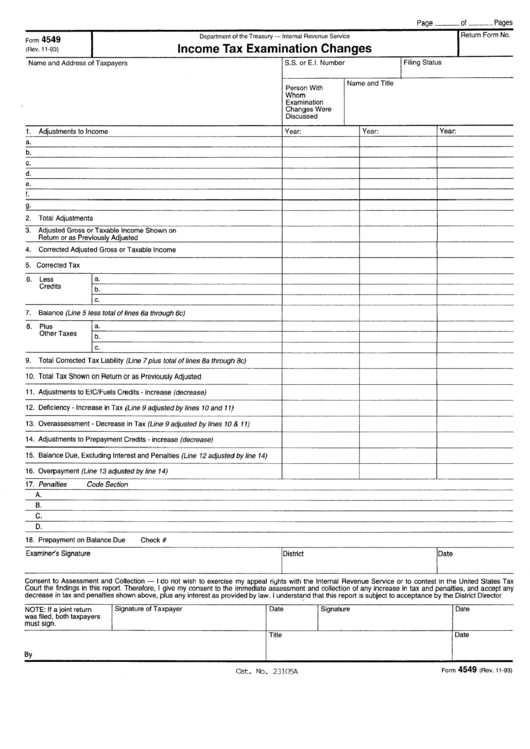

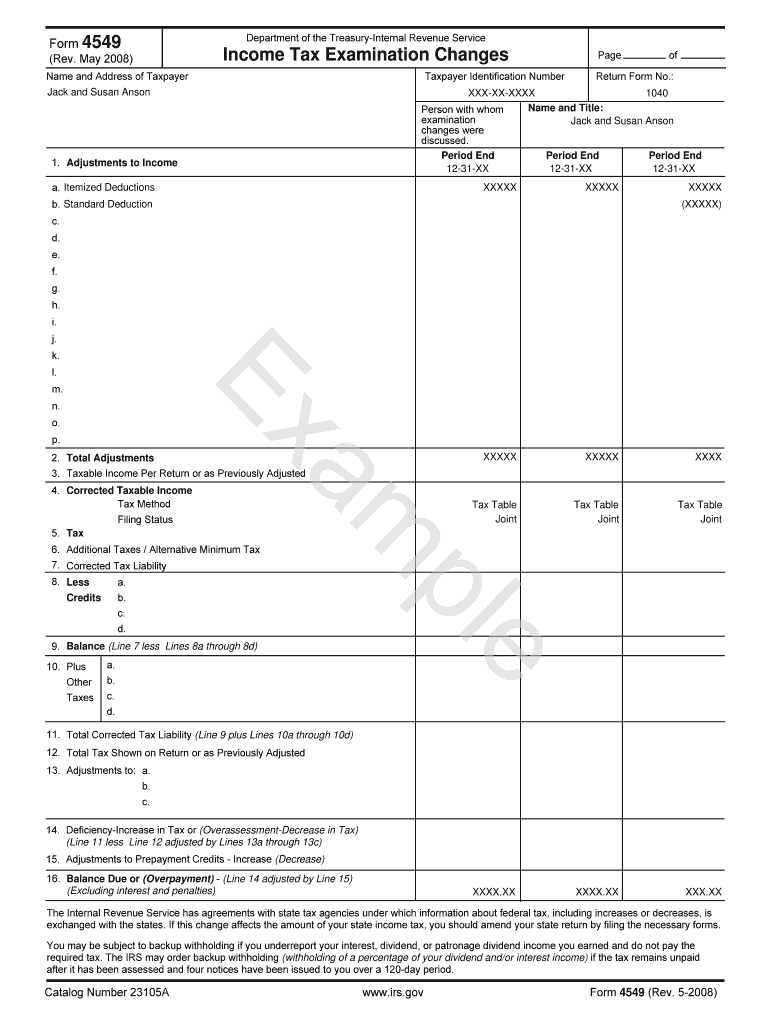

4549 Irs Form

4549 Irs Form - Web a regular agreed report (form 4549) may contain up to three tax years. What do i need to know? Web if we propose changes to your tax return, this letter will also include two forms. Web the irs form 4549 is the income tax examination changes letter. Adjustments to income or deduction items don’t affect or warrant a change in tax liability or refundable credits on the return audited. Web form 4549, report of income tax examination changes. Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person. Web the irs uses form 4549 when the audit is complete. Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations. If the irs is proposing income tax changes and expects the taxpayer to agree to them, they’re likely to use this form.

Normally, the irs will use the form for the initial report only, and the irs reasonably expects agreement. But there are certain times when they are more likely to use this letter. This form means the irs is questioning your tax return. Actions resources taxpayer rights related. Adjustments to income or deduction items don’t affect or warrant a change in tax liability or refundable credits on the return audited. Web the irs uses form 4549 when the audit is complete. The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes. Web a regular agreed report (form 4549) may contain up to three tax years. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations.

This letter is also used as an initial reporting tool. What do i need to know? Actions resources taxpayer rights related. December 1, 2022 audit reconsiderations did you get a notice from the irs saying your tax return was audited (or the irs created a return for you) and you owe taxes, and you disagree with the tax the irs says you owe? Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. This form means the irs is questioning your tax return. The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. Normally, the irs will use the form for the initial report only, and the irs reasonably expects agreement. Web if we propose changes to your tax return, this letter will also include two forms. It will include information, including:

Form 4549 Tax Examination Changes Internal Revenue Service

The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. Actions resources taxpayer rights related. It will include information, including: Web a regular agreed report (form 4549) may contain up to three tax years. Normally, the irs will use the form for the initial report only,.

Irs form 4549 Fill out & sign online DocHub

The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. It will include information, including: But there are certain times when they are more likely to use this letter. Adjustments to income or deduction items don’t affect or warrant a change in tax liability or refundable.

RA's Report Was Initial Determination For Penalty Assessment Purposes

Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations. Web a regular agreed report (form 4549) may contain up to three tax years. The agency may think you failed to report some income, took too many.

IRS Audit Letter 692 Sample 1

Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. What do i need to know? Actions resources taxpayer rights related. Web the irs uses form 4549 when the audit is complete. The agency may think you failed to report some income, took too many.

Irs Form 4549 ≡ Fill Out Printable PDF Forms Online

Web form 4549, report of income tax examination changes. Web the irs form 4549 is the income tax examination changes letter. The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. Web a regular agreed report (form 4549) may contain up to three tax years. If.

Form 4549 IRS Audit Reconsideration The Full Guide Silver Tax Group

January 12, 2022 | last updated: Web if we propose changes to your tax return, this letter will also include two forms. Web a regular agreed report (form 4549) may contain up to three tax years. But there are certain times when they are more likely to use this letter. What do i need to know?

4.10.8 Report Writing Internal Revenue Service

Web the irs uses form 4549 when the audit is complete. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. If the irs is proposing income tax changes and expects the taxpayer to agree to them, they’re likely to use this form. Agreed rars require the taxpayer’s signature and include a statement.

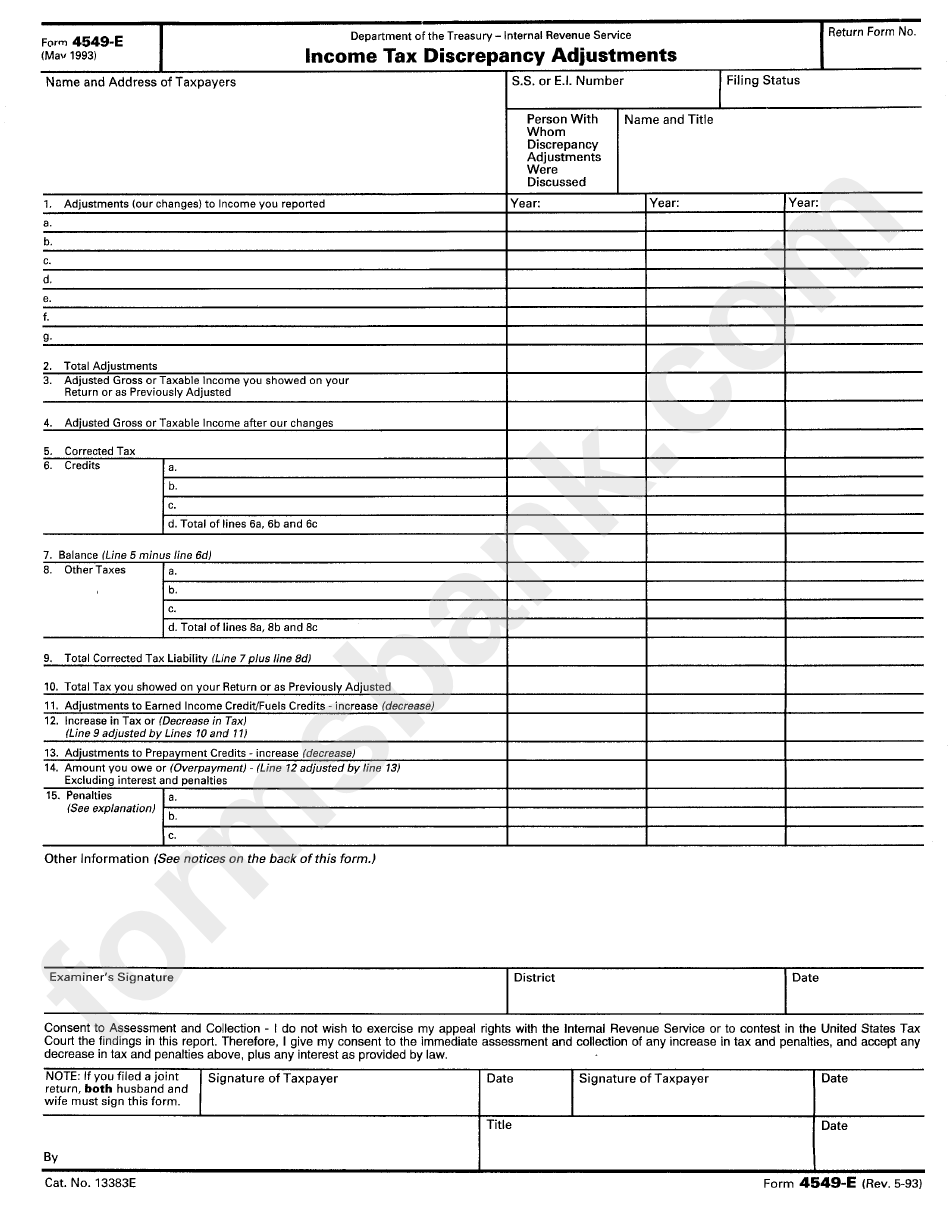

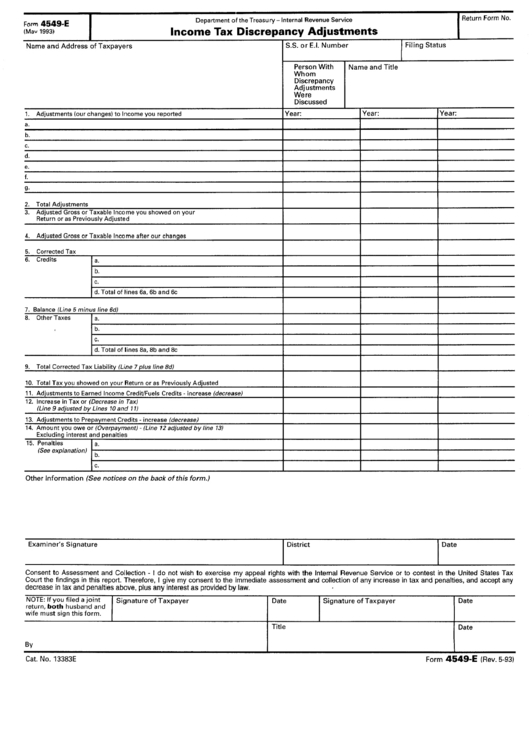

Form 4549e Tax Dicrepancy Adjustments printable pdf download

The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. Normally, the irs will use the form for the initial report only, and the irs reasonably expects agreement. This form means the irs is questioning your tax return. Web form 4549, report of income tax examination.

Form 4549E Tax Discrepancy Adjustments 1993 printable pdf

December 1, 2022 audit reconsiderations did you get a notice from the irs saying your tax return was audited (or the irs created a return for you) and you owe taxes, and you disagree with the tax the irs says you owe? But there are certain times when they are more likely to use this letter. The agency may think.

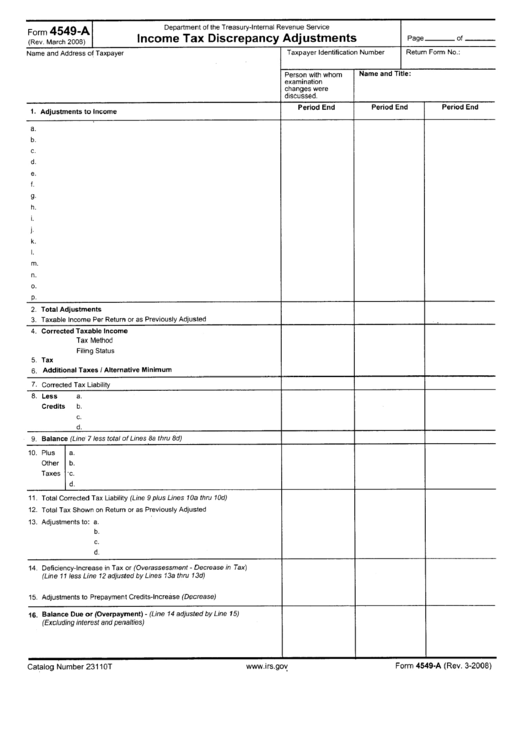

Form 4549A Tax Discrepancy Adjustments printable pdf download

If the irs is proposing income tax changes and expects the taxpayer to agree to them, they’re likely to use this form. This form means the irs is questioning your tax return. What do i need to know? This letter is also used as an initial reporting tool. Web if we propose changes to your tax return, this letter will.

If The Irs Is Proposing Income Tax Changes And Expects The Taxpayer To Agree To Them, They’re Likely To Use This Form.

Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. This form means the irs is questioning your tax return. What do i need to know? Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations.

Web The Irs Uses Form 4549 When The Audit Is Complete.

Normally, the irs will use the form for the initial report only, and the irs reasonably expects agreement. Web form 4549, report of income tax examination changes. January 12, 2022 | last updated: Web if we propose changes to your tax return, this letter will also include two forms.

The Agency May Think You Failed To Report Some Income, Took Too Many Deductions, Or Didn't Pay Enough Taxes.

Web a regular agreed report (form 4549) may contain up to three tax years. This letter is also used as an initial reporting tool. December 1, 2022 audit reconsiderations did you get a notice from the irs saying your tax return was audited (or the irs created a return for you) and you owe taxes, and you disagree with the tax the irs says you owe? The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit.

Web Form 4549 Is An Irs Form That Is Sent To Taxpayers Whose Returns Have Been Audited.

It will include information, including: Actions resources taxpayer rights related. But there are certain times when they are more likely to use this letter. Web form 4549, income tax examination changes, is used for cases that result in: