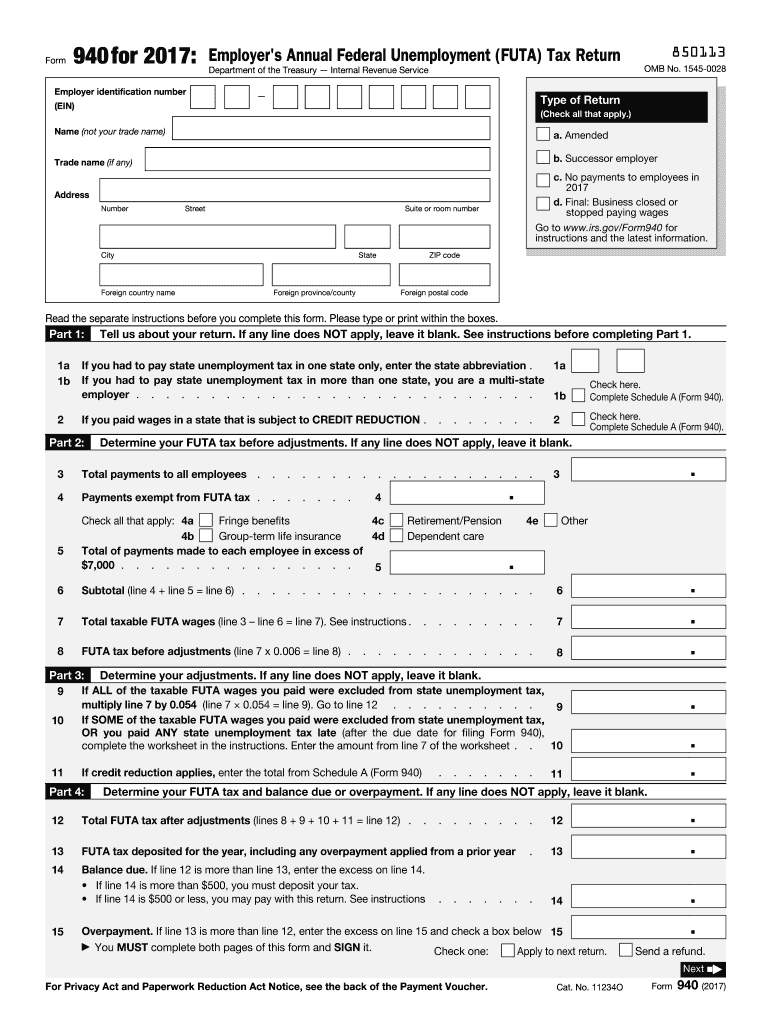

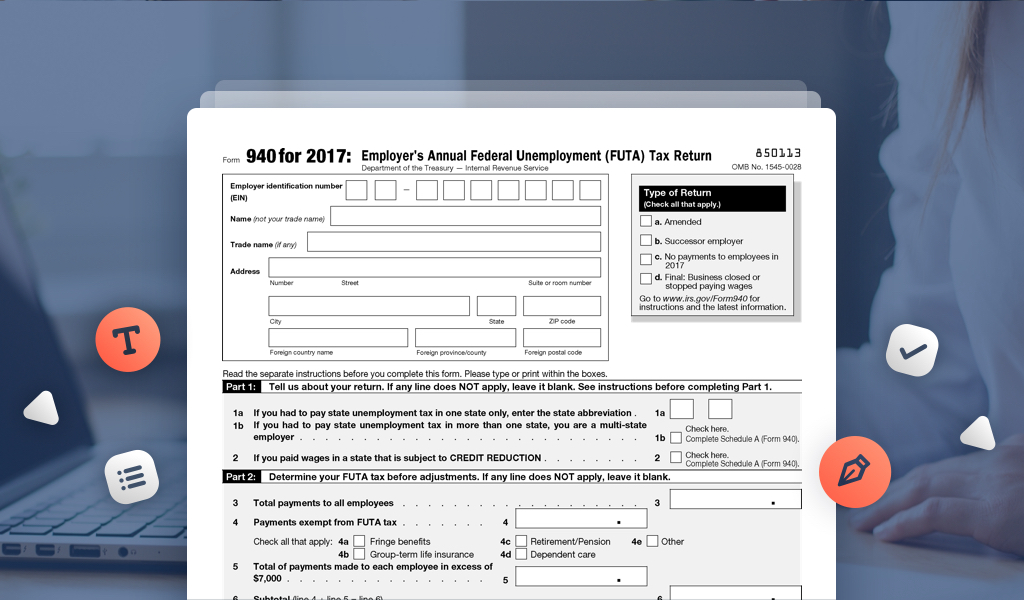

940 For 2017 Form

940 For 2017 Form - If you paid wages subject to the. The time to claim a 2017 tax refund has. 31 each year for the previous year. Use form 940 to report your annual federal. Most employers that have employees are. Web find and fill out the correct 940 amended return 2017. Web we at efile offer free online tax forms for federal and state that you can fill in. Web reduction state, you may have to pay more futa tax when filing your form 940. Employers use form 940 to report their federal unemployment tax act (futa) tax liability. You can also download it, export it or print it out.

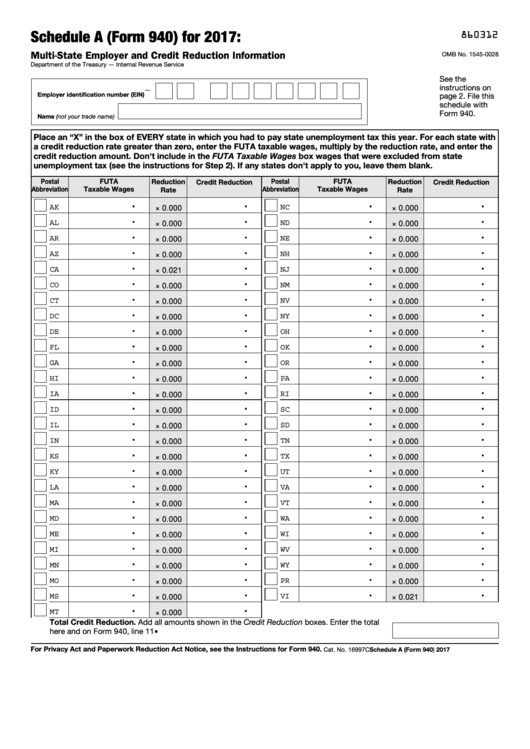

Free printable 2017 1040 tax form pdf file published by the irs. Web form 940 is due on jan. Web get the schedule a form 940 for 2017 accomplished. Web department of the treasury—internal revenue service (99) u.s. Download your adjusted document, export it. Individual income tax return 2017 omb no. Send schedule a form 940 2017 via email, link, or fax. 2017 1040 tax form pdf file published by the irs. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is. Web find and fill out the correct 940 amended return 2017.

Web reduction state, you may have to pay more futa tax when filing your form 940. Web department of the treasury—internal revenue service (99) u.s. Choose the correct version of the editable pdf form. Web form 940 is a tax form that allows employers to report their annual futa (federal unemployment tax act) payroll tax. If you haven't received your ein by the due date of form 941, write “applied for” and the date you applied in this entry. Download your adjusted document, export it. Send schedule a form 940 2017 via email, link, or fax. Web find and fill out the correct 940 amended return 2017. You can complete and sign 2017 tax forms here on. Ad access irs tax forms.

Irs form 940 2017 Fill out & sign online DocHub

Web department of the treasury—internal revenue service (99) u.s. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is. Web find and fill out the correct 940 amended return 2017. For employers who withhold taxes from employee's paychecks or who must pay. Sign it in a few clicks draw your.

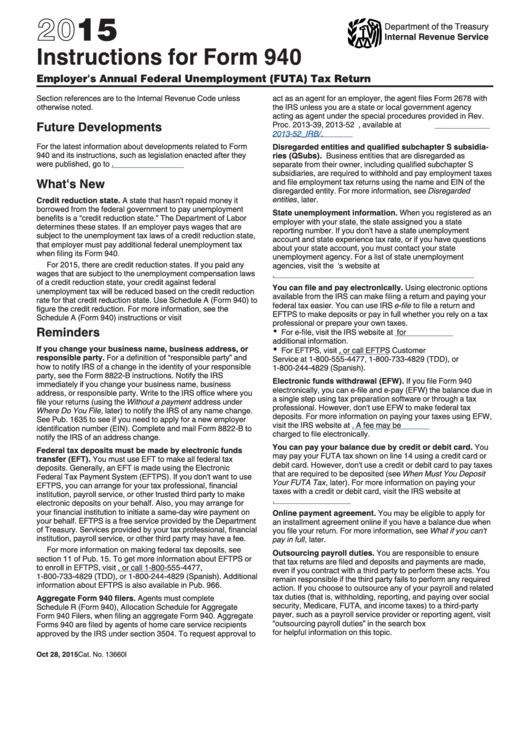

Instructions For Form 940 2017 printable pdf download

Individual income tax return 2017 omb no. Web get the schedule a form 940 for 2017 accomplished. Web november 1, 2018 by income tax pro. Choose the correct version of the editable pdf form. Use form 940 to report your annual federal.

Barbara Johnson Blog Form 940 Instructions How to Fill It Out and Who

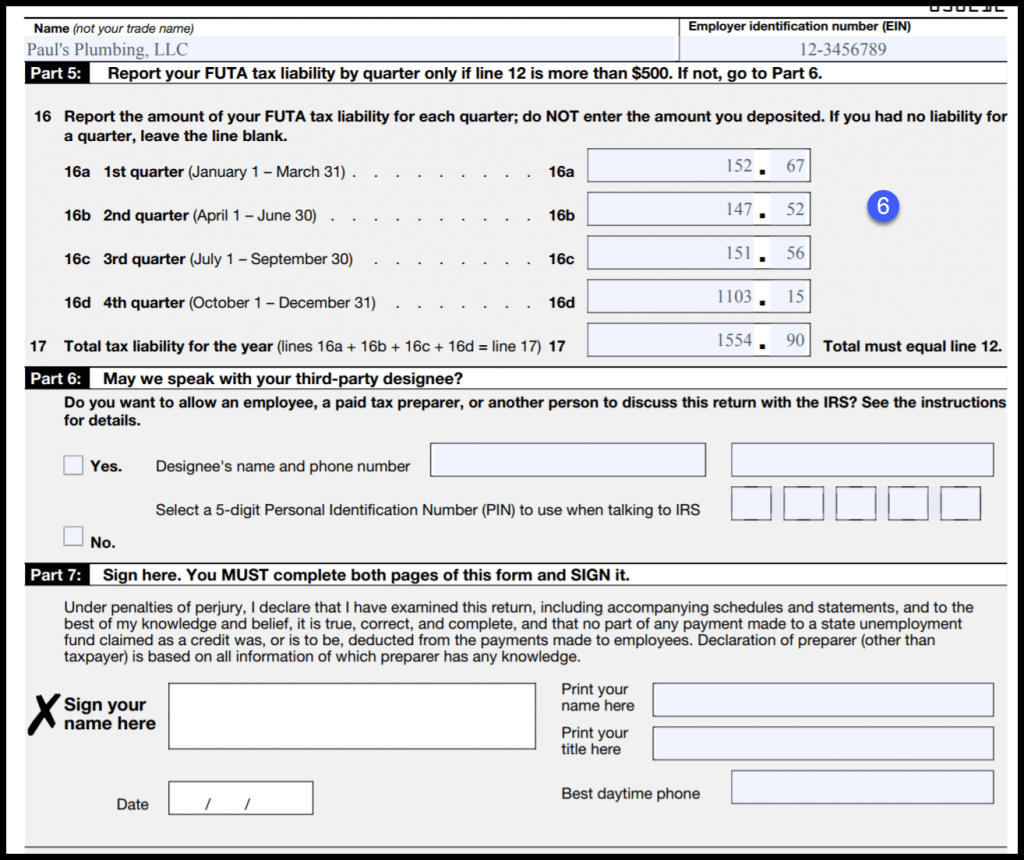

For tax year 2017, there are credit reduction states. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is. Web form 940 is due on jan. Ad access irs tax forms. You can complete and sign 2017 tax forms here on.

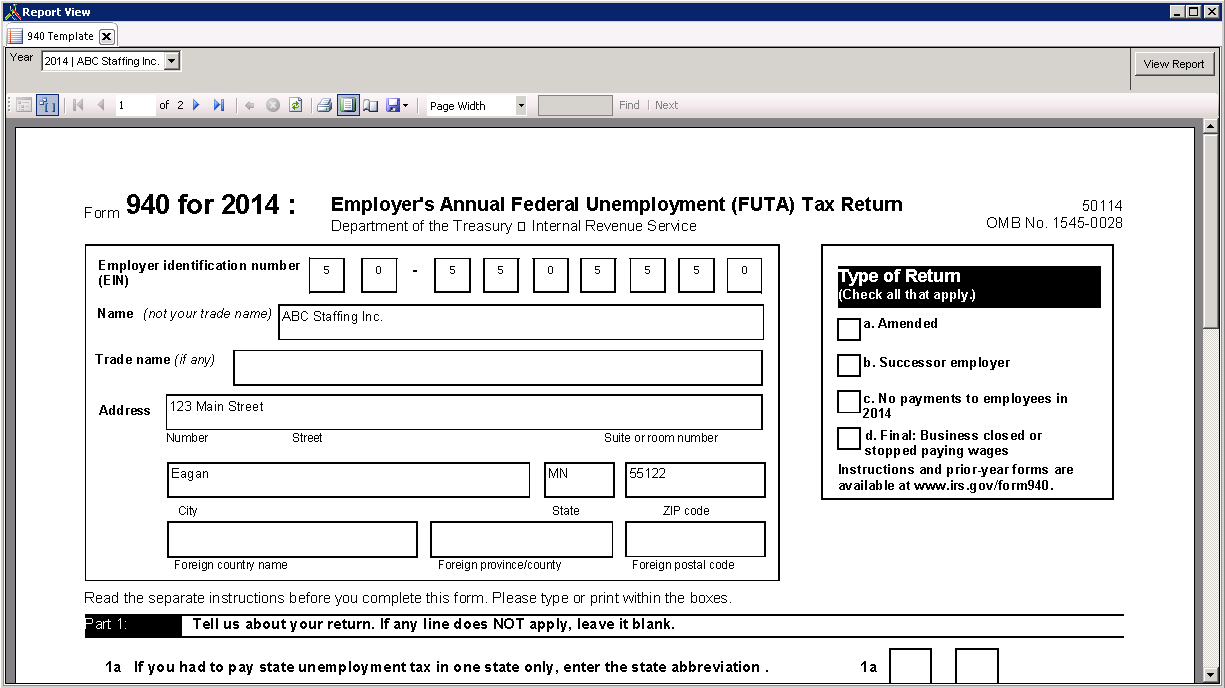

Standard Report 940 Template Avionte Classic

Most employers that have employees are. Employers use form 940 to report their federal unemployment tax act (futa) tax liability. Web share your form with others. Edit your form 940 for 2017 online type text, add images, blackout confidential details, add comments, highlights and more. Web we at efile offer free online tax forms for federal and state that you.

Fillable Schedule A (Form 940) MultiState Employer And Credit

Most employers that have employees are. Download or email irs 940 & more fillable forms, register and subscribe now! Web november 1, 2018 by income tax pro. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is. Ad access irs tax forms.

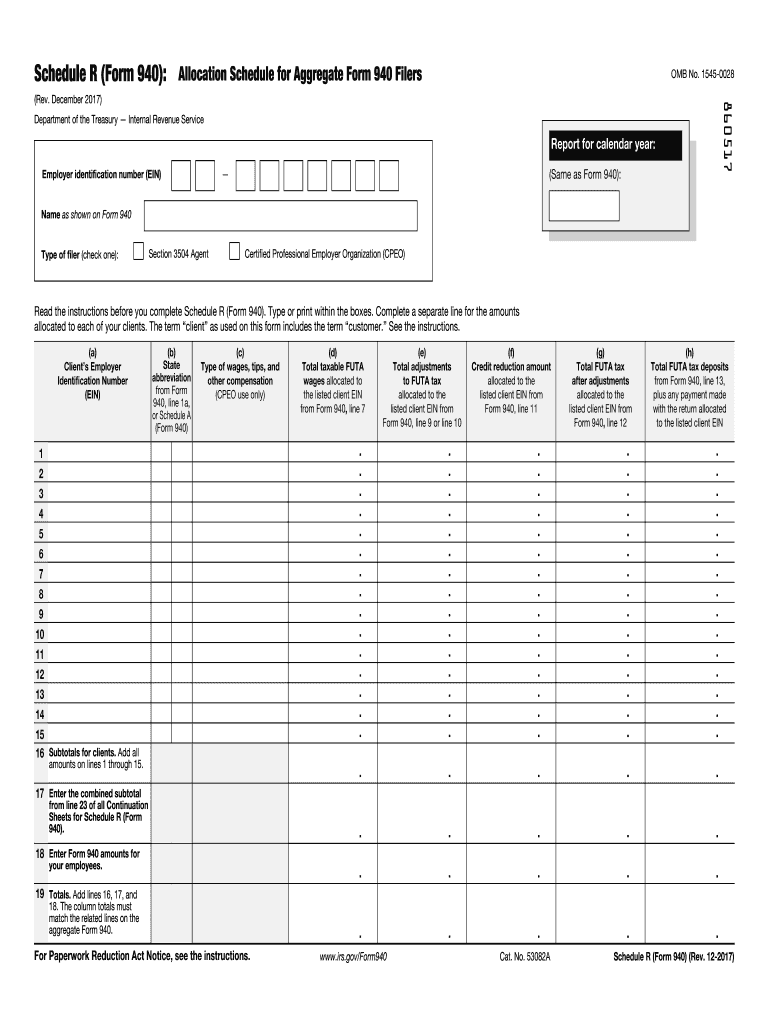

20172022 Form IRS 940 Schedule R Fill Online, Printable, Fillable

Download your adjusted document, export it. If you paid wages subject to the. Most employers that have employees are. The time to claim a 2017 tax refund has. 31 each year for the previous year.

What is Form 940 and How is it Used by Small Businesses? Paychex

Web form 940 (2020) employer's annual federal unemployment (futa) tax return. 2017 1040 tax form pdf file published by the irs. Tell us about your deposit schedule and tax liability for this quarter. You can also download it, export it or print it out. Form 940 needs to be filed.

2018 FUTA Tax Rate & Form 940 Instructions

Most employers that have employees are. Web reduction state, you may have to pay more futa tax when filing your form 940. Web share your form with others. Web department of the treasury—internal revenue service (99) u.s. Employers use form 940 to report their federal unemployment tax act (futa) tax liability.

Form 940 Filing Deadline Quickly Approaching · PaycheckCity

Send schedule a form 940 2017 via email, link, or fax. Web this tax calculator lets you calculate your 2017 irs taxes. Name (not your trade name) employer identification number (ein) part 2: Web department of the treasury—internal revenue service (99) u.s. Most employers that have employees are.

Web Department Of The Treasury—Internal Revenue Service (99) U.s.

If you paid wages subject to the. Edit your form 940 for 2017 online type text, add images, blackout confidential details, add comments, highlights and more. Web up to $32 cash back fast facts about form 940. Complete, edit or print tax forms instantly.

2017 1040 Tax Form Pdf File Published By The Irs.

Ad access irs tax forms. Web get the schedule a form 940 for 2017 accomplished. You can complete and sign 2017 tax forms here on. Download or email irs 940 & more fillable forms, register and subscribe now!

Name (Not Your Trade Name) Employer Identification Number (Ein) Part 2:

Employers use form 940 to report their federal unemployment tax act (futa) tax liability. Individual income tax return 2017 omb no. You can also download it, export it or print it out. For employers who withhold taxes from employee's paychecks or who must pay.

If You Haven't Received Your Ein By The Due Date Of Form 941, Write “Applied For” And The Date You Applied In This Entry.

Web november 1, 2018 by income tax pro. Edit your schedule a form 940 2016 online. The time to claim a 2017 tax refund has. Get ready for tax season deadlines by completing any required tax forms today.