8995 Form 2021

8995 Form 2021 - Form 8995 and form 8995a. Use separate schedules a, b, c, and/or d, as. You have qbi, section 199a dividends, or ptp income (defined below), b. Web great news for small business owners: By completing irs tax form 8995, eligible small business owners can claim. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. You have qbi, qualified reit dividends, or qualified ptp income or loss;. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Written by a turbotax expert •. Who can use form 8995?

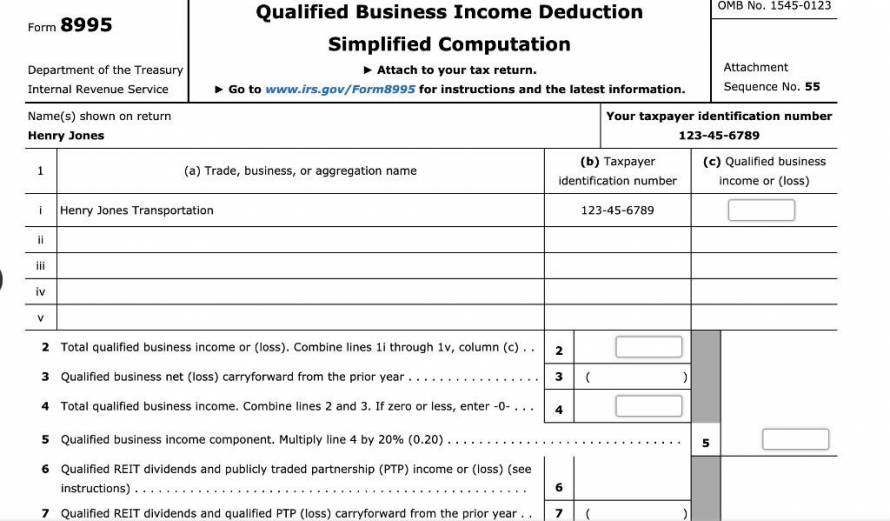

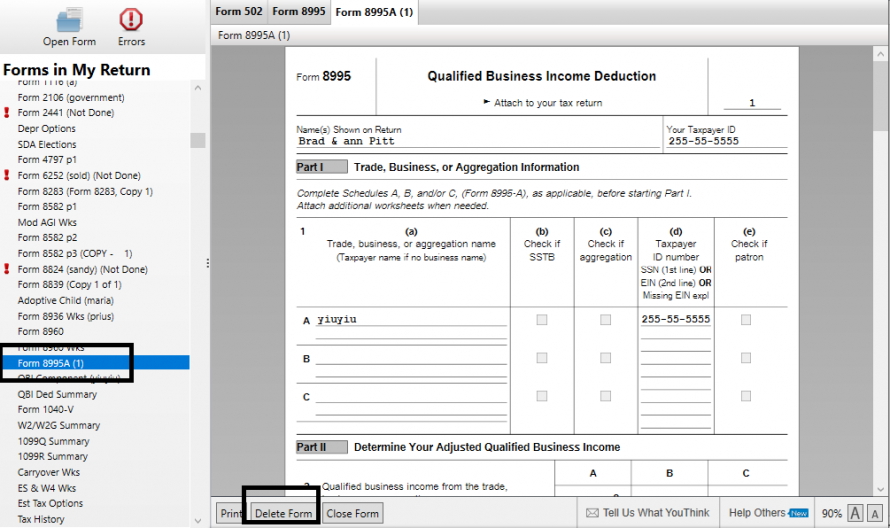

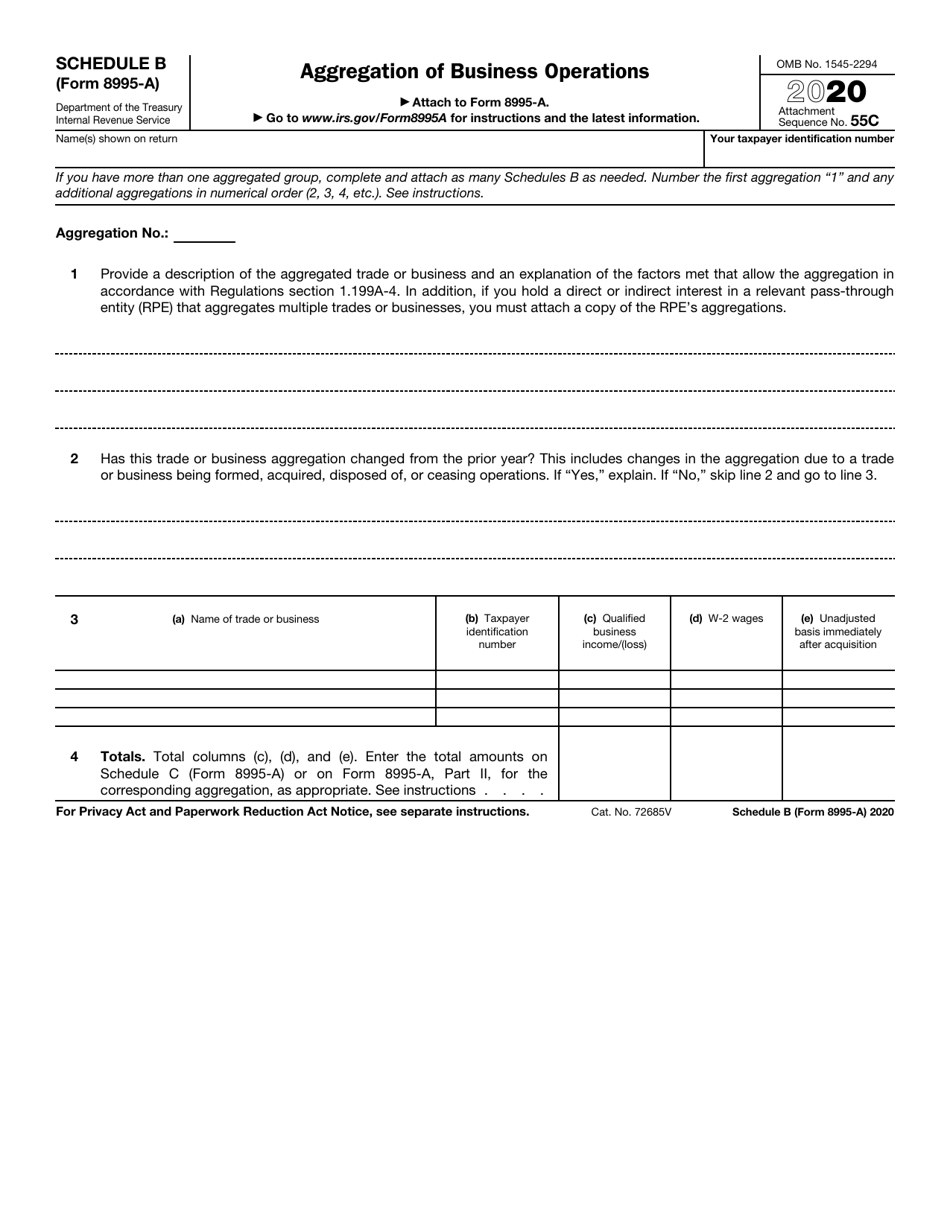

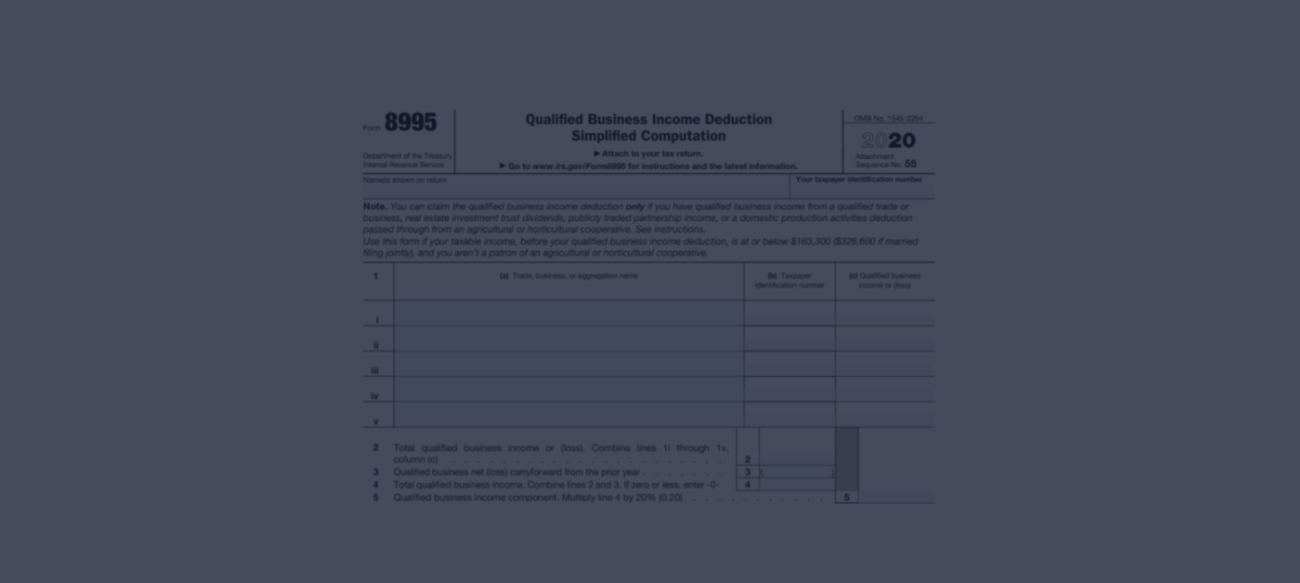

Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year 2022. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web great news for small business owners: By completing irs tax form 8995, eligible small business owners can claim. Your 20% tax savings is just one form away. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation aattach to your tax return. Use this form to figure your qualified business income deduction. Ad register and subscribe now to work on your irs form 8995 & more fillable forms. Web form 8995 is the simplified form and is used if all of the following are true: You have qbi, section 199a dividends, or ptp income (defined below), b.

Your 20% tax savings is just one form away. Form 8995 and form 8995a. Web use form 8995, qualified business income deduction simplified computation, if: The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Web what is form 8995? Use separate schedules a, b, c, and/or d, as. Use this form to figure your qualified business income deduction. Complete, edit or print tax forms instantly. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid).

8995 Form Updates Patch Notes fo 8995 Form Product Blog

Complete, edit or print tax forms instantly. Ad register and subscribe now to work on your irs form 8995 & more fillable forms. Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business. By completing irs tax form 8995, eligible small business owners.

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Who can use form 8995? Web use form 8995,.

8995 Form News Fresh Guides fo 8995 Form Product Blog

Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Upload, modify or create forms. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. The individual has qualified business income (qbi),.

2021 Entry Forms[5299].pdf DocDroid

Web form 8995 is the simplified form and is used if all of the following are true: Web what is form 8995? Enter 50% (.50) of the qualified business income (qbi) deduction claimed on your 2021 federal form 8995, line 15, or. Upload, modify or create forms. Ad register and subscribe now to work on your irs form 8995 &.

Online Form 8995 Blog 8995 Form Website

The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Upload, modify or create forms. You have qbi, section 199a dividends, or ptp income (defined below), b. Web great news for small business owners: Web what is form 8995?

Printable Form 8995 Blog 8995 Form Website

Use this form to figure your qualified business income deduction. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business. Web information.

Irs Form 8995a Schedule B Download Fillable Pdf Or Fill Online

Web what is form 8995? Enter 50% (.50) of the qualified business income (qbi) deduction claimed on your 2021 federal form 8995, line 15, or. Upload, modify or create forms. You have qbi, qualified reit dividends, or qualified ptp income or loss;. Web use form 8995, qualified business income deduction simplified computation, if:

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

Try it for free now! Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business. Web use form 8995, qualified business income deduction simplified computation, if: Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach.

8995 Form Updates Patch Notes fo 8995 Form Product Blog

Web federal tax addition and deduction. Use separate schedules a, b, c, and/or d, as. You have qbi, section 199a dividends, or ptp income (defined below), b. Who can use form 8995? Web form 8995 is the simplified form and is used if all of the following are true:

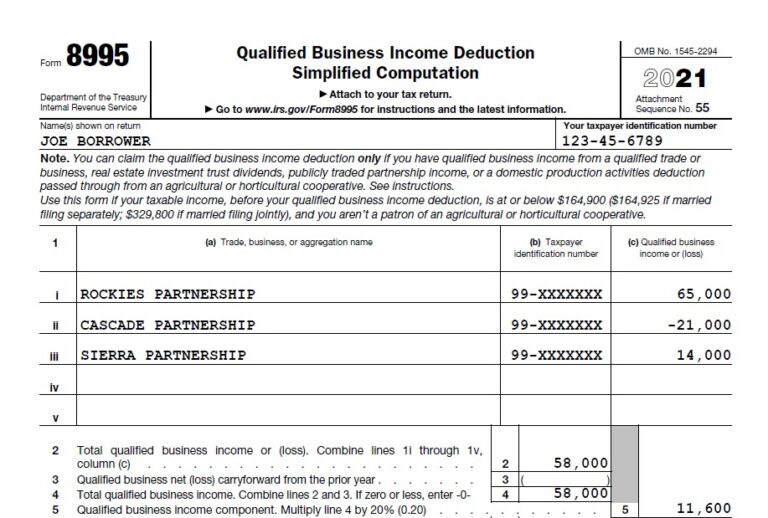

Using Form 8995 to Identify Your Borrower's K1s? Think Again! Bukers

Ad register and subscribe now to work on your irs form 8995 & more fillable forms. Web use form 8995, qualified business income deduction simplified computation, if: Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). You have qbi, section 199a dividends, or ptp income (defined below), b. By completing irs.

Ad Register And Subscribe Now To Work On Your Irs Form 8995 & More Fillable Forms.

Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Form 8995 and form 8995a. Enter 50% (.50) of the qualified business income (qbi) deduction claimed on your 2021 federal form 8995, line 15, or.

Your 20% Tax Savings Is Just One Form Away.

Web federal tax addition and deduction. Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Use separate schedules a, b, c, and/or d, as. Web what is form 8995?

Web Form 8995 Is The Simplified Form And Is Used If All Of The Following Are True:

Ad register and subscribe now to work on your irs form 8995 & more fillable forms. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year 2022.

Who Can Use Form 8995?

Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business. Web great news for small business owners: Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation aattach to your tax return.

![2021 Entry Forms[5299].pdf DocDroid](https://www.docdroid.net/file/view/wwCf8sl/2021-entry-forms5299-pdf.jpg)