2290 Exemption Form

2290 Exemption Form - Web form 2290 is used to report and pay the hvut for vehicles having a taxable gross weight of 55,000 pounds or more that you operate on public highways. Do your truck tax online & have it efiled to the irs! Get schedule 1 or your money back. Save big w/ (9) eform2290 verified promo codes & storewide coupon codes. The exemption applies to the tax. Web eform2290 promo codes, coupons & deals, august 2023. Use coupon code get20b & get 20% off. Plus, with 6 additional deals, you can save big on all of. Form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. Web and, today's best form 2290 coupon will save you 34% off your purchase!

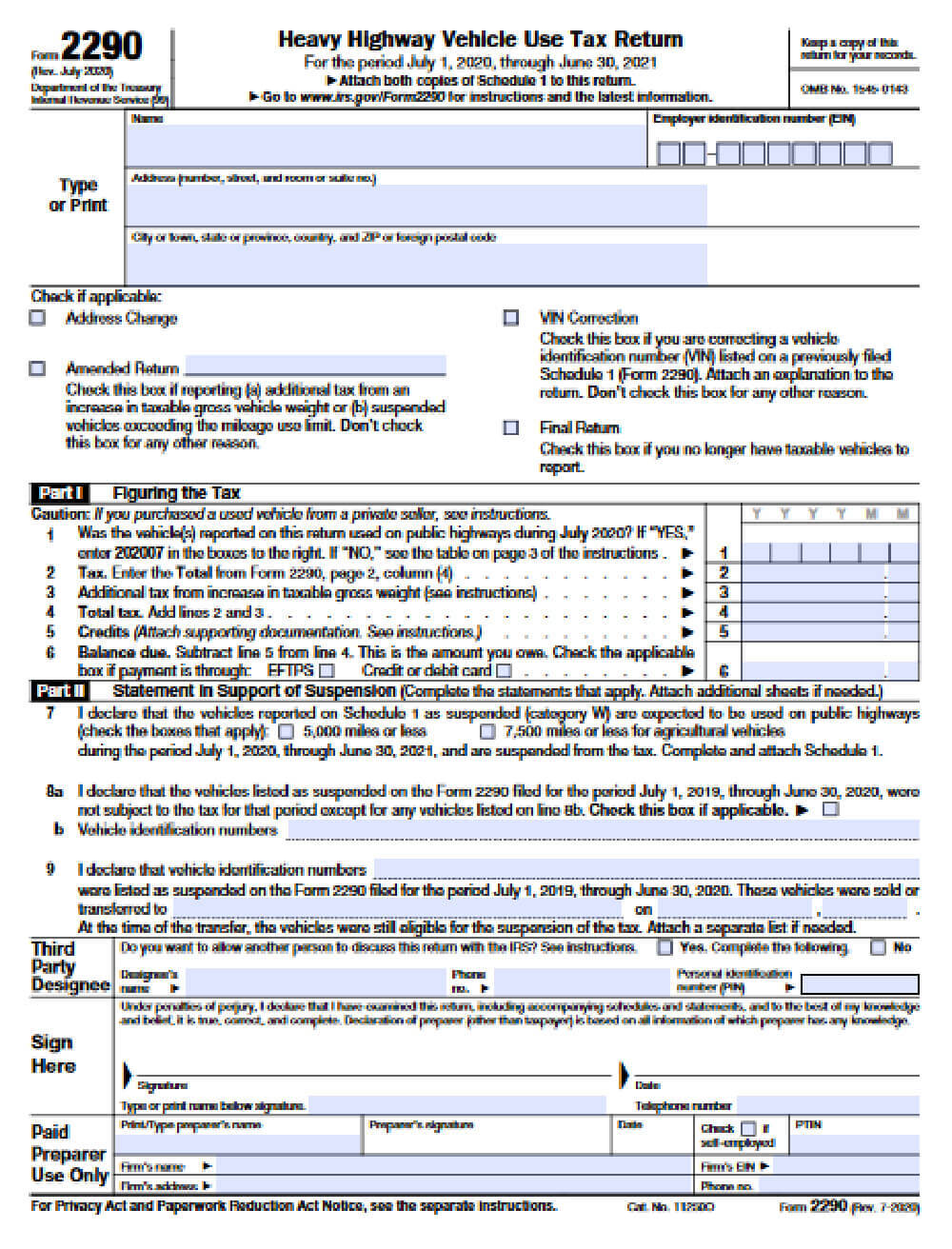

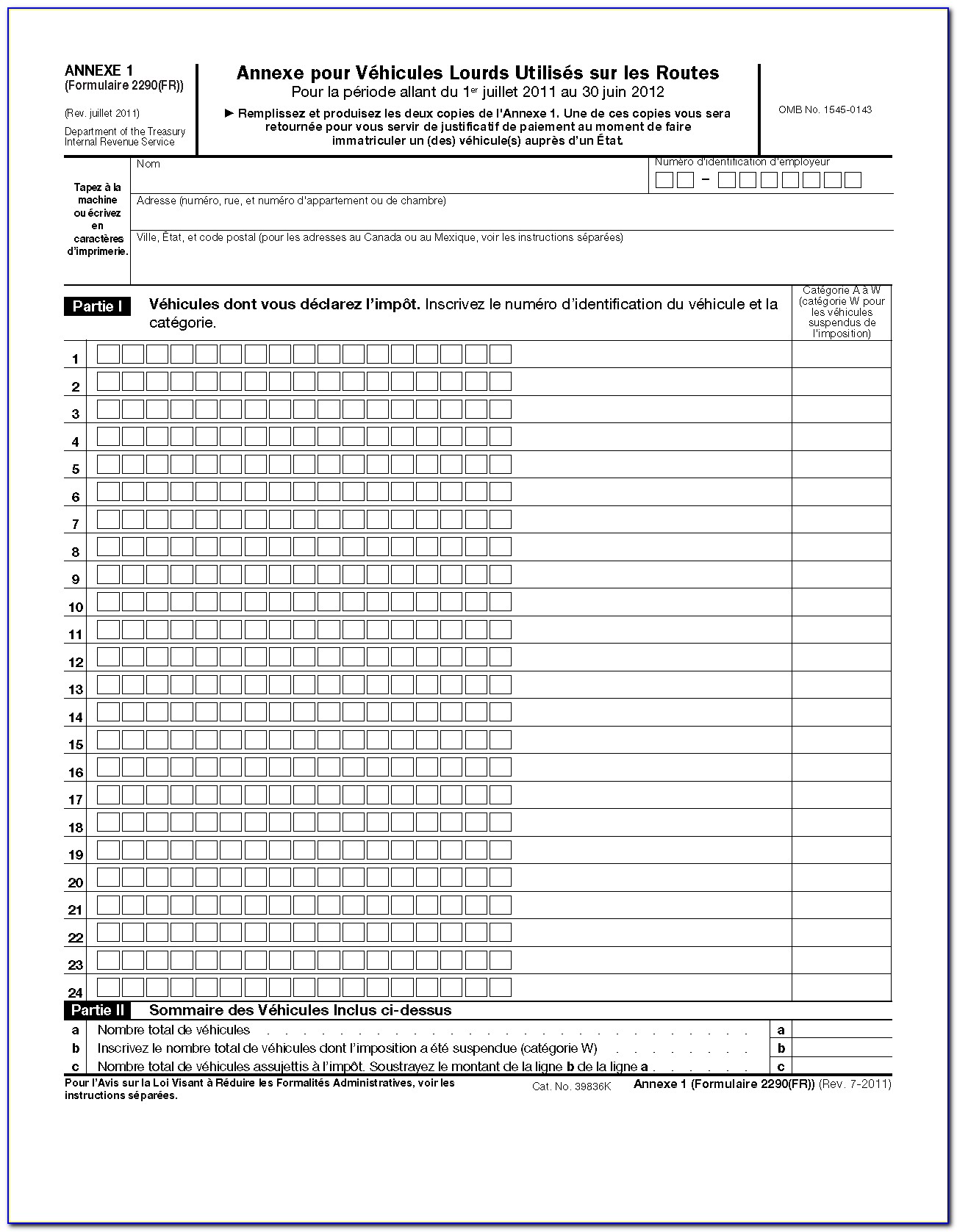

The irs mandates that everyone who owns a. Web form 2290 filers are able to pay their form 2290 tax liability with either a credit or debit card. Get schedule 1 or your money back. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Use coupon code get20b & get 20% off. Web and, today's best form 2290 coupon will save you 34% off your purchase! Do your truck tax online & have it efiled to the irs! Web file form 2290 online from your truck. See credit or debit card under how to pay the tax, later, for more information. How do i file form 2290 for an agricultural vehicle using expresstrucktax?

Web who must file form 2290? Web submit your registration information to form 2290 for receiving at least 30% off in august. The exemption applies to the tax. See credit or debit card under how to pay the tax, later, for more information. Web eform2290 promo codes, coupons & deals, august 2023. Web a 2290 exemption is an exemption that is available to certain taxpayers who use certain heavy highway vehicles listed above. Web file form 2290 online from your truck. How do i file form 2290 for an agricultural vehicle using expresstrucktax? We are offering 3 amazing coupon codes right now. Get schedule 1 or your money back.

E File form 2290 Free Brilliant form Road Use Tax Irs Farm Exemption

Easy, fast, secure & free to try. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Web who must file & who is exempt. Web and, today's best form 2290 coupon will save you 34% off your purchase! Save big w/ (9) eform2290 verified.

Fillable Form 2290 20232024 Create, Fill & Download 2290

Enjoy discounted pricing on most items with this 30 percent off form. We are offering 3 amazing coupon codes right now. Form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. This is an easy and fast method to. Learn more who must file.

Form 2290 tax calculator app

Web what is form 2290? Web form 2290 filers are able to pay their form 2290 tax liability with either a credit or debit card. Free vin checker & correction. Get schedule 1 or your money back. The irs mandates that everyone who owns a.

EFile Form 941, 2290, 1099NEC/MISC, W2, 940 ExpressEfile

We are offering 3 amazing coupon codes right now. What is the deadline to file form 2290 for an agricultural vehicle? 30% off file your form. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway. Get schedule 1 in minutes.

Get your Form 2290 Schedule 1 in Minutes Efile Form 2290 Now

Form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. Web eform2290 promo codes, coupons & deals, august 2023. Web file form 2290 online from your truck. See credit or debit card under how to pay the tax, later, for more information. Web this form is used.

Viewing a thread Weight exemption form 2290

Do your truck tax online & have it efiled to the irs! Web form 2290 is used to report and pay the hvut for vehicles having a taxable gross weight of 55,000 pounds or more that you operate on public highways. Web submit your registration information to form 2290 for receiving at least 30% off in august. Web features pricing.

How To Fill Out A 2290 Form Form Resume Examples K75PNAykl2

Form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. Web eform2290 promo codes, coupons & deals, august 2023. Shoppers saved an average of $23.17. How do i file form 2290 for an agricultural vehicle using expresstrucktax? The irs mandates that everyone who owns a.

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

Home am i exempt from the form 2290? Web who must file & who is exempt. This is an easy and fast method to. Taxpayers should file form 2290 and schedule 1 for the tax year between july 1st, 2022, and june 2023. 30% off file your form.

Form 2290 Edit, Fill, Sign Online Handypdf

Plus, with 6 additional deals, you can save big on all of. 30% off file your form. Use coupon code get20b & get 20% off. To be exempt from the tax, a highway. Web eform2290 promo codes, coupons & deals, august 2023.

Free Vin Checker & Correction.

Use coupon code get20b & get 20% off. Home am i exempt from the form 2290? Learn more who must file. Web acceptable proof of exemption — an original or photocopy of an irs receipted schedule 1, form 2290 (electronically watermarked or manually stamped), listing the vehicle as.

July 2021) Heavy Highway Vehicle Use Tax Return Department Of The Treasury Internal Revenue Service (99) For The Period July 1, 2021, Through June 30,.

Shoppers saved an average of $23.17. Web features pricing faq’s contact us blog am i exempt from the form 2290? Web a 2290 exemption is an exemption that is available to certain taxpayers who use certain heavy highway vehicles listed above. The exemption applies to the tax.

Web Eform2290 Promo Codes, Coupons & Deals, August 2023.

Get schedule 1 or your money back. We are offering 3 amazing coupon codes right now. Taxpayers should file form 2290 and schedule 1 for the tax year between july 1st, 2022, and june 2023. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway.

Get Schedule 1 In Minutes.

Enjoy discounted pricing on most items with this 30 percent off form. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web submit your registration information to form 2290 for receiving at least 30% off in august. Use coupon code get20b & get 20% off.