760 Tax Form

760 Tax Form - File your form 2290 online & efile with the irs. Printable virginia state tax forms for the. Web printable virginia income tax form 760. Web 20 rows virginia state income tax form 760 must be postmarked by may 1, 2023 in order to avoid penalties and late fees. Request for copy of tax return. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. (a person is considered a resident if they have been living in virginia for more than 183 days in a calendar year). Web i/we authorize the sharing of certain information from form 760 and schedule hci (as described in the instructions) with the department of medical assistance services. Enjoy smart fillable fields and interactivity. Get your online template and fill it in using progressive features.

Web always sign the va 760 instructions. Web when to file make estimated payments online or file form 760es payment voucher 1 by may 1, 2023. Get irs approved instant schedule 1 copy. For more information about the. Printable virginia state tax forms for the. Select an eform below to start filing. 07/21 your first name m.i. Get your online template and fill it in using progressive features. It is possible that this question generated because you had an amount due on your virginia tax return,. Virginia's date of conformity with the federal enhanced earned income.

California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Web when to file make estimated payments online or file form 760es payment voucher 1 by may 1, 2023. Do not sign this form unless all applicable lines have. Estimated income tax payments must be made in full on or before may. Web popular forms & instructions; Enjoy smart fillable fields and interactivity. 07/21 your first name m.i. Web virginia resident form 760 *va0760120888* individual income tax return. Printable virginia state tax forms for the. Click on the date field to automatically put in the appropriate date.

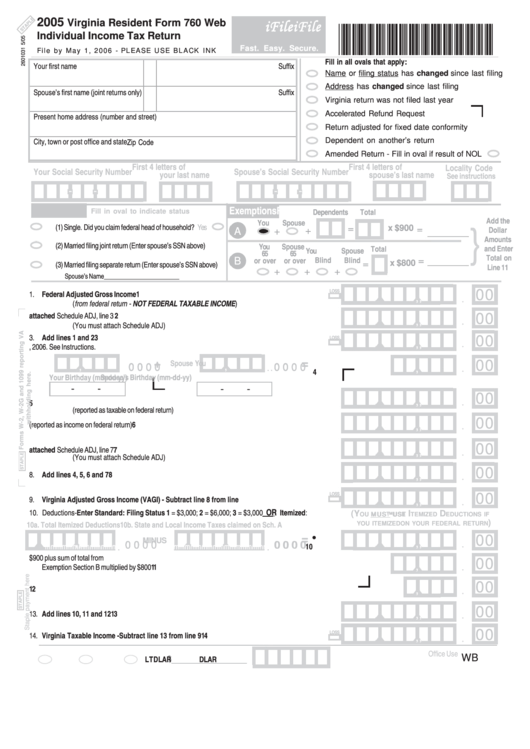

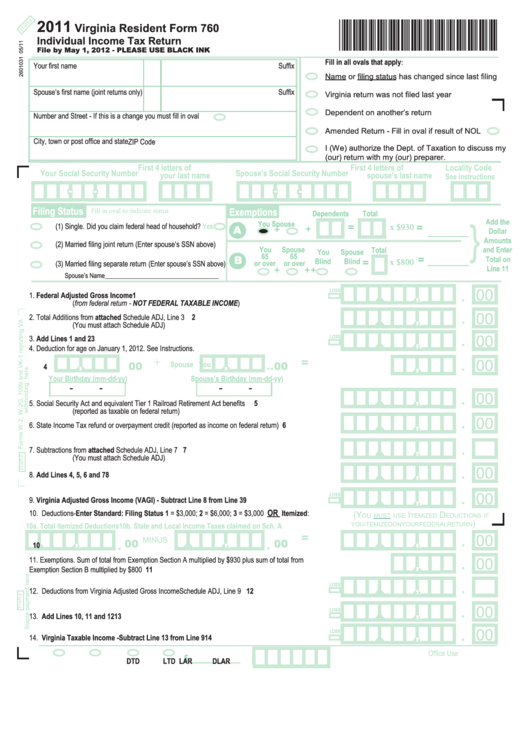

Virginia Resident Form 760 Web Individual Tax Return 2005

Get irs approved instant schedule 1 copy. Estimated income tax payments must be made in full on or before may. Do not sign this form unless all applicable lines have. (a person is considered a resident if they have been living in virginia for more than 183 days in a calendar year). Get your online template and fill it in.

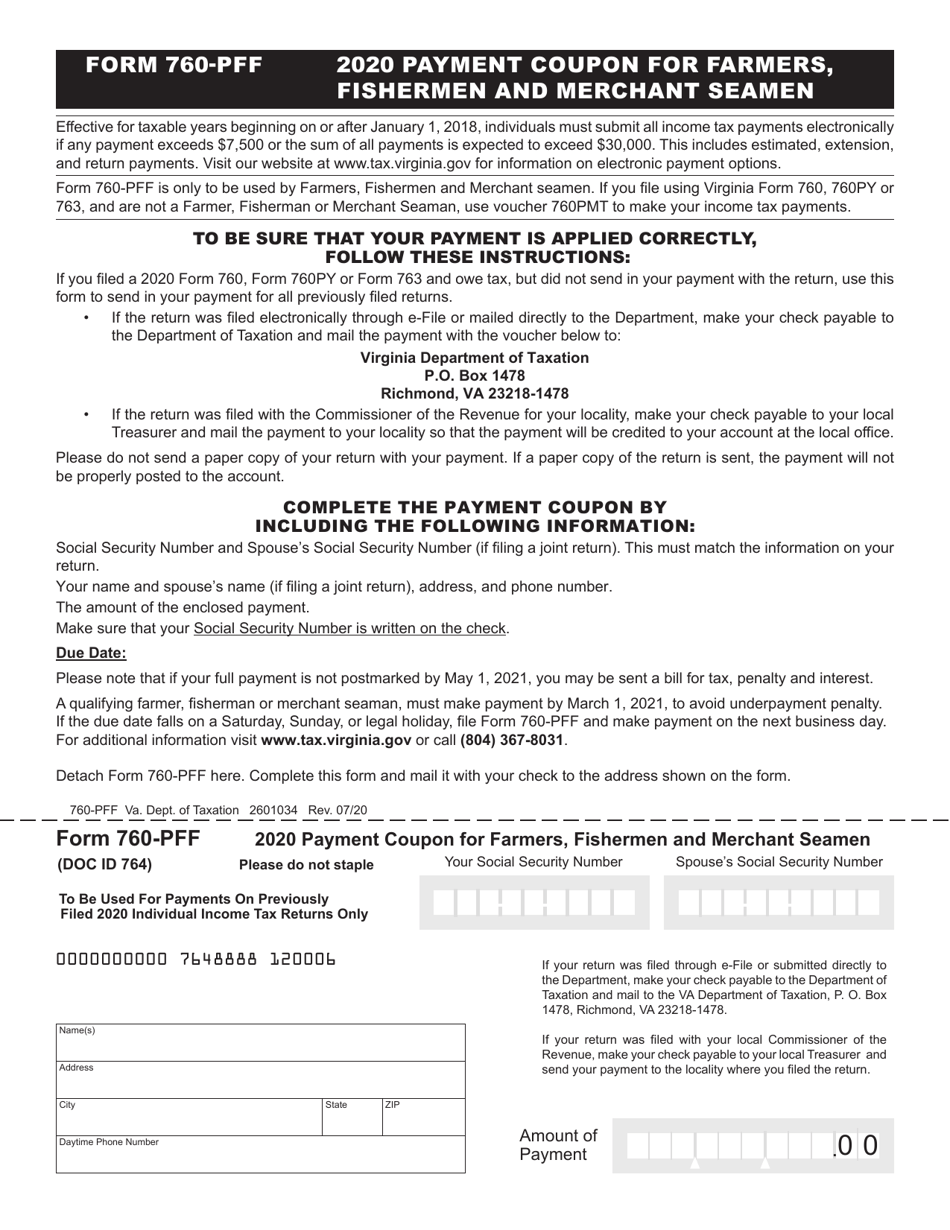

Form 760PFF Download Fillable PDF or Fill Online Payment Coupon for

Web virginia form 760 instructions what's new virginia's fixed date conformity with the internal revenue code: Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Web tax forms and publications. For more information about the. Estimated income tax payments must be made in full on or before may.

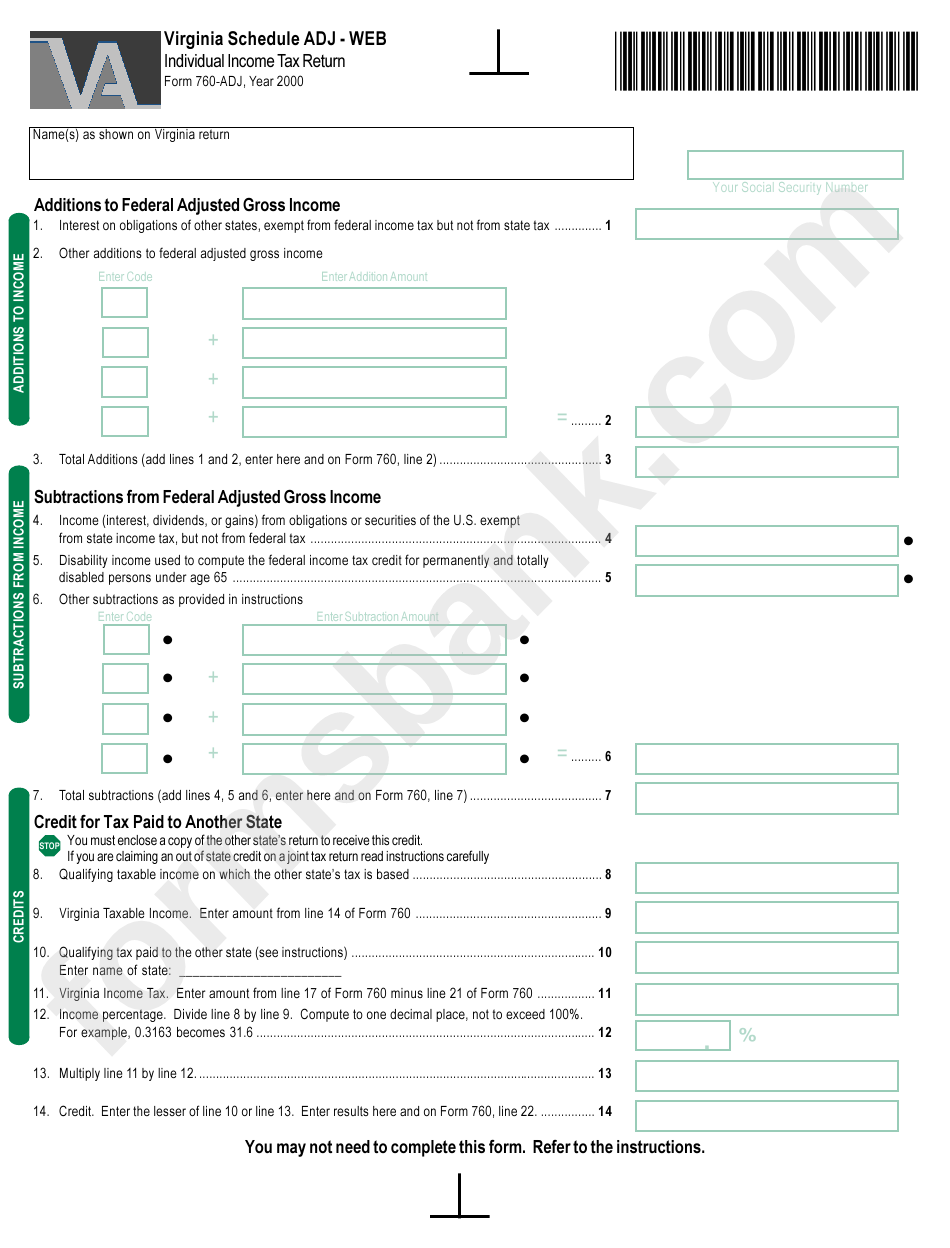

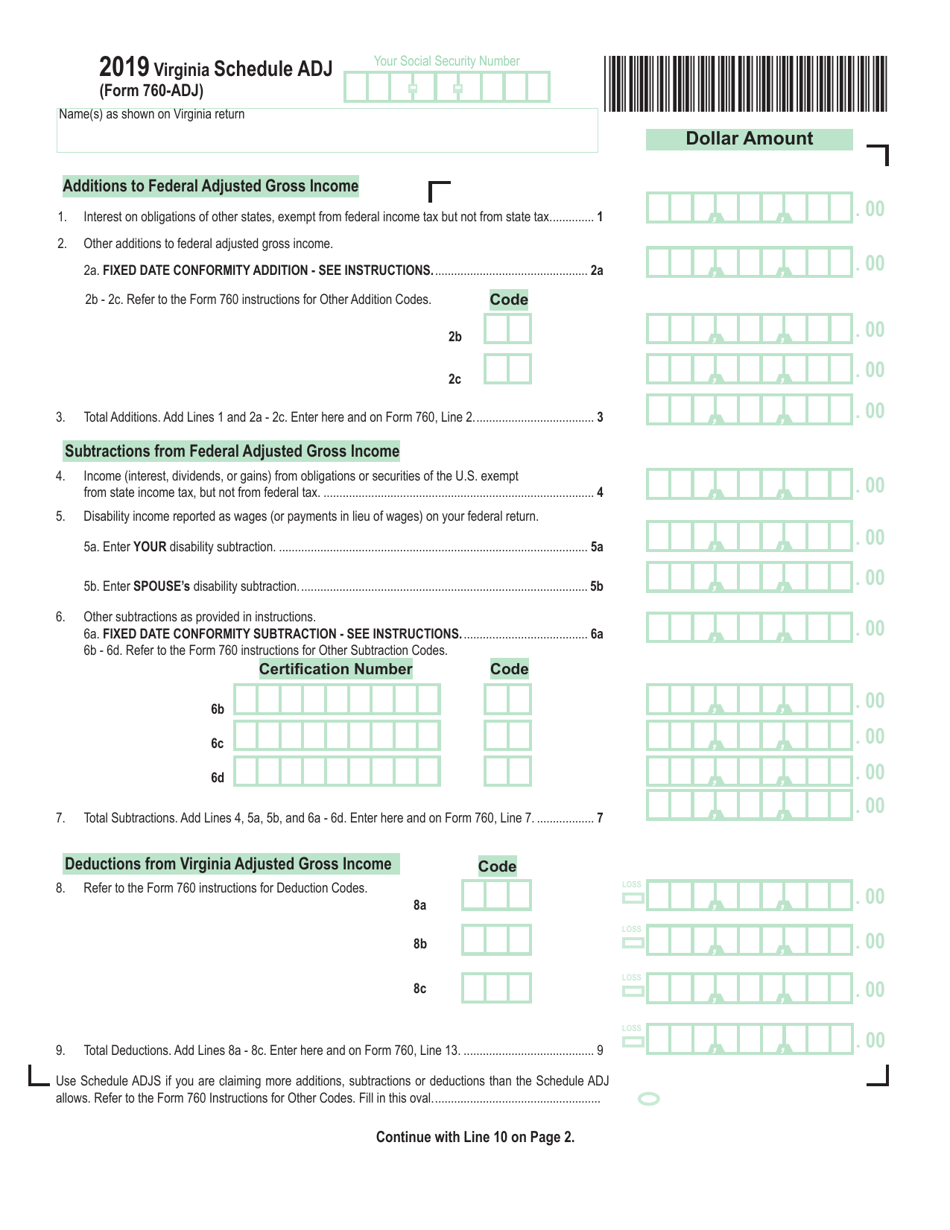

Form 760Adj Individual Tax Return 2000 printable pdf download

Web printable virginia income tax form 760. Individual tax return form 1040 instructions; Virginia's date of conformity with the federal enhanced earned income. Web 20 rows virginia state income tax form 760 must be postmarked by may 1, 2023 in order to avoid penalties and late fees. Web residents of virginia must file a form 760.

How to file State Tax Return Free Directly? 760_cg form includd with

Web popular forms & instructions; We last updated virginia form 760 in january 2023 from the virginia. Web tax forms and publications. Web how to fill out and sign 2016 virginia tax form 760 online? If you haven't filed or paid taxes using eforms and need more information,.

va form 20 0996 printable Va form 268497 download fillable pdf or fill

File your form 2290 today avoid the rush. Select an eform below to start filing. Web 2021 virginia form 760 *va0760121888* resident income tax return 2601031 file by may 1, 2022 — use black ink rev. Web virginia resident form 760 *va0760120888* individual income tax return. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia.

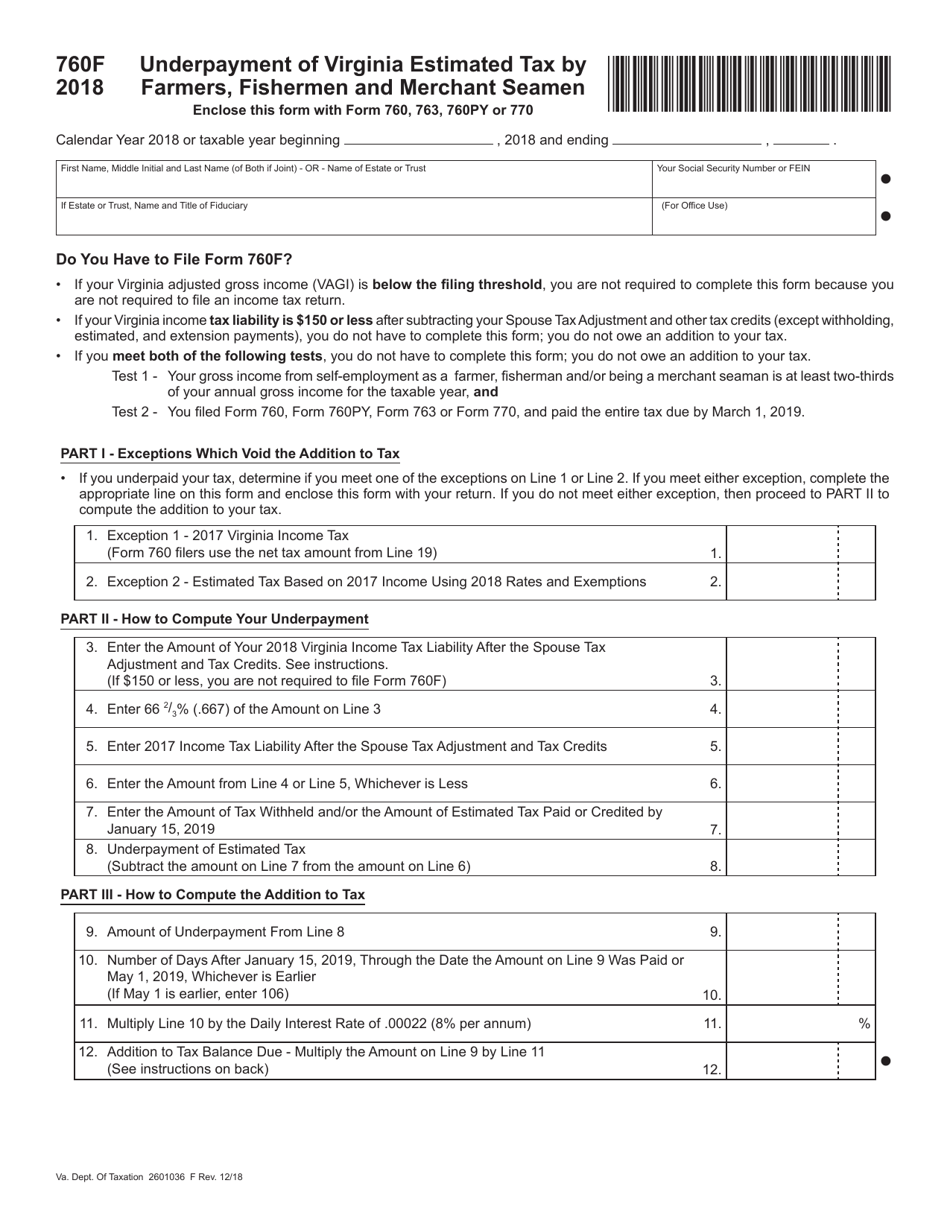

Form 760F Download Fillable PDF or Fill Online Underpayment of Virginia

Virginia's date of conformity with the federal enhanced earned income. Web tax forms and publications. Web how to fill out and sign 2016 virginia tax form 760 online? 07/21 your first name m.i. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia.

Virginia Resident Form 760 Individual Tax Return 2011

Web popular forms & instructions; Click on the date field to automatically put in the appropriate date. Select an eform below to start filing. Do not sign this form unless all applicable lines have. If you haven't filed or paid taxes using eforms and need more information,.

VA DoT 760 2018 Fill out Tax Template Online US Legal Forms

Get your online template and fill it in using progressive features. We last updated virginia form 760 in january 2023 from the virginia. Individual tax return form 1040 instructions; Web how to fill out and sign 2016 virginia tax form 760 online? There are a number of excellent sources available for taxpayers to obtain tax forms, instructions, and publications.

Form 760 Schedule ADJ Download Fillable PDF or Fill Online Virginia

File your form 2290 today avoid the rush. Web 20 rows virginia state income tax form 760 must be postmarked by may 1, 2023 in order to avoid penalties and late fees. There are a number of excellent sources available for taxpayers to obtain tax forms, instructions, and publications. Web form 4506 (novmeber 2021) department of the treasury internal revenue.

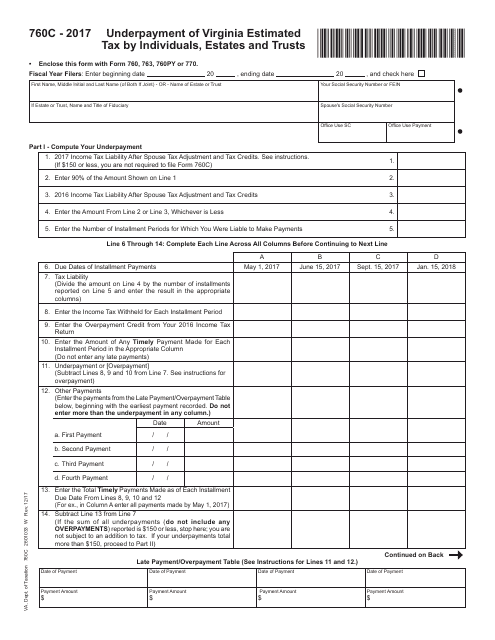

Form 760C Download Fillable PDF or Fill Online Underpayment of Virginia

We last updated the resident individual income tax return in january 2023, so. For more information about the. Web 2021 virginia form 760 *va0760121888* resident income tax return 2601031 file by may 1, 2022 — use black ink rev. Web eforms are a fast and free way to file and pay state taxes online. It is possible that this question.

Web How To Fill Out And Sign 2016 Virginia Tax Form 760 Online?

If you haven't filed or paid taxes using eforms and need more information,. Get irs approved instant schedule 1 copy. Printable virginia state tax forms for the. Web 20 rows virginia state income tax form 760 must be postmarked by may 1, 2023 in order to avoid penalties and late fees.

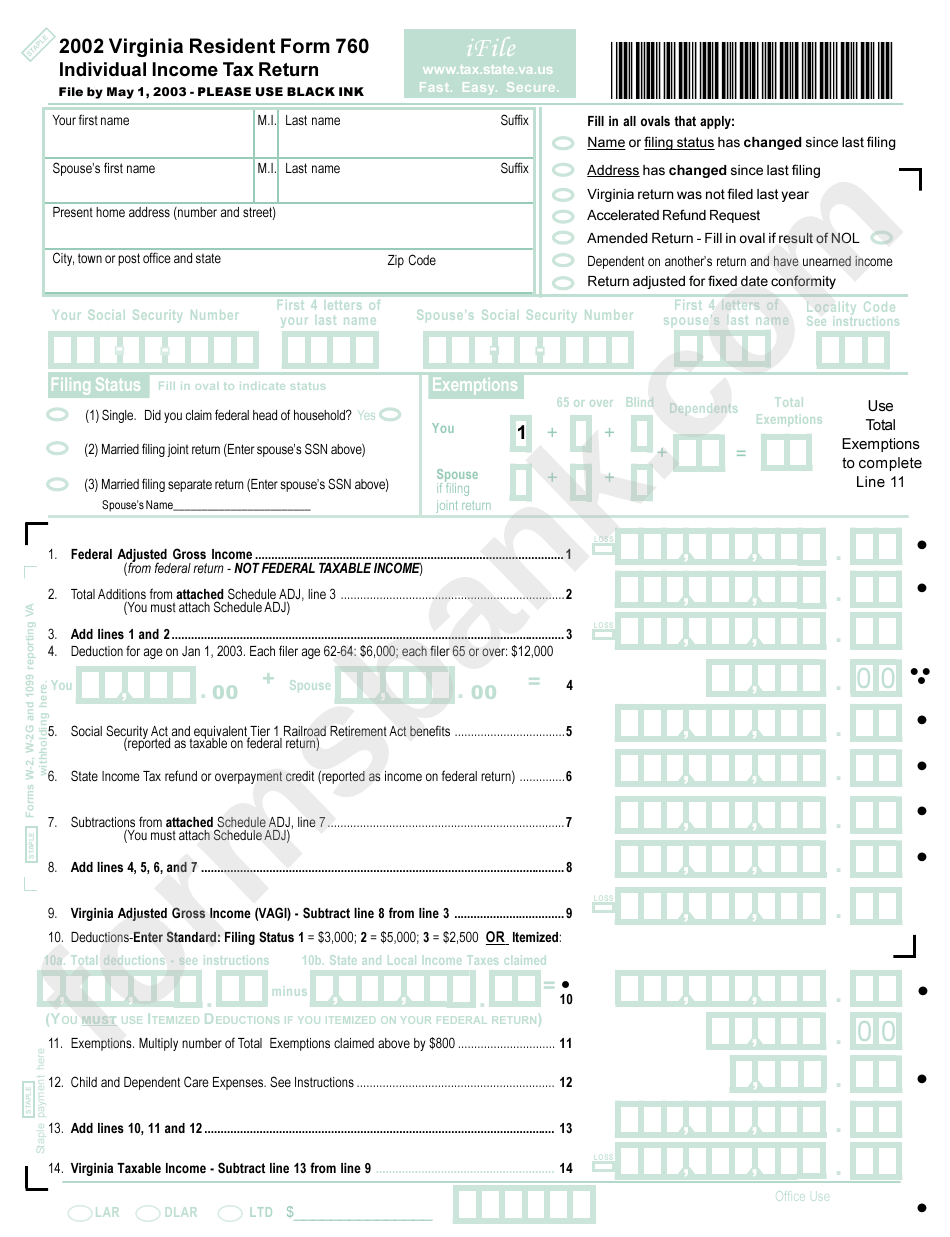

Web Printable Virginia Income Tax Form 760.

It is possible that this question generated because you had an amount due on your virginia tax return,. There are a number of excellent sources available for taxpayers to obtain tax forms, instructions, and publications. Virginia's date of conformity with the federal enhanced earned income. We last updated virginia form 760 in january 2023 from the virginia.

Select An Eform Below To Start Filing.

Web eforms are a fast and free way to file and pay state taxes online. Web residents of virginia must file a form 760. Web popular forms & instructions; (a person is considered a resident if they have been living in virginia for more than 183 days in a calendar year).

File Your Form 2290 Online & Efile With The Irs.

California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. We last updated the resident individual income tax return in january 2023, so. Request for copy of tax return. Web form 760c, line 3 is asking for your 2018 income tax liability.