1099 Form Pennsylvania

1099 Form Pennsylvania - For pennsylvania personal income tax purposes, the 1099. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered. Pennsylvania has a flat state income tax of 3.07% , which is administered by the pennsylvania department of revenue. Do not report negative figures,. Pa personal income tax guide. This form is used to indicate the amount of payments made to a particular social security number. Taxformfinder provides printable pdf copies of. You may also have a filing requirement. The state of pennsylvania also mandates the filing of form rev.

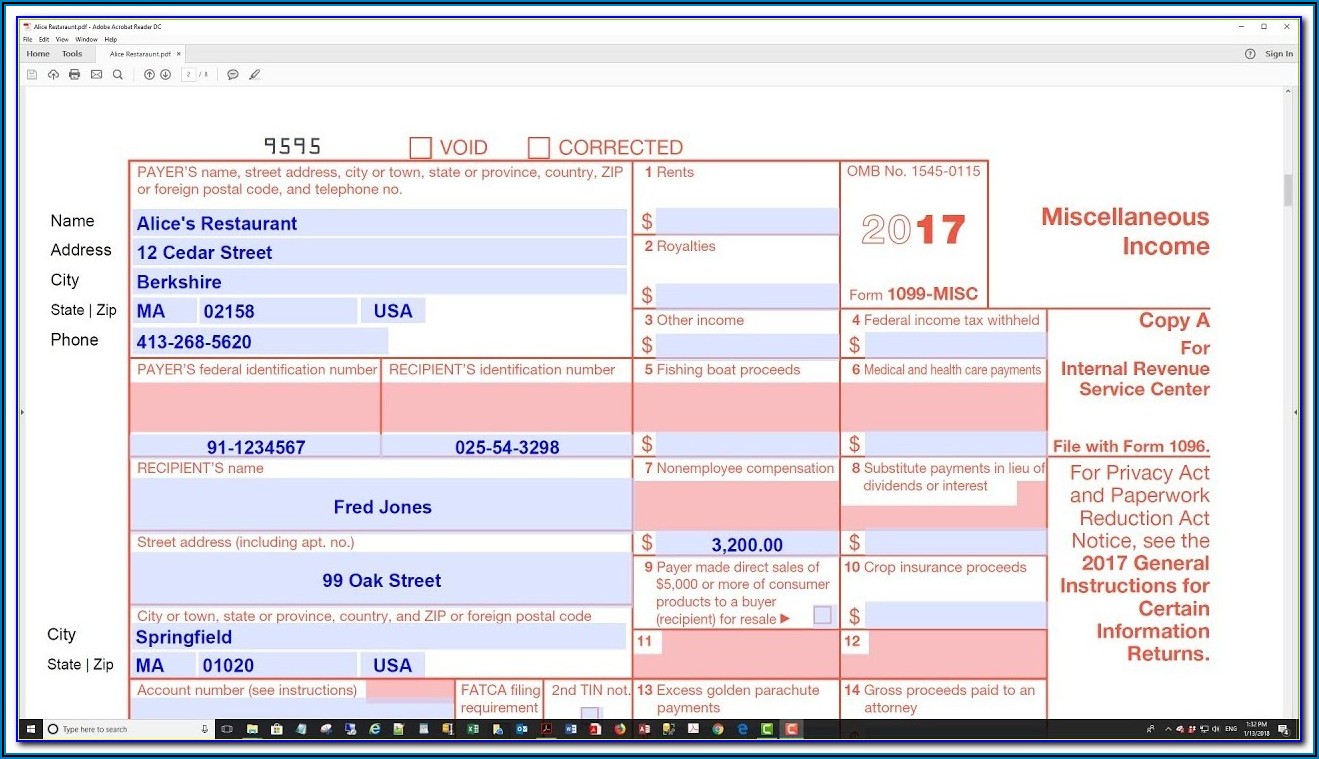

This form is used to indicate the amount of payments made to a particular social security number. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. You may also have a filing requirement. Pennsylvania has a flat state income tax of 3.07% , which is administered by the pennsylvania department of revenue. For pennsylvania personal income tax purposes, the 1099. This page provides the latest resources on pennsylvania state 1099 filing including compliance rules, sending 1099. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. This guide explains the information on the form and.

Accurate & dependable 1099 right to your email quickly and easily. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Pennsylvania has a flat state income tax of 3.07% , which is administered by the pennsylvania department of revenue. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered. Pa personal income tax guide. For pennsylvania personal income tax purposes, the 1099. Web looking for pennsylvania 1099 filing requirements? You may also have a filing requirement. Taxformfinder provides printable pdf copies of. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations.

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

Web you must obtain a pa employer account id, if reporting greater than zero. Web this tax form provides the total amount of money you were paid in benefits from the office of unemployment compensation in the prior calendar year, as well as any adjustments or. Pa personal income tax guide. See the instructions for form. Web on this form.

1099 Tax Forms Available Soon for Pa. Unemployment Claimants Erie

Web this tax form provides the total amount of money you were paid in benefits from the office of unemployment compensation in the prior calendar year, as well as any adjustments or. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Ap leaders rely on iofm’s expertise to keep them up to date.

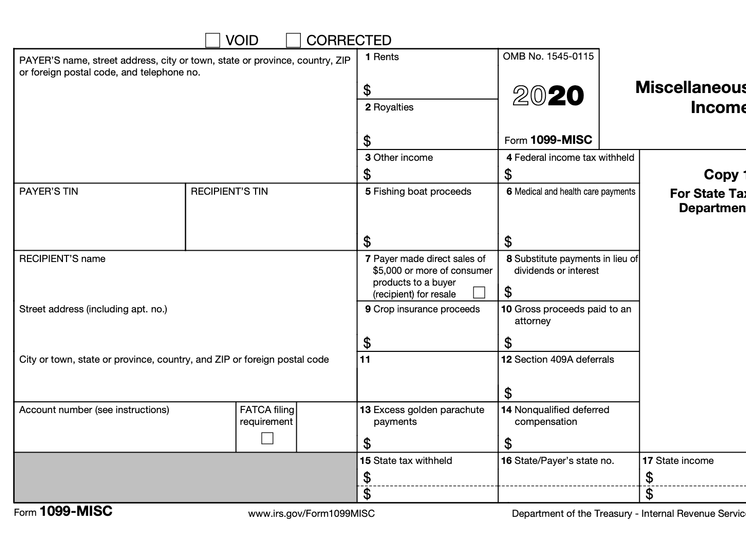

1099MISC Tax Basics

Do not report negative figures,. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web you must obtain a pa employer account id, if reporting greater than zero. For pennsylvania personal income tax purposes, the 1099. Web this tax form provides the total amount of money you were paid in benefits from the.

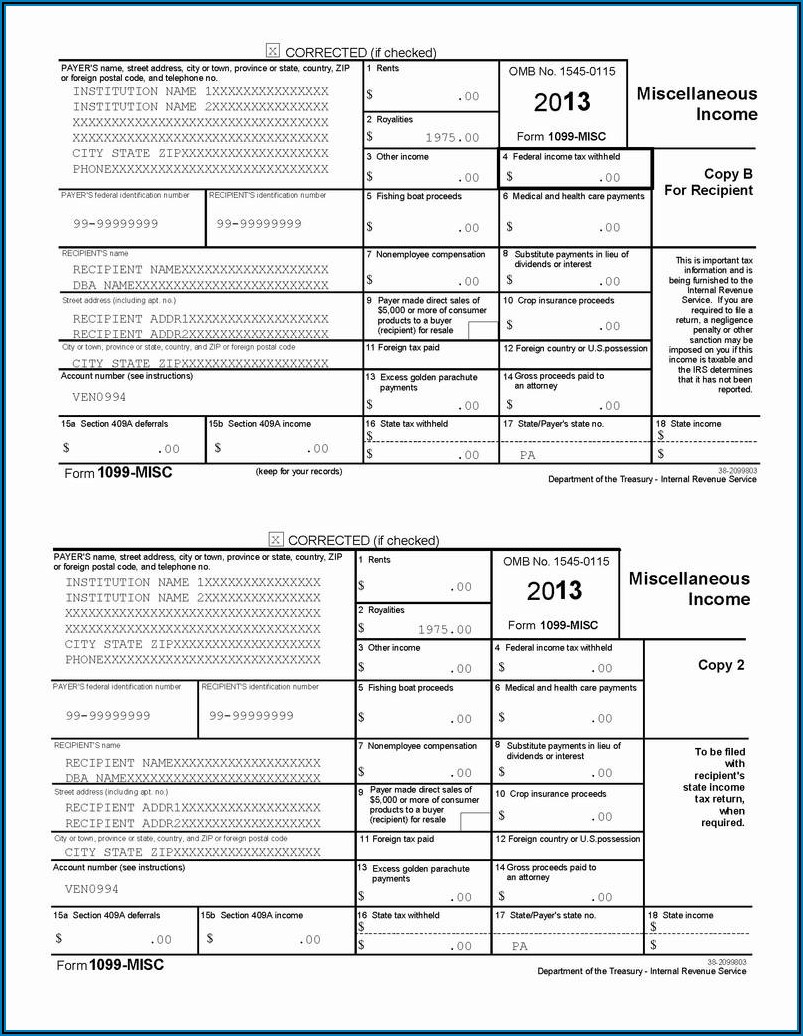

Pennsylvania Form 1099 Filing Requirements Form Resume Template

See the instructions for form. For pennsylvania personal income tax purposes, the 1099. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Do not report negative figures,. Pennsylvania has a flat state income tax of 3.07% , which is administered by the pennsylvania department of revenue.

How To File Form 1099NEC For Contractors You Employ VacationLord

Taxformfinder provides printable pdf copies of. Ad in a few easy steps, you can create your own 1099 forms and have them sent to your email. For pennsylvania personal income tax purposes, the 1099. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. The state of pennsylvania also mandates the filing of form.

1099 Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

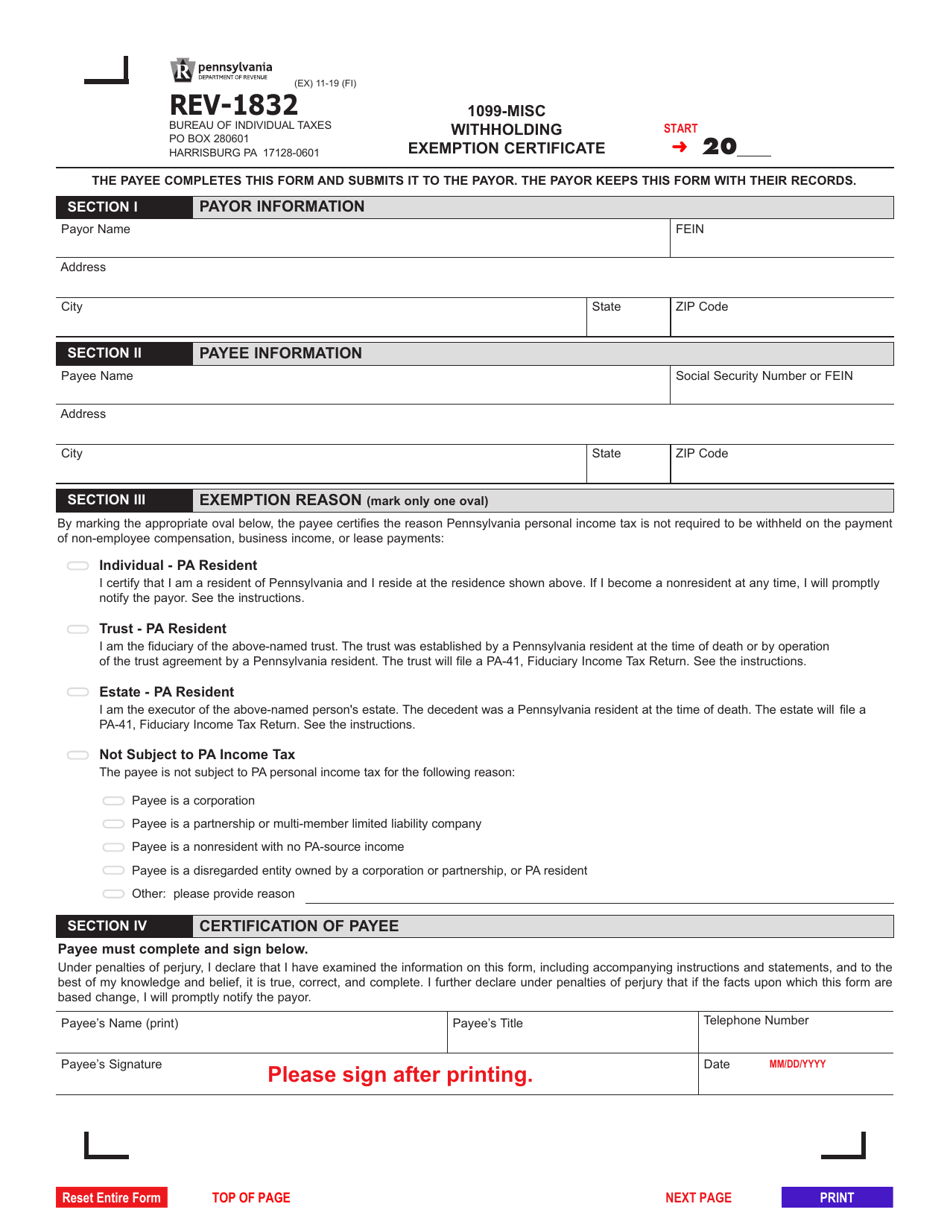

You may also have a filing requirement. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered. Web you must obtain a pa employer account id, if reporting greater than zero. This guide explains the information on the form and. The state of pennsylvania also mandates the filing of form.

Sample of completed 1099int 205361How to calculate 1099int

The state of pennsylvania also mandates the filing of form rev. See the instructions for form. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. For pennsylvania personal income tax purposes, the 1099. Taxformfinder provides printable pdf copies of.

Filing 1099 Forms In Pa Universal Network

Accurate & dependable 1099 right to your email quickly and easily. For pennsylvania personal income tax purposes, the 1099. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Csv format) and contain a.

Form REV1832 Download Fillable PDF or Fill Online 1099misc

Web you must obtain a pa employer account id, if reporting greater than zero. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered. For pennsylvania personal income tax purposes, the 1099. This guide explains the information on the form and. Web this is the easiest way to electronically fill.

Pennsylvania Form 1099 Filing Requirements Form Resume Template

Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered. Accurate & dependable 1099 right to your email quickly and easily. You may also have a filing requirement. See the instructions for form. This guide explains the information on the form and.

For Pennsylvania Personal Income Tax Purposes, The 1099.

Web looking for pennsylvania 1099 filing requirements? See the instructions for form. Pennsylvania has a flat state income tax of 3.07% , which is administered by the pennsylvania department of revenue. You may also have a filing requirement.

The State Of Pennsylvania Also Mandates The Filing Of Form Rev.

Pa personal income tax guide. This form is used to indicate the amount of payments made to a particular social security number. This guide explains the information on the form and. Csv format) and contain a data.

Do Not Report Negative Figures,.

Ad in a few easy steps, you can create your own 1099 forms and have them sent to your email. This page provides the latest resources on pennsylvania state 1099 filing including compliance rules, sending 1099. Web this tax form provides the total amount of money you were paid in benefits from the office of unemployment compensation in the prior calendar year, as well as any adjustments or. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations.

Web This Is The Easiest Way To Electronically Fill Out The Forms And Prevent Losing Any Information That You’ve Entered.

Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Accurate & dependable 1099 right to your email quickly and easily. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered.