1099 Form For Attorney Fees

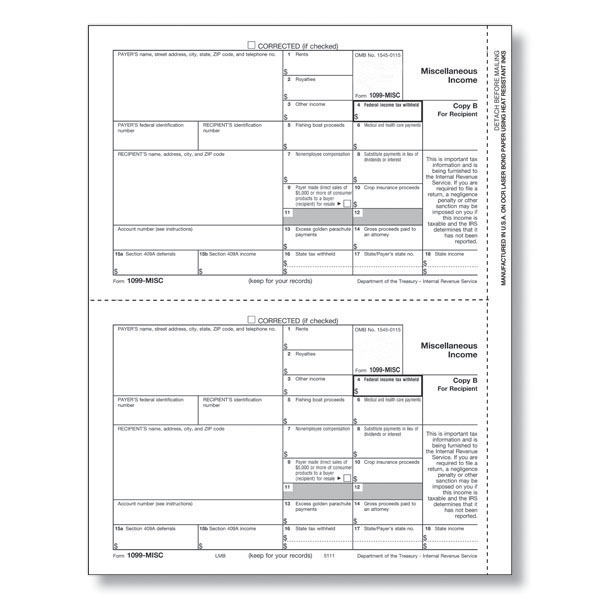

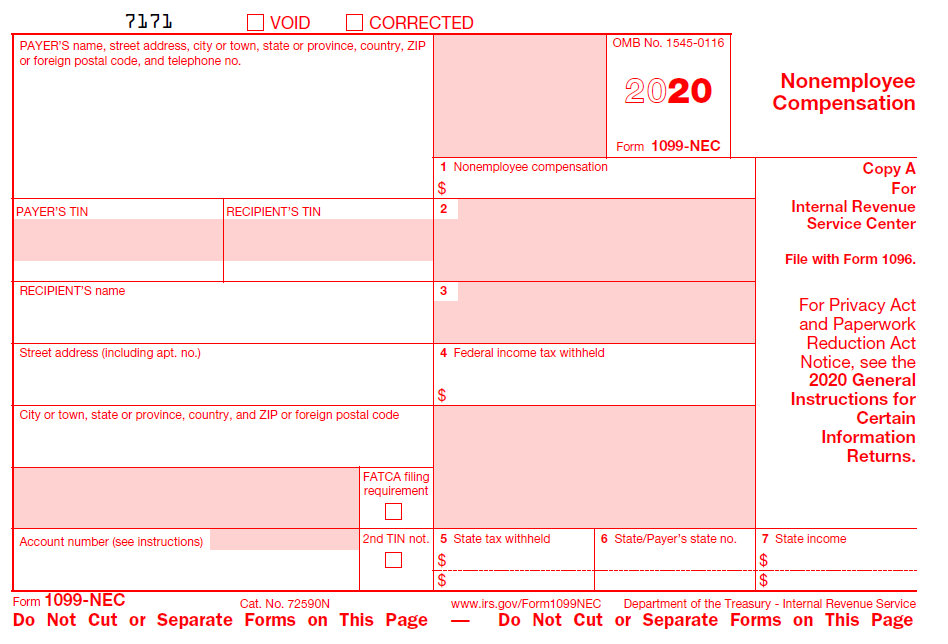

1099 Form For Attorney Fees - 1099 misc box 7 changed to 1099. This rule also applies to client. Ad get the latest 1099 misc online. 1099 form reports payments of $600 or more. Only if you itemize, you can deduct the attorney fee in proportion to the taxable amount of ss benefits over the total ss benefits paid to you. Web irc § 6045. My case took over 4 years to win. 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from. · contact name and telephone number. Attorney fees paid in the course of your.

Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. Beware final irs rules on forms 1099 for attorneys by robert w. Web attorney fees on ssa form 1099 i have over $20,000 in attorney fees for 2019 on my ssa 1099 which are included in box 3 & 5. · contact name and telephone number. Only if you itemize, you can deduct the attorney fee in proportion to the taxable amount of ss benefits over the total ss benefits paid to you. The term “attorney” includes a law. · describe the information to be collected, why the. Fill, edit, sign, download & print. This rule also applies to client. 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from.

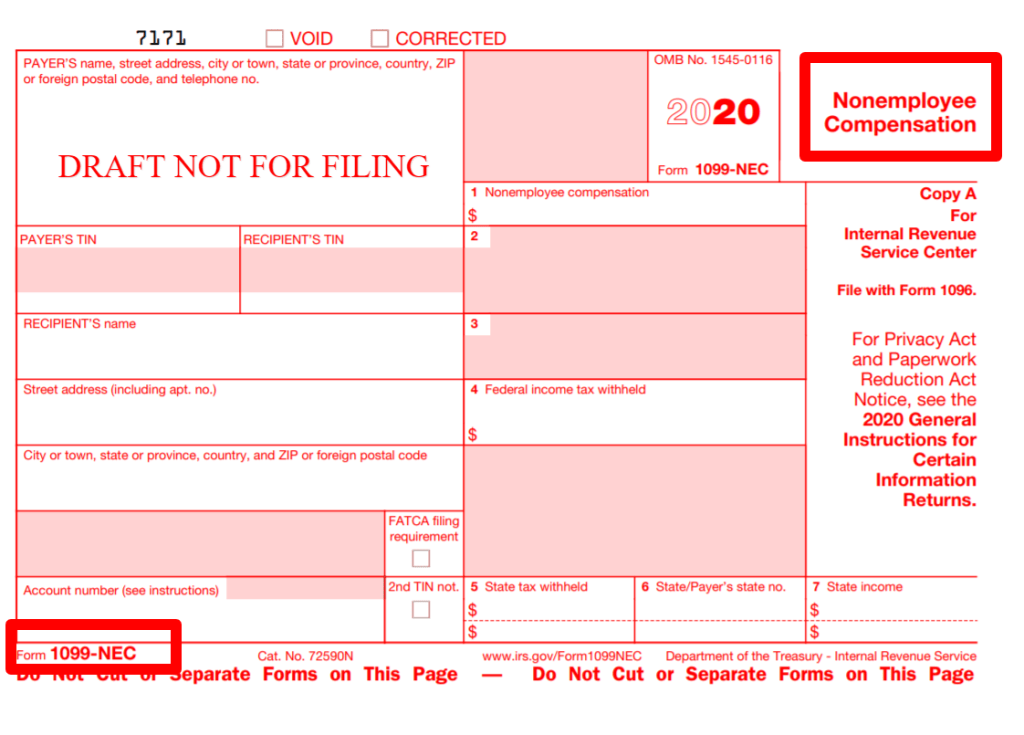

Beware final irs rules on forms 1099 for attorneys by robert w. Only if you itemize, you can deduct the attorney fee in proportion to the taxable amount of ss benefits over the total ss benefits paid to you. Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. My case took over 4 years to win. Web attorney fees on ssa form 1099 i have over $20,000 in attorney fees for 2019 on my ssa 1099 which are included in box 3 & 5. 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from. Do not miss the deadline 1099 form reports payments of $600 or more. 1099 misc box 7 changed to 1099. Ad get the latest 1099 misc online.

1099 Legal Fees The Simple Guide To File

The term “attorney” includes a law. Fill, edit, sign, download & print. Attorney fees paid in the course of your. Web n settlement (no back pay or wages) is paid directly to employee and attorney fees are identified — the entire amount of the settlement (including attorney fees) will be. Web irc § 6045.

26 LEGAL FEES FORM 1099 PDF DOC FREE DOWNLOAD

Web irc § 6045. Ad get the latest 1099 misc online. Web attorney fees on ssa form 1099 i have over $20,000 in attorney fees for 2019 on my ssa 1099 which are included in box 3 & 5. · describe the information to be collected, why the. Do not miss the deadline

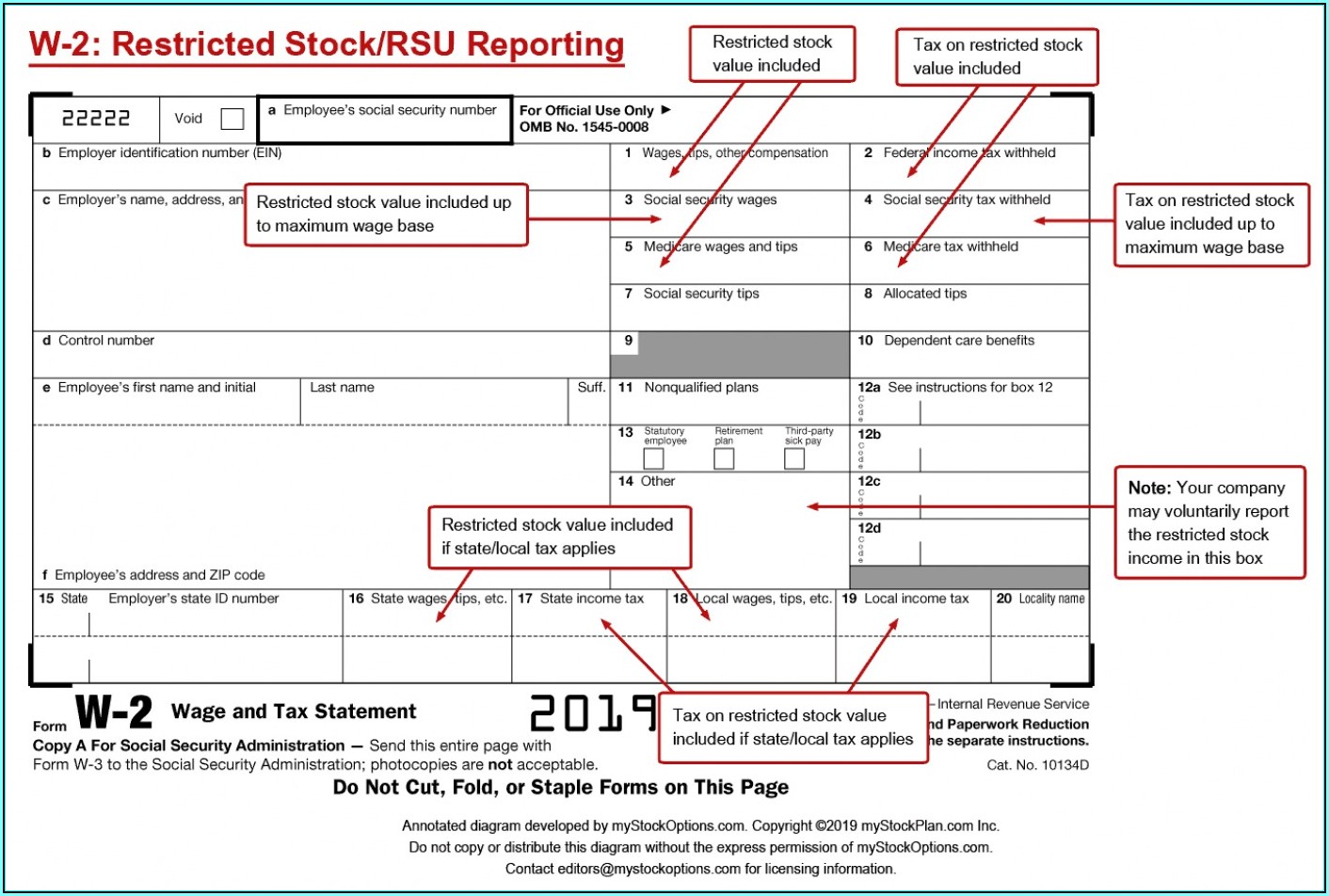

Employer Or Employee 1099 Form Form Resume Examples EZVggAgVJk

Beware final irs rules on forms 1099 for attorneys by robert w. · contact name and telephone number. · describe the information to be collected, why the. 1099 misc box 7 changed to 1099. 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from.

1099 Form Printable 2018 MBM Legal

My case took over 4 years to win. Web n settlement (no back pay or wages) is paid directly to employee and attorney fees are identified — the entire amount of the settlement (including attorney fees) will be. Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered.

Accounts Payable Software for Small Business Accurate Tracking

· describe the information to be collected, why the. Only if you itemize, you can deduct the attorney fee in proportion to the taxable amount of ss benefits over the total ss benefits paid to you. Attorney fees paid in the course of your. 1099 form reports payments of $600 or more. Fill, edit, sign, download & print.

IRS Form 1099 Reporting for Small Business Owners Best Practice in HR

Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. · describe the information to be collected, why the. 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from. 1099 form reports.

View Form Ssa 1099 Online Universal Network

1099 form reports payments of $600 or more. This rule also applies to client. My case took over 4 years to win. Web irc § 6045. · contact name and telephone number.

1099 Form 2020 📝 Get 1099 MISC Printable Form, Instructions

1099 form reports payments of $600 or more. Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. This rule also applies to client. Ad get the latest 1099 misc online. Only if you itemize, you can.

How do I Access 1099NEC form Files for Use with Sage Checks & Forms?

The term “attorney” includes a law. Only if you itemize, you can deduct the attorney fee in proportion to the taxable amount of ss benefits over the total ss benefits paid to you. Ad get the latest 1099 misc online. · describe the information to be collected, why the. 201, accelerated the due date for filing form 1099 that includes.

Ssa 1099 Form 2019 Pdf Fill Online, Printable, Fillable, Blank

Web n settlement (no back pay or wages) is paid directly to employee and attorney fees are identified — the entire amount of the settlement (including attorney fees) will be. Do not miss the deadline 1099 misc box 7 changed to 1099. Ad get the latest 1099 misc online. Only if you itemize, you can deduct the attorney fee in.

Web Attorney Fees On Ssa Form 1099 I Have Over $20,000 In Attorney Fees For 2019 On My Ssa 1099 Which Are Included In Box 3 & 5.

This rule also applies to client. Ad get the latest 1099 misc online. Only if you itemize, you can deduct the attorney fee in proportion to the taxable amount of ss benefits over the total ss benefits paid to you. 1099 misc box 7 changed to 1099.

· Contact Name And Telephone Number.

Fill, edit, sign, download & print. 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from. Do not miss the deadline Web irc § 6045.

My Case Took Over 4 Years To Win.

· describe the information to be collected, why the. 1099 form reports payments of $600 or more. Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. Attorney fees paid in the course of your.

Beware Final Irs Rules On Forms 1099 For Attorneys By Robert W.

Web n settlement (no back pay or wages) is paid directly to employee and attorney fees are identified — the entire amount of the settlement (including attorney fees) will be. The term “attorney” includes a law.