Allegheny County Homestead Exemption Form

Allegheny County Homestead Exemption Form - Web to see the format for the homestead/farmstead application, please visit the application for homestead and farmstead exclusions. 2024 application will be available in the spring. Do you use this property as your primary residence? To qualify, you must be the owner and occupy the dwelling as your primary residence. The application deadline is march 1 of each year. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Signnow has paid close attention to ios users and developed an application just for them. Web how do i apply for homestead exemption in allegheny county? To qualify for the allegheny county homestead act, you must be the owner of the property and occupy the dwelling as your primary residence. Homeowners should contact their county assessment office (position 48) for a copy of their county’s homestead and farmstead application form.

Web the treasurer’s office administrates act 77, senior citizen tax relief, which entitles qualified senior citizen homeowners to a flat 30% discount on the real estate tax on their primary residence. Web allegheny county homestead exemptioneasily create electronic signatures for signing an allegheny county homestead exemption form in pdf format. The application deadline is march 1 of each year. Homeowners should contact their county assessment office (position 48) for a copy of their county’s homestead and farmstead application form. You do not have to reapply each year. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Web notification letter request to include tax delinquent properties in treasurer’s sale form discount extension form if you did not meet the 2% discount deadline (february 10th) of the current tax year, you can complete discount. To qualify, you must be the owner and occupy the dwelling as your primary residence. Web how do i apply for homestead exemption in allegheny county? Web to see the format for the homestead/farmstead application, please visit the application for homestead and farmstead exclusions.

2024 application will be available in the spring. Web the treasurer’s office administrates act 77, senior citizen tax relief, which entitles qualified senior citizen homeowners to a flat 30% discount on the real estate tax on their primary residence. To qualify, you must be the owner and occupy the dwelling as your primary residence. Web to see the format for the homestead/farmstead application, please visit the application for homestead and farmstead exclusions. The application deadline is march 1st of each year. The exemptions apply only to property that you own and occupy as your principal place of residence. The application deadline is march 1 of each year. To qualify, you must be the owner and occupy the dwelling as your primary residence. Homeowners should contact their county assessment office (position 48) for a copy of their county’s homestead and farmstead application form. Web the homestead act (act 50) is a program that reduces your market value by $15,000 for county taxes only.

2007 Form OH DTE 105A Fill Online, Printable, Fillable, Blank pdfFiller

To qualify for the allegheny county homestead act, you must be the owner of the property and occupy the dwelling as your primary residence. Web how do i apply for homestead exemption in allegheny county? The application deadline is march 1 of each year. Signnow has paid close attention to ios users and developed an application just for them. Yes.

Hays County Homestead Exemption Form 2023

Web the treasurer’s office administrates act 77, senior citizen tax relief, which entitles qualified senior citizen homeowners to a flat 30% discount on the real estate tax on their primary residence. 2024 application will be available in the spring. Web how do i apply for homestead exemption in allegheny county? Web the homestead act (act 50) is a program that.

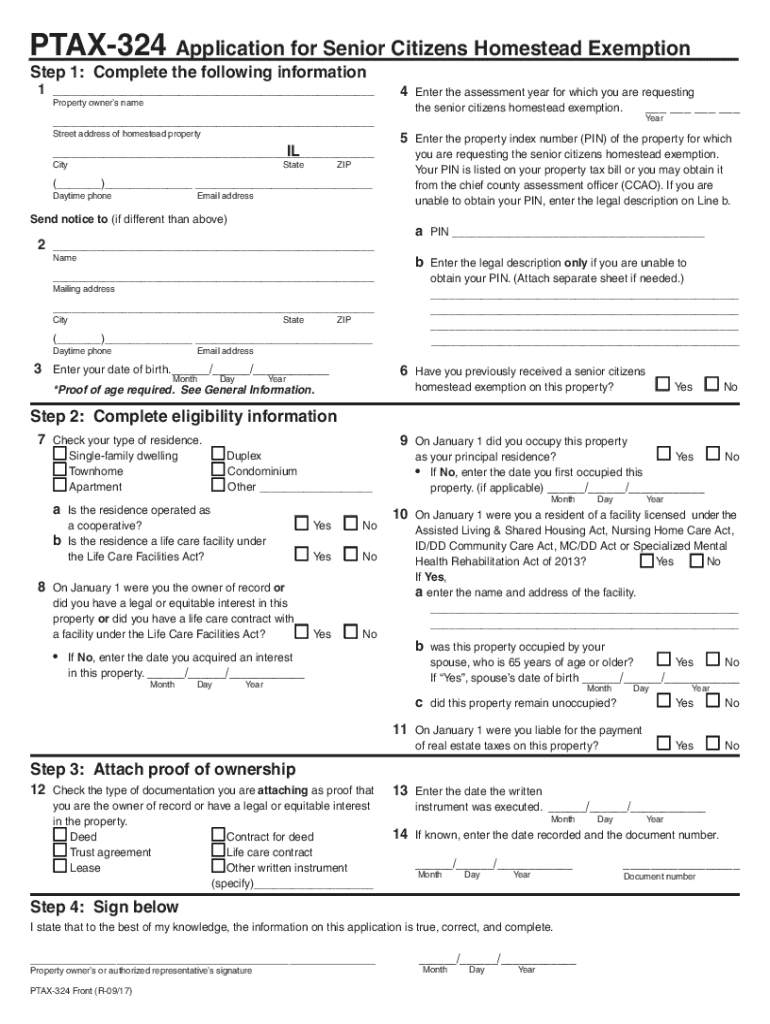

Ptax 324 Fill Out and Sign Printable PDF Template signNow

Do you use this property as your primary residence? Signnow has paid close attention to ios users and developed an application just for them. Web how do i apply for homestead exemption in allegheny county? The exemptions apply only to property that you own and occupy as your principal place of residence. Web the treasurer’s office administrates act 77, senior.

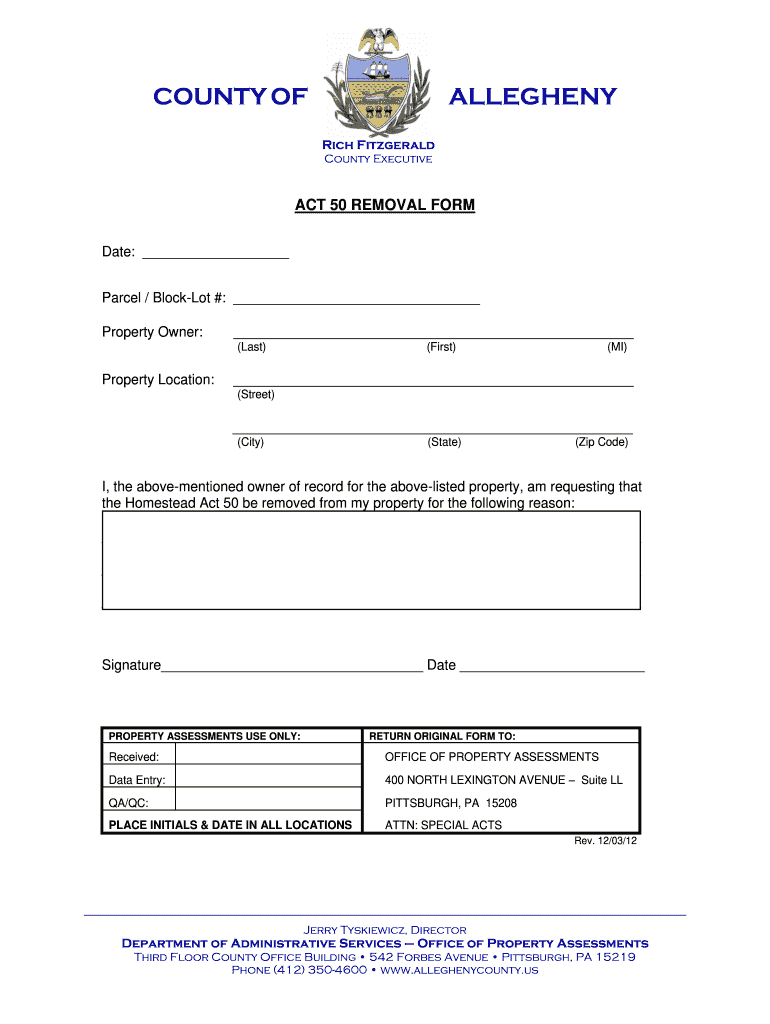

Allegheny County Homestead Exemption Fill Out and Sign Printable PDF

Web the treasurer’s office administrates act 77, senior citizen tax relief, which entitles qualified senior citizen homeowners to a flat 30% discount on the real estate tax on their primary residence. You do not have to reapply each year. Do you use this property as your primary residence? 2024 application will be available in the spring. Signnow has paid close.

Fill Free fillable County of Allegheny ACT 50 Application for

Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. The application deadline is march 1st of each year. Homeowners should contact their county assessment office (position 48) for a copy of their county’s homestead and farmstead application form. Web how do i apply for homestead exemption in allegheny.

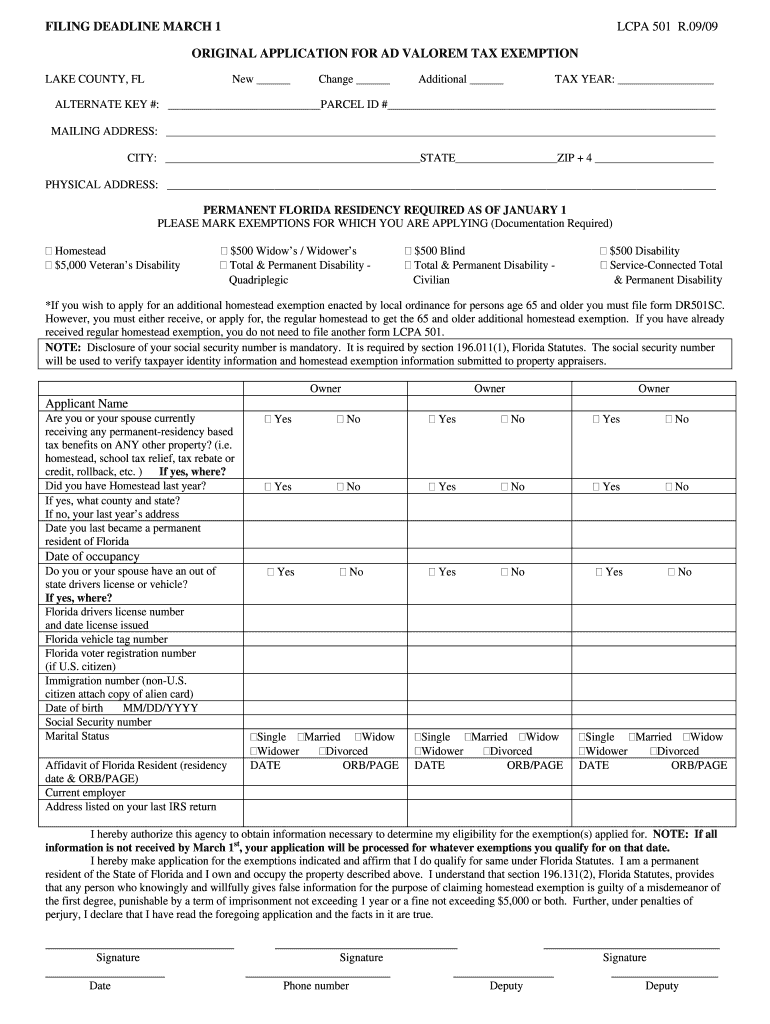

St Lucie County Homestead Exemption Form Fill Out and Sign Printable

You do not have to reapply each year. The exemptions apply only to property that you own and occupy as your principal place of residence. To qualify for the allegheny county homestead act, you must be the owner of the property and occupy the dwelling as your primary residence. Web to see the format for the homestead/farmstead application, please visit.

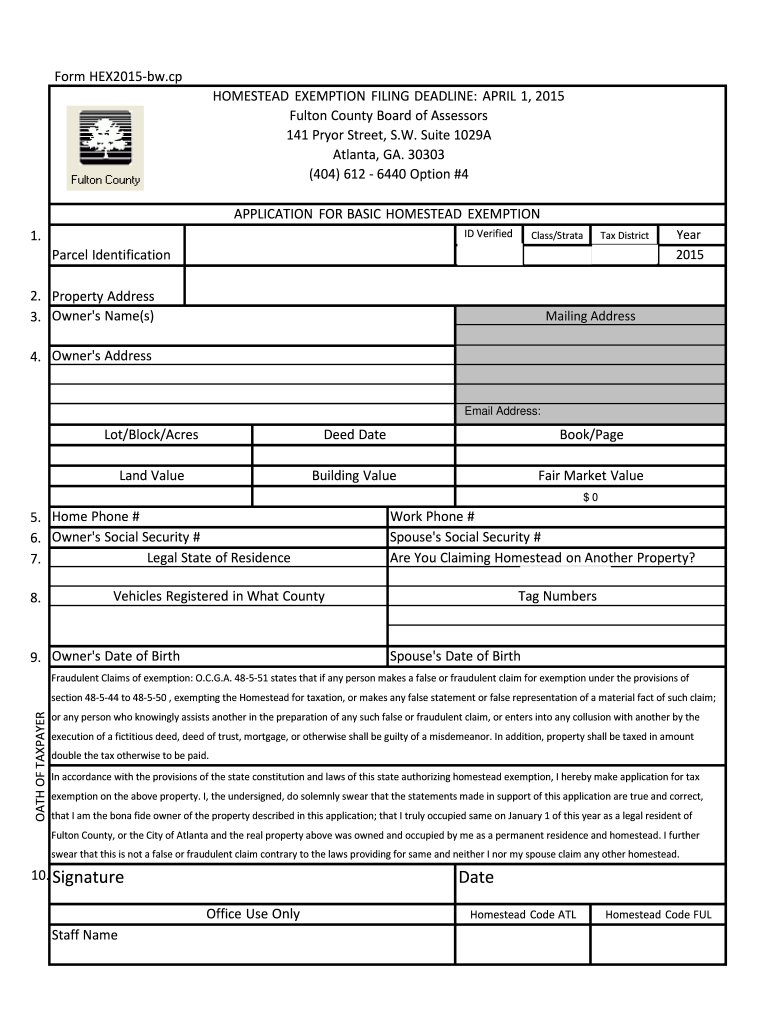

Fulton County Homestead Exemption Form Fill Out and Sign Printable

The application deadline is march 1 of each year. Do you use this property as your primary residence? You do not have to reapply each year. The application deadline is march 1st of each year. 2024 application will be available in the spring.

Fillable Form T 1058 Homestead Exemption Update 1996 Printable Pdf

The application deadline is march 1st of each year. You do not have to reapply each year. Web the homestead act (act 50) is a program that reduces your market value by $18,000 for county taxes only. To qualify, you must be the owner and occupy the dwelling as your primary residence. You do not have to reapply each year.

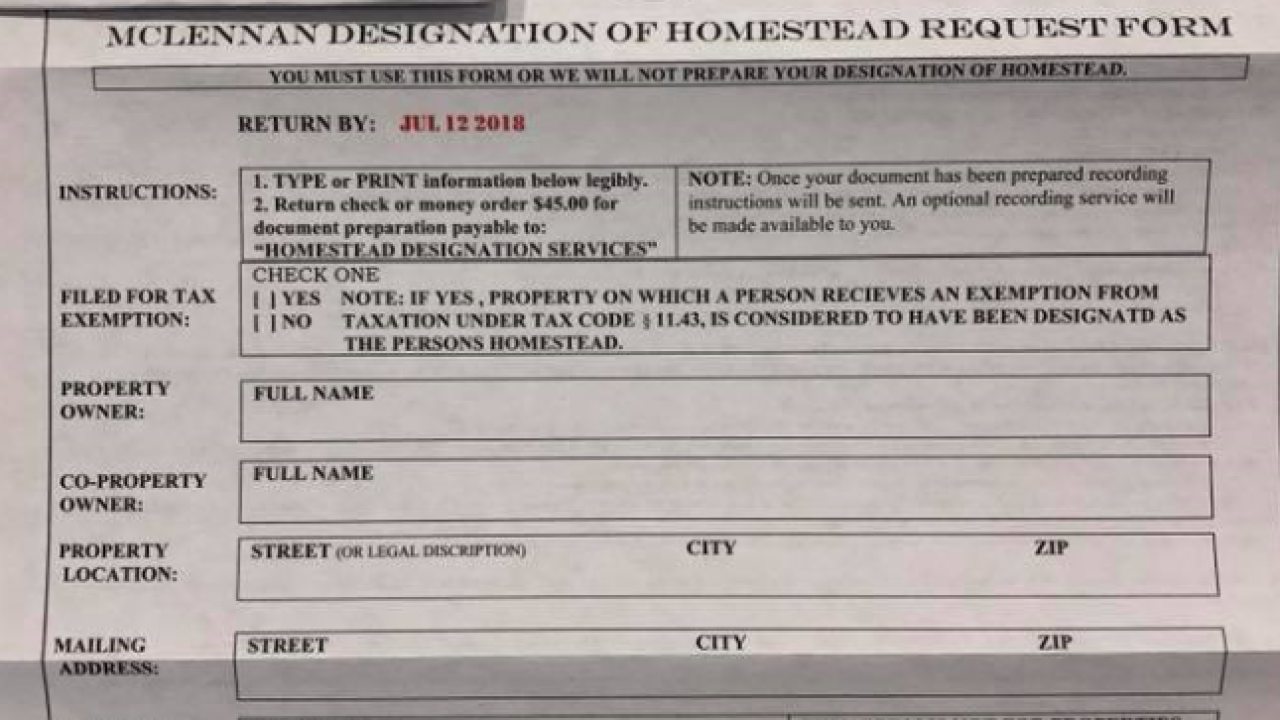

Homestead Exemption Form O'Connor Property Tax Reduction Experts

Homeowners should contact their county assessment office (position 48) for a copy of their county’s homestead and farmstead application form. Web allegheny county homestead exemptioneasily create electronic signatures for signing an allegheny county homestead exemption form in pdf format. Web to see the format for the homestead/farmstead application, please visit the application for homestead and farmstead exclusions. 2024 application will.

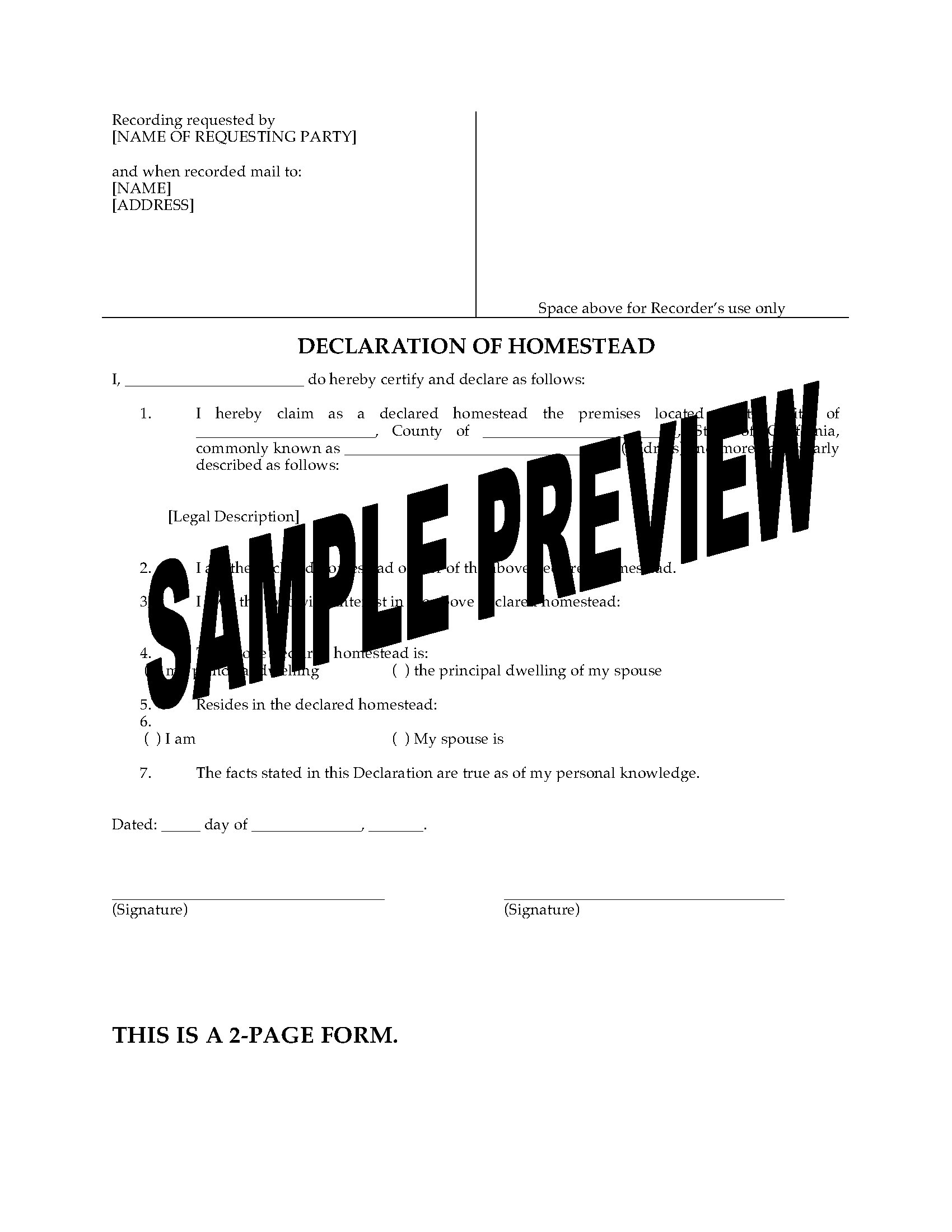

California Homestead Exemption Form Riverside County

Web allegheny county homestead exemptioneasily create electronic signatures for signing an allegheny county homestead exemption form in pdf format. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. You do not have to reapply each year. 2024 application will be available in the spring. The application deadline is.

Web The Homestead Act (Act 50) Is A Program That Reduces Your Market Value By $18,000 For County Taxes Only.

You do not have to reapply each year. Yes no do you claim anywhere else as your primary residence? Web how do i apply for homestead exemption in allegheny county? To qualify for the allegheny county homestead act, you must be the owner of the property and occupy the dwelling as your primary residence.

To Qualify, You Must Be The Owner And Occupy The Dwelling As Your Primary Residence.

2024 application will be available in the spring. Homeowners should contact their county assessment office (position 48) for a copy of their county’s homestead and farmstead application form. Web to see the format for the homestead/farmstead application, please visit the application for homestead and farmstead exclusions. The exemptions apply only to property that you own and occupy as your principal place of residence.

The Application Deadline Is March 1St Of Each Year.

To qualify, you must be the owner and occupy the dwelling as your primary residence. Web the treasurer’s office administrates act 77, senior citizen tax relief, which entitles qualified senior citizen homeowners to a flat 30% discount on the real estate tax on their primary residence. The application deadline is march 1 of each year. Web the homestead act (act 50) is a program that reduces your market value by $15,000 for county taxes only.

Web Notification Letter Request To Include Tax Delinquent Properties In Treasurer’s Sale Form Discount Extension Form If You Did Not Meet The 2% Discount Deadline (February 10Th) Of The Current Tax Year, You Can Complete Discount.

You do not have to reapply each year. Do you use this property as your primary residence? Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Web allegheny county homestead exemptioneasily create electronic signatures for signing an allegheny county homestead exemption form in pdf format.