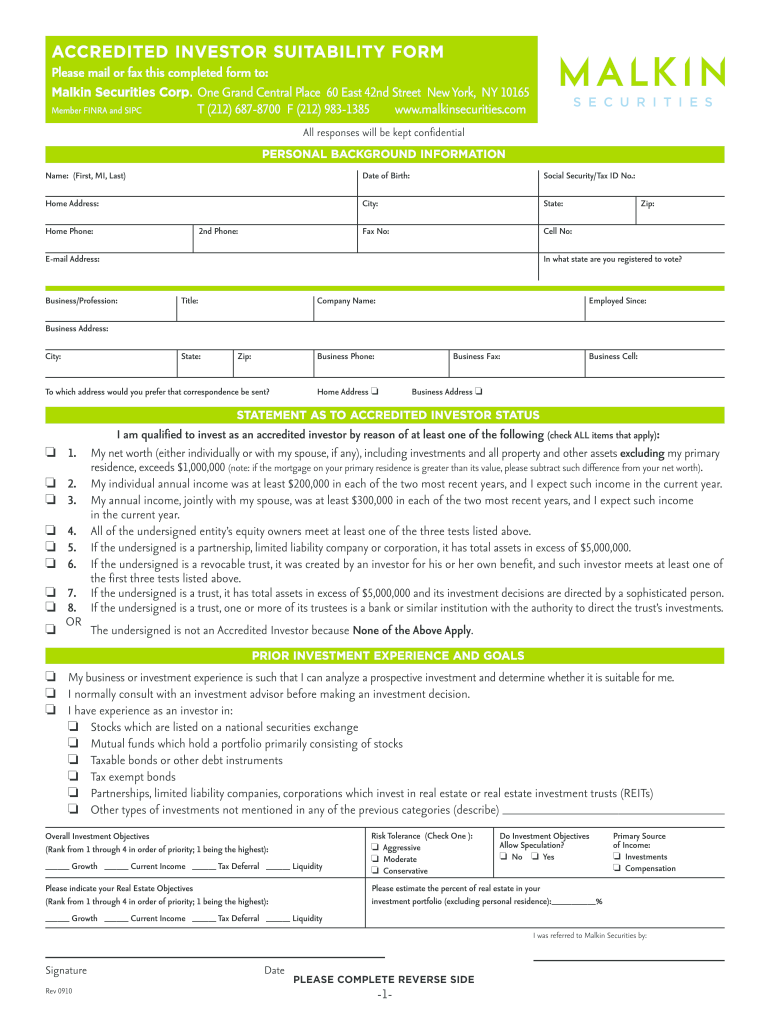

Accredited Investor Form

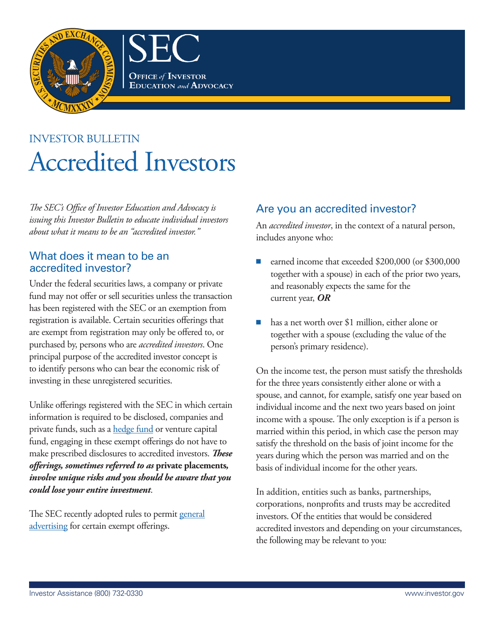

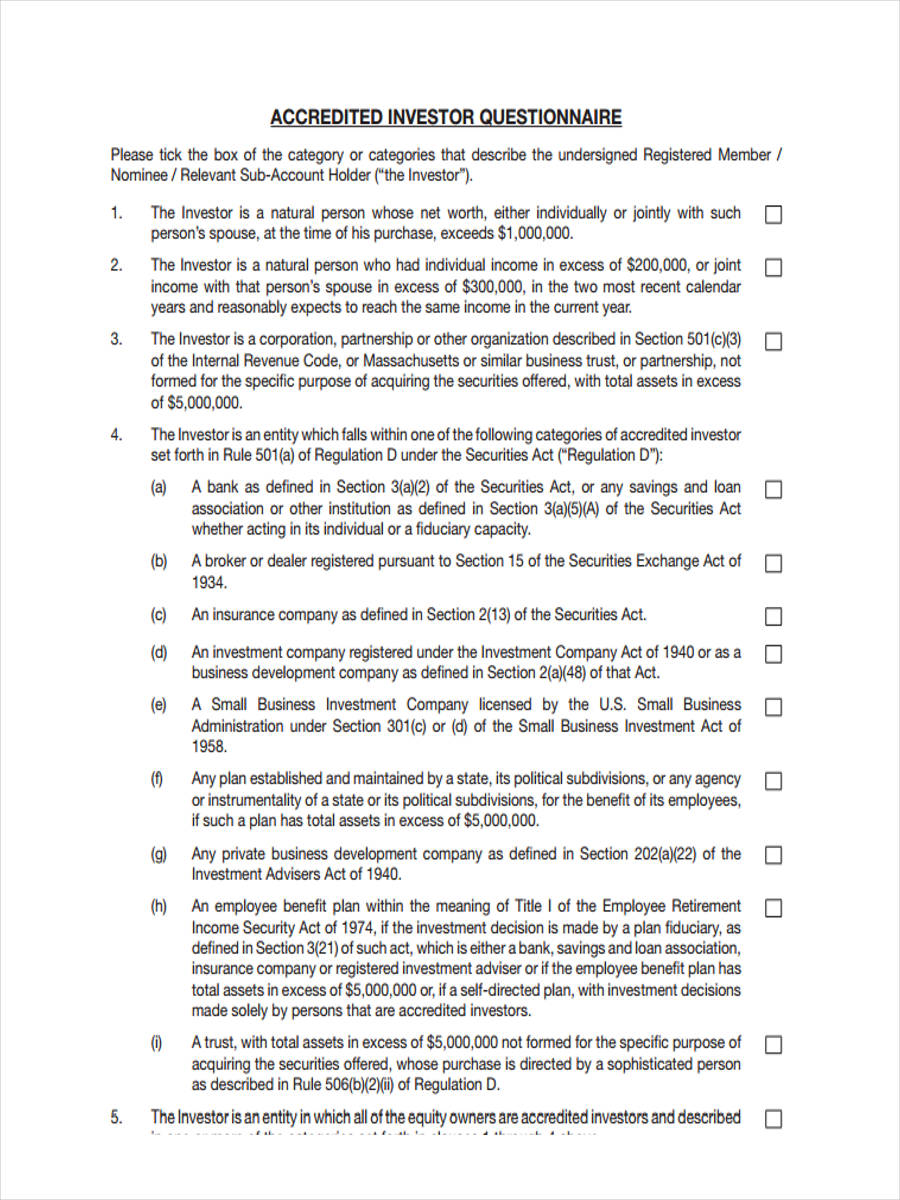

Accredited Investor Form - Note that this document is intended only for us companies raising money from us investors. Web as expected, the amendment adding any form of entity with at least $5 million of investments to the list of accredited investors is beneficial to private funds and other issuers that have potential investors that are large sophisticated institutions that historically did not meet the technical requirements to qualify as accredited investors. Web financial criteria net worth over $1 million, excluding primary residence (individually or with spouse or partner) income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year professional criteria Web as a resource to startups seeking to raise capital, we at cooley go have made available a form of accredited investor questionnaire. Web timothy li an accredited investor is a person or entity that is allowed to invest in securities that are not registered with the securities and exchange commission (sec). Visit our raise guidance section for more articles on fundraising strategies. Web that investor is an “accredited investor” as such term is defined in rule 501 of the securities act, and hereby provides written confirmation of the following: Have a net worth exceeding $1 million on your own or with a spouse or its equivalent; Have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ability to maintain this. The sec’s office of investor education and advocacy is issuing this investor bulletin to educate individual investors about what it means to be an “accredited investor.”.

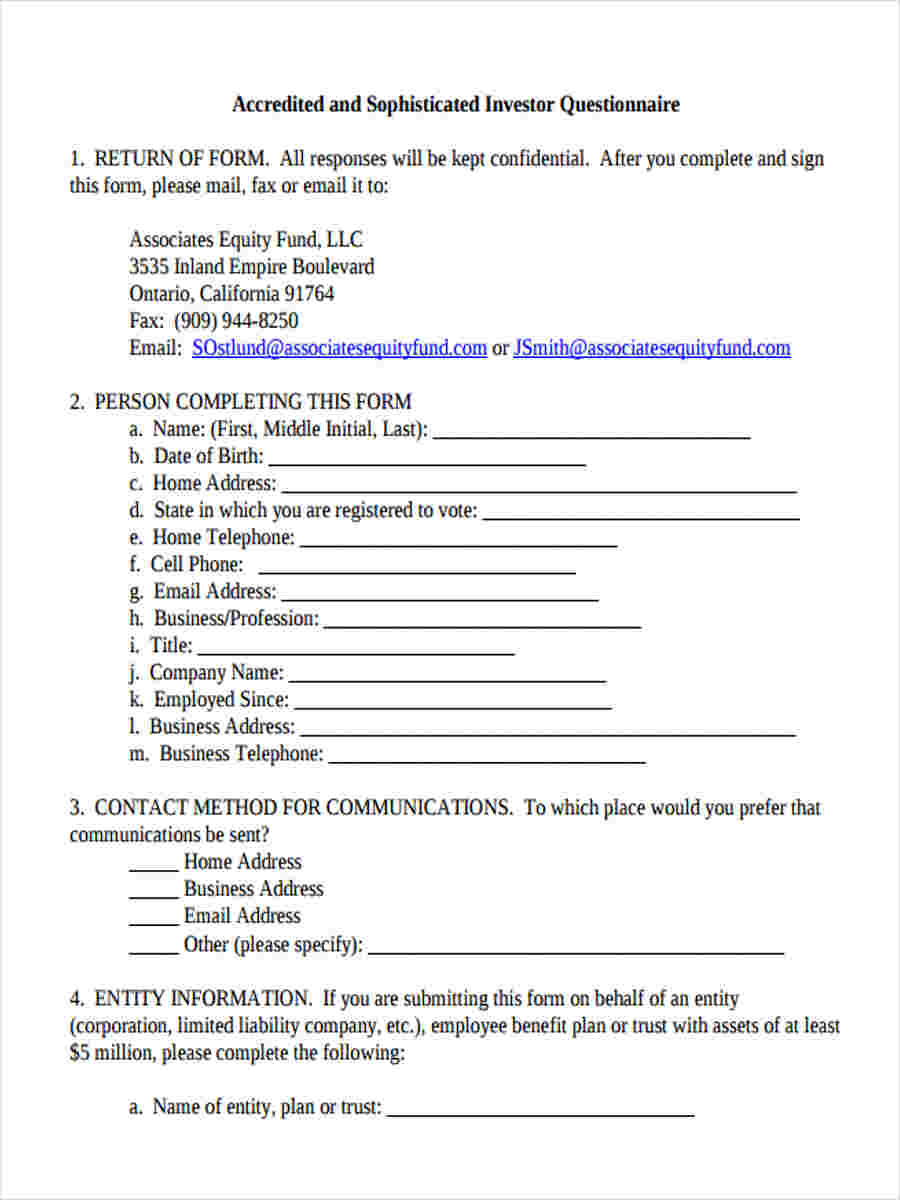

Visit our raise guidance section for more articles on fundraising strategies. Have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ability to maintain this. Web individuals who want to become accredited investors must fall into one of three categories: A) it has over five million dollars ($5,000,000) in assets, and b) that it was not formed to acqu. Name of verifying individual or entity Web that investor is an “accredited investor” as such term is defined in rule 501 of the securities act, and hereby provides written confirmation of the following: Note that this document is intended only for us companies raising money from us investors. Web timothy li an accredited investor is a person or entity that is allowed to invest in securities that are not registered with the securities and exchange commission (sec). Web in the u.s., the term accredited investor is used by the securities and exchange commission (sec) under regulation d to refer to investors who are financially sophisticated and have a reduced. Web as a resource to startups seeking to raise capital, we at cooley go have made available a form of accredited investor questionnaire.

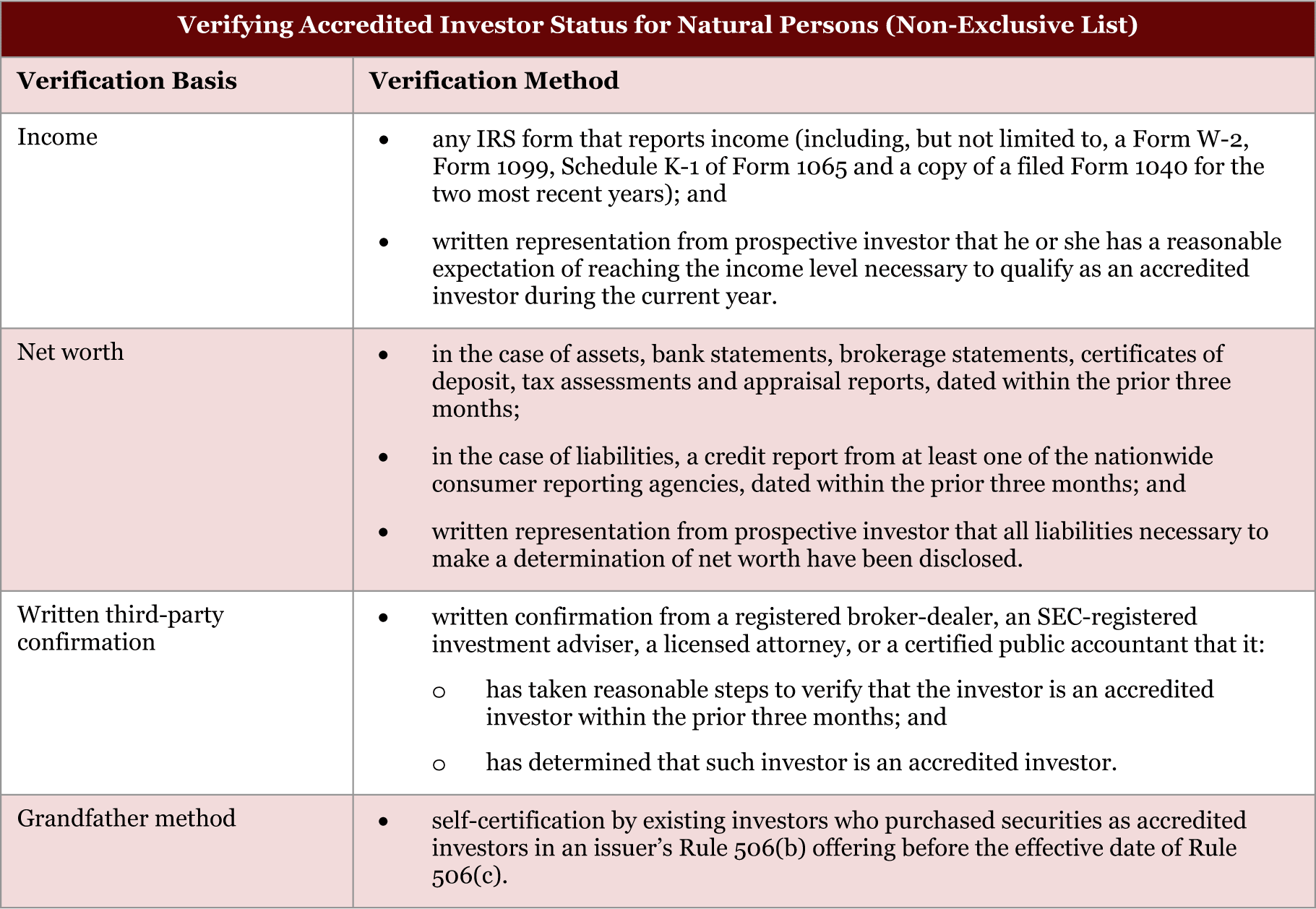

Web as a resource to startups seeking to raise capital, we at cooley go have made available a form of accredited investor questionnaire. X a copy of the trust, agency or other agreement and a document authorizing the investment signed by the requisite parties identified in the agreement, and x documentation that the trust qualifies as an accredited investor because: Web individuals who want to become accredited investors must fall into one of three categories: Have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ability to maintain this. Web that investor is an “accredited investor” as such term is defined in rule 501 of the securities act, and hereby provides written confirmation of the following: Name of verifying individual or entity Web in the u.s., the term accredited investor is used by the securities and exchange commission (sec) under regulation d to refer to investors who are financially sophisticated and have a reduced. Web as expected, the amendment adding any form of entity with at least $5 million of investments to the list of accredited investors is beneficial to private funds and other issuers that have potential investors that are large sophisticated institutions that historically did not meet the technical requirements to qualify as accredited investors. Web financial criteria net worth over $1 million, excluding primary residence (individually or with spouse or partner) income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year professional criteria 26, 2020 — the securities and exchange commission today adopted amendments to the “accredited investor” definition, one of the principal tests for determining who is eligible to participate in our private capital markets.

Accredited Investor Western Alliance Group

Note that this document is intended only for us companies raising money from us investors. Web as expected, the amendment adding any form of entity with at least $5 million of investments to the list of accredited investors is beneficial to private funds and other issuers that have potential investors that are large sophisticated institutions that historically did not meet.

Accredited Investor What Can Accredited Investors Invest In?

Web in the u.s., the term accredited investor is used by the securities and exchange commission (sec) under regulation d to refer to investors who are financially sophisticated and have a reduced. Web individuals who want to become accredited investors must fall into one of three categories: Have earned an income surpassing $200,000 ($300,000 if combined with a spouse or.

Investor Bulletin Accredited Investors Download Printable PDF

Have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ability to maintain this. Note that this document is intended only for us companies raising money from us investors. Web in the u.s., the term accredited investor is used by the securities and exchange commission (sec) under.

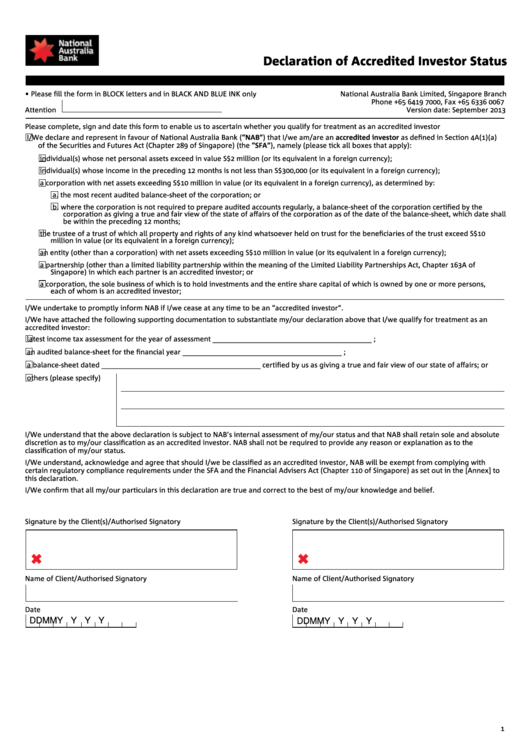

Fillable Declaration Of Accredited Investor Status printable pdf download

X a copy of the trust, agency or other agreement and a document authorizing the investment signed by the requisite parties identified in the agreement, and x documentation that the trust qualifies as an accredited investor because: A) it has over five million dollars ($5,000,000) in assets, and b) that it was not formed to acqu. Web as expected, the.

Understanding The Difference Between Accredited vs Nonaccredited

Name of verifying individual or entity X a copy of the trust, agency or other agreement and a document authorizing the investment signed by the requisite parties identified in the agreement, and x documentation that the trust qualifies as an accredited investor because: Web as a resource to startups seeking to raise capital, we at cooley go have made available.

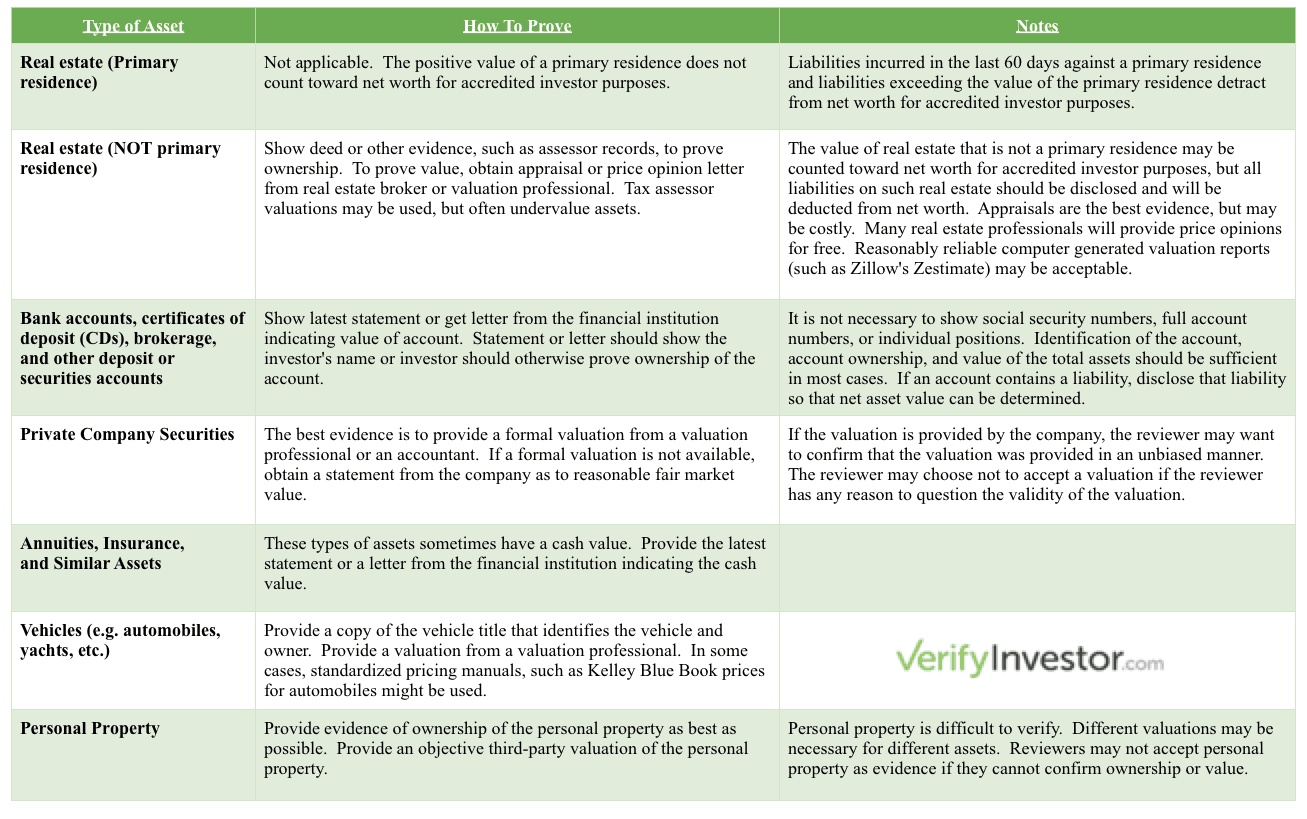

Everything You Need To Know About Accredited Investor Verification

Have a net worth exceeding $1 million on your own or with a spouse or its equivalent; Web financial criteria net worth over $1 million, excluding primary residence (individually or with spouse or partner) income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year.

FREE 43+ Sample Questionnaire Forms in PDF MS Word Excel

Web timothy li an accredited investor is a person or entity that is allowed to invest in securities that are not registered with the securities and exchange commission (sec). Have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ability to maintain this. Web individuals who want.

Accredited Investor Form 2021 Fill Out and Sign Printable PDF

Visit our raise guidance section for more articles on fundraising strategies. Web individuals who want to become accredited investors must fall into one of three categories: Have a net worth exceeding $1 million on your own or with a spouse or its equivalent; 26, 2020 — the securities and exchange commission today adopted amendments to the “accredited investor” definition, one.

SEC’s New Reg D Rules and Private Fund Offerings

Web timothy li an accredited investor is a person or entity that is allowed to invest in securities that are not registered with the securities and exchange commission (sec). Have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ability to maintain this. Web that investor is.

FREE 7+ Sample Investor Questionnaire Forms in MS Word PDF

The sec’s office of investor education and advocacy is issuing this investor bulletin to educate individual investors about what it means to be an “accredited investor.”. Have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ability to maintain this. X a copy of the trust, agency.

Have A Net Worth Exceeding $1 Million On Your Own Or With A Spouse Or Its Equivalent;

Web individuals who want to become accredited investors must fall into one of three categories: 26, 2020 — the securities and exchange commission today adopted amendments to the “accredited investor” definition, one of the principal tests for determining who is eligible to participate in our private capital markets. Web in the u.s., the term accredited investor is used by the securities and exchange commission (sec) under regulation d to refer to investors who are financially sophisticated and have a reduced. Web financial criteria net worth over $1 million, excluding primary residence (individually or with spouse or partner) income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year professional criteria

Web Timothy Li An Accredited Investor Is A Person Or Entity That Is Allowed To Invest In Securities That Are Not Registered With The Securities And Exchange Commission (Sec).

Name of verifying individual or entity A) it has over five million dollars ($5,000,000) in assets, and b) that it was not formed to acqu. The sec’s office of investor education and advocacy is issuing this investor bulletin to educate individual investors about what it means to be an “accredited investor.”. Web as a resource to startups seeking to raise capital, we at cooley go have made available a form of accredited investor questionnaire.

Note That This Document Is Intended Only For Us Companies Raising Money From Us Investors.

Web as expected, the amendment adding any form of entity with at least $5 million of investments to the list of accredited investors is beneficial to private funds and other issuers that have potential investors that are large sophisticated institutions that historically did not meet the technical requirements to qualify as accredited investors. Verifying individual or entity ( _____ ) qualifies as (check one): Have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ability to maintain this. Visit our raise guidance section for more articles on fundraising strategies.

Web That Investor Is An “Accredited Investor” As Such Term Is Defined In Rule 501 Of The Securities Act, And Hereby Provides Written Confirmation Of The Following:

X a copy of the trust, agency or other agreement and a document authorizing the investment signed by the requisite parties identified in the agreement, and x documentation that the trust qualifies as an accredited investor because: