Alabama State Tax Withholding Form 2022

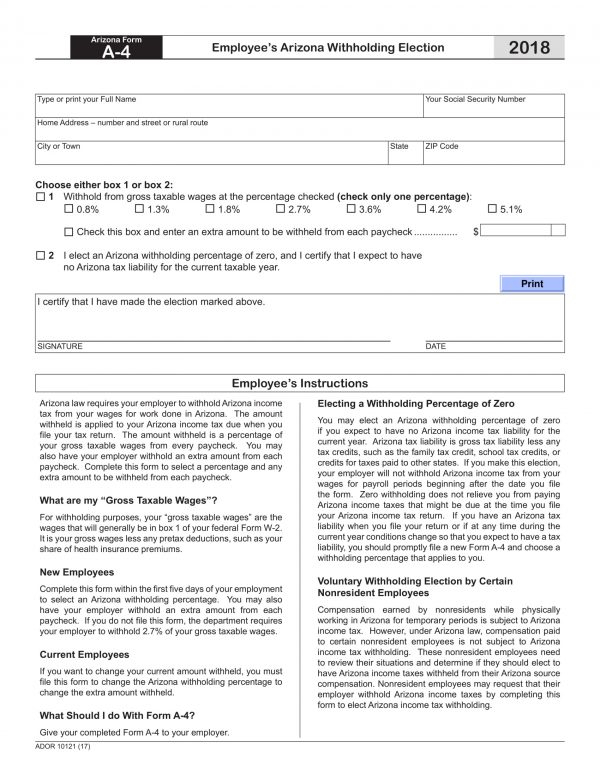

Alabama State Tax Withholding Form 2022 - Web alabama small business development center. Web any correspondence concerning this form should be sent to the alabama department of revenue, individual and corporate tax division, withholding tax section, p.o. Withholding tax tables and instructions for employers. Pay period 12, 2022 summary the income tax withholding formula for the state of alabama includes the following changes: Web in late april, the alabama department of revenue issued revised withholding tax tables and instructions for employers and withholding agents to reflect changes to the. The zero (0) or single,. Mat is an online filing system. State withholding tax is the money an employer is required to. Find your income exemptions 2. There are a few variations of.

Web the withholding tables provided in the “withholding tax tables and instructions for employers and withholding agents” have been updated to reflect these. Web how to calculate 2022 alabama state income tax by using state income tax table 1. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Web in late april, the alabama department of revenue issued revised withholding tax tables and instructions for employers and withholding agents to reflect changes to the. State withholding tax is the money an employer is required to. The zero (0) or single,. Web state withholding tax alabama is one of many states which impose a state tax on personal income. Find your income exemptions 2. Web the alabama state tax tables for 2022 displayed on this page are provided in support of the 2022 us tax calculator and the dedicated 2022 alabama state tax calculator. Withholding tax tables and instructions for employers.

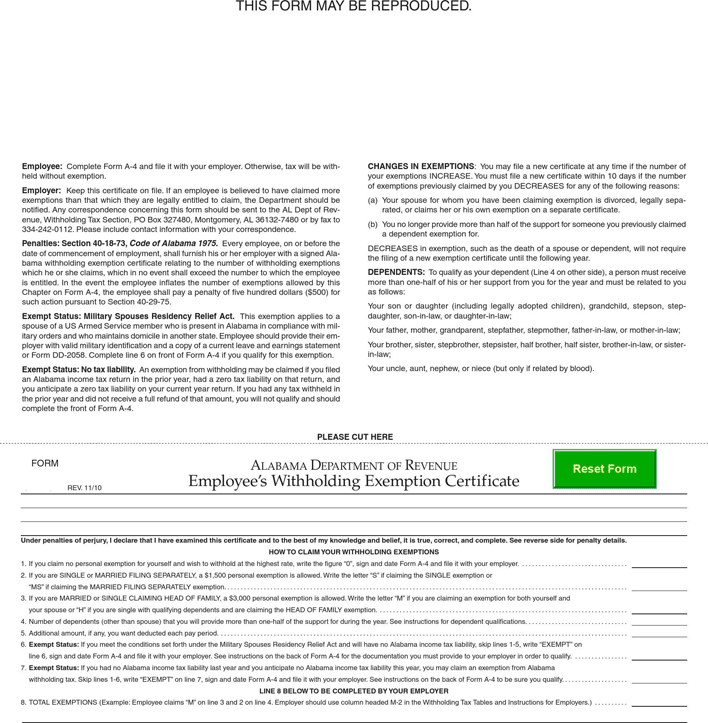

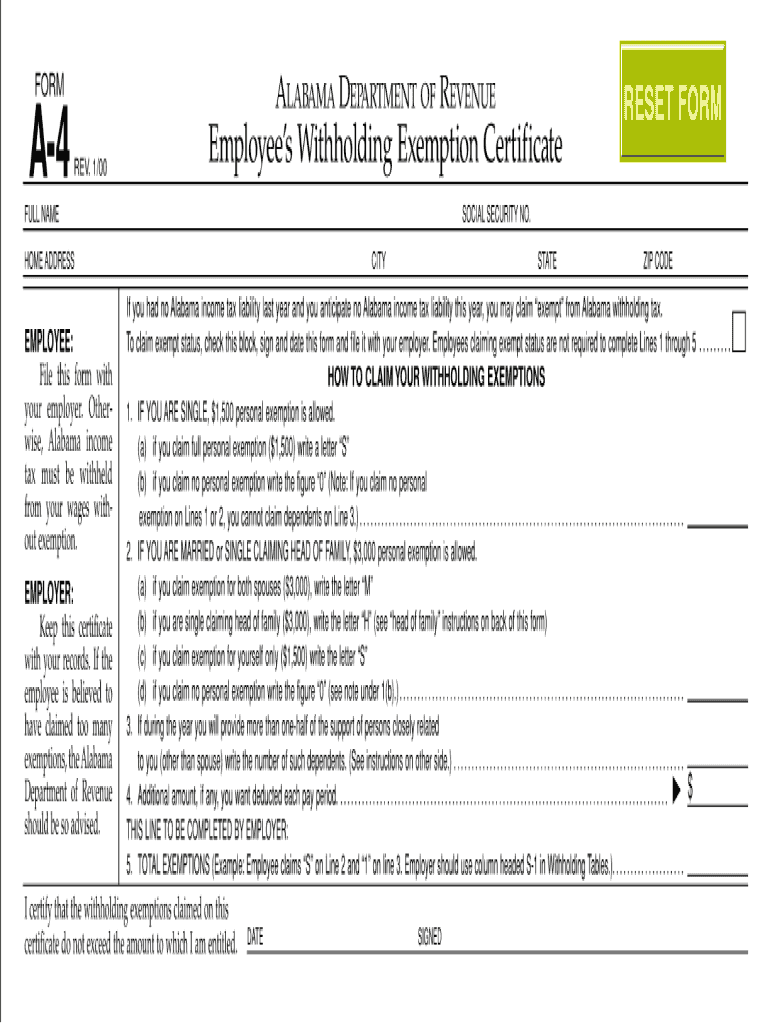

Web alabama small business development center. Sba.gov's business licenses and permits search tool allows you to get a listing of federal, state and local. Find your income exemptions 2. State withholding tax is the money an employer is required to. Withholding tax tables and instructions for employers. Web to assist you in reviewing your state income tax withholding rates for 2022, below is a chart of the most recent income tax withholding tables published by states and us. The zero (0) or single,. Find your pretax deductions, including 401k, flexible. If you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim an exemption from alabama. Web the alabama department of revenue offers a free electronic service, my alabama taxes (mat), for filing and remitting withholding tax.

Alabama State Tax Withholding Form 2022 W4 Form

Web the alabama department of revenue offers a free electronic service, my alabama taxes (mat), for filing and remitting withholding tax. The zero (0) or single,. Find your income exemptions 2. Web alabama small business development center. Web in late april, the alabama department of revenue issued revised withholding tax tables and instructions for employers and withholding agents to reflect.

State Tax Withholding Forms Template Free Download Speedy Template

Mat is an online filing system. Sba.gov's business licenses and permits search tool allows you to get a listing of federal, state and local. State withholding tax is the money an employer is required to. Web in late april, the alabama department of revenue issued revised withholding tax tables and instructions for employers and withholding agents to reflect changes to.

State Tax Withholding Form 2022

Web the alabama department of revenue offers a free electronic service, my alabama taxes (mat), for filing and remitting withholding tax. Web any correspondence concerning this form should be sent to the alabama department of revenue, individual and corporate tax division, withholding tax section, p.o. Web withholding tax tables and instructions for employers and withholding agents. The zero (0) or.

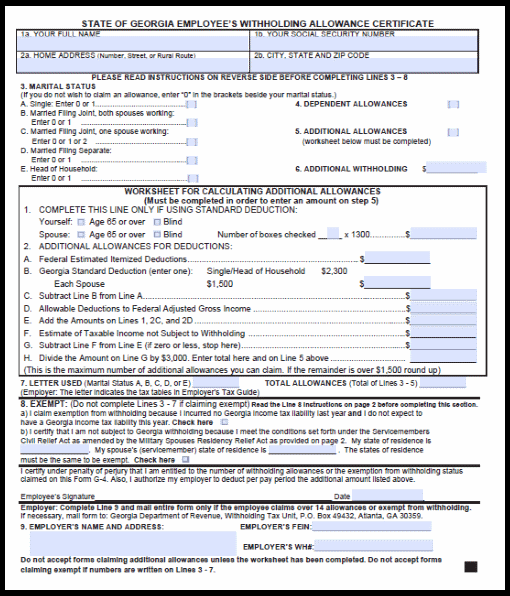

FREE 11+ Employee Election Forms in PDF MS Word

Web the alabama state tax tables for 2022 displayed on this page are provided in support of the 2022 us tax calculator and the dedicated 2022 alabama state tax calculator. Web how to calculate 2022 alabama state income tax by using state income tax table 1. Web state withholding tax alabama is one of many states which impose a state.

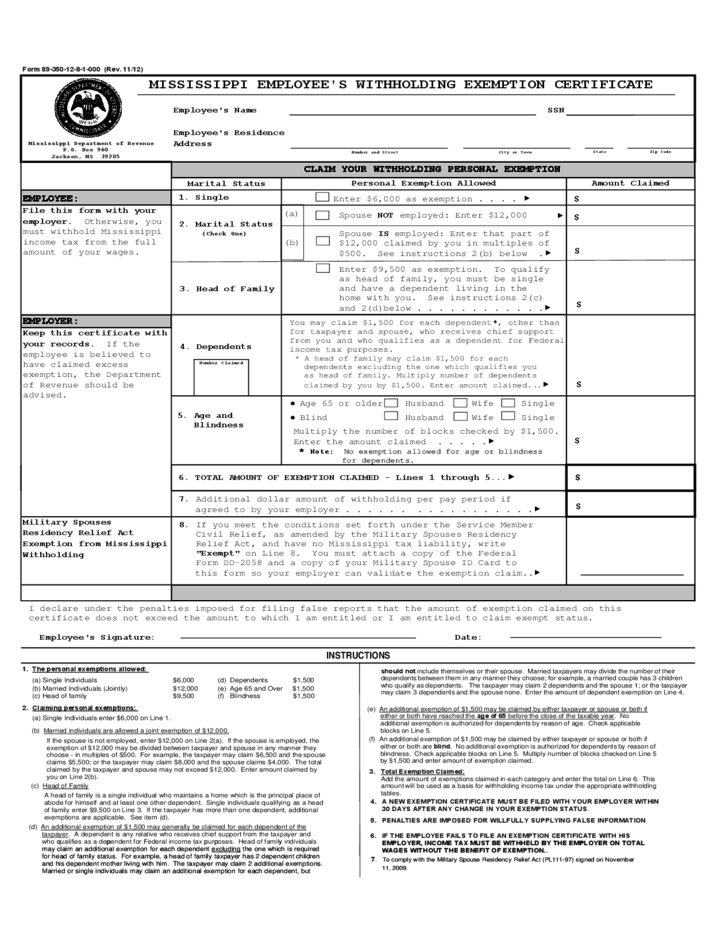

Mississippi State Withholding Form Personal Exemption

State withholding tax is the money an employer is required to. Web withholding tax tables and instructions for employers and withholding agents. Mat is an online filing system. Find your income exemptions 2. Pay period 12, 2022 summary the income tax withholding formula for the state of alabama includes the following changes:

Reading your pay stub 8 factors that could be affecting your takehome pay

Web the alabama department of revenue offers a free electronic service, my alabama taxes (mat), for filing and remitting withholding tax. State withholding tax is the money an employer is required to. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to.

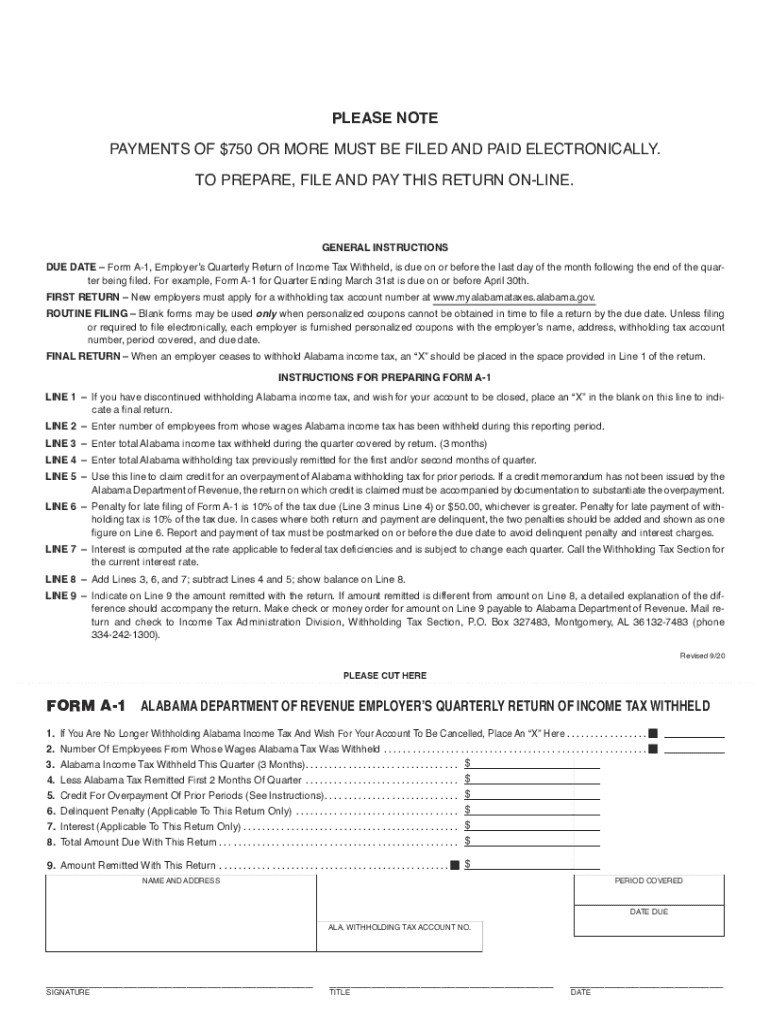

20202022 Form AL A1 Fill Online, Printable, Fillable, Blank pdfFiller

Web how to calculate 2022 alabama state income tax by using state income tax table 1. Find your pretax deductions, including 401k, flexible. If you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim an exemption from alabama. Web in late april, the alabama department of revenue issued.

Nebraska State Tax Withholding Form 2022

Find your income exemptions 2. There are a few variations of. Sba.gov's business licenses and permits search tool allows you to get a listing of federal, state and local. Web the alabama department of revenue offers a free electronic service, my alabama taxes (mat), for filing and remitting withholding tax. Web to assist you in reviewing your state income tax.

Happy tax day Forbes says Alabama is the 10th best state for taxes

Web the withholding tables provided in the “withholding tax tables and instructions for employers and withholding agents” have been updated to reflect these. Web in late april, the alabama department of revenue issued revised withholding tax tables and instructions for employers and withholding agents to reflect changes to the. Withholding tax tables and instructions for employers. This form is used.

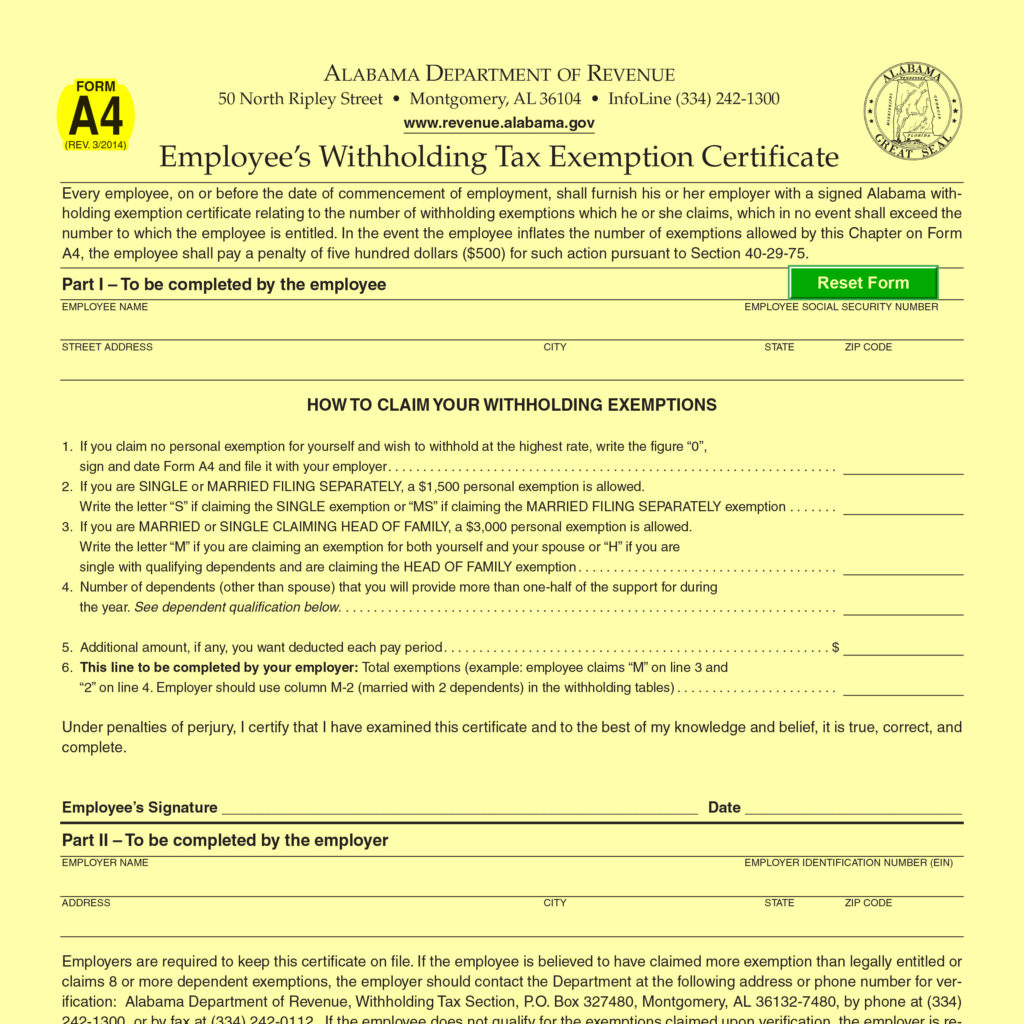

Alabama a 4 2000 form Fill out & sign online DocHub

Web state withholding tax alabama is one of many states which impose a state tax on personal income. Withholding tax tables and instructions for employers. If you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim an exemption from alabama. There are a few variations of. Web withholding.

Web The Alabama Department Of Revenue Offers A Free Electronic Service, My Alabama Taxes (Mat), For Filing And Remitting Withholding Tax.

Web withholding tax tables and instructions for employers and withholding agents. Withholding tax tables and instructions for employers. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. State withholding tax is the money an employer is required to.

Web How To Calculate 2022 Alabama State Income Tax By Using State Income Tax Table 1.

Mat is an online filing system. Web the alabama state tax tables for 2022 displayed on this page are provided in support of the 2022 us tax calculator and the dedicated 2022 alabama state tax calculator. Find your pretax deductions, including 401k, flexible. There are a few variations of.

Web State Withholding Tax Alabama Is One Of Many States Which Impose A State Tax On Personal Income.

Details on how to only. Web any correspondence concerning this form should be sent to the alabama department of revenue, individual and corporate tax division, withholding tax section, p.o. Pay period 12, 2022 summary the income tax withholding formula for the state of alabama includes the following changes: Web the withholding tables provided in the “withholding tax tables and instructions for employers and withholding agents” have been updated to reflect these.

Web In Late April, The Alabama Department Of Revenue Issued Revised Withholding Tax Tables And Instructions For Employers And Withholding Agents To Reflect Changes To The.

Web to assist you in reviewing your state income tax withholding rates for 2022, below is a chart of the most recent income tax withholding tables published by states and us. If you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim an exemption from alabama. This form is used by alabama residents who file an individual income tax return. Find your income exemptions 2.