945 Tax Form

945 Tax Form - Form 945 is a summary form, showing all the different nonpayroll payments you've made. For more information on income tax withholding, see pub. Web irs form 945 is used to report federal income tax withheld from nonpayroll payments. Web watch this instructional video to learn more about filing your nonpayroll tax withholdings with irs form 945. Web these instructions give you some background information about form 945. Use form 945 to report federal income tax withheld (or required to be withheld) from nonpayroll payments. Use this form to report your federal tax liability (based on the dates payments were made or wages were paid) for the following tax returns. Web form 945 is the annual record of federal tax liability. December 2020) annual record of federal tax liability department of the treasury internal revenue service go to www.irs.gov/form945a for instructions and the latest information. Web use this form to report withheld federal income tax from nonpayroll payments.

What is irs form 945? For instructions and the latest information. Department of the treasury internal revenue service. Web these instructions give you some background information about form 945. Web watch this instructional video to learn more about filing your nonpayroll tax withholdings with irs form 945. Here's why your business might need to complete form 945 and how to fill it out. Form 945 is a summary form, showing all the different nonpayroll payments you've made. December 2020) annual record of federal tax liability department of the treasury internal revenue service go to www.irs.gov/form945a for instructions and the latest information. For more information on income tax withholding, see pub. They tell you who must file form 945, how to complete it line by line, and when and where to file it.

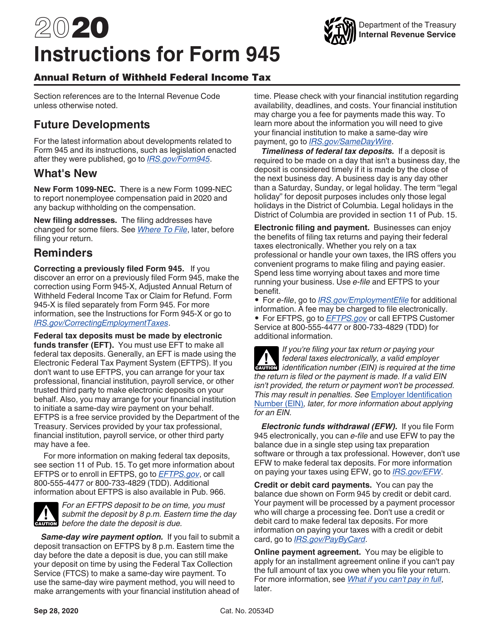

Web form 945 is the annual record of federal tax liability. Use form 945 to report federal income tax withheld (or required to be withheld) from nonpayroll payments. Here's why your business might need to complete form 945 and how to fill it out. Annual return of withheld federal income tax. For instructions and the latest information. Web irs form 945 is used to report federal income tax withheld from nonpayroll payments. This form should be completed by semiweekly schedule depositors. For more information on income tax withholding, see pub. They tell you who must file form 945, how to complete it line by line, and when and where to file it. Use this form to report your federal tax liability (based on the dates payments were made or wages were paid) for the following tax returns.

Form 945 Reporting Withholding for Defined Benefit Plans Saber Pension

What is irs form 945? For more information on income tax withholding, see pub. Use this form to report your federal tax liability (based on the dates payments were made or wages were paid) for the following tax returns. For instructions and the latest information. Web watch this instructional video to learn more about filing your nonpayroll tax withholdings with.

Form 945 Annual Return of Withheld Federal Tax Form (2015

Annual return of withheld federal income tax. Web use this form to report withheld federal income tax from nonpayroll payments. Department of the treasury internal revenue service. Web watch this instructional video to learn more about filing your nonpayroll tax withholdings with irs form 945. This form must also be completed by any business that accumulates $100,000 of tax liability.

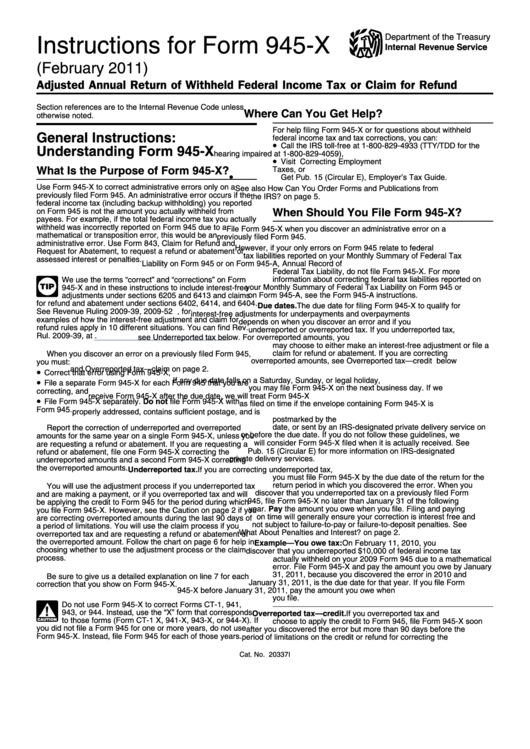

Form 945X Instructions For Adjusted Annual Return Of Withheld

This form must also be completed by any business that accumulates $100,000 of tax liability during any month of the tax year. Web these instructions give you some background information about form 945. Department of the treasury internal revenue service. For instructions and the latest information. Web use this form to report withheld federal income tax from nonpayroll payments.

File Form 945 Online Efile 945 Form 945 2020 945 Schedule A

Form 945 is a summary form, showing all the different nonpayroll payments you've made. What is irs form 945? Here's why your business might need to complete form 945 and how to fill it out. Use this form to report your federal tax liability (based on the dates payments were made or wages were paid) for the following tax returns..

Form 945X Adjusted Annual Return of Withheld Federal Tax or

December 2020) annual record of federal tax liability department of the treasury internal revenue service go to www.irs.gov/form945a for instructions and the latest information. For instructions and the latest information. This form should be completed by semiweekly schedule depositors. Web use this form to report withheld federal income tax from nonpayroll payments. Web these instructions give you some background information.

How to Fill Out IRS Form 945 for Solo 401k Distributions My Solo 401k

For instructions and the latest information. Web watch this instructional video to learn more about filing your nonpayroll tax withholdings with irs form 945. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for qualified pensions, gambling profits, and military retirement and pay..

File Form 945 Online Efile 945 Form 945 2020 945 Schedule A

This form must also be completed by any business that accumulates $100,000 of tax liability during any month of the tax year. Web form 945 is the annual record of federal tax liability. Web watch this instructional video to learn more about filing your nonpayroll tax withholdings with irs form 945. For more information on income tax withholding, see pub..

2019 Form IRS 945 Fill Online, Printable, Fillable, Blank pdfFiller

Use form 945 to report federal income tax withheld (or required to be withheld) from nonpayroll payments. This form must also be completed by any business that accumulates $100,000 of tax liability during any month of the tax year. What is irs form 945? Web form 945 is used to report backup withholding tax for an independent contractor. For more.

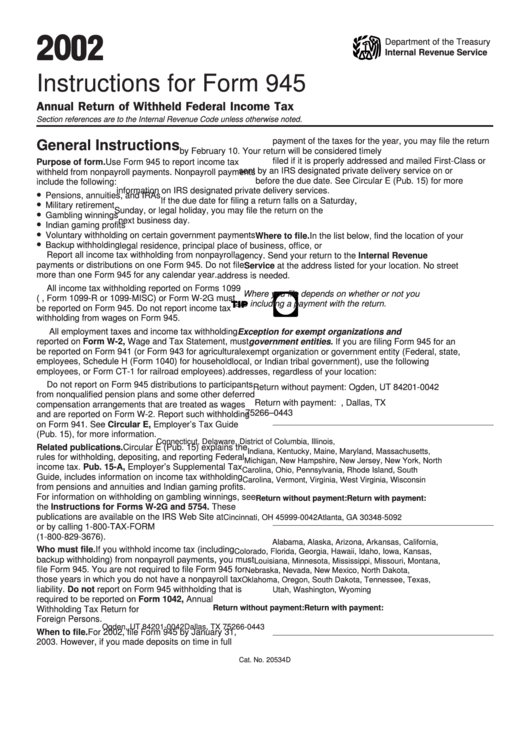

Instructions For Form 945 Annual Return Of Withheld Federal

This form must also be completed by any business that accumulates $100,000 of tax liability during any month of the tax year. Web form 945 is the annual record of federal tax liability. This form should be completed by semiweekly schedule depositors. Web irs form 945 is used to report federal income tax withheld from nonpayroll payments. Web these instructions.

Download Instructions for IRS Form 945 Annual Return of Withheld

Web these instructions give you some background information about form 945. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for qualified pensions, gambling profits, and military retirement and pay. Web watch this instructional video to learn more about filing your nonpayroll tax.

Web Irs Form 945 Is Used To Report Federal Income Tax Withheld From Nonpayroll Payments.

This form must also be completed by any business that accumulates $100,000 of tax liability during any month of the tax year. For instructions and the latest information. Web form 945 is used to report backup withholding tax for an independent contractor. Web these instructions give you some background information about form 945.

Web Form 945 Is The Annual Record Of Federal Tax Liability.

For more information on income tax withholding, see pub. Here's why your business might need to complete form 945 and how to fill it out. Annual return of withheld federal income tax. Form 945 is a summary form, showing all the different nonpayroll payments you've made.

Use This Form To Report Your Federal Tax Liability (Based On The Dates Payments Were Made Or Wages Were Paid) For The Following Tax Returns.

Web watch this instructional video to learn more about filing your nonpayroll tax withholdings with irs form 945. Use form 945 to report federal income tax withheld (or required to be withheld) from nonpayroll payments. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for qualified pensions, gambling profits, and military retirement and pay. Department of the treasury internal revenue service.

December 2020) Annual Record Of Federal Tax Liability Department Of The Treasury Internal Revenue Service Go To Www.irs.gov/Form945A For Instructions And The Latest Information.

This form should be completed by semiweekly schedule depositors. Web use this form to report withheld federal income tax from nonpayroll payments. They tell you who must file form 945, how to complete it line by line, and when and where to file it. What is irs form 945?