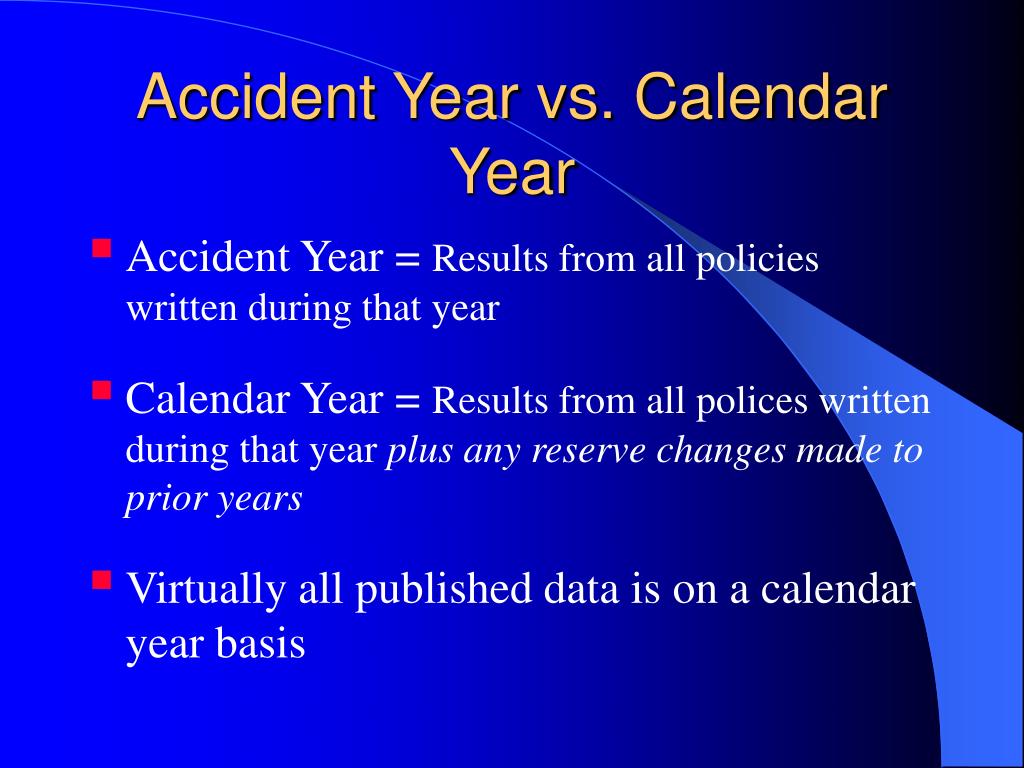

Accident Year Vs Calendar Year

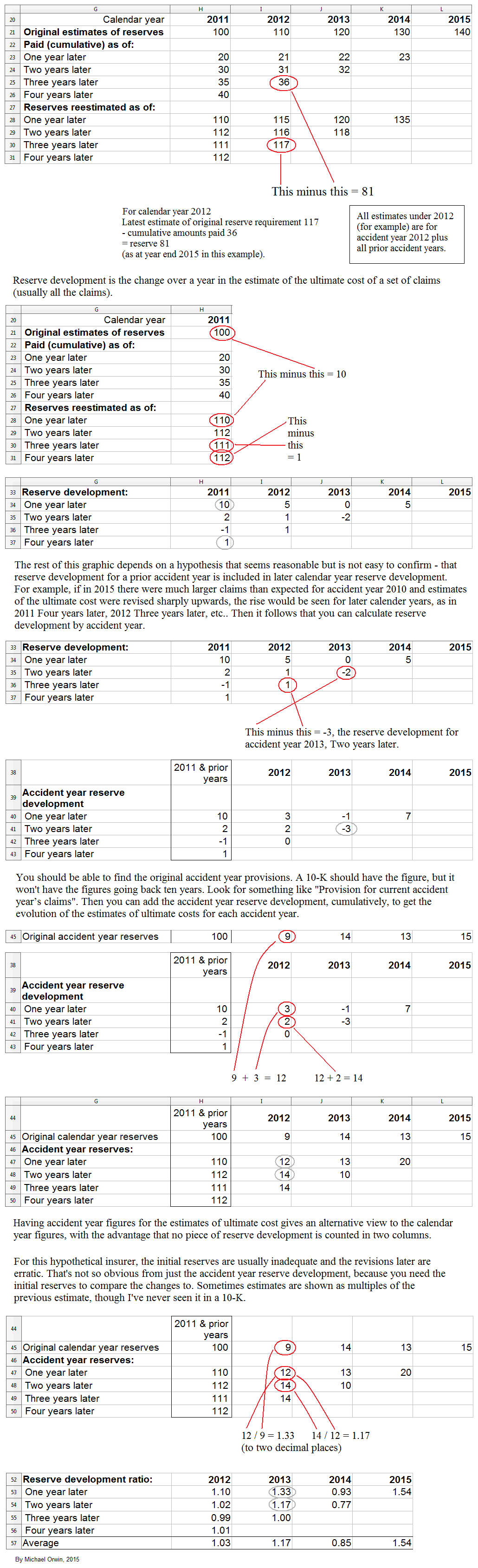

Accident Year Vs Calendar Year - Web learn what a calendar year experience is, how it is calculated, and why it is important for insurance companies. While traditional actuarial reserving methods assume that development patterns are stable over time, changes are often observed in practice. Officers were called to the collision on the a911 between glenrothes and leven shortly after. Web catch up on itv calendar (south) from wednesday 18th september. Investigators have identified the driver who was killed in the traffic crash on highway 99 between southwest langer farms parkway. Watch the most recent edition of itv news calendar (south) Web learn the definitions of calendar year, accident year, policy year and other insurance data terms from the consumer education and justice (cej) website. Web this video describes the difference between accident year and calendar year with the help of an example. Web • underwriting year seems like an obvious segmentation basis: Web accident year experience (aye) focuses on premiums earned and losses incurred within a specific period, typically 12 months, while calendar year experience.

Web accident year factors are known at other development ages, a simple approach would be to fit a curve to the known factors and then use the curve to get the year end factors. Officers were called to the collision on the a911 between glenrothes and leven shortly after. Web accident year experience (aye) focuses on premiums earned and losses incurred within a specific period, typically 12 months, while calendar year experience. Investigators have identified the driver who was killed in the traffic crash on highway 99 between southwest langer farms parkway. A calendar year experience is the difference. Two other cost accounting terms used in sorting loss. Web this paper sets forth the mathematical definitions of these methods, examines the conditions under which the results equal those of a policy year or accident year. Web a calendar year experience, also referred to as an underwriting year experience or accident year experience, is a crucial metric in the insurance sector. Tue 17 sept 8pm • catch up: Web learn what a calendar year experience is, how it is calculated, and why it is important for insurance companies.

Web accident year factors are known at other development ages, a simple approach would be to fit a curve to the known factors and then use the curve to get the year end factors. Web learn the differences among these types of data for workers compensation insurance. While traditional actuarial reserving methods assume that development patterns are stable over time, changes are often observed in practice. Web hence, the standard calendar year approach is superior when the amount of incurred loss adequacy has not changed because it will then match the accident year loss ratio. Watch the most recent edition of itv news calendar (south) Officers were called to the collision on the a911 between glenrothes and leven shortly after. Web learn the definitions of calendar year, accident year, policy year and other insurance data terms from the consumer education and justice (cej) website. Web posted september 18, 2024. Web • underwriting year seems like an obvious segmentation basis: Learn how to calculate accident year experience, the difference between calendar year and policy year experience, and the factors that affect it.

Accident Year Vs Calendar Year Month Calendar Printable

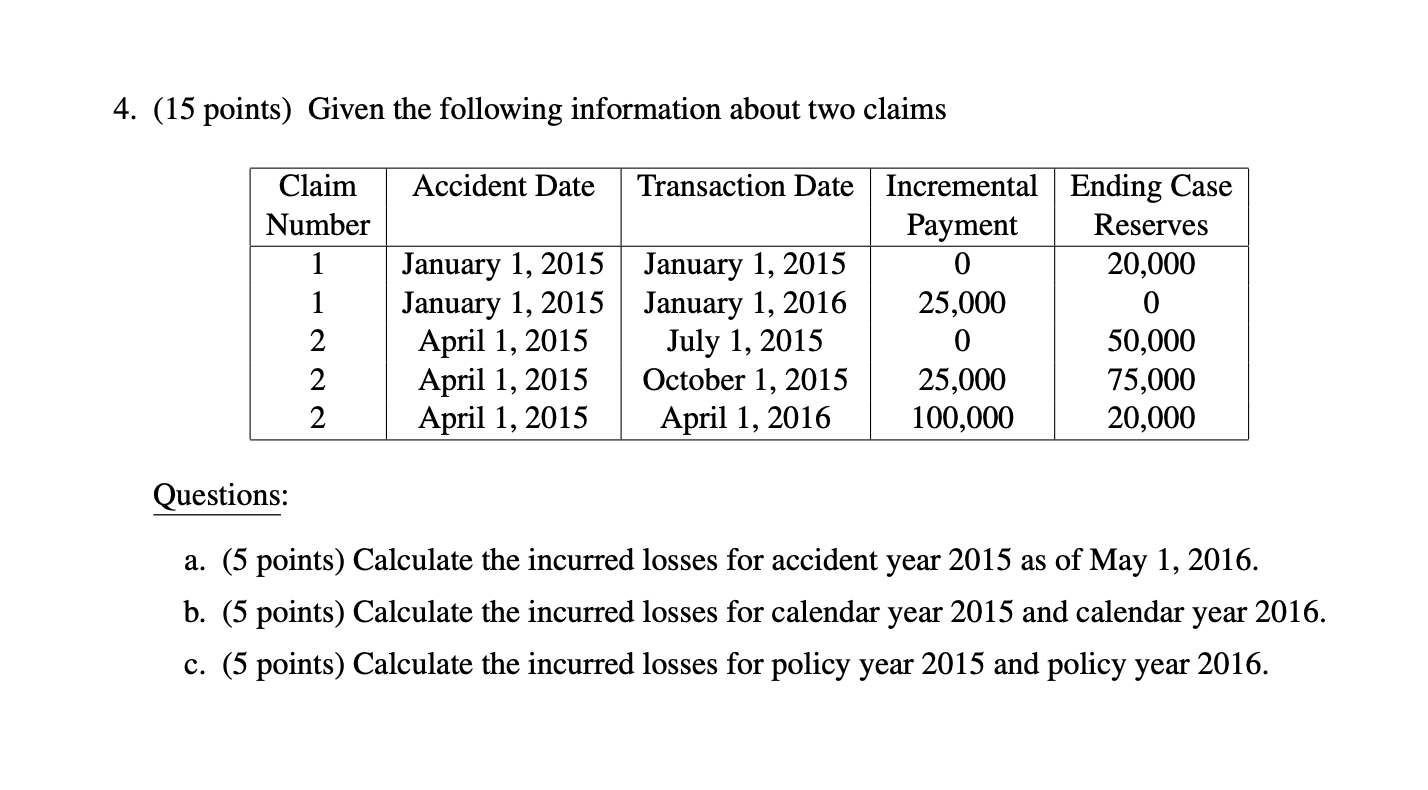

Web learn the definitions of calendar year, accident year, policy year and other insurance data terms from the consumer education and justice (cej) website. Unlike a calendar year, which is january 1 to december 31, a policy year depends on. Learn how to calculate accident year experience, the difference between calendar year and policy year experience, and the factors that.

Trends ASAP by Actuarial Services and Programs Evaluating Changes in

Officers were called to the collision on the a911 between glenrothes and leven shortly after. Web accident year data is a method of comparing losses and premiums by calendar year. Web catch up on itv calendar (south) from wednesday 18th september. Web learn what a calendar year experience is, how it is calculated, and why it is important for insurance.

Accident Year Vs Calendar Year Calendar Printables Free Templates

Two other cost accounting terms used in sorting loss. Web learn the definitions of calendar year, accident year, policy year and other insurance data terms from the consumer education and justice (cej) website. A calendar year experience is the difference. Web • underwriting year seems like an obvious segmentation basis: Web hence, the standard calendar year approach is superior when.

Accident Year Vs Calendar Year Calendar Printables Free Templates

Web catch up on itv calendar (south) from wednesday 18th september. Two other cost accounting terms used in sorting loss. Web learn what a calendar year experience is, how it is calculated, and why it is important for insurance companies. Web this paper sets forth the mathematical definitions of these methods, examines the conditions under which the results equal those.

Combined Ratio Difference Debate Calendar vs. Accident Year

Web accident year experience (aye) focuses on premiums earned and losses incurred within a specific period, typically 12 months, while calendar year experience. Web accident year data is a method of comparing losses and premiums by calendar year. Investigators have identified the driver who was killed in the traffic crash on highway 99 between southwest langer farms parkway. Web accident.

Policy Year, Calendar Year, & Accident Year Insurance Terminology

Web hence, the standard calendar year approach is superior when the amount of incurred loss adequacy has not changed because it will then match the accident year loss ratio. While traditional actuarial reserving methods assume that development patterns are stable over time, changes are often observed in practice. Unlike a calendar year, which is january 1 to december 31, a.

Accident Year Vs Calendar Year Month Calendar Printable

Watch the most recent edition of itv news calendar (south) Web this video describes the difference between accident year and calendar year with the help of an example. Web posted september 18, 2024. Web learn the differences among these types of data for workers compensation insurance. Investigators have identified the driver who was killed in the traffic crash on highway.

Accident Year Vs Calendar Year 2024 Calendar 2024 Ireland Printable

A calendar year experience is the difference. Web posted september 18, 2024. Investigators have identified the driver who was killed in the traffic crash on highway 99 between southwest langer farms parkway. Learn how to calculate accident year experience, the difference between calendar year and policy year experience, and the factors that affect it. Web a calendar year experience, also.

PPT Malpractice Loss Trends 2007 Update DRI, March 15, 2007

Learn how to calculate accident year experience, the difference between calendar year and policy year experience, and the factors that affect it. Web posted september 18, 2024. Investigators have identified the driver who was killed in the traffic crash on highway 99 between southwest langer farms parkway. While traditional actuarial reserving methods assume that development patterns are stable over time,.

Accident Year vs Calendar Year Insurance Terminology Actuarial 101

Web learn what a calendar year experience is, how it is calculated, and why it is important for insurance companies. Tue 17 sept 8pm • catch up: Policy year is based on effective dates, accident year is based on accident dates,. Officers were called to the collision on the a911 between glenrothes and leven shortly after. Investigators have identified the.

Officers Were Called To The Collision On The A911 Between Glenrothes And Leven Shortly After.

Web • underwriting year seems like an obvious segmentation basis: Web accident year data is a method of comparing losses and premiums by calendar year. Investigators have identified the driver who was killed in the traffic crash on highway 99 between southwest langer farms parkway. Web posted september 18, 2024.

Accident Year Experience Is A Measure Of Insurance Underwriting Performance Based On Premiums And Losses In A Specific Period, Usually 12 Months.

Policy year is based on effective dates, accident year is based on accident dates,. Learn how to calculate accident year experience, the difference between calendar year and policy year experience, and the factors that affect it. Web this paper sets forth the mathematical definitions of these methods, examines the conditions under which the results equal those of a policy year or accident year. Web this video describes the difference between accident year and calendar year with the help of an example.

Web Learn What A Calendar Year Experience Is, How It Is Calculated, And Why It Is Important For Insurance Companies.

Web accident year factors are known at other development ages, a simple approach would be to fit a curve to the known factors and then use the curve to get the year end factors. Web catch up on itv calendar (south) from wednesday 18th september. Tue 17 sept 8pm • catch up: Web accident year experience (aye) focuses on premiums earned and losses incurred within a specific period, typically 12 months, while calendar year experience.

Web Hence, The Standard Calendar Year Approach Is Superior When The Amount Of Incurred Loss Adequacy Has Not Changed Because It Will Then Match The Accident Year Loss Ratio.

Web learn the definitions of calendar year, accident year, policy year and other insurance data terms from the consumer education and justice (cej) website. Web learn the differences among these types of data for workers compensation insurance. Two other cost accounting terms used in sorting loss. While traditional actuarial reserving methods assume that development patterns are stable over time, changes are often observed in practice.