940 Form 2021 Printable

940 Form 2021 Printable - Web this guide will discuss these taxes in detail, form 940 instructions, timing, and other important resources. Web we last updated the employer's annual federal unemployment (futa) tax return in december 2022, so this is the latest version of form 940, fully updated for tax year 2022. Get the current filing year’s forms, instructions, and publications for free from the irs. Must be removed before printing. Businesses must file form 940 in 2021 if the wages paid to employees is more than $1,500 in a quarter. Learn how to fill out form 940 the right way to avoid penalties and fines. Web use printable form 940 in 2023 to report your annual federal unemployment tax act (futa) tax. Most states will release updated tax forms between january and april. Futa is different from fica as employees don’t. Web get federal tax forms.

So, how to fill out a 940 tax form also differs. Complete schedule a (form 940). Individual income tax return (irs) form. The streamlined template is filed by employers who use the annual wage base to calculate the tax, have had no significant changes in employment, and have no current or prior year futa tax liability. Individual income tax return (irs) on average this form takes 28 minutes to complete. All forms are printable and downloadable. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. The 2021 form 940 was not substantially changed from the 2020 version. Determine your futa tax before adjustments. The 2021 form 940, employer’s annual federal unemployment (futa) tax return, was released dec.

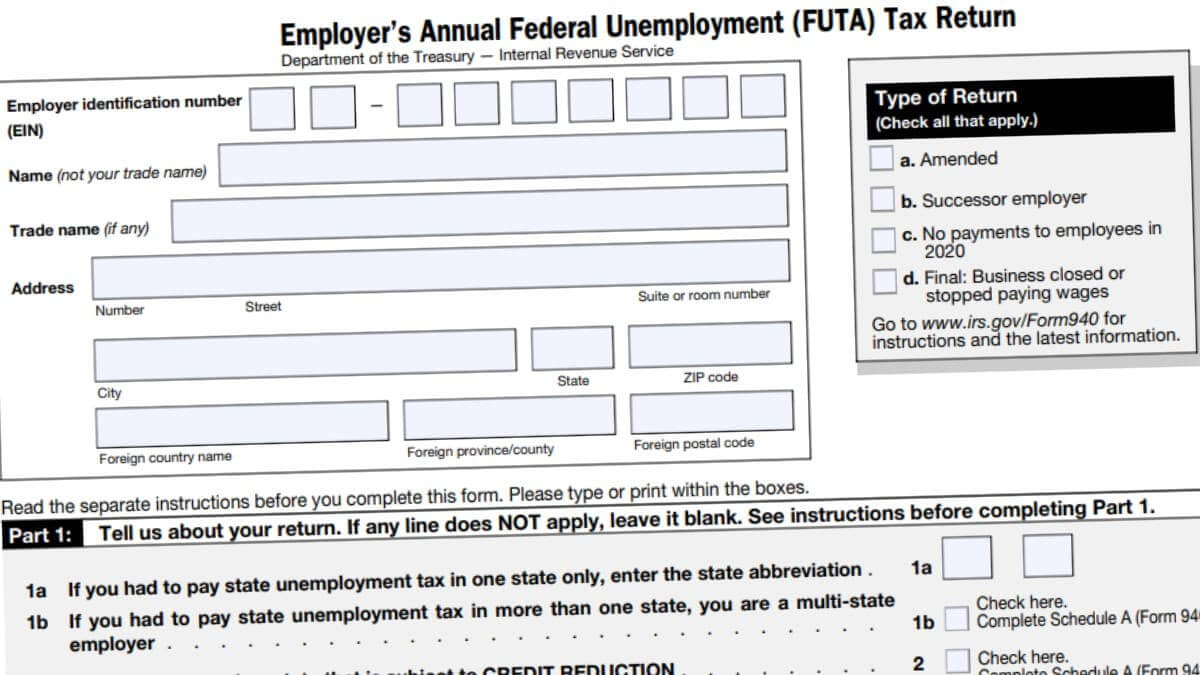

Check out our guide on fica, futa, and suta taxes what is form 940? Get the current filing year’s forms, instructions, and publications for free from the irs. Total payments to all employees. If you paid wages in a state that is subject to credit reduction. Most employers pay both a federal and a state unemployment tax. Web use printable form 940 in 2023 to report your annual federal unemployment tax act (futa) tax. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. Web use form 940 to report your annual federal unemployment tax act (futa) tax. For instructions and the latest information. Most states will release updated tax forms between january and april.

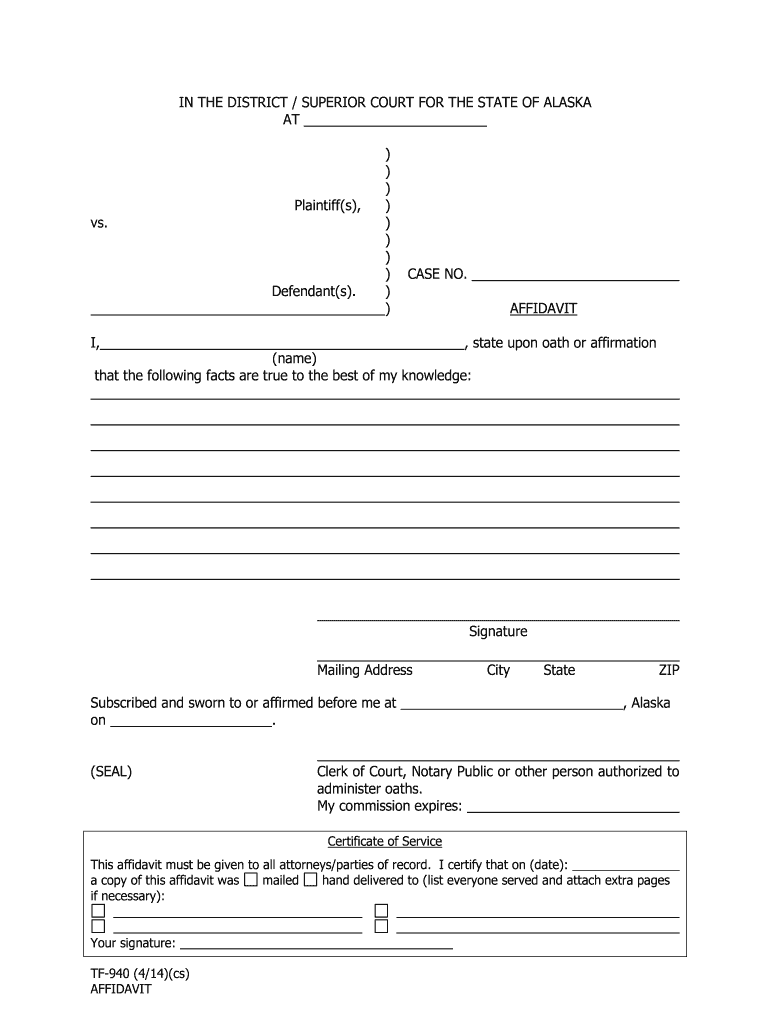

Tf 940 Fill Out and Sign Printable PDF Template signNow

The futa tax return differs from other employment tax forms in a few ways. Learn how to fill out form 940 the right way to avoid penalties and fines. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. For most taxpayers, your 2022 federal tax forms must be postmarked by april 18, 2023. The deadline for filing.

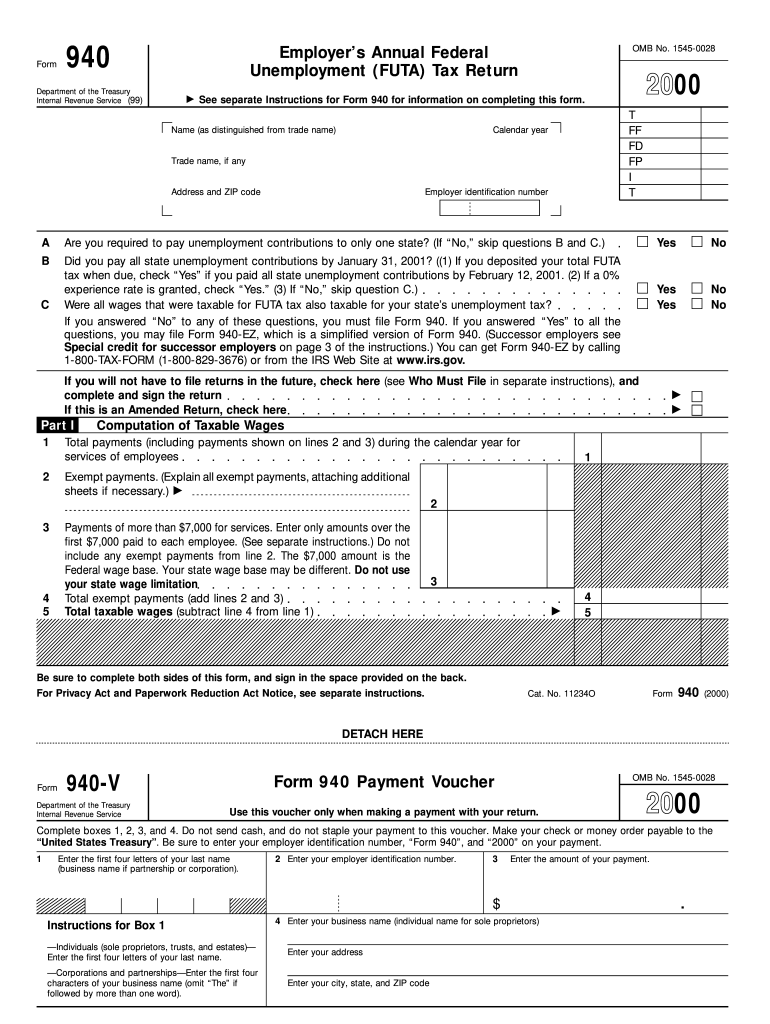

940 Form Fill Out and Sign Printable PDF Template signNow

Form 940 is a tax return used to report a small business owner ’s futa tax liability throughout the calendar year. Complete schedule a (form 940). Web use printable form 940 in 2023 to report your annual federal unemployment tax act (futa) tax. Futa is different from fica as employees don’t. File and submit form 940 to the irs by.

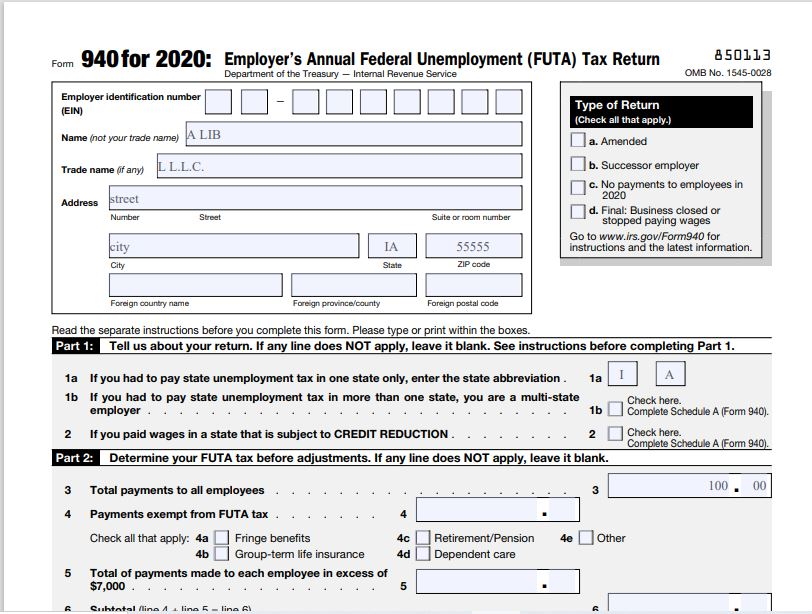

How to Complete 2020 Form 940 FUTA Tax Return Nina's Soap

Most employers pay both a federal and a state unemployment tax. Futa is different from fica as employees don’t. The futa tax return differs from other employment tax forms in a few ways. Web printable federal tax forms can be found throughout this section of our website along with instructions, supporting schedules, and federal tax tables. Complete schedule a (form.

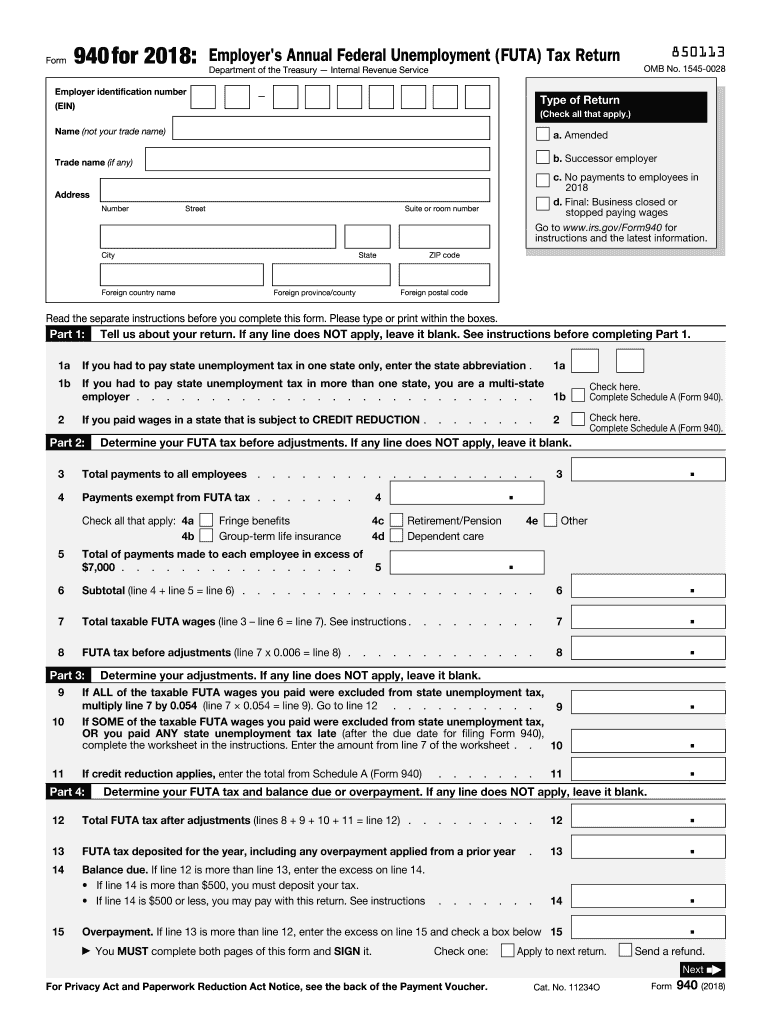

Form 940 For 2018 Fill Out and Sign Printable PDF Template signNow

All forms are printable and downloadable. Web get your form 940 (2021) in 3 easy steps. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. Type or print within the boxes. Individual income tax return (irs) on average this form takes 28 minutes to complete.

2022 Form 940 Schedule A

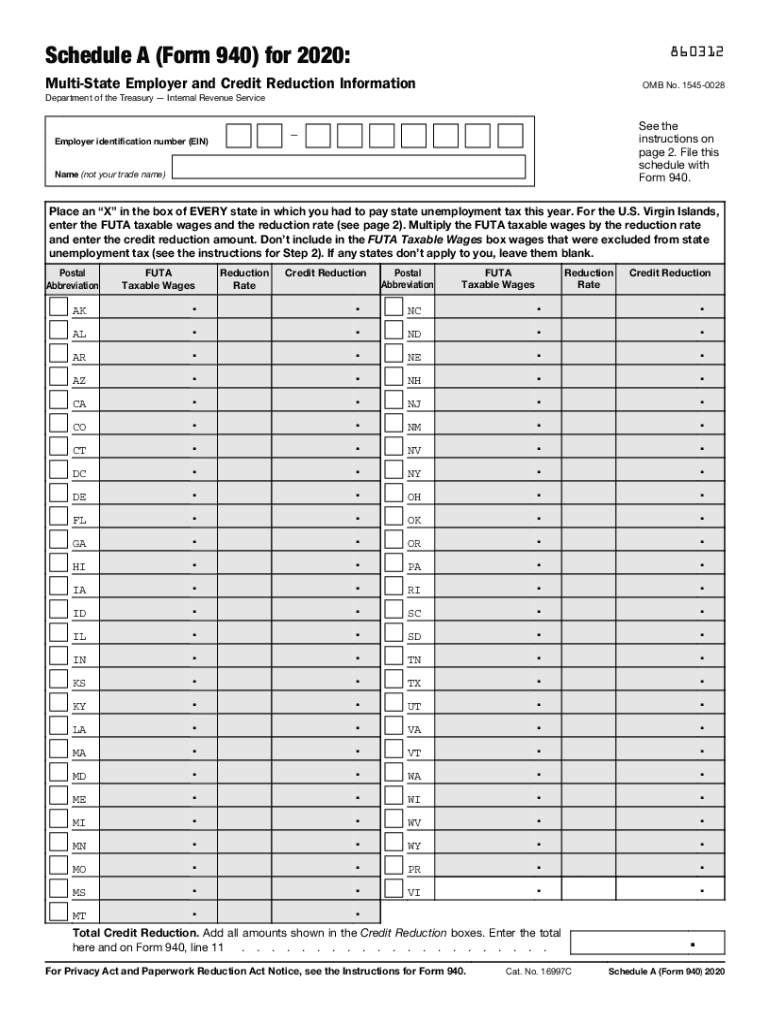

Web printable federal tax forms can be found throughout this section of our website along with instructions, supporting schedules, and federal tax tables. Individual income tax return (irs) form. Web employment tax forms: Web schedule a (form 940) for 2021: So, how to fill out a 940 tax form also differs.

2020 Form IRS 940 Schedule A Fill Online, Printable, Fillable, Blank

Web report for this quarter of 2021 (check one.) 1: The 2021 form 940, employer’s annual federal unemployment (futa) tax return, was released dec. Web use fill to complete blank online irs pdf forms for free. Web it’s about time to complete form 940, employer’s annual federal unemployment (futa) tax return. Futa is different from fica as employees don’t.

IRS Instructions 940 2018 2019 Fillable and Editable PDF Template

For instructions and the latest information. Complete schedule a (form 940). So, how to fill out a 940 tax form also differs. Web use form 940 to report your annual federal unemployment tax act (futa) tax. File and submit form 940 to the irs by january 31, 2021.

940 Form 2021

Web report for this quarter of 2021 (check one.) 1: Determine your futa tax before adjustments. The streamlined template is filed by employers who use the annual wage base to calculate the tax, have had no significant changes in employment, and have no current or prior year futa tax liability. So, how to fill out a 940 tax form also.

Payroll Tax Forms and Reports in ezPaycheck Software

Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Form 940 is a tax return used to report a small business owner ’s futa tax liability throughout the calendar year. All forms are printable and downloadable. If any line does not apply, leave it blank. Form 940, employer's annual federal unemployment tax return.

USA 940 Form Template Templates, Pdf templates, How to apply

2022 instructions for form 940 employer's annual federal unemployment (futa) tax return 03 export or print immediately. Most employers pay both a federal and a state unemployment tax. The futa tax return differs from other employment tax forms in a few ways. Complete schedule a (form 940).

If You Paid Wages In A State That Is Subject To Credit Reduction.

For instructions and the latest information. Futa is different from fica as employees don’t. Form 941, employer's quarterly federal tax return. Web this guide will discuss these taxes in detail, form 940 instructions, timing, and other important resources.

Web We Last Updated The Employer's Annual Federal Unemployment (Futa) Tax Return In December 2022, So This Is The Latest Version Of Form 940, Fully Updated For Tax Year 2022.

The futa tax return differs from other employment tax forms in a few ways. 03 export or print immediately. Form 940 is a tax return used to report a small business owner ’s futa tax liability throughout the calendar year. Get the current filing year’s forms, instructions, and publications for free from the irs.

Web Complete Schedule A (Form 940).

Web employment tax forms: You can print other federal tax forms here. All forms are printable and downloadable. Web report for this quarter of 2021 (check one.) 1:

Total Payments To All Employees.

Must be removed before printing. Learn how to fill out form 940 the right way to avoid penalties and fines. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Web download since you’ll be filing this tax form for the 2020 tax year in 2021, the “941 form for 2020” refers to the 2021 tax season.