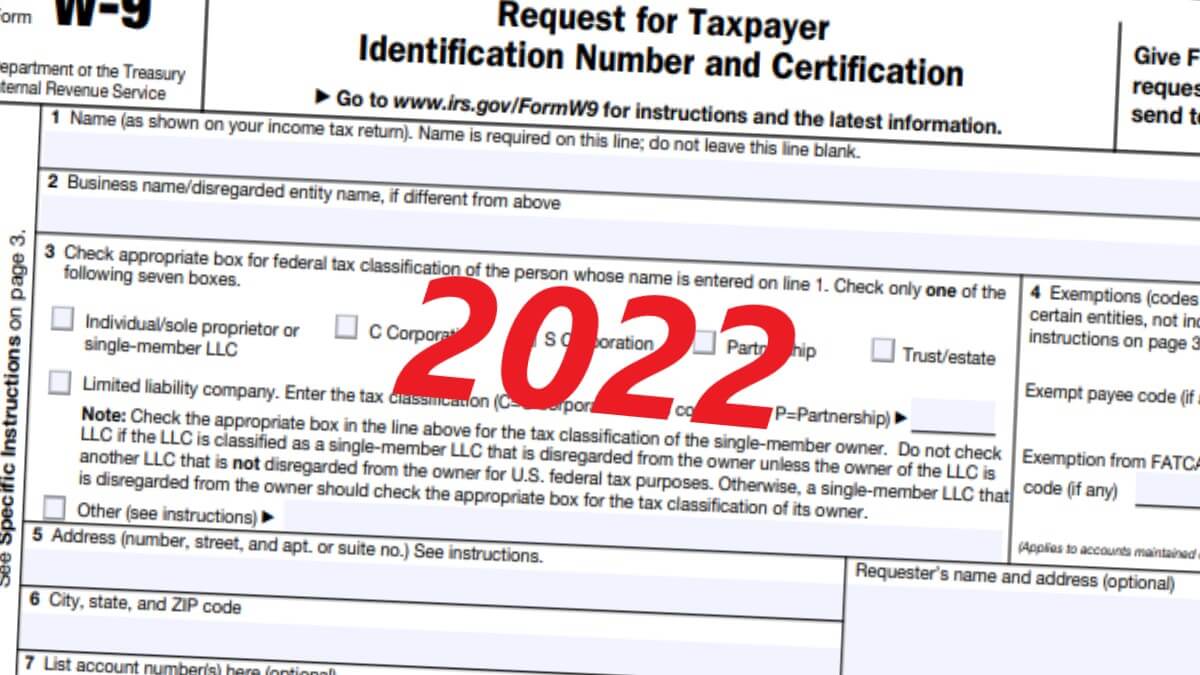

2022 Form 3893

2022 Form 3893 - Please provide your email address and it will be emailed to you. I tried a jump to input on form 3893 but it did not take me anywhere. Employer’s annual federal tax return for agricultural employees. We have our january update. Web form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. Web form 3903 department of the treasury internal revenue service moving expenses go to www.irs.gov/form3903 for instructions and the latest information. Go to ftb.ca.gov/pay for more information. (optional) override income and withholding amount of partners on 3804 go to california > ca29. Web july 28, 2022 due to an issue with some software providers, many passthrough entity tax payments made with 2022 vouchers have been improperly applied to the 2021 tax year. Web tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet.

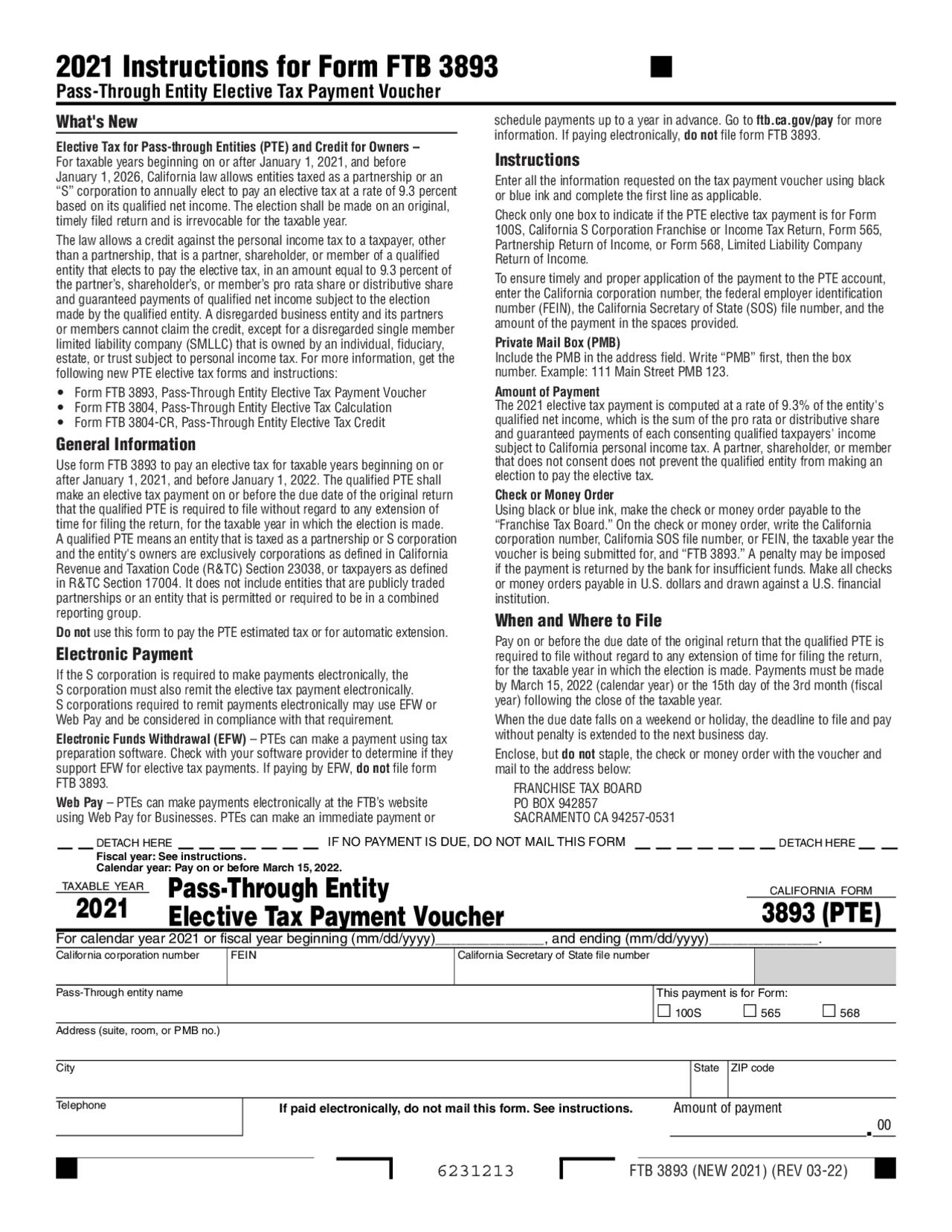

If an entity does not make that first payment by june 15, it may not make the election for that tax year. Web july 28, 2022 due to an issue with some software providers, many passthrough entity tax payments made with 2022 vouchers have been improperly applied to the 2021 tax year. This is resulting in refunds of june passthrough entity elective tax. Web address as shown on form 943. Environment cch axcess cch axcess tax cch prosystem fx tax 1120s worksheet california form 3804 form. Please provide your email address and it will be emailed to you. Web form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. 501 page is at irs.gov/pub501; The issue is illustrated below with 100s line welcome back! We anticipate the revised form 3893 will be available march 7, 2022.

Web form 3903 department of the treasury internal revenue service moving expenses go to www.irs.gov/form3903 for instructions and the latest information. For example, the form 1040 page is at irs.gov/form1040; The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family. 501 page is at irs.gov/pub501; And the schedule a (form. A list of items being revised due to sb 113 is available on our forms and publications page at ftb.ca.gov. How is the tax calculated?. Instructions, page 1, column 2, when and where to file section, payment 2 paragraph. But my question is if there is a place yet for the pass through entity tax payment, etc. I tried a jump to input on form 3893 but it did not take me anywhere.

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

(optional) override income and withholding amount of partners on 3804 go to california > ca29. Instructions, page 1, column 2, when and where to file section, payment 2 paragraph. Web 11/05/2022 objectives prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet view. • enclose your check or money order made payable.

Virginia fprm pte Fill out & sign online DocHub

(optional) override income and withholding amount of partners on 3804 go to california > ca29. The issue is illustrated below with 100s line welcome back! Ptes can make an immediate payment or schedule payments up to a year in advance. If an entity does not make that first payment by june 15, it may not make the election for that.

W4 Form 2022 Fillable PDF

Web ab 150 form 3893. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your check or money order. Web july 28, 2022 due to an issue with some software providers, many passthrough entity tax payments made with 2022 vouchers have been improperly applied to.

California Form 3893 Passthrough Entity Tax Problems Windes

How is the tax calculated?. Ptes can make an immediate payment or schedule payments up to a year in advance. It won’t show up if there is no 2021 pte tax. (optional) override income and withholding amount of partners on 3804 go to california > ca29. For this discussion, ignore the effect of income tax liability (llc or s corp).

W9 Form 2022

Department of the treasury internal revenue service. This is only available by request. A list of items being revised due to sb 113 is available on our forms and publications page at ftb.ca.gov. Environment cch prosystem fx tax 1120s california interview form 3804 form 3893 procedure prepare. For example, the form 1040 page is at irs.gov/form1040;

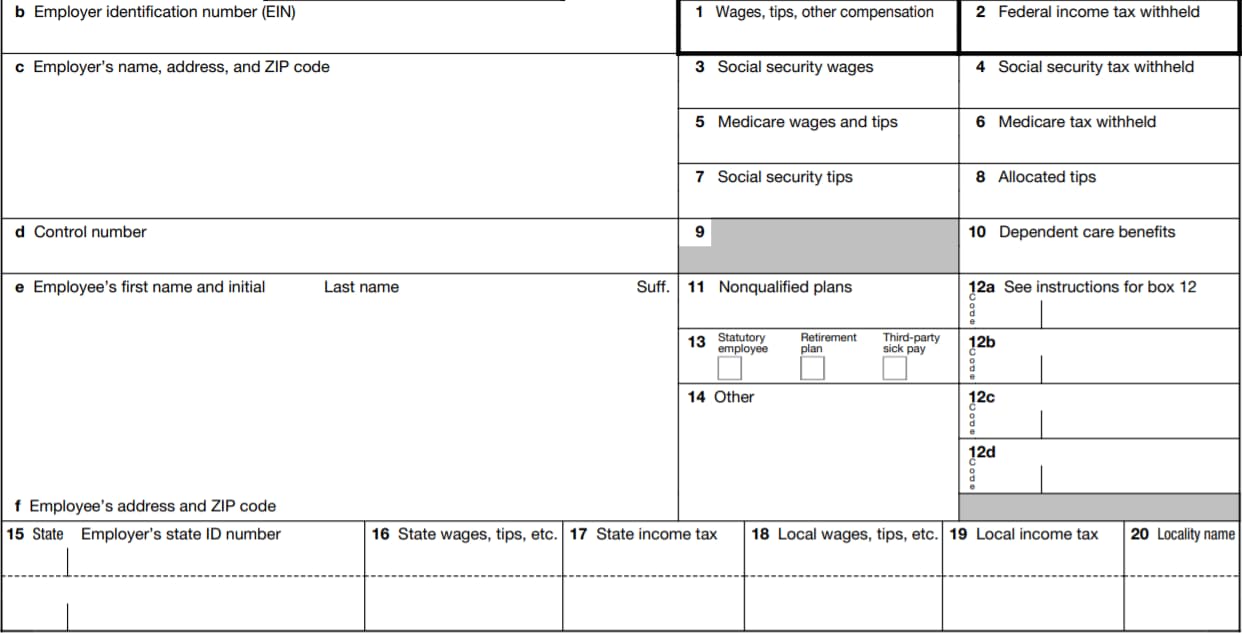

W2 Form 2022 Fillable PDF

This is only available by request. Web 11/05/2022 objectives prepare and populate california form 3804 and / or form 3893 in an s corporation return using interview forms view. (optional) override income and withholding amount of partners on 3804 go to california > ca29. For instructions and the latest information. For this discussion, ignore the effect of income tax liability.

ECOHSAT Admission Form 2021/2022 ND, HND, Diploma & Cert.

Web form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. (optional) override income and withholding amount of partners on 3804 go to california > ca29. Web form 3903 department of the treasury internal revenue service moving expenses go to www.irs.gov/form3903 for instructions and the latest information. Instructions, page 1, column 2, when and.

2021 Instructions for Form 3893, PassThrough Entity Elective

How is the tax calculated?. Department of the treasury internal revenue service. Environment cch prosystem fx tax 1120s california interview form 3804 form 3893 procedure prepare. Environment cch axcess cch axcess tax cch prosystem fx tax 1120s worksheet california form 3804 form. We anticipate the revised form 3893 will be available march 7, 2022.

W4 Form 2023 Instructions

Please provide your email address and it will be emailed to you. We anticipate the revised form 3893 will be available march 7, 2022. What's new social security and medicare tax for 2022. (optional) override income and withholding amount of partners on 3804 go to california > ca29. How is the tax calculated?.

The Great Wave on form

Web almost every form and publication has a page on irs.gov with a friendly shortcut. Web i forced a 2021 profit and now the 2022 form 3893 (es) shows up in lacerte. Web form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. And the schedule a (form. Go to ftb.ca.gov/pay for more information.

Employer’s Annual Federal Tax Return For Agricultural Employees.

Ptes can make an immediate payment or schedule payments up to a year in advance. Department of the treasury internal revenue service. Please provide your email address and it will be emailed to you. Lacerte really needs a diagnostic for this.

We Anticipate The Revised Form 3893 Will Be Available March 7, 2022.

Web ab 150 form 3893. How is the tax calculated?. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your check or money order. For example, the form 1040 page is at irs.gov/form1040;

Not Paying The $1,000 By 6/15/22 Closes The Window For Making The 2022 Election.

For this discussion, ignore the effect of income tax liability (llc or s corp) and estimated tax. (optional) override income and withholding amount of partners on 3804 go to california > ca29. For instructions and the latest information. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family.

Web 11/05/2022 Objectives Prepare And Populate California Form 3804 And / Or Form 3893 In An S Corporation Return Using Interview Forms View.

501 page is at irs.gov/pub501; The issue is illustrated below with 100s line welcome back! Web almost every form and publication has a page on irs.gov with a friendly shortcut. Instructions, page 1, column 2, when and where to file section, payment 2 paragraph.