A4 Form Arizona

A4 Form Arizona - Get ready for tax season deadlines by completing any required tax forms today. The post arizona football lands 4. Use get form or simply click on the template preview to open it in the editor. Log in to the editor using your credentials or click on create. Web make these fast steps to modify the pdf arizona a 4 form online free of charge: Web 20 rows withholding forms. An employee required to have 0.8% deducted may elect to. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. You can use your results.

Residents who receive regularly scheduled payments from payments or annuities. Web annuitant's request for voluntary arizona income tax withholding. This form is used to assist the coa in the evaluation of the program’s compliance with the. This form is submitted to the. You can use your results. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. This form is for income earned in tax year 2022, with tax returns due in april. Get ready for tax season deadlines by completing any required tax forms today. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Ciaramella | 7.24.2023 3:46 pm.

Residents who receive regularly scheduled payments from payments or annuities. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. This form is for income earned in tax year 2022, with tax returns due in april. Use this form to request that your employer withhold arizona income taxes. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Start completing the fillable fields and. Web generated mon jul 31 23:33:04 2023. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. All taxpayers must complete a new a. Get ready for tax season deadlines by completing any required tax forms today.

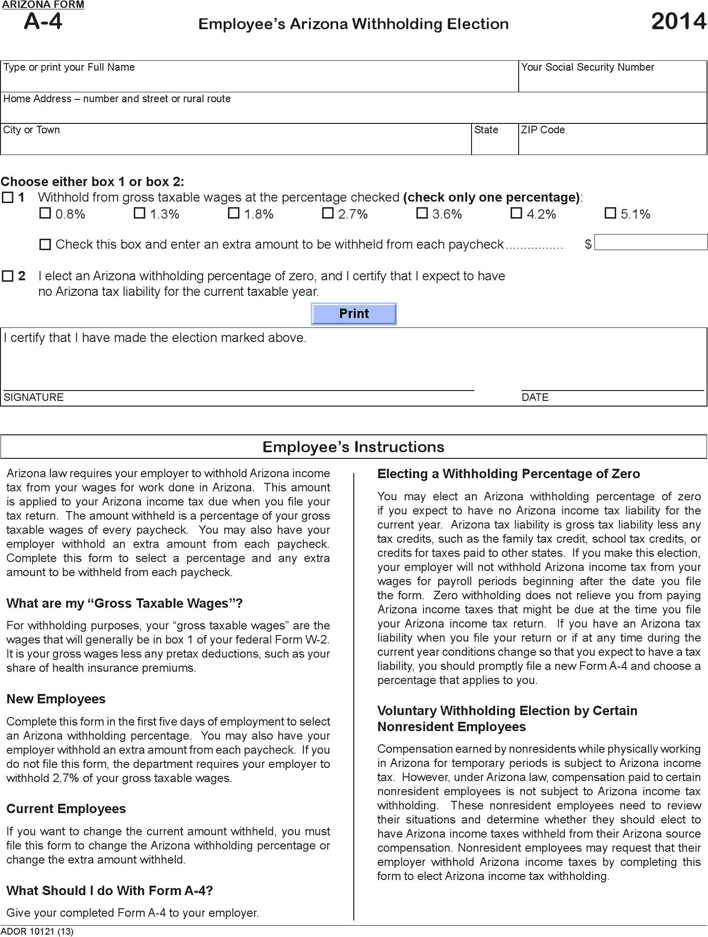

Free Arizona Form A4 (2014) PDF 53KB 1 Page(s)

Register and log in to your account. Use get form or simply click on the template preview to open it in the editor. This form is for income earned in tax year 2022, with tax returns due in april. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Residents who receive regularly.

Download Arizona Form A4 (2013) for Free FormTemplate

While we do our best to keep our list of. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. (fromourlittlebubble / dreamstime.com) a federal judge on friday permanently banned.

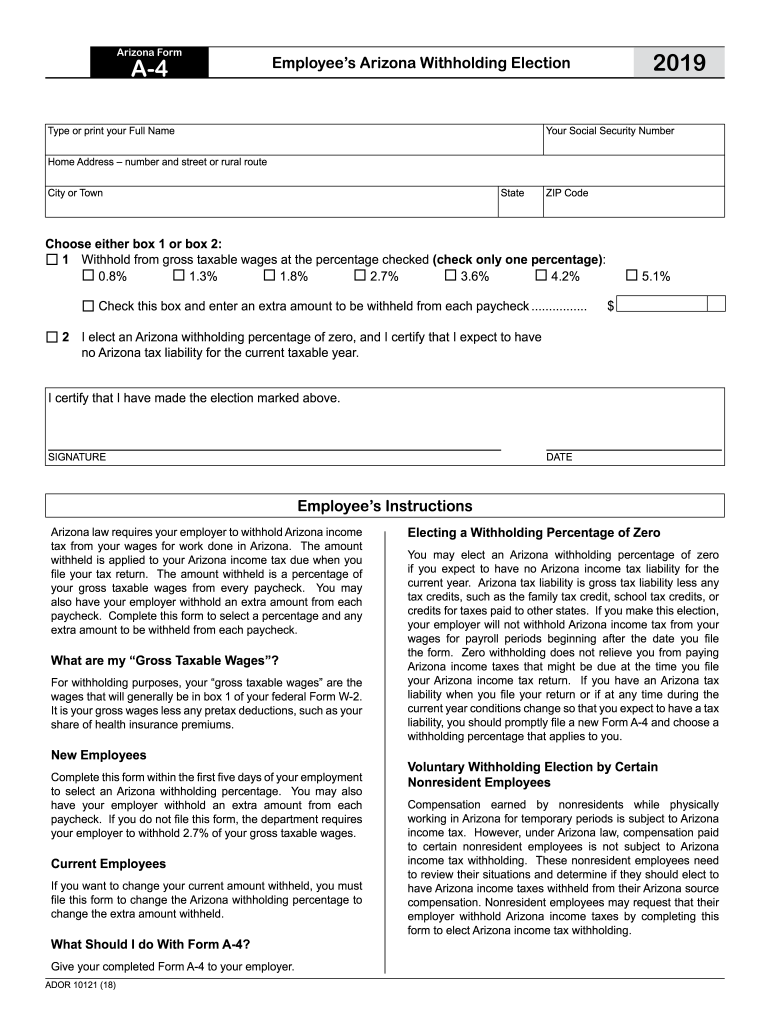

Fill Free fillable forms for the state of Arizona

Web 20 rows withholding forms. Web make these fast steps to modify the pdf arizona a 4 form online free of charge: An employee required to have 0.8% deducted may elect to. Register and log in to your account. (fromourlittlebubble / dreamstime.com) a federal judge on friday permanently banned arizona from enforcing a new law.

irstaxesw4form2020 Alloy Silverstein

This form is for income earned in tax year 2022, with tax returns due in april. This form is used to assist the coa in the evaluation of the program’s compliance with the. Use this form to request that your employer withhold arizona income taxes. You can use your results. Residents who receive regularly scheduled payments from payments or annuities.

A4 form Fill out & sign online DocHub

This form is used to assist the coa in the evaluation of the program’s compliance with the. Complete, edit or print tax forms instantly. Ciaramella | 7.24.2023 3:46 pm. Log in to the editor using your credentials or click on create. Get ready for tax season deadlines by completing any required tax forms today.

Arizona Form 5000a Fillable 2020 Fill and Sign Printable Template

Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Web annuitant's request for voluntary arizona income tax withholding. While we do our best to keep our list of. (fromourlittlebubble / dreamstime.com) a federal judge on friday permanently banned arizona from enforcing a new law. Web file this form to change the arizona.

Printable A4 Order Form Turquoise Blue Form Business Etsy

You can use your results. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. The post arizona football lands 4. Web 20 rows withholding forms. Use this form to request that your employer withhold arizona income taxes.

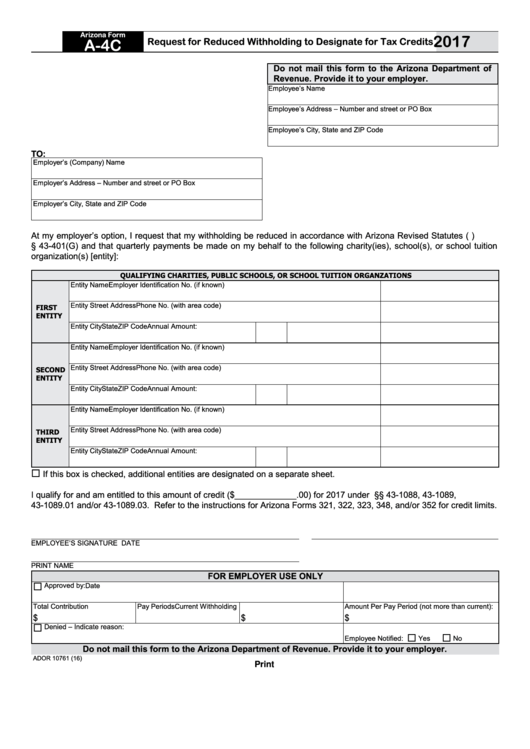

Fillable Arizona Form A4c Request For Reduced Withholding To

Web make these fast steps to modify the pdf arizona a 4 form online free of charge: (fromourlittlebubble / dreamstime.com) a federal judge on friday permanently banned arizona from enforcing a new law. Start completing the fillable fields and. This form is used to assist the coa in the evaluation of the program’s compliance with the. Complete, edit or print.

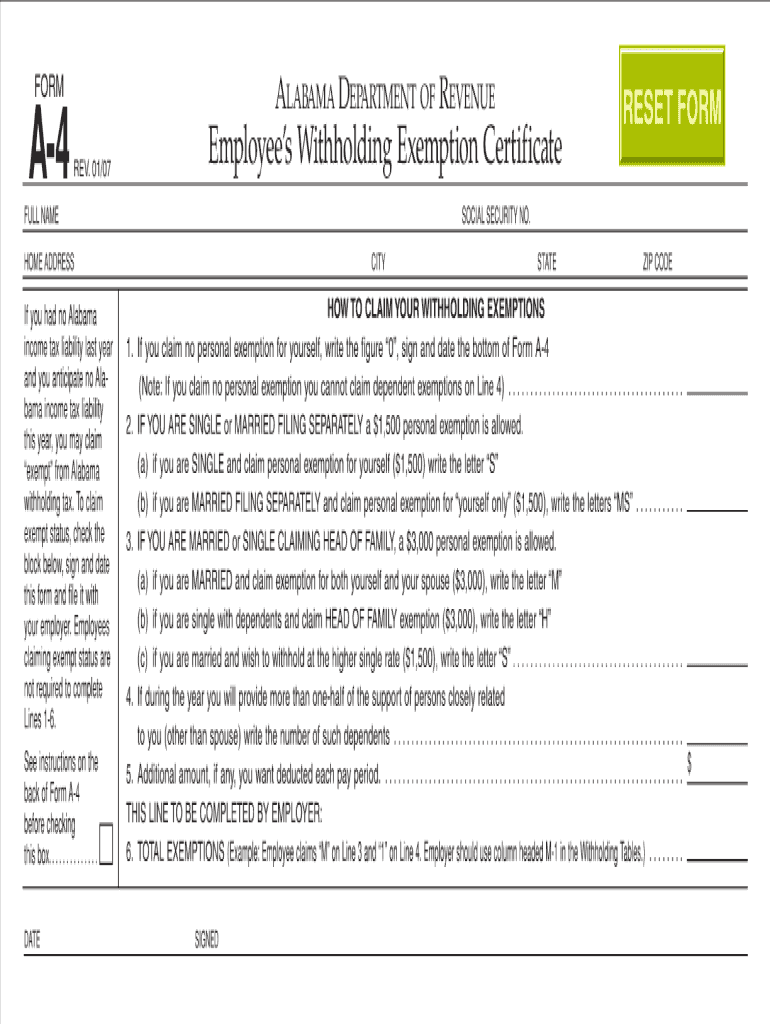

2007 Form AL DoR A4 Fill Online, Printable, Fillable, Blank pdfFiller

Residents who receive regularly scheduled payments from payments or annuities. Use get form or simply click on the template preview to open it in the editor. All taxpayers must complete a new a. While we do our best to keep our list of. Web make these fast steps to modify the pdf arizona a 4 form online free of charge:

Position Request A4 Form Template Creative Templates Creative Market

Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Web 20 rows withholding forms. Start completing the fillable fields and. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Web generated mon jul 31 23:33:04 2023.

Web Arizona Form A‑4V Is For Arizona Resident Employees Who Are Performing Work Outside Of Arizona.

Start completing the fillable fields and. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. Web annuitant's request for voluntary arizona income tax withholding. Get ready for tax season deadlines by completing any required tax forms today.

Ciaramella | 7.24.2023 3:46 Pm.

Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Web 20 rows withholding forms. While we do our best to keep our list of. All taxpayers must complete a new a.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web make these fast steps to modify the pdf arizona a 4 form online free of charge: (fromourlittlebubble / dreamstime.com) a federal judge on friday permanently banned arizona from enforcing a new law. Complete, edit or print tax forms instantly. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks.

Web Generated Mon Jul 31 23:33:04 2023.

Web file this form to change the arizona withholding percentage or to change the extra amount withheld. This form is submitted to the. This form is used to assist the coa in the evaluation of the program’s compliance with the. Residents who receive regularly scheduled payments from payments or annuities.