Amount Of Money Generated By A Property In A Year

Amount Of Money Generated By A Property In A Year - Let’s say i have a $100,000 property i bought last year with a $70,000. While rental property offers the potential for generating profits through recurring income, appreciation in property value, and tax benefits,. This cash flow rule helps real. The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. My annual cash flow last year was $3,000, and it appreciated by. Cash flow is the amount of money generated by an investment property after accounting for all income and expenses.

My annual cash flow last year was $3,000, and it appreciated by. While rental property offers the potential for generating profits through recurring income, appreciation in property value, and tax benefits,. The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. This cash flow rule helps real. Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. Let’s say i have a $100,000 property i bought last year with a $70,000.

Let’s say i have a $100,000 property i bought last year with a $70,000. Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. My annual cash flow last year was $3,000, and it appreciated by. The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. While rental property offers the potential for generating profits through recurring income, appreciation in property value, and tax benefits,. This cash flow rule helps real.

How to Create a Real Estate Investment Model in Excel Financial Edge

The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. This cash flow rule helps real. Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. While rental property offers the potential for generating profits through recurring income, appreciation in property value,.

US Tax Revenue Government Revenue in the US Tax Foundation

My annual cash flow last year was $3,000, and it appreciated by. The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. This cash flow rule helps real. While rental property offers the potential for generating profits through recurring income, appreciation in property value, and tax benefits,. Cash flow is the.

How Real Estate Can Generate For the Retirement Years Ed

Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. Let’s say i have a $100,000 property i bought last year with a $70,000. The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. This cash flow rule helps real. While rental.

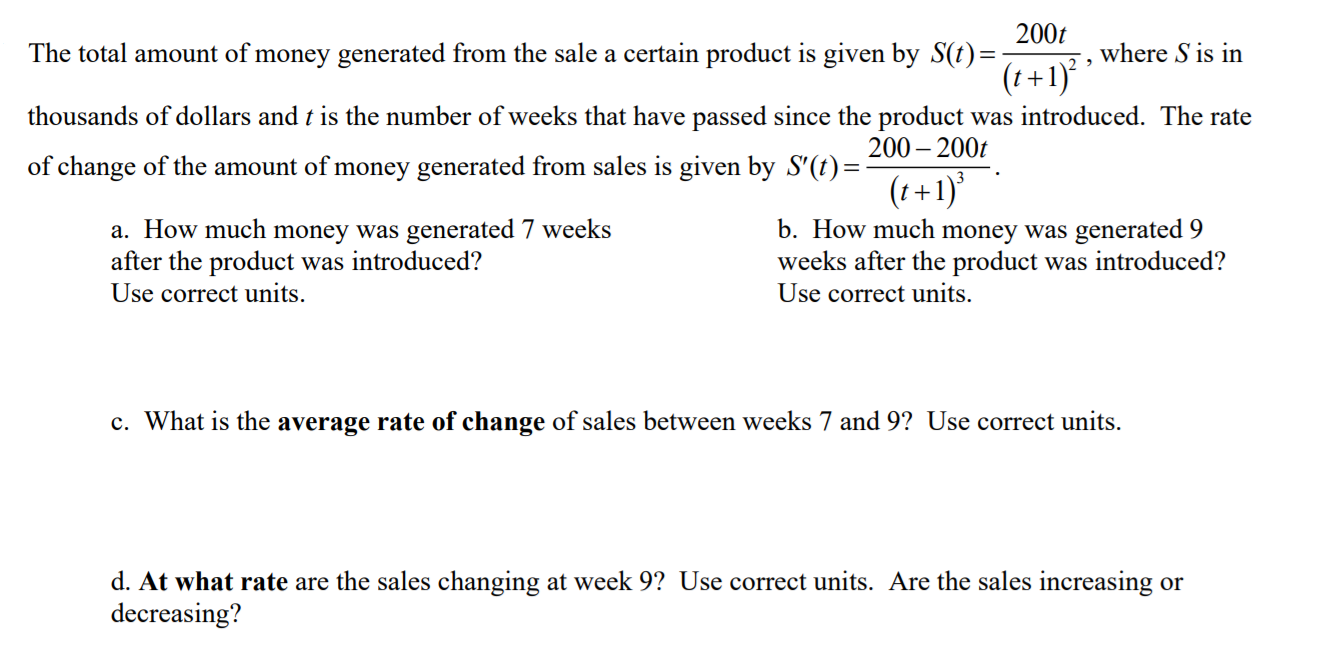

Solved The total amount of money generated from the sale a

Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. This cash flow rule helps real. While rental property offers the potential for generating profits through recurring income, appreciation in property value,.

Real Estate Investing Tips for Beginners

My annual cash flow last year was $3,000, and it appreciated by. Let’s say i have a $100,000 property i bought last year with a $70,000. This cash flow rule helps real. The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. Cash flow is the amount of money generated by.

How to Make Money in Real Estate

My annual cash flow last year was $3,000, and it appreciated by. This cash flow rule helps real. While rental property offers the potential for generating profits through recurring income, appreciation in property value, and tax benefits,. Let’s say i have a $100,000 property i bought last year with a $70,000. Cash flow is the amount of money generated by.

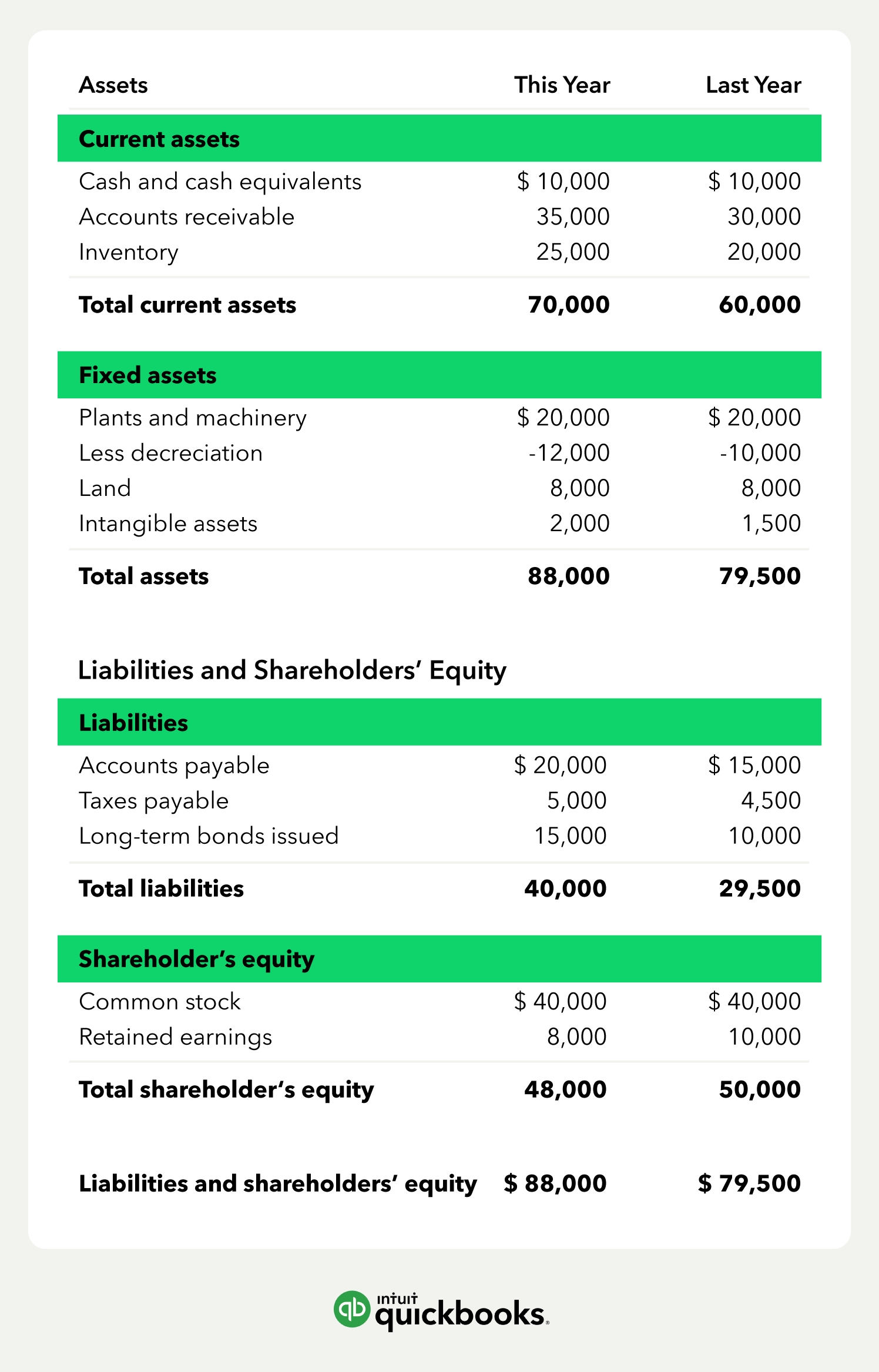

How to Read & Prepare a Balance Sheet QuickBooks

This cash flow rule helps real. Let’s say i have a $100,000 property i bought last year with a $70,000. My annual cash flow last year was $3,000, and it appreciated by. Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. While rental property offers the potential for generating profits.

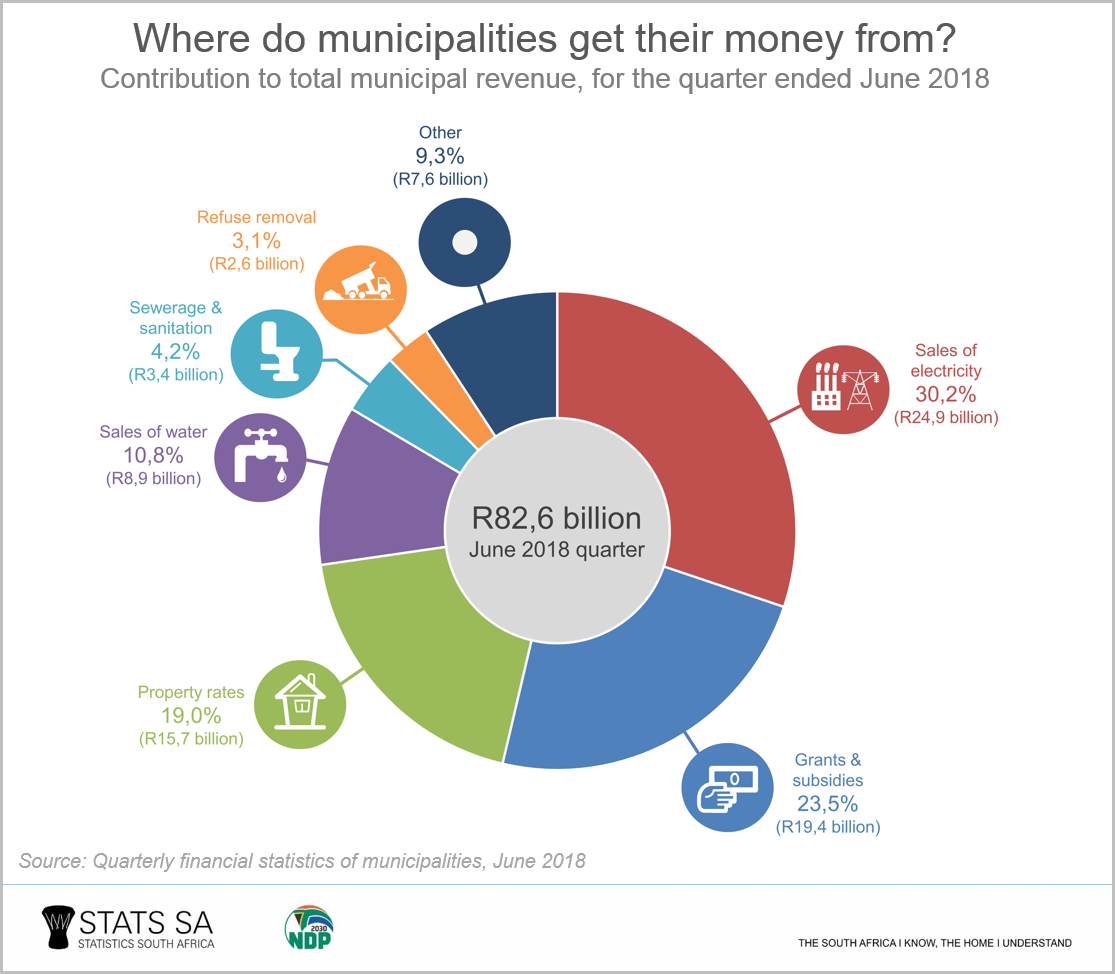

An update to municipal spending and revenue (June 2018) Statistics

Let’s say i have a $100,000 property i bought last year with a $70,000. While rental property offers the potential for generating profits through recurring income, appreciation in property value, and tax benefits,. The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. My annual cash flow last year was $3,000,.

This cash flow rule helps real. Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. My annual cash flow last year was $3,000, and it appreciated by. The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. Let’s say i have.

53 Important Statistics About How Much Data Is Created Every Day in

The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. This cash flow rule helps real. While rental property offers the potential for generating profits through recurring income, appreciation in property value,.

The 2% Cash Flow Rule Of Thumb Calculates The Amount Of Rental Income A Property Can Expected To Generate.

This cash flow rule helps real. My annual cash flow last year was $3,000, and it appreciated by. Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. While rental property offers the potential for generating profits through recurring income, appreciation in property value, and tax benefits,.

:max_bytes(150000):strip_icc()/real-estate-investing-101-357985-final-5bdb4da04cedfd0026ac6b3f.png)

:max_bytes(150000):strip_icc()/HOWMONEYISMADEREALESTATEFINALJPEG-8db8883c13df4233ba2aad6ae392647f.jpg)