2022 Form 944

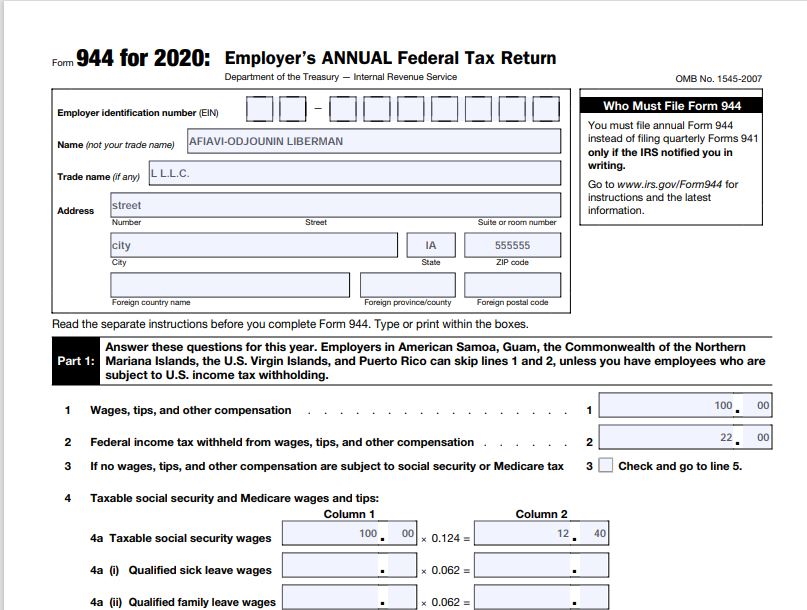

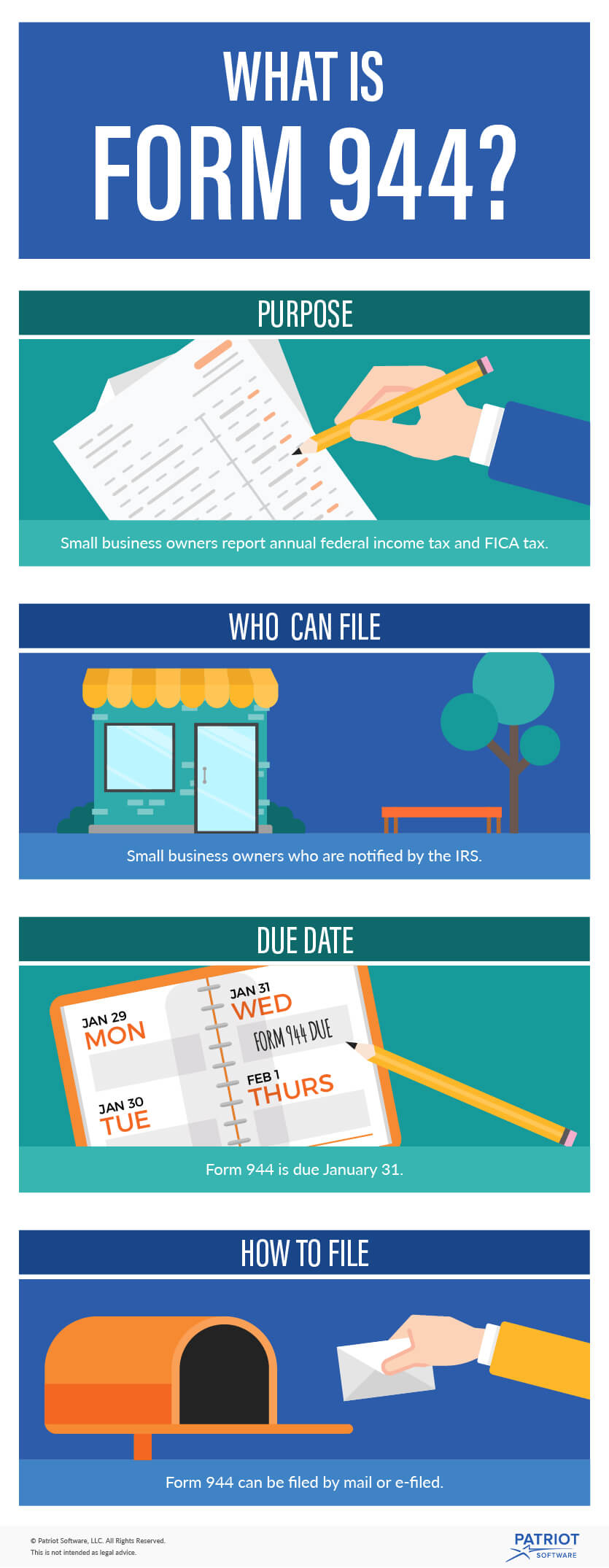

2022 Form 944 - Irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. Web for 2022, you have to file form 944 by january 31, 2023. Web this being said, the deadline to file form 944 is jan. The other reason for form 944 is to save the irs man. “no” answers indicate possible errors in. Web annual federal tax return. You must complete all five pages. Web irs form 944 is the employer's annual federal tax return. The form was introduced by the irs to give smaller employers a break in filing and paying federal. 944 (2022) this page intentionally left blank.

You must file annual form 944 instead of filing quarterly forms 941 only if the irs notified you in writing. However, if you made deposits on time in full payment of the taxes due for the year, you may file the. Get ready for tax season deadlines by completing any required tax forms today. Web for 2022, you have to file form 944 by january 31, 2023. Ad access irs tax forms. The other reason for form 944 is to save the irs man. 31 for the previous tax year — the return covering the 2021 year, therefore, would be due jan. Web the deadline to file your 2022 form 944 return is january 31, 2023. Ad access irs tax forms. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file.

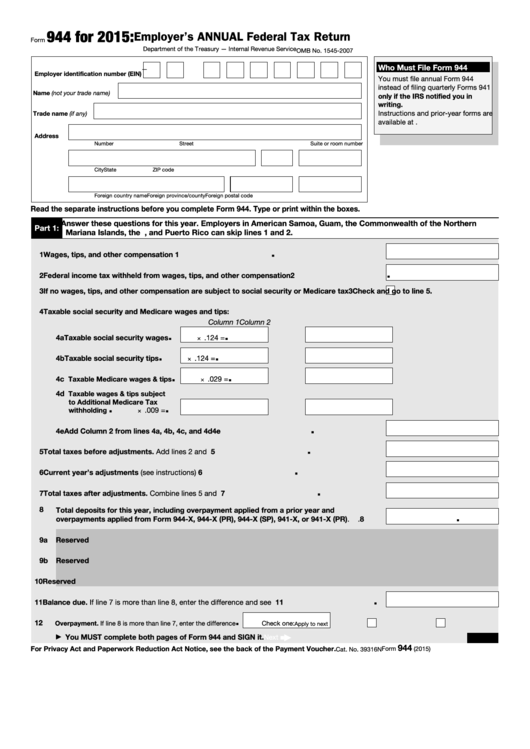

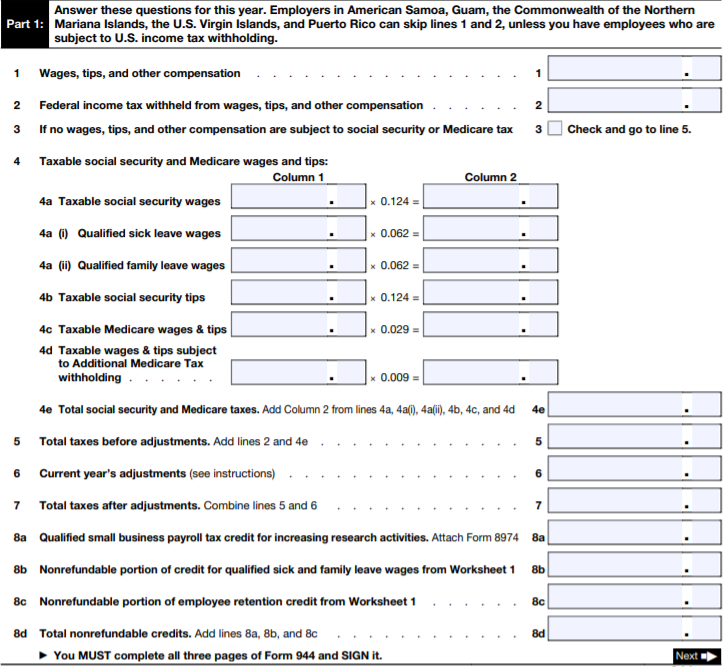

1 choose form and tax year 2 enter social security & medicare taxes 3 enter federal income tax. 944 (2022) this page intentionally left blank. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Please use the link below to. Let's get your 941 changed to 944 forms in quickbooks online. Employer’s annual federal tax return department of the treasury — internal revenue service. Web annual federal tax return. Web what is irs form 944 for 2022? You must file annual form 944 instead of filing quarterly forms 941 only if the irs notified you in writing. Ad access irs tax forms.

How to Complete Form 944 for 2020 Employer’s Annual Federal Tax

You must file annual form 944 instead of filing quarterly forms 941 only if the irs notified you in writing. Get ready for tax season deadlines by completing any required tax forms today. Web department of homeland security u.s. Complete, edit or print tax forms instantly. Ad access irs tax forms.

Fillable Form 944 Employer'S Annual Federal Tax Return 2017

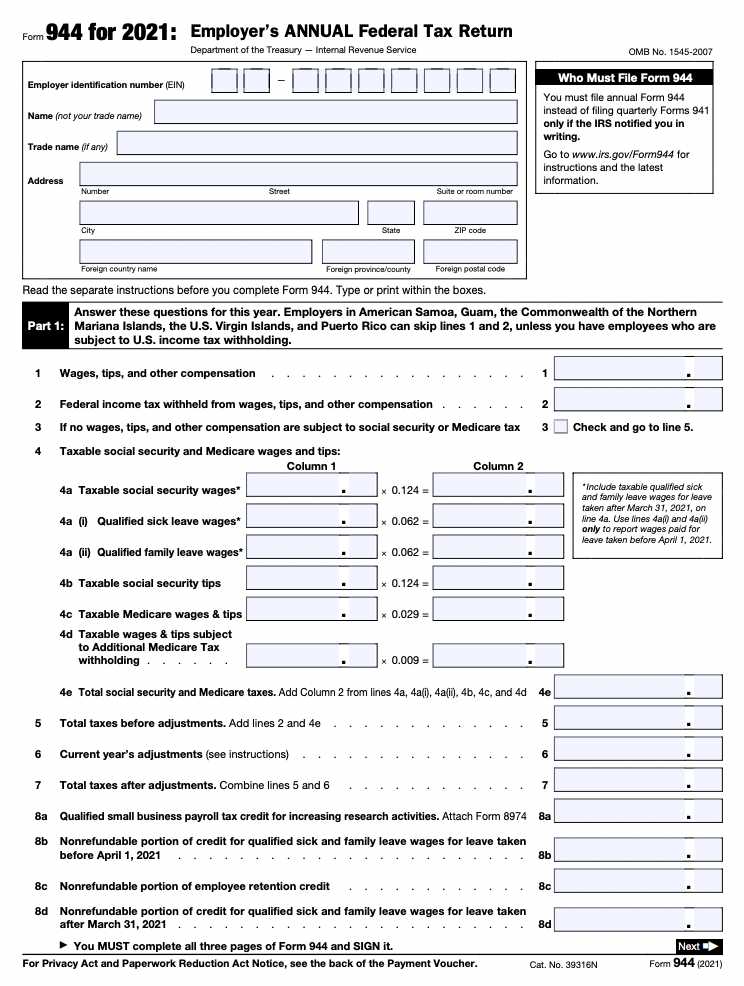

Through the payroll settings, we can. Web form 944 for 2021: Irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. Web supplemental worksheets will be prepared automatically. Web the deadline to file your 2022 form 944 return is january 31, 2023.

2016 Form IRS 944 Fill Online, Printable, Fillable, Blank PDFfiller

Web annual federal tax return. Web this being said, the deadline to file form 944 is jan. Let's get your 941 changed to 944 forms in quickbooks online. Web what is irs form 944 for 2022? Unlike those filing a 941, small business owners have the option to pay taxes when filing, rather than making.

What is Form 944? Reporting Federal & FICA Taxes

You must complete all five pages. The form was introduced by the irs to give smaller employers a break in filing and paying federal. Web january 12, 2023 06:41 pm. Web this being said, the deadline to file form 944 is jan. Web federal employer's annual federal tax return form 944 pdf form content report error it appears you don't.

Finance Archives XperimentalHamid

Let's get your 941 changed to 944 forms in quickbooks online. Through the payroll settings, we can. You must file annual form 944 instead of filing quarterly forms 941 only if the irs notified you in writing. Web federal employer's annual federal tax return form 944 pdf form content report error it appears you don't have a pdf plugin for.

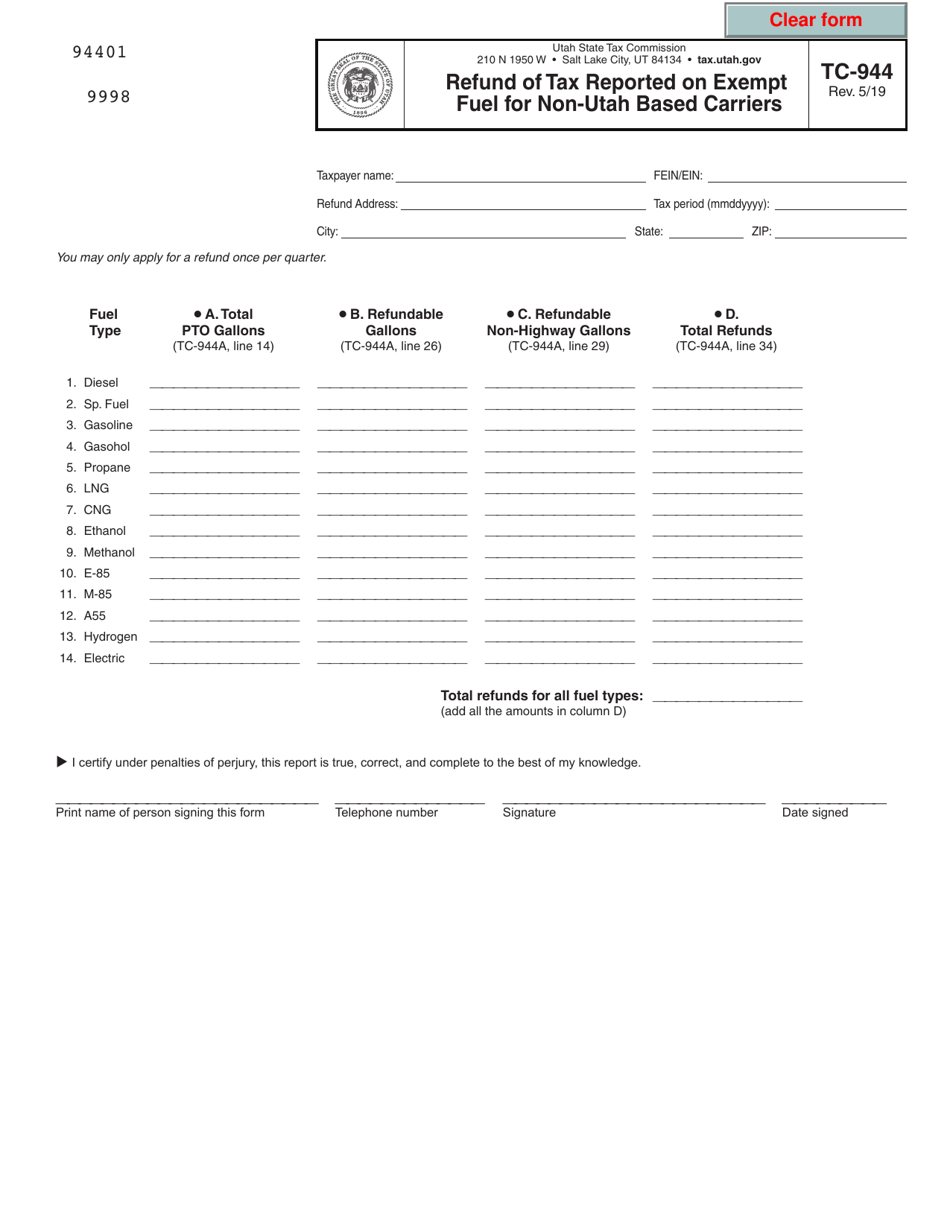

Form TC944 Download Fillable PDF or Fill Online Refund of Tax Reported

You must complete all five pages. Ad access irs tax forms. Complete, edit or print tax forms instantly. Web supplemental worksheets will be prepared automatically. Irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes.

IRS Tax Form 944 Instruction How to Fill Out 944

However, if you made deposits on time in full payment of the taxes due for the year, you may file the. Ad access irs tax forms. Complete, edit or print tax forms instantly. You must file annual form 944 instead of filing quarterly forms 941 only if the irs notified you in writing. The other reason for form 944 is.

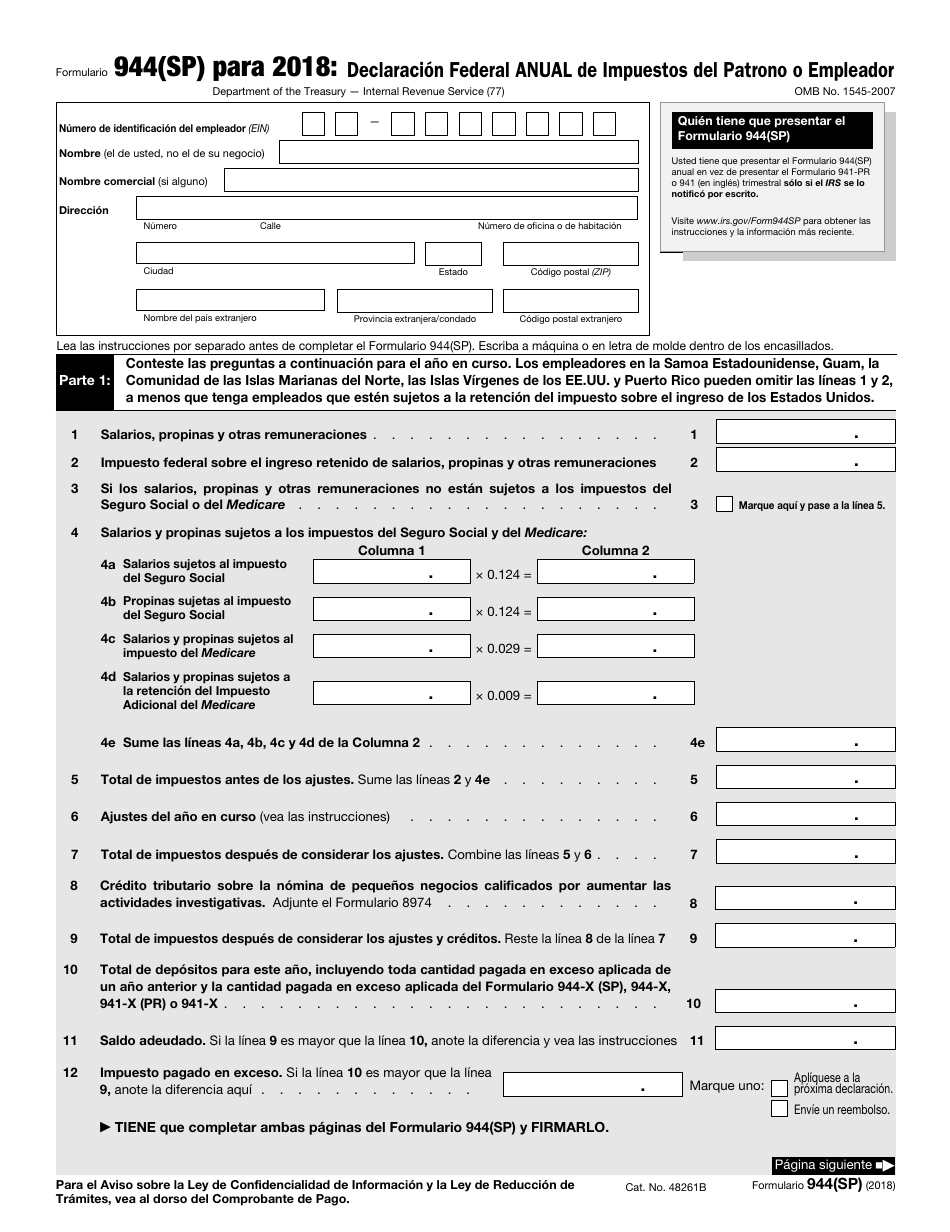

IRS Formulario 944(SP) Download Fillable PDF or Fill Online Declaracion

The form was introduced by the irs to give smaller employers a break in filing and paying federal. The other reason for form 944 is to save the irs man. Please use the link below to. Web irs form 944 is the employer's annual federal tax return. 1 choose form and tax year 2 enter social security & medicare taxes.

944 Form 2020 2021 IRS Forms Zrivo

Let's get your 941 changed to 944 forms in quickbooks online. 1 choose form and tax year 2 enter social security & medicare taxes 3 enter federal income tax. Employer’s annual federal tax return department of the treasury — internal revenue service. 944 (2022) this page intentionally left blank. “no” answers indicate possible errors in.

Form 944 2022 How To Fill it Out and What You Need To Know

Web form 944, employer’s annual federal tax return, reports federal income and fica (social security and medicare) tax on employee wages. Type or print within the boxes. Form 944 is to report the payroll taxes. Web annual federal tax return. Unlike those filing a 941, small business owners have the option to pay taxes when filing, rather than making.

Through The Payroll Settings, We Can.

Get ready for tax season deadlines by completing any required tax forms today. Irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. Web form 944 was intended to give small business employers a break when it came to filing and paying federal payroll taxes. “no” answers indicate possible errors in.

You Must File Annual Form 944 Instead Of Filing Quarterly Forms 941 Only If The Irs Notified You In Writing.

Web this being said, the deadline to file form 944 is jan. Employer’s annual federal tax return department of the treasury — internal revenue service. Ad access irs tax forms. Web form 944 for 2021:

Type Or Print Within The Boxes.

Web department of homeland security u.s. Complete, edit or print tax forms instantly. Web form 944, employer’s annual federal tax return, reports federal income and fica (social security and medicare) tax on employee wages. Web the deadline to file your 2022 form 944 return is january 31, 2023.

Web Supplemental Worksheets Will Be Prepared Automatically.

However, if you made deposits on time in full payment of the taxes due for the year, you may file the. Ad access irs tax forms. Unlike those filing a 941, small business owners have the option to pay taxes when filing, rather than making. Web for 2022, you have to file form 944 by january 31, 2023.