2021 Form 990-Pf Instructions

2021 Form 990-Pf Instructions - Complete, edit or print tax forms instantly. Try it for free now! The form consists of sixteen sections covering. Or section 4947(a)(1) trust treated as private foundation2020. Schedule b is required for organizations with. G do not enter social security numbers on this form. Identifying mistakes on the front end reduces the. Ad get ready for tax season deadlines by completing any required tax forms today. Upload, modify or create forms. For paperwork reduction act notice, see.

G do not enter social security numbers on this form. The form consists of sixteen sections covering. Or section 4947(a)(1) trust treated as private foundation2020. As required by section 3101 of the taxpayer first. Complete, edit or print tax forms instantly. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Ad get ready for tax season deadlines by completing any required tax forms today. For paperwork reduction act notice, see. Web for paperwork reduction act notice, see instructions. Web department of the treasury internal revenue service return of private foundation or section 4947(a)(1) trust treated as private foundation do not enter social security.

Try it for free now! For paperwork reduction act notice, see. Web for paperwork reduction act notice, see instructions. Web department of the treasury internal revenue service return of private foundation or section 4947(a)(1) trust treated as private foundation do not enter social security. Schedule b is required for organizations with. Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990. Identifying mistakes on the front end reduces the. Teea0101l 01/19/21 form 990 (2020) 7/01 6/30 2021 uc santa cruz. The form consists of sixteen sections covering. Complete, edit or print tax forms instantly.

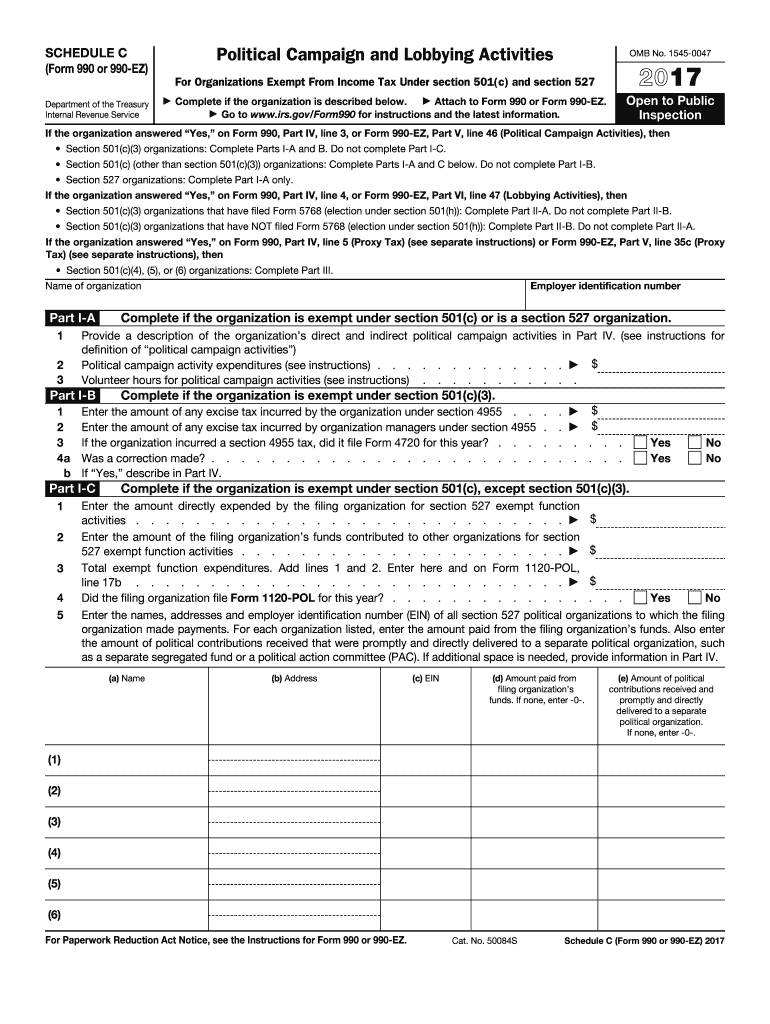

2017 Form IRS 990 or 990EZ Schedule C Fill Online, Printable

G do not enter social security numbers on this form. Identifying mistakes on the front end reduces the. Teea0101l 01/19/21 form 990 (2020) 7/01 6/30 2021 uc santa cruz. Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990. As required by section 3101 of the taxpayer.

form 990 schedule o Fill Online, Printable, Fillable Blank form990

As required by section 3101 of the taxpayer first. Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990. Or section 4947(a)(1) trust treated as private foundation2020. Complete, edit or print tax forms instantly. Try it for free now!

File 990PF Online Efile 990 PF Form 990PF 2021 Instructions

Web for paperwork reduction act notice, see instructions. Complete, edit or print tax forms instantly. Or section 4947(a)(1) trust treated as private foundation2020. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web pwc is pleased to make available our annotated version of.

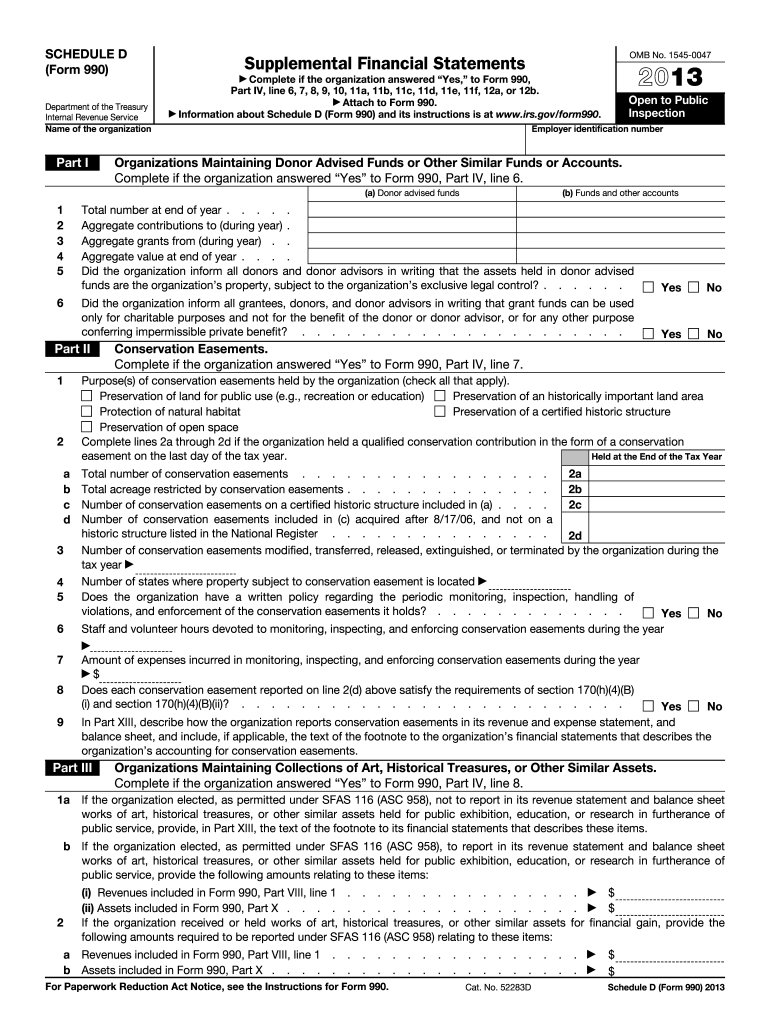

Form 990 Schedule D Fill Out and Sign Printable PDF Template signNow

Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web department of the treasury internal revenue service return of organization.

File 990PF Online Efile 990 PF Form 990PF 2021 Instructions

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web for paperwork reduction act notice, see instructions. Web department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code..

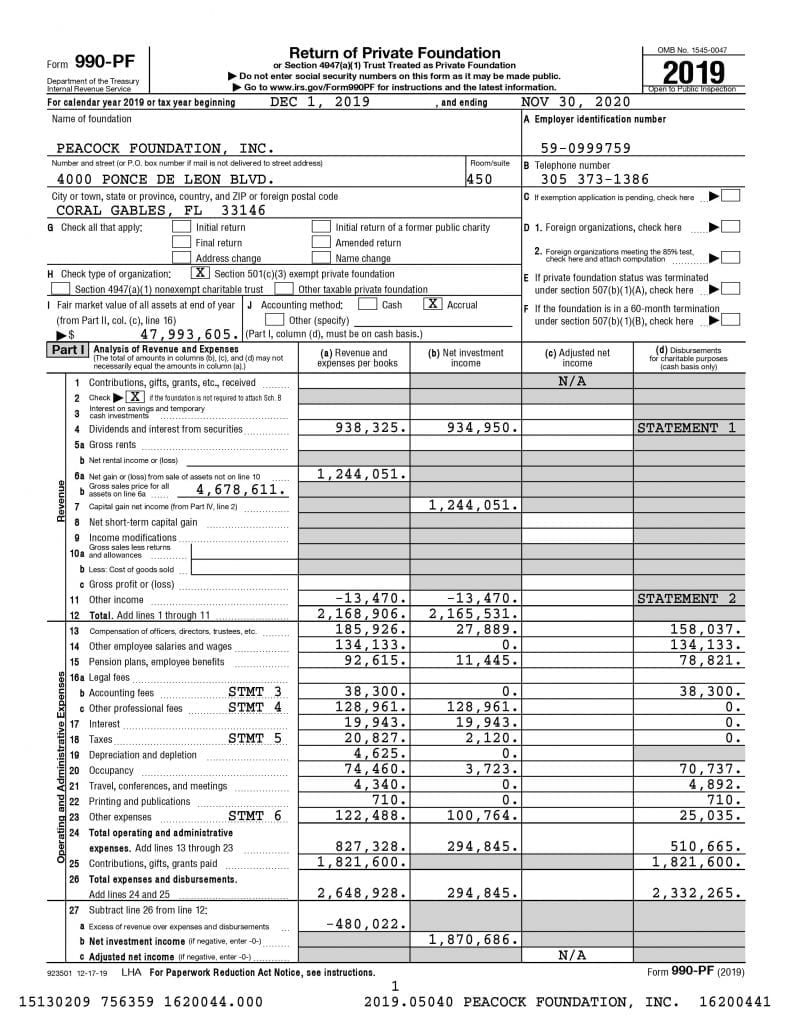

IRS Form 990PF Peacock Foundation, Inc.

Try it for free now! Teea0101l 01/19/21 form 990 (2020) 7/01 6/30 2021 uc santa cruz. Web department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code. Complete, edit or print tax forms instantly. The form consists of sixteen sections covering.

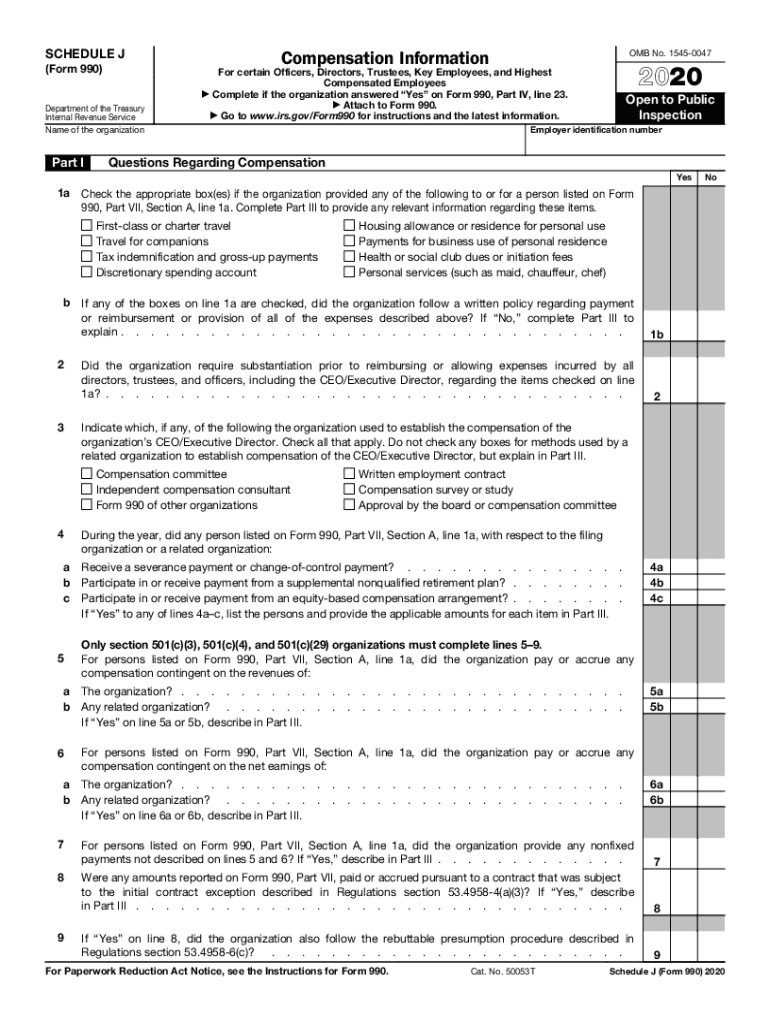

Schedule J Form 990 Compensation Information Fill Out and Sign

Web see instructions form (2021) form 990 (2021) page check if schedule o contains a response or note to any line in this part viii. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web for paperwork reduction act notice, see instructions. Web.

Form 990 Filing Instructions Fill Out and Sign Printable PDF Template

Teea0101l 01/19/21 form 990 (2020) 7/01 6/30 2021 uc santa cruz. For paperwork reduction act notice, see. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Or section 4947(a)(1) trust treated as private foundation2020.

File 990PF Online Efile 990 PF Form 990PF 2021 Instructions

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. G do not enter social security numbers on this form. As required by section 3101 of the taxpayer first. Or section 4947(a)(1) trust treated as private foundation2020.

Instructions for Form 990EZ (2023)

For paperwork reduction act notice, see. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Try it for free now! G do not enter social security numbers on this form. Identifying mistakes on the front end reduces the.

Schedule B Is Required For Organizations With.

For paperwork reduction act notice, see. Ad get ready for tax season deadlines by completing any required tax forms today. Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990. Web department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code.

Try It For Free Now!

Complete, edit or print tax forms instantly. G do not enter social security numbers on this form. Complete, edit or print tax forms instantly. Teea0101l 01/19/21 form 990 (2020) 7/01 6/30 2021 uc santa cruz.

Identifying Mistakes On The Front End Reduces The.

Web see instructions form (2021) form 990 (2021) page check if schedule o contains a response or note to any line in this part viii. The form consists of sixteen sections covering. Web department of the treasury internal revenue service return of private foundation or section 4947(a)(1) trust treated as private foundation do not enter social security. As required by section 3101 of the taxpayer first.

Web Form 990 Department Of The Treasury Internal Revenue Service Return Of Organization Exempt From Income Tax Under Section 501(C), 527, Or 4947(A)(1) Of The Internal.

Upload, modify or create forms. Web for paperwork reduction act notice, see instructions. Or section 4947(a)(1) trust treated as private foundation2020.