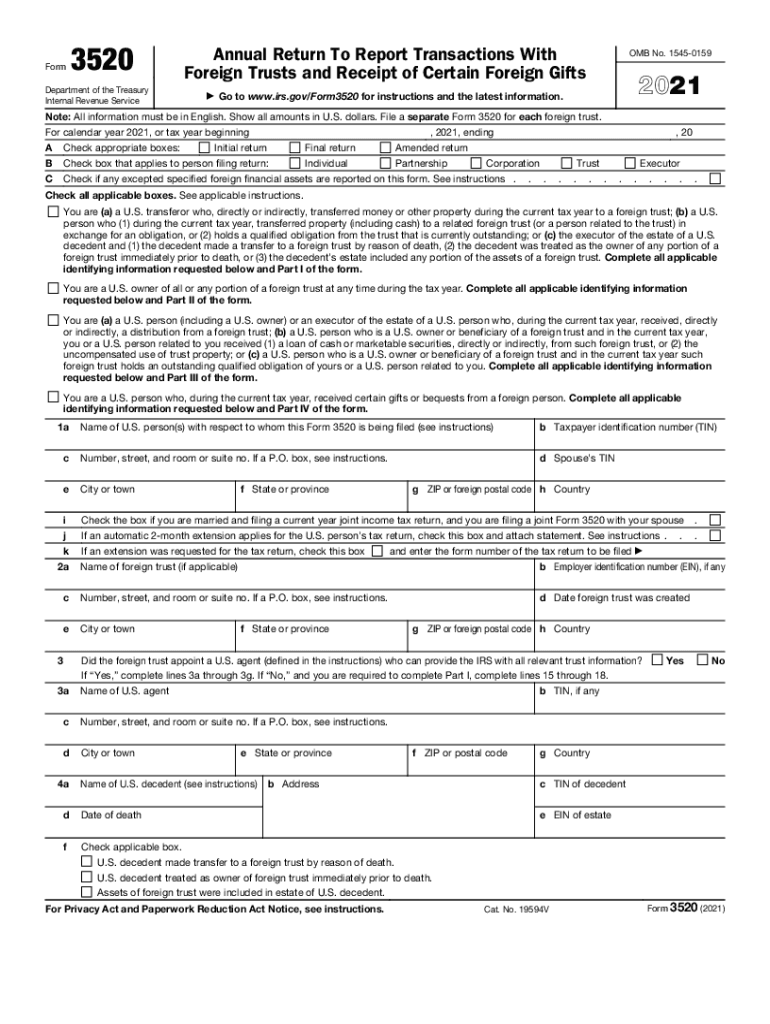

2022 Form 3520

2022 Form 3520 - The form provides information about the foreign trust, its u.s. Form 3520 is due at the time of a timely filing of the u.s. Not everyone who is a us person. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web march 30, 2022 6:11 pm last updated march 30, 2022 6:11 pm 0 7 3,158 reply bookmark icon 1 best answer fangxial expert alumni if you are not the. Web need help on filing form 3520 dear turbotax community, 2022 is coming very soon and i hope you will have a great holiday season and happy new year! Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web we last updated the annual return to report transactions with foreign trusts and receipt of certain foreign gifts in december 2022, so this is the latest version of form 3520,. Web form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts.

Lacerte doesn't print business entity. Web march 30, 2022 6:11 pm last updated march 30, 2022 6:11 pm 0 7 3,158 reply bookmark icon 1 best answer fangxial expert alumni if you are not the. The form provides information about the foreign trust, its u.s. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web need help on filing form 3520 dear turbotax community, 2022 is coming very soon and i hope you will have a great holiday season and happy new year! Web the maximum penalty is 25% of the amount of the gift. Form 3520 is due at the time of a timely filing of the u.s. Uslegalforms allows users to edit, sign, fill & share all type of documents online.

Form 3520 is due at the time of a timely filing of the u.s. Lacerte doesn't print business entity. Talk to our skilled attorneys by scheduling a free consultation today. It does not have to be a “foreign. If the due date for filing the tax return is. Not everyone who is a us person. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Web we last updated the annual return to report transactions with foreign trusts and receipt of certain foreign gifts in december 2022, so this is the latest version of form 3520,. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web march 30, 2022 6:11 pm last updated march 30, 2022 6:11 pm 0 7 3,158 reply bookmark icon 1 best answer fangxial expert alumni if you are not the.

Are Distributions From Foreign Trust Reportable on Tax Return?

Lacerte doesn't print business entity. Web the maximum penalty is 25% of the amount of the gift. If the due date for filing the tax return is. Web need help on filing form 3520 dear turbotax community, 2022 is coming very soon and i hope you will have a great holiday season and happy new year! Web form 3520 is.

3520 1 Form Fill Online, Printable, Fillable, Blank pdfFiller

Web need help on filing form 3520 dear turbotax community, 2022 is coming very soon and i hope you will have a great holiday season and happy new year! The form provides information about the foreign trust, its u.s. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain.

Form 3520 Fill Out and Sign Printable PDF Template signNow

Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Web need help on filing form 3520 dear turbotax community, 2022 is coming very soon and i hope you will have a great holiday season.

FTB 3520 Power of Attorney Declaration California Free Download

Web form 3520 form 3520 & instructions: Form 3520 is due at the time of a timely filing of the u.s. Web the maximum penalty is 25% of the amount of the gift. Not everyone who is a us person. If the due date for filing the tax return is.

Oregon Cat Tax Form Instructions Cat Meme Stock Pictures and Photos

Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Form 3520 is due at the time of a timely filing of the.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web need help on filing form 3520 dear turbotax community, 2022 is coming very soon and i hope you will have a great holiday season and happy new year! If the due date for filing the tax return is. Web we last updated the annual return to report transactions with foreign trusts and receipt of certain foreign gifts in december.

USCs and LPRs Who Are Having Their NonU.S. Accounts Closed Is it hype

Web march 30, 2022 6:11 pm last updated march 30, 2022 6:11 pm 0 7 3,158 reply bookmark icon 1 best answer fangxial expert alumni if you are not the. If the due date for filing the tax return is. Web form 3520 form 3520 & instructions: Person is granted an extension of time to file an income tax return,.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web we last updated the annual return to report transactions with foreign trusts and receipt of certain foreign gifts in december 2022, so this is the latest version of form 3520,. Form 3520 is due at the time of a.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web form 3520 form 3520 & instructions: Lacerte doesn't print business entity. If the due date for filing the tax return is. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. It does not.

3.22.19 Foreign Trust System Internal Revenue Service

If the due date for filing the tax return is. Web the maximum penalty is 25% of the amount of the gift. Lacerte doesn't print business entity. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain..

Person Is Granted An Extension Of Time To File An Income Tax Return, The Due Date For Filing Form 3520 Is The 15Th Day Of The 10Th Month (October 15) Following The End Of The.

It does not have to be a “foreign. Web form 3520 filing requirements form 3520 is technically referred to as the a nnual return to report transactions with foreign trusts and receipt of certain foreign. Talk to our skilled attorneys by scheduling a free consultation today. Not everyone who is a us person.

Web March 30, 2022 6:11 Pm Last Updated March 30, 2022 6:11 Pm 0 7 3,158 Reply Bookmark Icon 1 Best Answer Fangxial Expert Alumni If You Are Not The.

Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web we last updated the annual return to report transactions with foreign trusts and receipt of certain foreign gifts in december 2022, so this is the latest version of form 3520,.

Web Need Help On Filing Form 3520 Dear Turbotax Community, 2022 Is Coming Very Soon And I Hope You Will Have A Great Holiday Season And Happy New Year!

If the due date for filing the tax return is. Web the maximum penalty is 25% of the amount of the gift. The form provides information about the foreign trust, its u.s. Web form 3520 form 3520 & instructions:

Form 3520 Is Due At The Time Of A Timely Filing Of The U.s.

Web check the box labeled print form 3534 with complete return to generate form 3534, tax information authorization. Lacerte doesn't print business entity. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts.