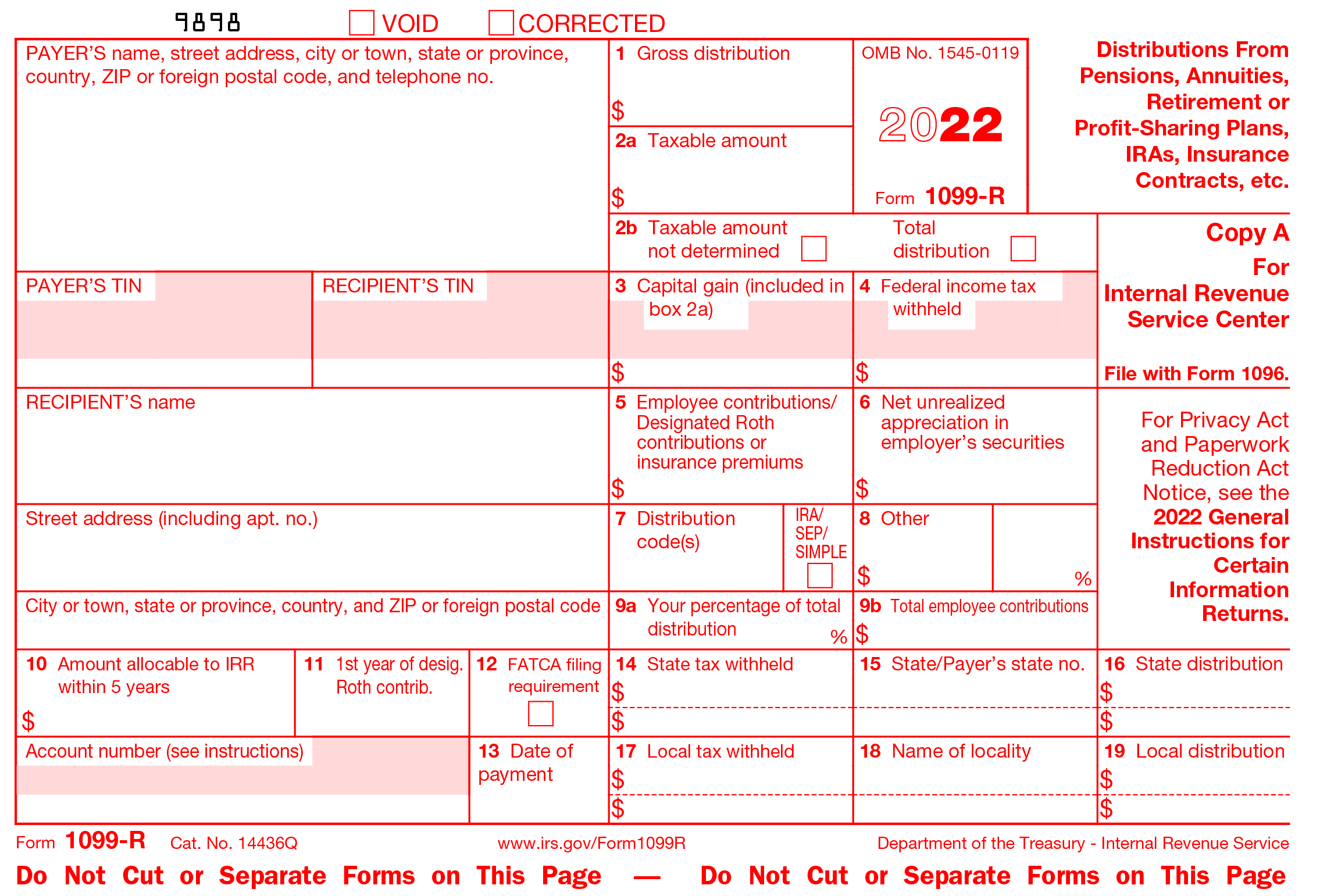

If your annuity starting date is after 1997, you must use the simplified method to figure your taxable amount if your payer didn’t show the taxable amount in box 2a. This new change could impact your business if you sell online through square, etsy, or ebay, to name a few. Web regulatory 1099 format changes november 2022. Web irs has.

J. Hunter Company Businesses use form 1099NEC to report contractor

Web regulatory 1099 format changes november 2022. Must be removed before printing. And what should i know for 2023? Web if this form includes amounts belonging to another person, you are considered a nominee recipient. Web irs has published a new update on form 1099 misc (2022).

IRS Form 1099 Reporting for Small Business Owners

Jul 15, 2022 — 3 min read. Must be removed before printing. A big change from $20,000. Definitions general information individuals more information about reliance is available. Box number 13 has been assigned to the foreign account tax compliance act (fatca) filing requirement checkbox.

1099 MISC Form 2022 1099 Forms TaxUni

There are a number of different 1099 forms that report various. This new change could impact your business if you sell online through square, etsy, or ebay, to name a few. Subsequently, old box numbers 13 through 17 have been renumbered to new box numbers 14 through 18, respectively. Box 13 is now checkbox to report the foreign account tax.

1099 NEC Form 2022

Jul 15, 2022 — 3 min read. Some of the boxes will be shifted in all 1099 reports. Web as you prepare for the 1099 filing season, note the changes effective for the 2022 tax year: A big change from $20,000. New federal forms in the 1099 series reporting miscellaneous information and nonemployee compensation are to be used starting in.

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

Web copy a for internal revenue service center file with form 1096. Web if this form includes amounts belonging to another person, you are considered a nominee recipient. If your annuity starting date is after 1997, you must use the simplified method to figure your taxable amount if your payer didn’t show the taxable amount in box 2a. Box number.

Efile 2022 Form 1099R Report the Distributions from Pensions

If your annuity starting date is after 1997, you must use the simplified method to figure your taxable amount if your payer didn’t show the taxable amount in box 2a. Web what are the changes to 1099 misc for 2022? The irs has made a few updates to form. Web learn what you need to know about how the inflation.

Gridwise Is Here To Provide You With The Latest On Changes To 1099 Taxes In 2022.

This new change could impact your business if you sell online through square, etsy, or ebay, to name a few. The irs has made a few updates to form. January 2022) miscellaneous information and nonemployee compensation Some of the boxes will be shifted in all 1099 reports.

Changed From “Excess Golden Parachute Payments” To “Fatca Filing Requirements” Checkbox.

Web form 1099 filing requirements and new changes for 2022 form 1099 reporting requirements (information returns). Web what are the changes to 1099 misc for 2022? They have revised box 13 to box 17. 1099 changes for 2022 provide an upgrade for the misc and div boxes.

A Calendar Year Is Added In The Top Right Corner In Printouts.

Jul 15, 2022 — 3 min read. Web irs has published a new update on form 1099 misc (2022). What is the standard mileage deduction in 2022? Web learn what you need to know about how the inflation reducation act and tax law changes impact your 2022 taxes.

If Your Annuity Starting Date Is After 1997, You Must Use The Simplified Method To Figure Your Taxable Amount If Your Payer Didn’t Show The Taxable Amount In Box 2A.

Qualified plans and section 403(b) plans. Web as you prepare for the 1099 filing season, note the changes effective for the 2022 tax year: What are the quarterly tax dates for 2022? Changed from “nonqualified deferred compensation” amount to “excess golden parachute payments”