2020 Form 941X

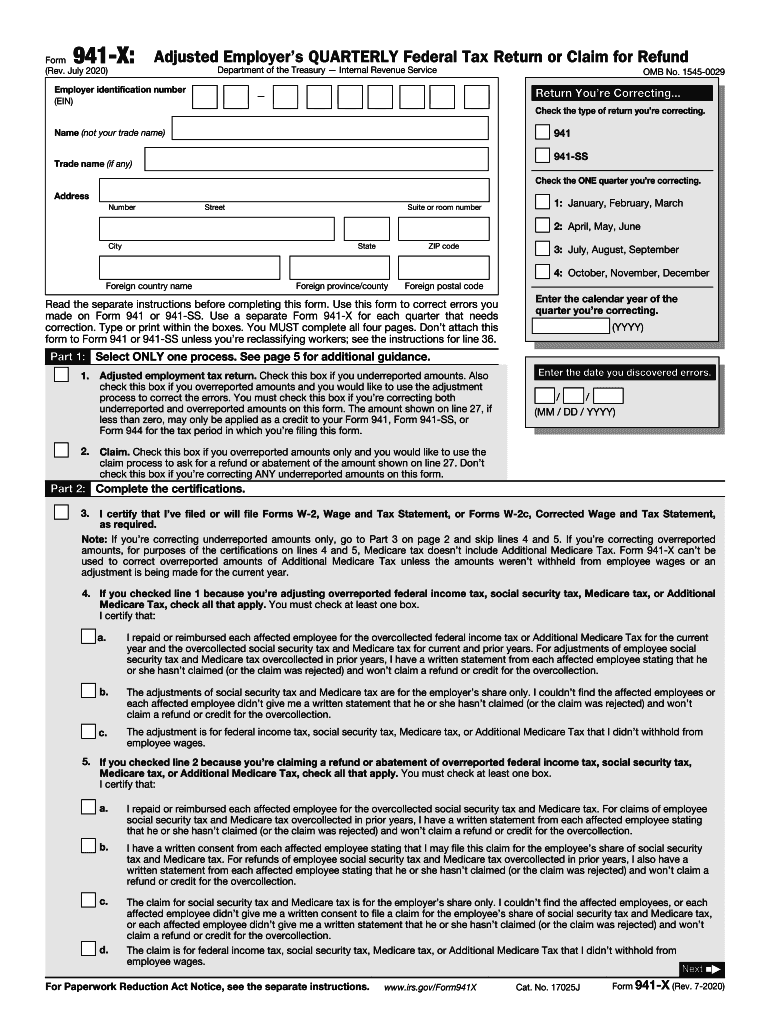

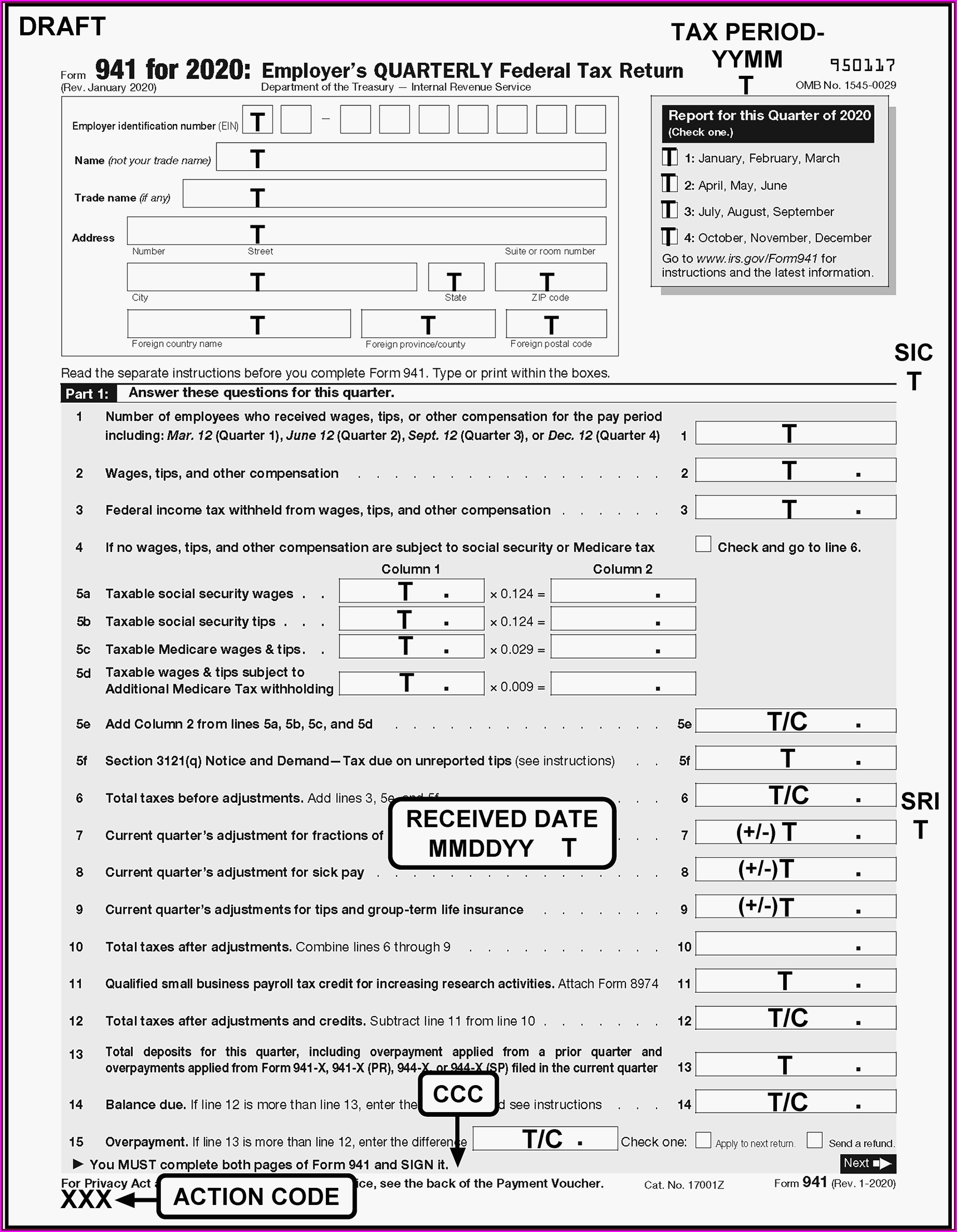

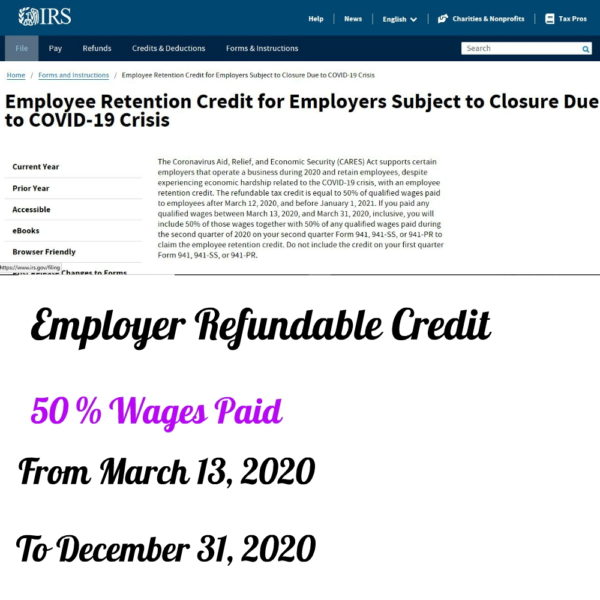

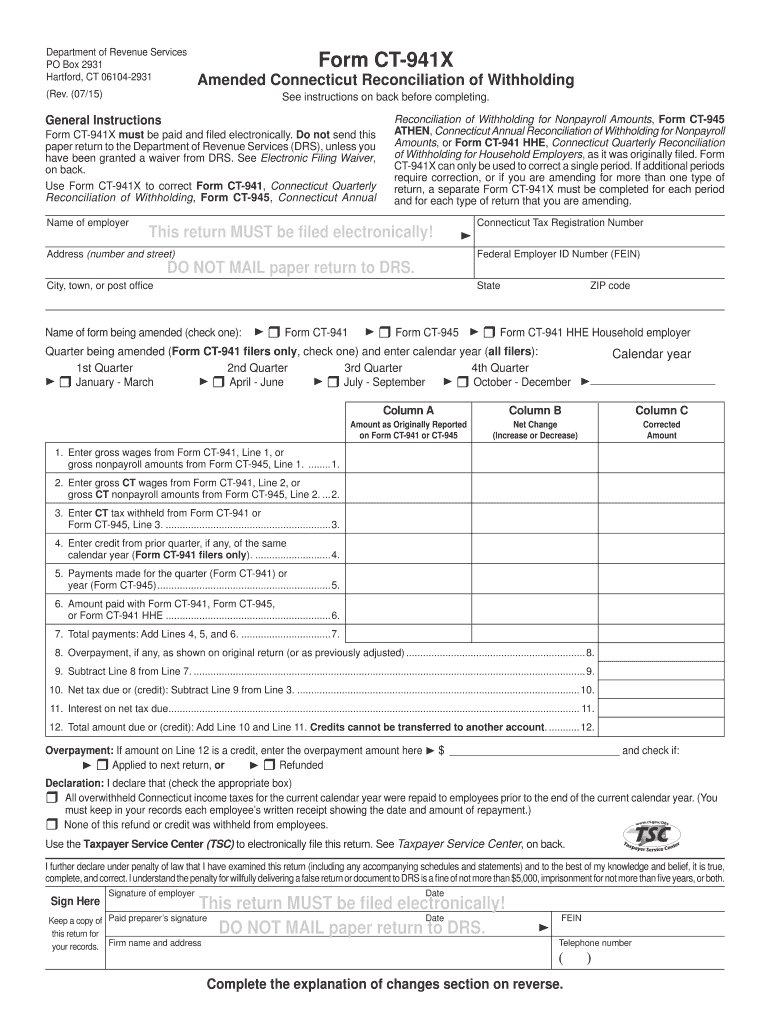

2020 Form 941X - April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. Adjusted employer's quarterly federal tax return or claim for refund keywords: Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on form 941‐x filed for the second quarter of 2020. If you are located in. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction.

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; Adjusted employer's quarterly federal tax return or claim for refund keywords: Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. If you are located in. Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on form 941‐x filed for the second quarter of 2020.

April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on form 941‐x filed for the second quarter of 2020. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. If you are located in. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. Adjusted employer's quarterly federal tax return or claim for refund keywords: Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020;

941x Fill out & sign online DocHub

Adjusted employer's quarterly federal tax return or claim for refund keywords: July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on form 941‐x filed for.

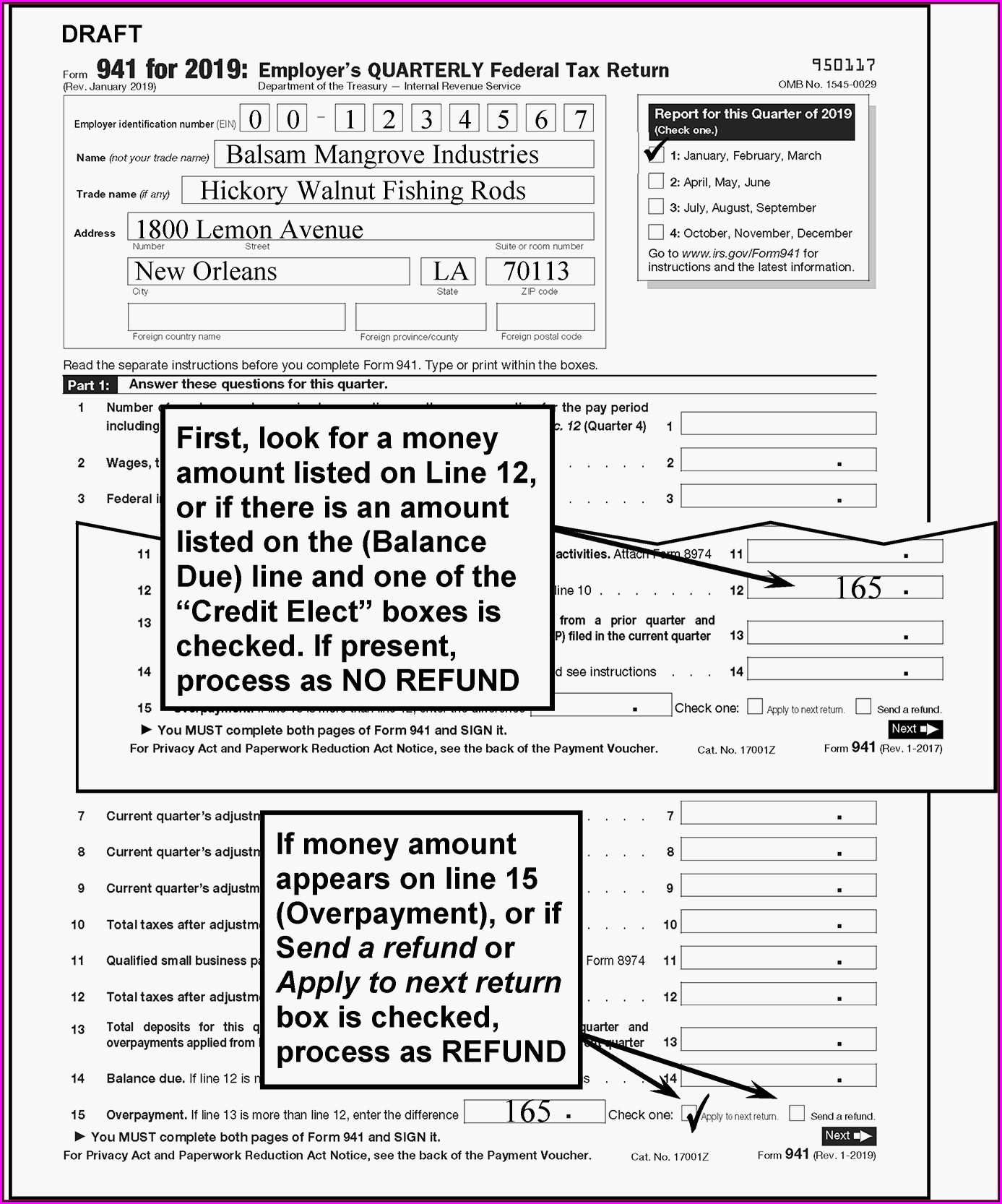

Irs.gov Form 941 X Instructions Form Resume Examples 1ZV8dX3V3X

January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service.

2020 Form 941 Employee Retention Credit for Employers subject to

Adjusted employer's quarterly federal tax return or claim for refund keywords: July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Therefore, you may need to amend your income tax.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on form 941‐x filed for the second quarter of 2020. July 2020) adjusted employer’s quarterly federal.

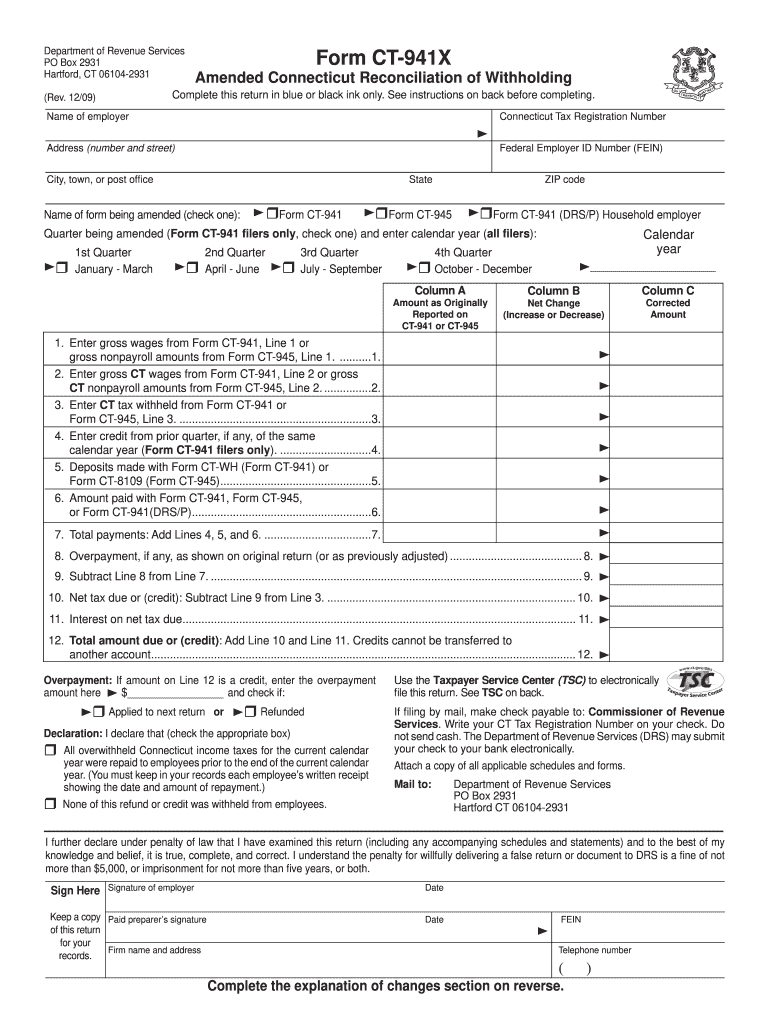

Ct 941 Hhe Fill Out and Sign Printable PDF Template signNow

Adjusted employer's quarterly federal tax return or claim for refund keywords: Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on form 941‐x filed for.

Ct Form 941 X Fill Out and Sign Printable PDF Template signNow

Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on form 941‐x filed for the second quarter of 2020. Adjusted employer's.

Worksheet 2 941x

If you are located in. Adjusted employer's quarterly federal tax return or claim for refund keywords: January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on form 941‐x filed.

Irs.gov Form 941x Form Resume Examples yKVBjnRVMB

Adjusted employer's quarterly federal tax return or claim for refund keywords: Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. If.

7 Awesome Reasons To File Your Form 941 With TaxBandits Blog TaxBandits

July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; Therefore, you may need to amend your income tax return (for example,.

Simple Form 941X 2018 Fill Out and Sign Printable PDF Template signNow

Adjusted employer's quarterly federal tax return or claim for refund keywords: Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on.

April 2023) Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund Department Of The Treasury — Internal Revenue Service Omb No.

July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Adjusted employer's quarterly federal tax return or claim for refund keywords: Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on form 941‐x filed for the second quarter of 2020. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction.

Web The Employee Retention Credit For Wages Paid March 13, 2020, Through March 31, 2020, Is Claimed On Form 941 For The Second Quarter Of 2020;

January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. If you are located in.