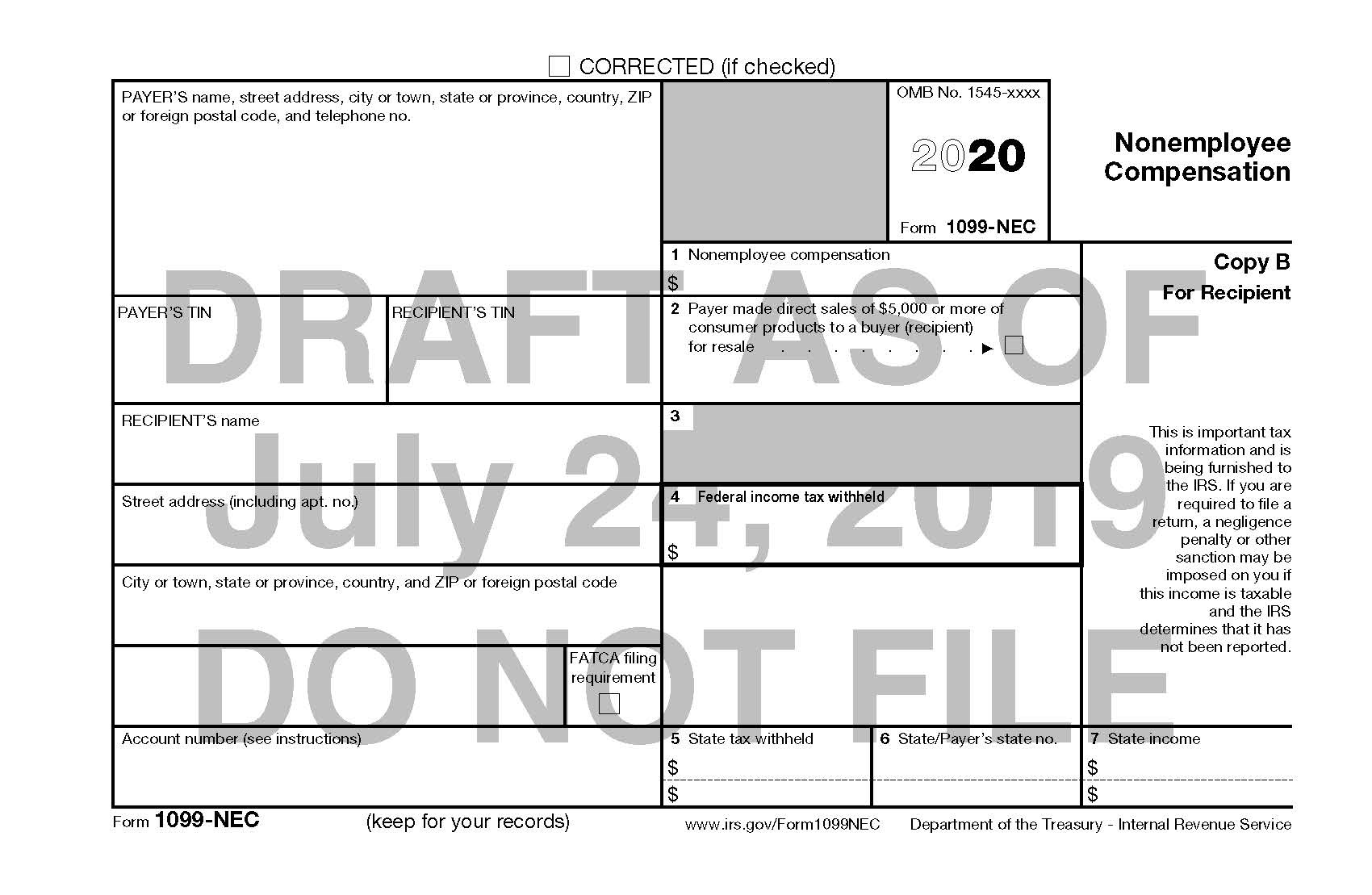

1099 Nec Form 2020

1099 Nec Form 2020 - 01 fill and edit template. Current general instructions for certain information returns. If you are in the trade or business of catching fish, box 1 may show cash you received for the sale of fish. Web reporting nec with new 1099 form 2020: Web the social security administration shares the information with the internal revenue service. 2 edit as soon as the file opens inside the editor, you enter all the tools to change the first content and add a completely new one. Web 1 wide open broaden a fillable file by simply hitting the get form button and begin to prepare 1099 form using built in features without the more steps and delays. 03 export or print immediately. Shows nonemployee compensation and/or nonqualified deferred compensation (nqdc). For internal revenue service center.

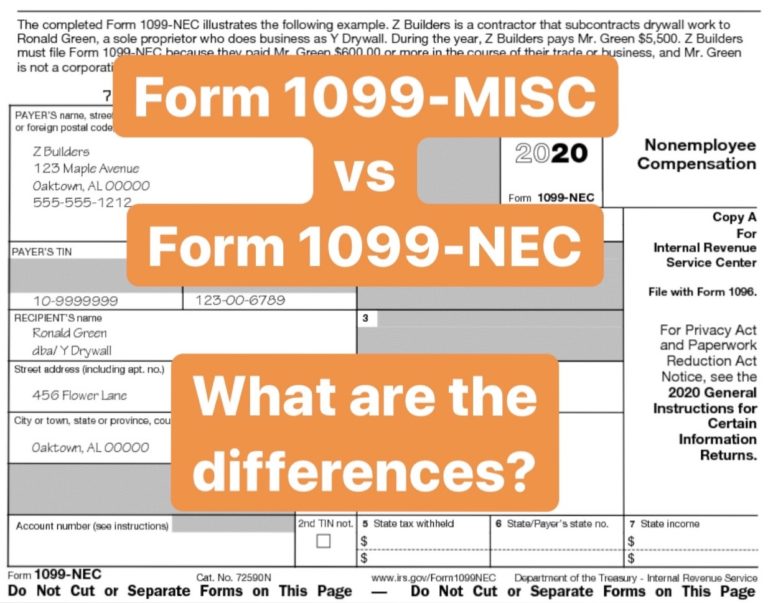

Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an. 01 fill and edit template. Previously, businesses reported this income information on 1099 misc box 7. Web reporting nec with new 1099 form 2020: Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Shows nonemployee compensation and/or nonqualified deferred compensation (nqdc). For internal revenue service center. Web the social security administration shares the information with the internal revenue service. 03 export or print immediately. This tax session, millions of independent workers will receive 1099 nec form in the mail for the first time.

Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an. Current general instructions for certain information returns. 03 export or print immediately. Web the social security administration shares the information with the internal revenue service. Shows nonemployee compensation and/or nonqualified deferred compensation (nqdc). If you are in the trade or business of catching fish, box 1 may show cash you received for the sale of fish. For internal revenue service center. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Web reporting nec with new 1099 form 2020: Previously, businesses reported this income information on 1099 misc box 7.

What is Form 1099NEC and Who Needs to File? 123PayStubs Blog

If you are in the trade or business of catching fish, box 1 may show cash you received for the sale of fish. Previously, businesses reported this income information on 1099 misc box 7. Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to.

There’s A New Tax Form With Some Changes For Freelancers & Gig

If you are in the trade or business of catching fish, box 1 may show cash you received for the sale of fish. This tax session, millions of independent workers will receive 1099 nec form in the mail for the first time. Web 1 wide open broaden a fillable file by simply hitting the get form button and begin to.

1099 Nec Form 2020 Printable Customize and Print

Web the social security administration shares the information with the internal revenue service. 2 edit as soon as the file opens inside the editor, you enter all the tools to change the first content and add a completely new one. 03 export or print immediately. 01 fill and edit template. Businesses will use this form if they made payments totaling.

Form 1099MISC vs Form 1099NEC How are they Different?

Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an. Web 1 wide open broaden a fillable file by simply hitting the get form button and begin to prepare 1099 form using built in features without the more steps and delays. Shows nonemployee.

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

03 export or print immediately. Web reporting nec with new 1099 form 2020: If you are in the trade or business of catching fish, box 1 may show cash you received for the sale of fish. Web 1 wide open broaden a fillable file by simply hitting the get form button and begin to prepare 1099 form using built in.

IRS 1099NEC 20202022 Fill and Sign Printable Template Online US

Current general instructions for certain information returns. Previously, businesses reported this income information on 1099 misc box 7. 01 fill and edit template. If you are in the trade or business of catching fish, box 1 may show cash you received for the sale of fish. Web reporting nec with new 1099 form 2020:

For the Love of 1099s! Preparing for JD Edwards YearEnd Circular

Shows nonemployee compensation and/or nonqualified deferred compensation (nqdc). Web the social security administration shares the information with the internal revenue service. 03 export or print immediately. 2 edit as soon as the file opens inside the editor, you enter all the tools to change the first content and add a completely new one. If you are in the trade or.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

This tax session, millions of independent workers will receive 1099 nec form in the mail for the first time. Web reporting nec with new 1099 form 2020: Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Web 1 wide open broaden a fillable file by simply hitting the.

1099 Nec Form 2020 Printable Customize and Print

This tax session, millions of independent workers will receive 1099 nec form in the mail for the first time. Previously, businesses reported this income information on 1099 misc box 7. Web the social security administration shares the information with the internal revenue service. Web reporting nec with new 1099 form 2020: Web 1 wide open broaden a fillable file by.

IRS to Bring Back Form 1099NEC, Last Used in 1982 — Current Federal

Web reporting nec with new 1099 form 2020: Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. 01 fill and edit template. Web 1 wide open broaden a fillable file by simply hitting the get form button and begin to prepare 1099 form using built in features without.

If You Are In The Trade Or Business Of Catching Fish, Box 1 May Show Cash You Received For The Sale Of Fish.

Current general instructions for certain information returns. Web 1 wide open broaden a fillable file by simply hitting the get form button and begin to prepare 1099 form using built in features without the more steps and delays. 01 fill and edit template. Shows nonemployee compensation and/or nonqualified deferred compensation (nqdc).

Businesses Will Use This Form If They Made Payments Totaling $600 Or More To Certain Nonemployees, Such As An Independent Contractor.

2 edit as soon as the file opens inside the editor, you enter all the tools to change the first content and add a completely new one. This tax session, millions of independent workers will receive 1099 nec form in the mail for the first time. 03 export or print immediately. Previously, businesses reported this income information on 1099 misc box 7.

Web The Social Security Administration Shares The Information With The Internal Revenue Service.

Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an. For internal revenue service center. Web reporting nec with new 1099 form 2020:

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)