940 Form For 2023

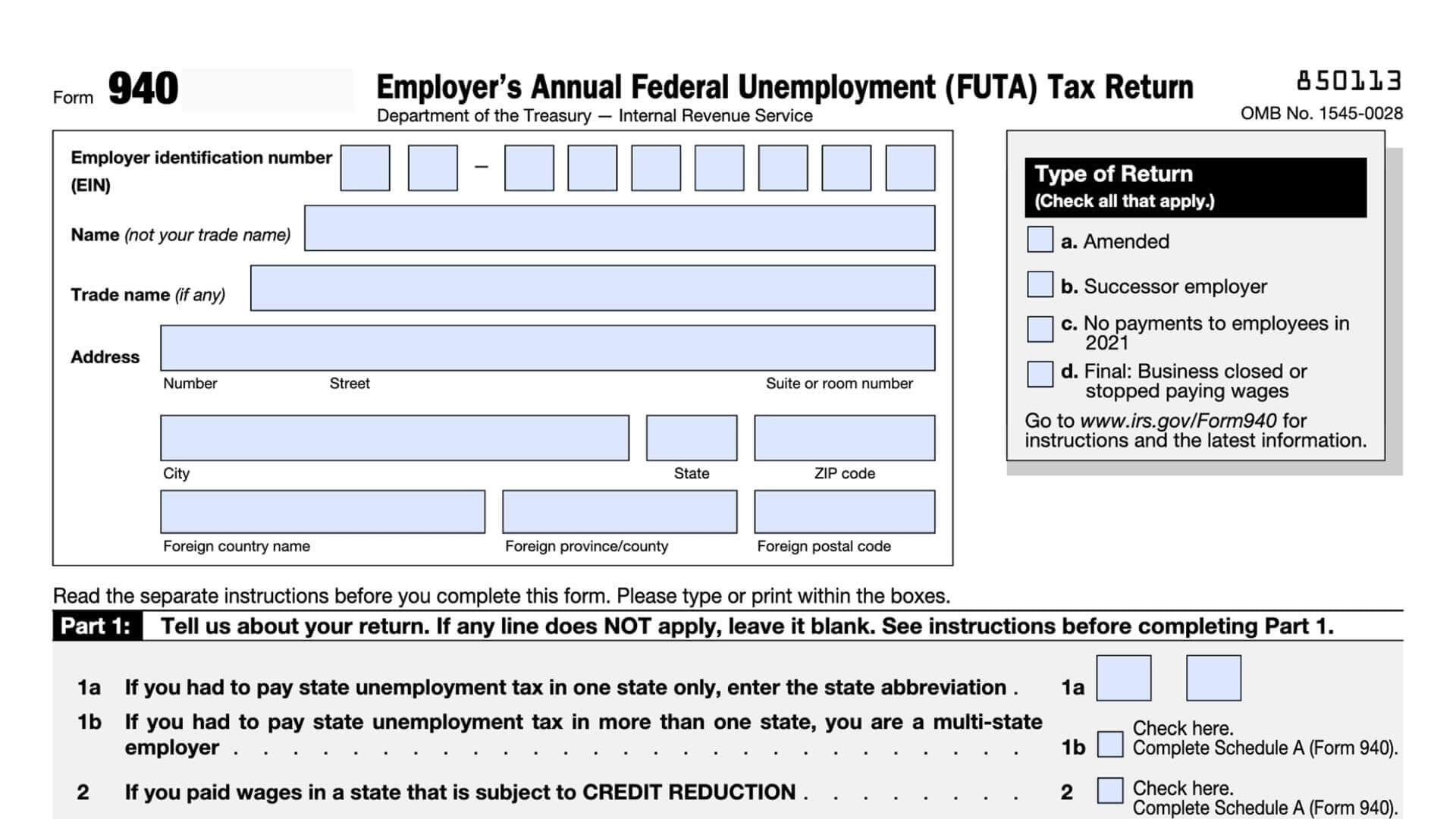

940 Form For 2023 - The due date for filing form 940 for 2021 is january 31,. Exempt under 501c (3) of irc. Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically. Simple instructions and pdf download updated: Web federal forms, internal revenue service (irs): Web unlike your futa payments, which are due every calendar quarter, you must submit form 940 annually. Web form 940 has you enter information about the state unemployment taxes paid to show that you qualify for the 5.4% tax credit. Web 940 form 2023 1 numbers and dates you need to know before filling out 940 form as of 2022, the tax rate is set at 6% for the first $7,000. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. Web up to $32 cash back irs form 940 for 2023:

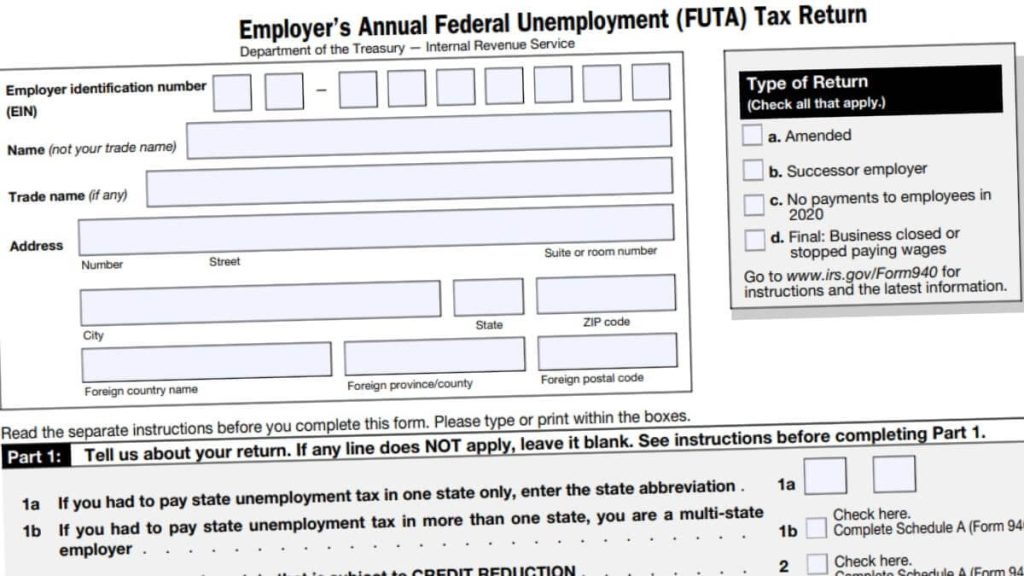

Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. The due date for filing form 940 for 2021 is january 31,. Employer’s quarterly federal tax return (form 941), employer’s annual federal unemployment tax return (form 940), wage. Web file payroll tax forms for 2023 & 2022. Don’t forget about futa taxes Web in a major step in the new digital intake scanning initiative, the irs has already scanned more than 120,000 paper forms 940 since the start of 2023, this is a. Web form 940 has you enter information about the state unemployment taxes paid to show that you qualify for the 5.4% tax credit. For more information about a cpeo’s. Web up to $32 cash back irs form 940 for 2023: Web street suite or room number city state zip code foreign country name foreign province/county foreign postal code type of return (check all that apply.) amended.

Form 940, employer's annual federal unemployment tax return. Web june 8, 2023 · 5 minute read the revised drafts of form 940 (employer’s annual federal unemployment (futa) tax return) and form 940 schedule a (multi. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. Don’t forget about futa taxes Web unlike your futa payments, which are due every calendar quarter, you must submit form 940 annually. Web federal forms, internal revenue service (irs): Web form 940 not required. Web file payroll tax forms for 2023 & 2022. The due date for filing form 940 for 2021 is january 31,. Web in a major step in the new digital intake scanning initiative, the irs has already scanned more than 120,000 paper forms 940 since the start of 2023, this is a.

940 Form 2023 Fillable Form 2023

Web in a major step in the new digital intake scanning initiative, the irs has already scanned more than 120,000 paper forms 940 since the start of 2023, this is a. Employer’s quarterly federal tax return (form 941), employer’s annual federal unemployment tax return (form 940), wage. Web making payments with form 940 to avoid a penalty, make your payment.

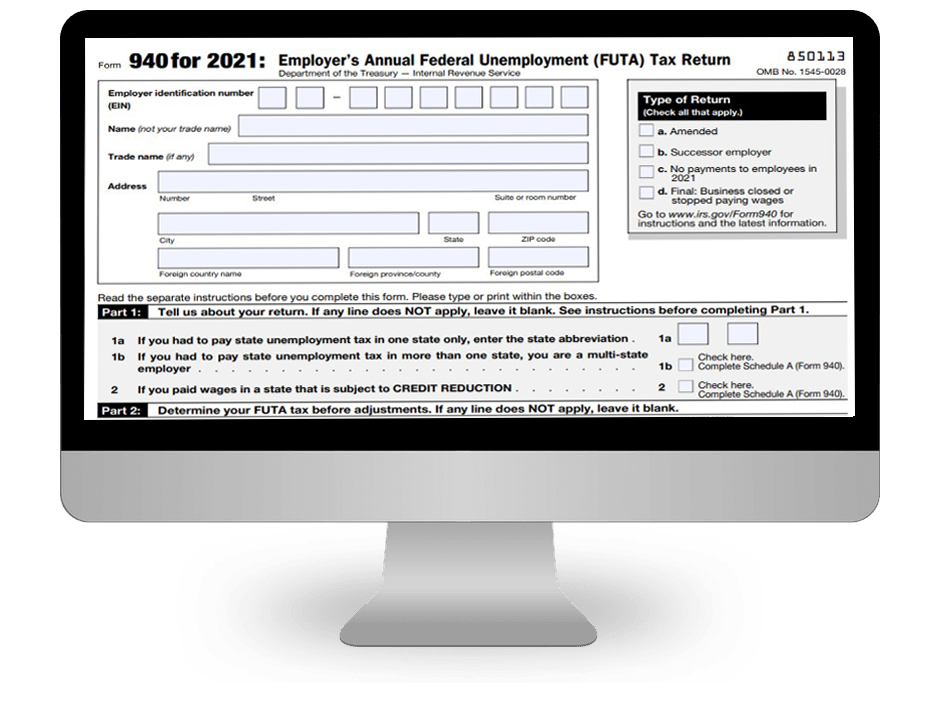

EFile Form 940 for 2021 tax year File Form 940 Online

Web unlike your futa payments, which are due every calendar quarter, you must submit form 940 annually. Web 940 form 2023 1 numbers and dates you need to know before filling out 940 form as of 2022, the tax rate is set at 6% for the first $7,000. Web schedule a (form 940) for 2022: Web up to $32 cash.

940 Form 2023

Web file payroll tax forms for 2023 & 2022. Web form 940 not required. The due date for filing form 940 for 2021 is january 31,. Web schedule a (form 940) for 2022: Simple instructions and pdf download updated:

940 Form 2021 IRS Forms

Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. Web the 2024 toyota camry sedan rolls into the new year unchanged and with a modest $100 price increase for gas models and a $200 increase for hybrid models..

940 Form 2023

Exempt under 501c (3) of irc. Web form 940 has you enter information about the state unemployment taxes paid to show that you qualify for the 5.4% tax credit. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts..

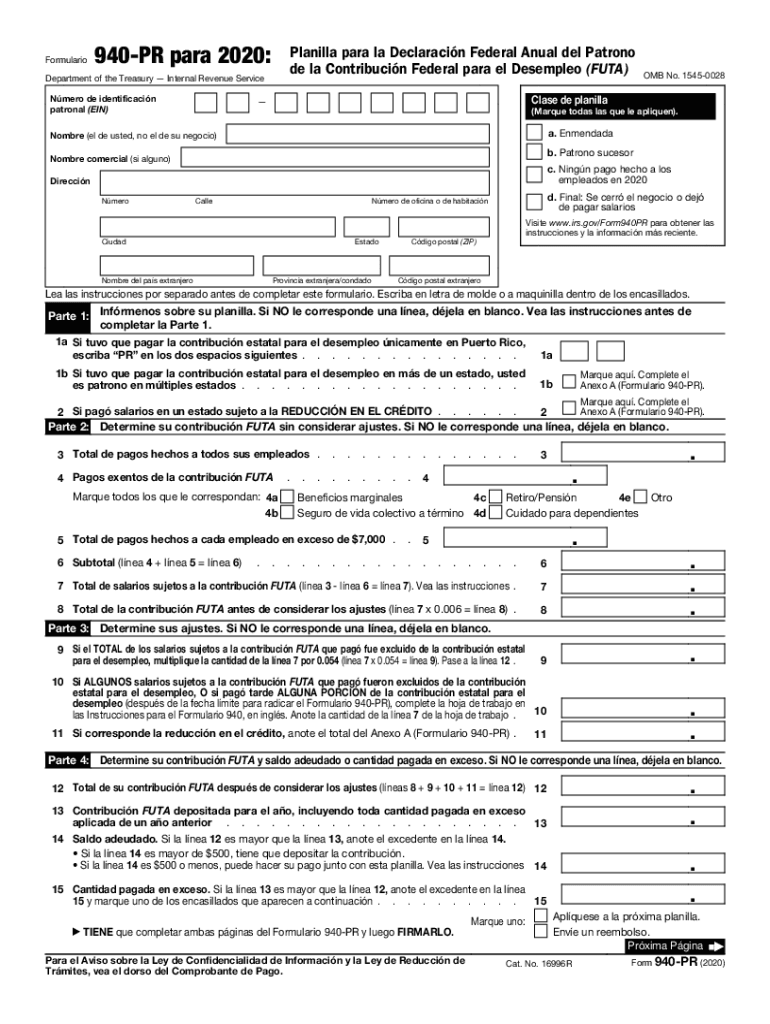

Form 940 PR Employer's Annual Federal Unemployment FUTA Tax Return

Web employment tax forms: Web form 940 not required. Web the 2024 toyota camry sedan rolls into the new year unchanged and with a modest $100 price increase for gas models and a $200 increase for hybrid models. Form 940, employer's annual federal unemployment tax return. Web street suite or room number city state zip code foreign country name foreign.

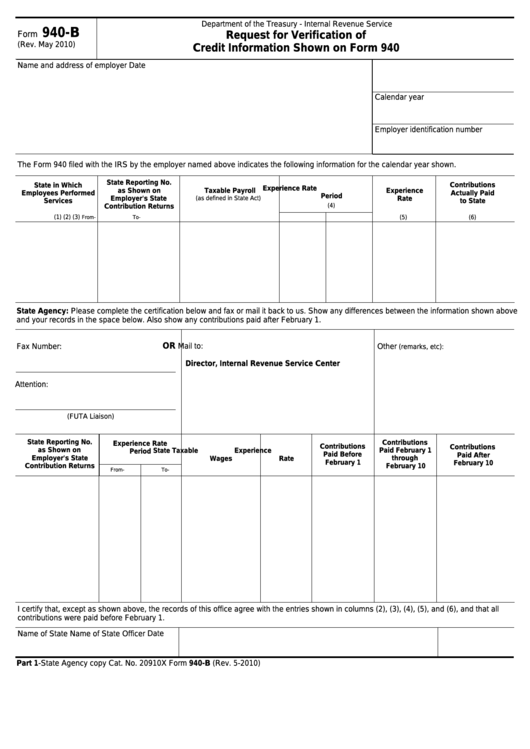

Fillable Form 940B Request For Verification Of Credit Information

Web street suite or room number city state zip code foreign country name foreign province/county foreign postal code type of return (check all that apply.) amended. Form 940, employer's annual federal unemployment tax return. Web 940 form 2023 1 numbers and dates you need to know before filling out 940 form as of 2022, the tax rate is set at.

USA 940 Form Template ALL PSD TEMPLATES

The due date for filing form 940 for 2021 is january 31,. Employer’s quarterly federal tax return (form 941), employer’s annual federal unemployment tax return (form 940), wage. Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically. Web schedule a (form 940) for 2022: Web making payments with form.

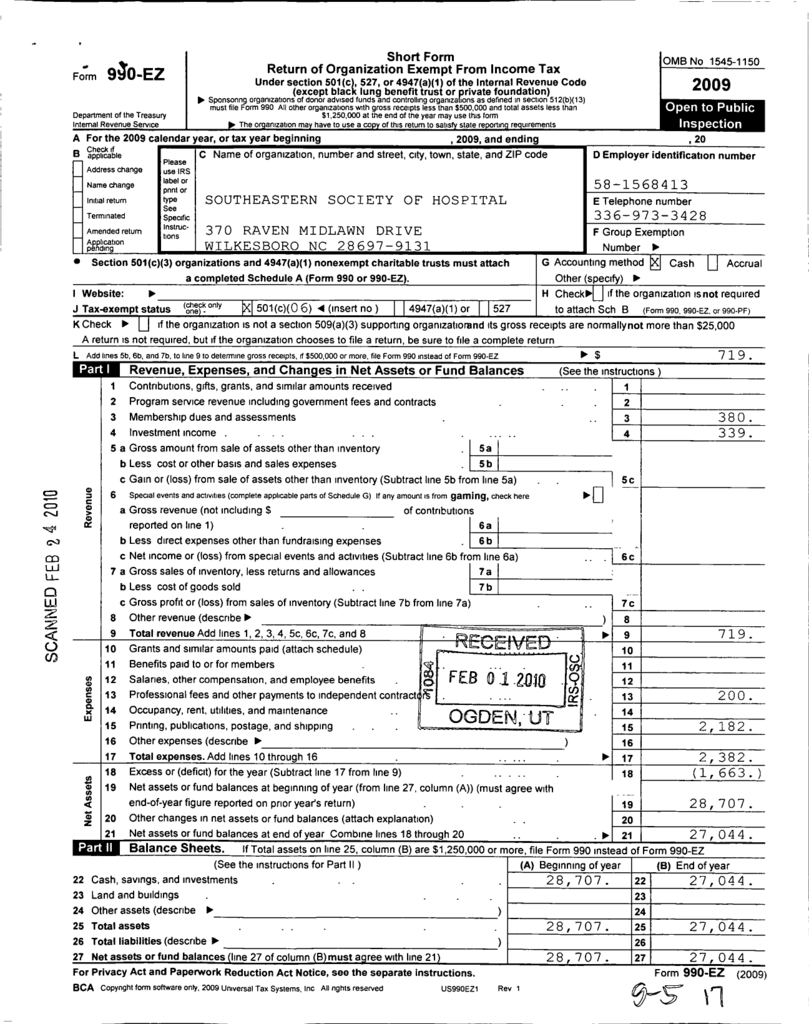

Form 940EZ 2009 Foundation Center

Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. Web employment tax forms: March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Web making payments with form.

Form 940 pr 2023 Fill online, Printable, Fillable Blank

Don’t forget about futa taxes If employers pay their taxes on time,. Simple instructions and pdf download updated: Employer’s quarterly federal tax return (form 941), employer’s annual federal unemployment tax return (form 940), wage. Web federal forms, internal revenue service (irs):

Web June 8, 2023 · 5 Minute Read The Revised Drafts Of Form 940 (Employer’s Annual Federal Unemployment (Futa) Tax Return) And Form 940 Schedule A (Multi.

Web 940 form 2023 1 numbers and dates you need to know before filling out 940 form as of 2022, the tax rate is set at 6% for the first $7,000. If employers pay their taxes on time,. Web file payroll tax forms for 2023 & 2022. Exempt under 501c (3) of irc.

Web In A Major Step In The New Digital Intake Scanning Initiative, The Irs Has Already Scanned More Than 120,000 Paper Forms 940 Since The Start Of 2023, This Is A.

Web the 2024 toyota camry sedan rolls into the new year unchanged and with a modest $100 price increase for gas models and a $200 increase for hybrid models. The due date for filing form 940 for 2021 is january 31,. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Web employment tax forms:

Web Cpeos Must Generally File Form 940 And Schedule R (Form 940), Allocation Schedule For Aggregate Form 940 Filers, Electronically.

Web form 940 has you enter information about the state unemployment taxes paid to show that you qualify for the 5.4% tax credit. Web unlike your futa payments, which are due every calendar quarter, you must submit form 940 annually. Web federal forms, internal revenue service (irs): For more information about a cpeo’s.

Web Form 940 Not Required.

Web up to $32 cash back irs form 940 for 2023: Employer’s quarterly federal tax return (form 941), employer’s annual federal unemployment tax return (form 940), wage. Form 940, employer's annual federal unemployment tax return. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts.