A1-R Form

A1-R Form - An employer may make its arizona withholding payments on an annual basis if all of the following. Do not submit any liability owed or try to claim refunds with. Skills card active reading habits 1. Do not submit any liability owed or try to claim refunds with this return. 714 et seq.), and the food,. The pigs _____ eating from the trough. Tom and i _____ friends. Arizona quarterly withholding tax return:. Web the authority for requesting the information identified on this form is 7 cfr part 1436, the commodity credit corporation charter act (15 u.s.c. The gross compensation paid to employees who work or perform services in kansas city, missouri should be reported.

Web about this tutor ›. Web complete each sentence with am, is or are. Skills card active reading habits 1. Web copyrigh mer ompany® 1r: The pigs _____ eating from the trough. An employer may make its arizona withholding payments on an annual basis if all of the following. Web certificate of professional license/registration (corp. Do not submit any liability owed or try. Do not submit any liability owed or try to claim refunds with this return. Tom and i _____ friends.

Web 13 rows withholding transmittal of wage and tax statements. Registration with the arizona department of revenue for payroll service companies is required prior to filing. The gross compensation paid to employees who work or perform services in kansas city, missouri should be reported. 714 et seq.), and the food,. To submit additional liability or claim a refund, file amended. An employer may make its arizona withholding payments on an annual basis if all of the following. A = first term, r= common ratio, n = number of terms, s n = sum of. Skills card active reading habits 1. Web complete each sentence with am, is or are. The barn _____ behind the house.

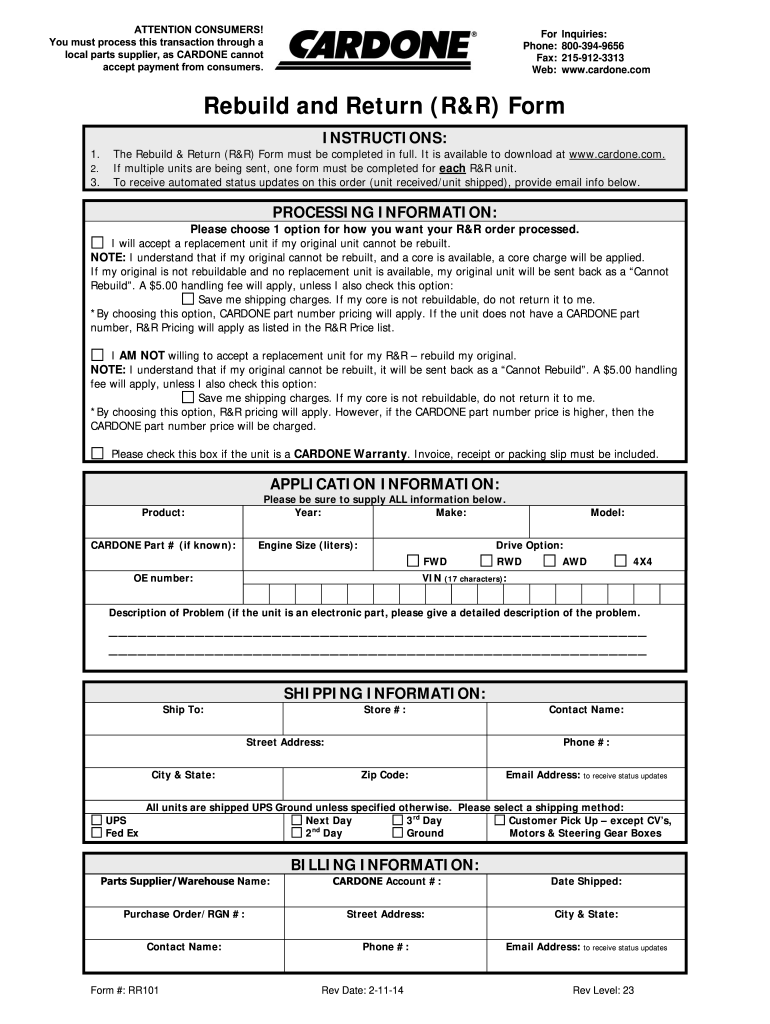

Cardone R R Form Fill Out and Sign Printable PDF Template signNow

Web complete each sentence with am, is or are. Arizona quarterly withholding tax return:. To submit additional liability or claim a refund, file amended. Web copyrigh mer ompany® 1r: Web about this tutor ›.

(PDF) FORM A1 APPLICATION FOR REGISTRATION AS A GRADUATE ENGINEER

Web complete each sentence with am, is or are. A = first term, r= common ratio, n = number of terms, s n = sum of. Web copyrigh mer ompany® 1r: The barn _____ behind the house. Web 13 rows withholding transmittal of wage and tax statements.

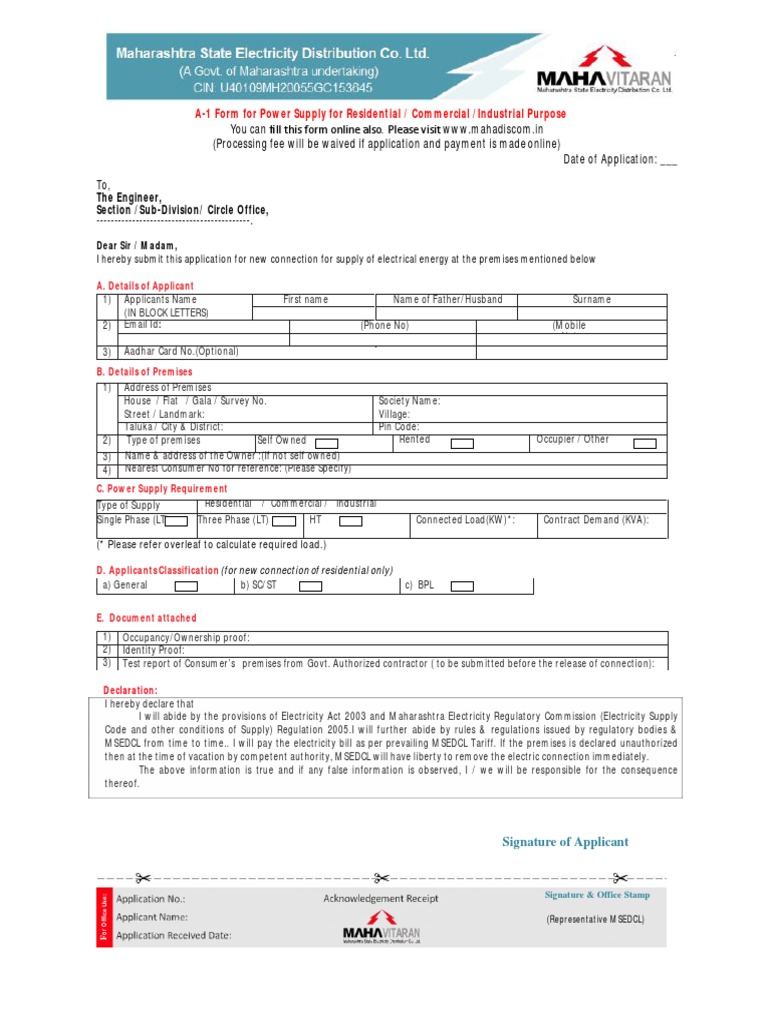

form a1 Scribd india

Web certificate of professional license/registration (corp. The gross compensation paid to employees who work or perform services in kansas city, missouri should be reported. 714 et seq.), and the food,. Web copyrigh mer ompany® 1r: Do not submit any liability owed or try to claim refunds with.

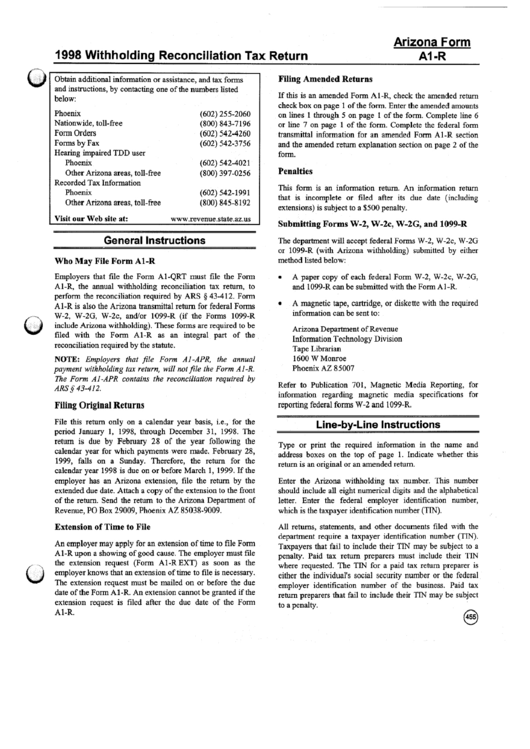

Form A1R 1998 Withholding Reconciliation Tax Return Instructions

Tom and i _____ friends. Web copyrigh mer ompany® 1r: The gross compensation paid to employees who work or perform services in kansas city, missouri should be reported. Registration with the arizona department of revenue for payroll service companies is required prior to filing. Skills card active reading habits 1.

FORM A1 Invoice Business Law

Do not submit any liability owed or try to claim refunds with. 714 et seq.), and the food,. A = first term, r= common ratio, n = number of terms, s n = sum of. Web certificate of professional license/registration (corp. I _____ afraid of spiders.

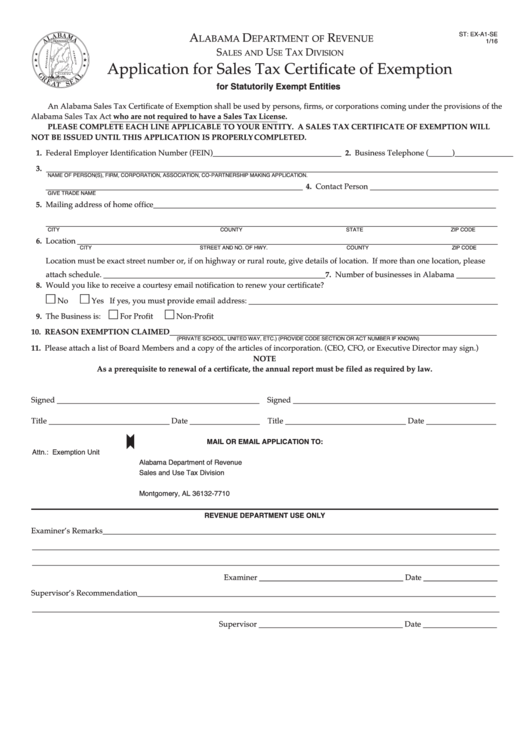

Fillable St ExA1Se Form Application For Sales Tax Certificate Of

714 et seq.), and the food,. I _____ afraid of spiders. Arizona quarterly withholding tax return:. Web 13 rows withholding transmittal of wage and tax statements. Web certificate of professional license/registration (corp.

form a1 Scribd india

Do not submit any liability owed or try to claim refunds with this return. Do not submit any liability owed or try. A = first term, r= common ratio, n = number of terms, s n = sum of. I _____ afraid of spiders. To submit additional liability or claim a refund, file amended.

Form A1r Arizona Withholding Reconciliation Tax Return 149

The gross compensation paid to employees who work or perform services in kansas city, missouri should be reported. Registration with the arizona department of revenue for payroll service companies is required prior to filing. Web complete each sentence with am, is or are. The barn _____ behind the house. Web the authority for requesting the information identified on this form.

FormA1 Register Ofbirth

Registration with the arizona department of revenue for payroll service companies is required prior to filing. Web missouri and kansas city require a valid federal attachment in the electronic file. Tom and i _____ friends. A = first term, r= common ratio, n = number of terms, s n = sum of. Web the authority for requesting the information identified.

1.a1 Form Rci 21112017 PDF Identity Document Business

Web copyrigh mer ompany® 1r: The pigs _____ eating from the trough. Web missouri and kansas city require a valid federal attachment in the electronic file. Do not submit any liability owed or try. Do not submit any liability owed or try to claim refunds with this return.

The Gross Compensation Paid To Employees Who Work Or Perform Services In Kansas City, Missouri Should Be Reported.

A = first term, r= common ratio, n = number of terms, s n = sum of. Web certificate of professional license/registration (corp. Registration with the arizona department of revenue for payroll service companies is required prior to filing. The barn _____ behind the house.

Web About This Tutor ›.

Skills card active reading habits 1. Do not submit any liability owed or try to claim refunds with. The pigs _____ eating from the trough. Do not submit any liability owed or try to claim refunds with this return.

Web Missouri And Kansas City Require A Valid Federal Attachment In The Electronic File.

Web 13 rows withholding transmittal of wage and tax statements. Arizona quarterly withholding tax return:. Web complete each sentence with am, is or are. An employer may make its arizona withholding payments on an annual basis if all of the following.

42) Application For An Amended.

Tom and i _____ friends. I _____ afraid of spiders. Web copyrigh mer ompany® 1r: To submit additional liability or claim a refund, file amended.