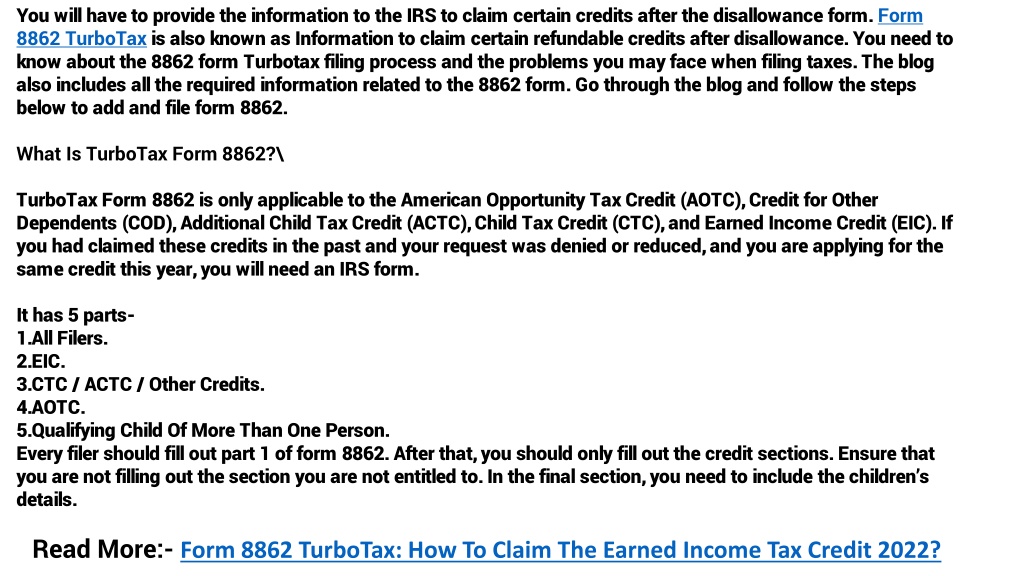

8862 Form Turbotax

8862 Form Turbotax - Ad get your taxes done right & maximize your refund with turbotax®. Adhere to our simple actions to get your irs 8862 prepared quickly: Web it’s easy to do in turbotax. Select continue and then done. Web irs form 8862 (information to claim certain credits after disallowance) must be included with your tax return if you have previously been denied the earned. Web if the irs rejected one or more of these credits: Web form 8862 is available in turbo tax. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Answer the questions accordingly, and we’ll include form 8862 with your return. Search for 8862 and select the link to go to the section.

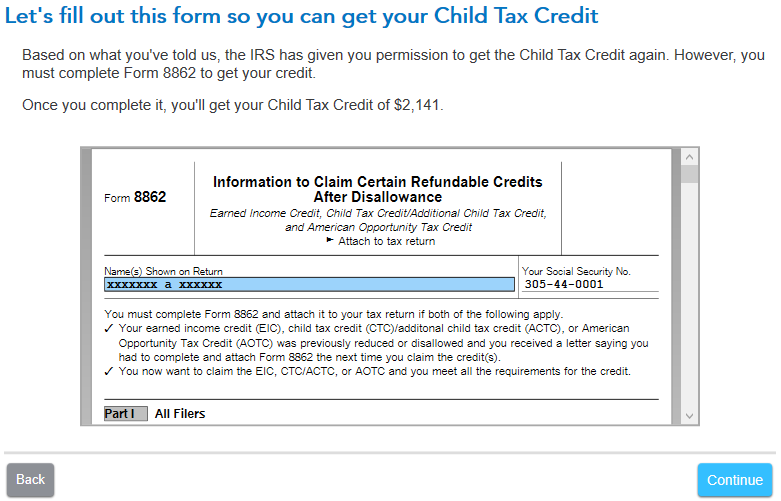

Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Answer the questions accordingly, and we’ll include form 8862 with your return. Web form 8862 is available in turbo tax. Open your return if you don't already. Web open form follow the instructions easily sign the form with your finger send filled & signed form or save irs form 8862 for 2021 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★. Web if the irs rejected one or more of these credits: Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service.

Open your return if you don't already. Use get form or simply click on the template preview to open it in the editor. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Web it’s easy to do in turbotax. Web if the irs rejected one or more of these credits: We have thousands of employers on file to help you easily import your tax forms. Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. Adhere to our simple actions to get your irs 8862 prepared quickly: Ad access irs tax forms. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits.

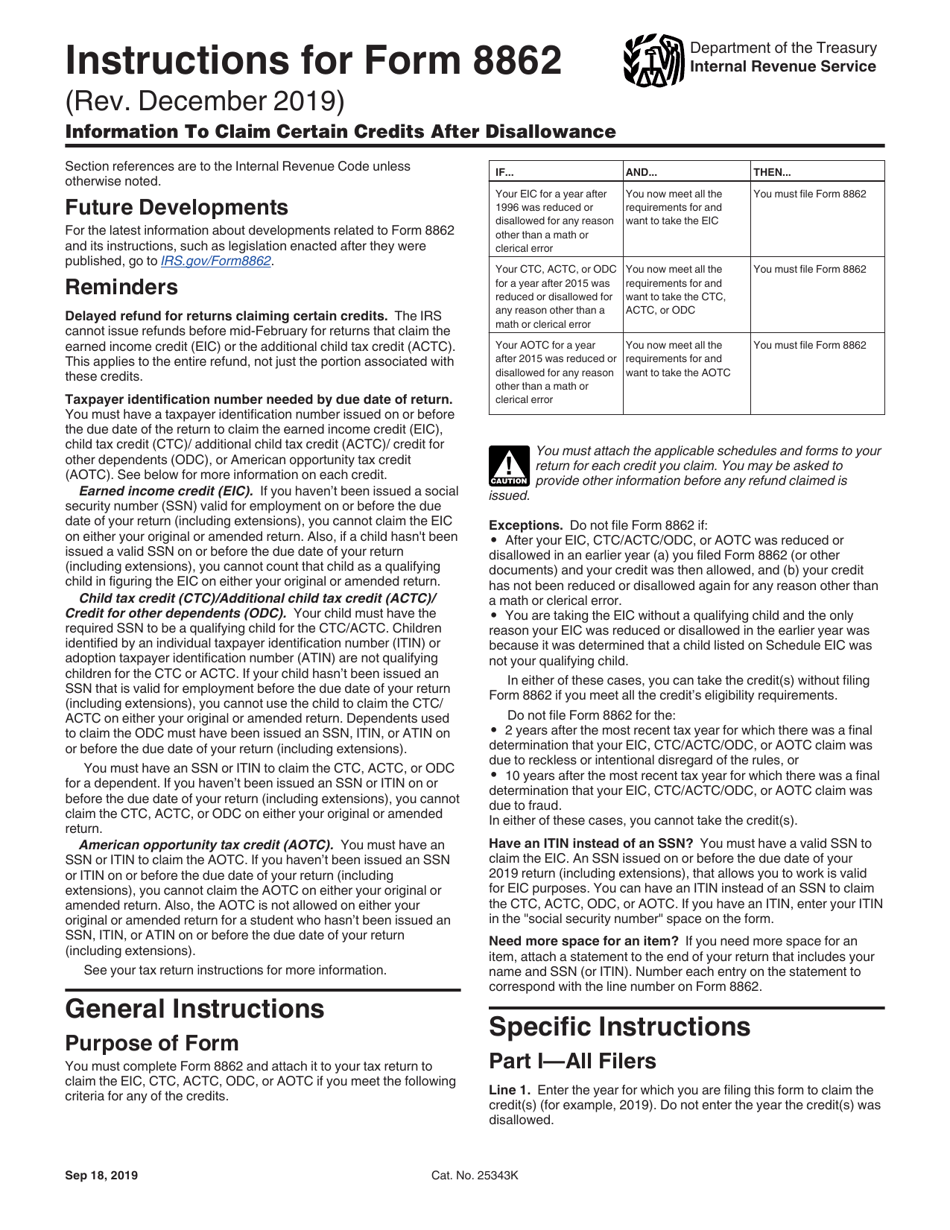

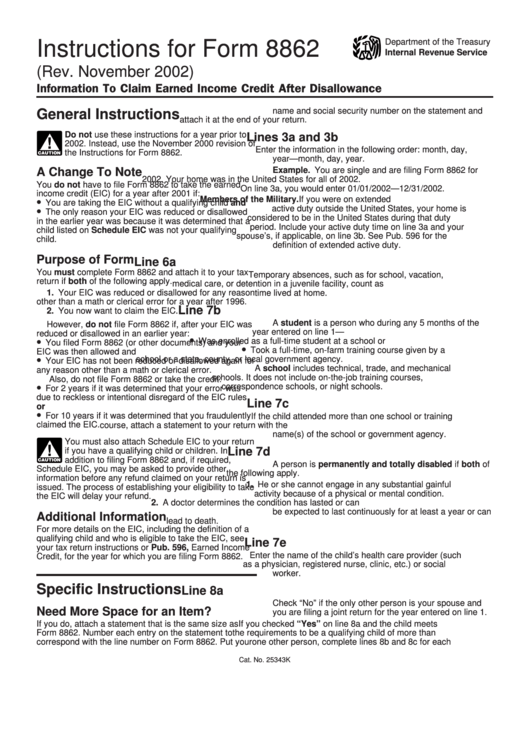

Instructions For Form 8862 Information To Claim Earned Credit

Web if the irs rejected one or more of these credits: Select continue and then done. Web form 8862 is available in turbo tax. Information to claim certain credits after disallowance. Web taxpayers complete form 8862 and attach it to their tax return if:

How To File Form 8862 On Turbotax House for Rent

Ad access irs tax forms. This form is for income earned in tax year 2022, with tax returns due in april. Web check the box that says, i/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Web file form 8862 if we denied or reduced your eitc for.

Top 14 Form 8862 Templates free to download in PDF format

Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year..

What is Form 8862? TurboTax Support Video YouTube

Web check the box that says, i/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the.

how do i add form 8862 TurboTax® Support

Ad access irs tax forms. Web irs form 8862 (information to claim certain credits after disallowance) must be included with your tax return if you have previously been denied the earned. If you wish to take the credit in a. Complete, edit or print tax forms instantly. Web for the latest information about developments related to form 8862 and its.

Form 8862 Information to Claim Earned Credit After

Ad access irs tax forms. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Web check the box that says, i/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Eitc, ctc,.

PPT Form 8862 TurboTax How To Claim The Earned Tax Credit

Web it’s easy to do in turbotax. Use get form or simply click on the template preview to open it in the editor. Start completing the fillable fields and. We have thousands of employers on file to help you easily import your tax forms. Web if the irs rejected one or more of these credits:

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Start completing the fillable fields and. Answer the questions accordingly, and we’ll include form 8862 with your return. Open your return if you don't already. Turbotax can help you fill out your.

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Ad get your taxes done right & maximize your refund with turbotax®. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. Turbotax can help you fill.

Download Instructions for IRS Form 8862 Information to Claim Certain

Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Adhere to our simple actions to get your irs 8862 prepared quickly: Answer the questions accordingly, and we’ll include form 8862 with your return. This.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

If you wish to take the credit in a. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Ad get your taxes done right & maximize your refund with turbotax®. November 2018) department of the treasury internal revenue service.

Search For 8862 And Select The Link To Go To The Section.

Turbotax can help you fill out your. We have thousands of employers on file to help you easily import your tax forms. This form is for income earned in tax year 2022, with tax returns due in april. Adhere to our simple actions to get your irs 8862 prepared quickly:

Web Form 8862 Is The Form The Irs Requires To Be Filed When The Earned Income Credit Or Eic Has Been Disallowed In A Prior Year.

Web form 8862 is available in turbo tax. Web open form follow the instructions easily sign the form with your finger send filled & signed form or save irs form 8862 for 2021 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Web if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs allows.

Ad Access Irs Tax Forms.

Web check the box that says, i/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Web if the irs rejected one or more of these credits: Make sure you perform these following steps so that the form generates in your return.

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-172737-768x501.jpg)