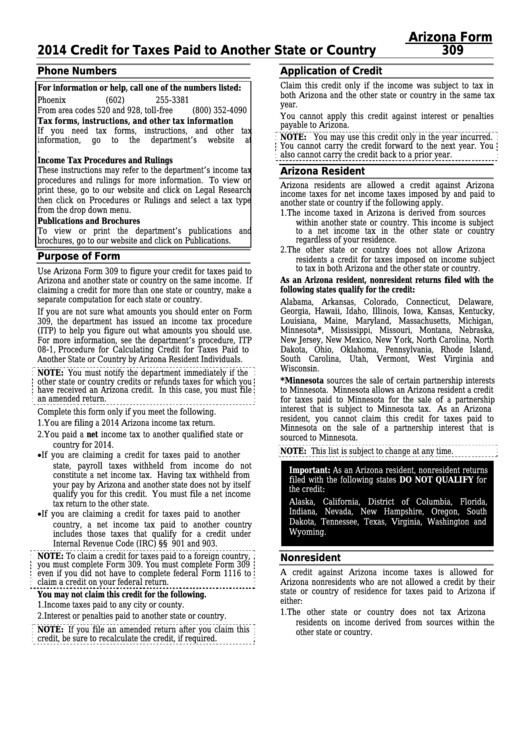

Arizona Form 309 Instructions

Arizona Form 309 Instructions - 9 enter the amount of personal exemption claimed on arizona form 140, page 1, line 18 plus the amount. Web page 5 of the instructions for a list of state abbreviations. Web home check return error: Per the az form 309 instructions: If you cannot carry the credit forward to the next year. Web we last updated the credit for taxes paid to another state or country in february 2023, so this is the latest version of form 309, fully updated for tax year 2022. Web arizona form 301, nonrefundable individual tax credits and recapture, and include form 301 and form(s) 309 with your tax return to claim this credit. A separate form must be filed for each state or country for which a credit is. Web those individuals taxed on income earned in another state and in arizona may earn a credit for taxes paid. Web $ 5 income subject to tax by both arizona and the other state or country.

Verify the list of accepted states as it is subject to. Its purpose is to calculate the income subject to tax by both arizona and another state to. A separate form must be filed for each. If you cannot carry the credit forward to the next year. Web those individuals taxed on income earned in another state and in arizona may earn a credit for taxes paid. You also claiming a credit for more than one state or country,. Web arizona form 309credit for taxes paid to another state or country2017 include with your return. A separate form must be filed for each state or country for which a credit is. Web form 309 is an arizona individual income tax form. Per the az form 309 instructions:

Web those individuals taxed on income earned in another state and in arizona may earn a credit for taxes paid. Web what is a form 309? Web form 309 is an arizona individual income tax form. A separate form must be filed for each. Web page 5 of the instructions for a list of state abbreviations. Enter the smaller of the amount entered on line 3 or line 4 5 $ 00 $ 00 6 total income subject to tax in both. Web arizona form 301, nonrefundable individual tax credits and recapture, and include form 301 and form(s) 309 with your tax return to claim this credit. Verify the list of accepted states as it is subject to. Web arizona form 309credit for taxes paid to another state or country2014 include with your return. Fill in the required fields which are.

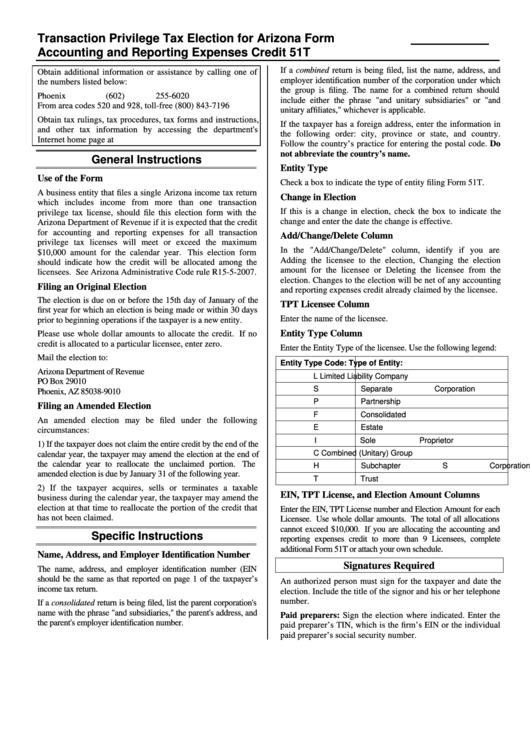

Instructions For Arizona Form 51t printable pdf download

Fill in the required fields which are. Web arizona form 309credit for taxes paid to another state or country2017 include with your return. Web arizona and another state or country on the same income. Web arizona form 309credit for taxes paid to another state or country2014 include with your return. Web arizona form 309credit for taxes paid to another state.

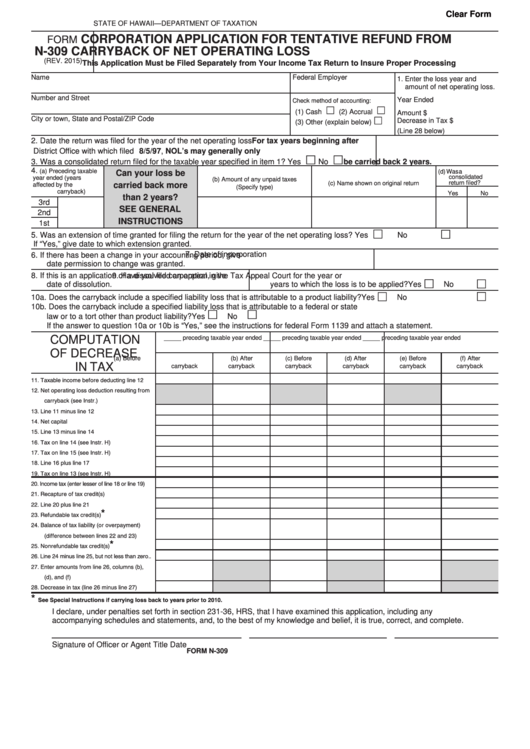

Fillable Form N309 Corporation Application For Tentative Refund From

A separate form must be filed for each state or country for which a credit is. Web $ 5 income subject to tax by both arizona and the other state or country. Web arizona form 301, nonrefundable individual tax credits and recapture, and include form 301 and form(s) 309 with your tax return to claim this credit. Complete this form.

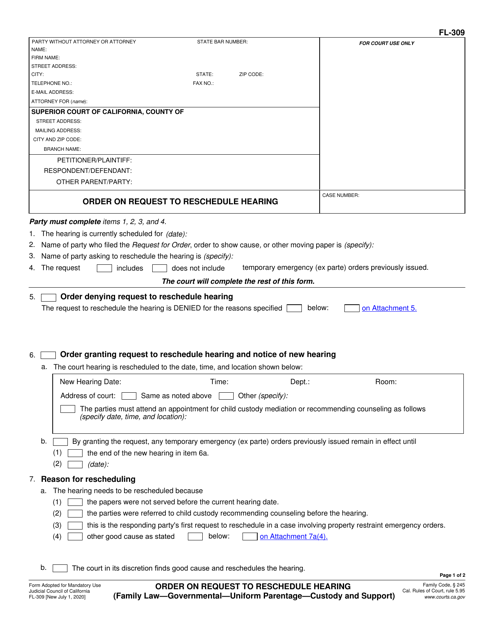

Form FL309 Download Fillable PDF or Fill Online Order on Request to

9 enter the amount of personal exemption claimed on arizona form 140, page 1, line 18 plus the amount. Web arizona form 309credit for taxes paid to another state or country2017 include with your return. If you cannot carry the credit forward to the next year. A separate form must be filed for each state or country for which a.

Arizona Form 309 Instructions Credit For Taxes Paid To Another State

More about the arizona form 309 tax credit we last. Web arizona form 309credit for taxes paid to another state or country2014 include with your return. Web those individuals taxed on income earned in another state and in arizona may earn a credit for taxes paid. Web form 309 is an arizona individual income tax form. Its purpose is to.

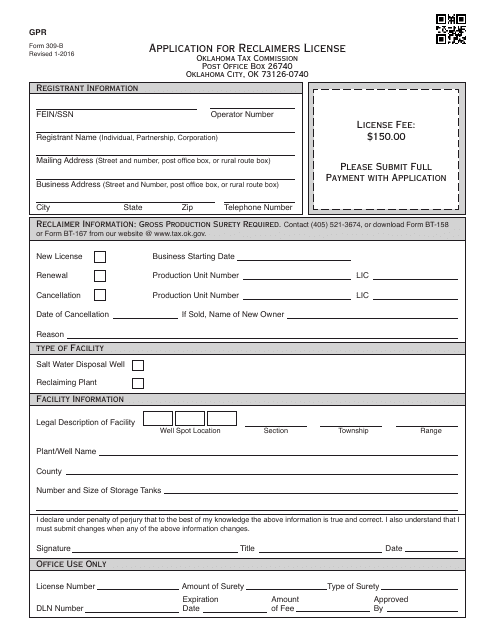

OTC Form 309B Download Printable PDF or Fill Online Application for

A separate form must be filed for each. Fill in the required fields which are. Web page 5 of the instructions for a list of state abbreviations. Enter the smaller of the amount entered on line 3 or line 4 5 $ 00 $ 00 6 total income subject to tax in both. Arizona credit for taxes paid to another.

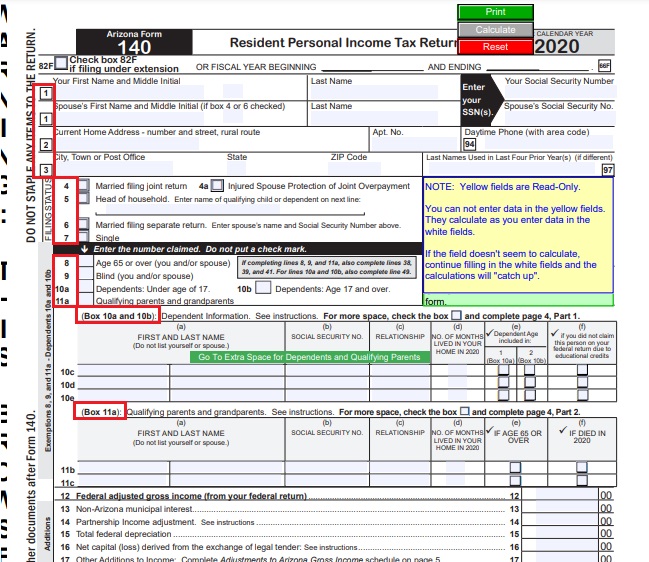

Instructions and Download of Arizona Form 140 Unemployment Gov

Web what is a form 309? Fill in the required fields which are. Web 24 rows a nonrefundable individual tax credit against income tax imposed. 9 enter the amount of personal exemption claimed on arizona form 140, page 1, line 18 plus the amount. Complete this form only if you.

Arizona 4.23 Annual Report Form Download Fillable PDF Templateroller

Web what is a form 309? 9 enter the amount of personal exemption claimed on arizona form 140, page 1, line 18 plus the amount. Web arizona form 309credit for taxes paid to another state or country2020 include with your return. Enter the smaller of the amount entered on line 3 or line 4 5 $ 00 $ 00 6.

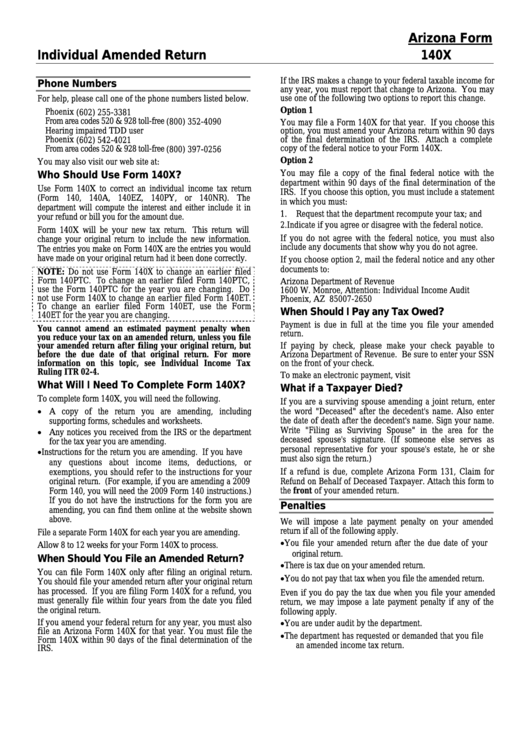

Instructions For Arizona Form 140x Individual Amended Return

Verify the list of accepted states as it is subject to. Web arizona form 309credit for taxes paid to another state or country2017 include with your return. Please see arizona form 309 instructions or income tax ruling (itr). Official form 309 is used to give notice to creditors, equity security holders, and other interested parties of the filing of the.

Instructions and Download of Arizona Form 140 Unemployment Gov

Web arizona and another state or country on the same income. A separate form must be filed for each. A separate form must be filed for each state or country for which a credit is. Its purpose is to calculate the income subject to tax by both arizona and another state to. If you cannot carry the credit forward to.

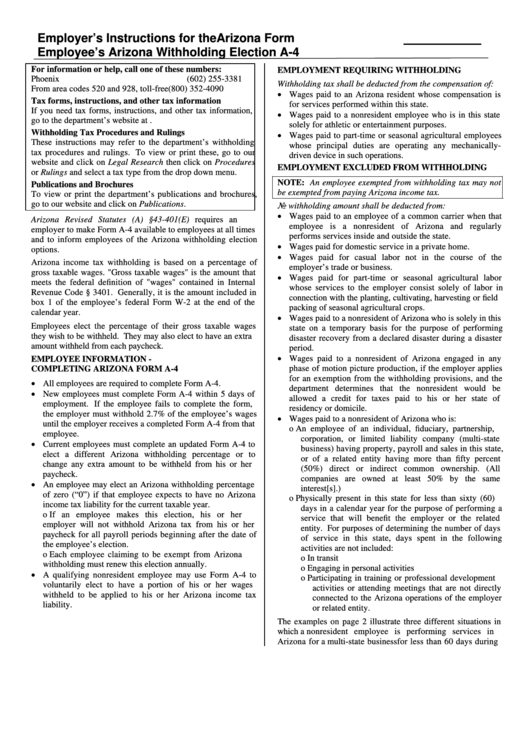

Arizona Form A4 Employer'S Instructions For The Employee'S Arizona

Web arizona form 309credit for taxes paid to another state or country2020 include with your return. Please see arizona form 309 instructions or income tax ruling (itr). Web arizona and another state or country on the same income. Its purpose is to calculate the income subject to tax by both arizona and another state to. A separate form must be.

A Separate Form Must Be Filed For Each State Or Country For Which A Credit Is.

Web arizona form 309 credit for taxes paid to another state or country for forms 140, 140nr, 140py and 140x 2022 include with your return. Arizona credit for taxes paid to another state or country (form 309) form 309 is used to claim credit in arizona for taxes paid to another state or country. Web we last updated the credit for taxes paid to another state or country in february 2023, so this is the latest version of form 309, fully updated for tax year 2022. Web arizona form 301, nonrefundable individual tax credits and recapture, and include form 301 and form(s) 309 with your tax return to claim this credit.

More About The Arizona Form 309 Tax Credit We Last.

Web $ 5 income subject to tax by both arizona and the other state or country. Web arizona form 309credit for taxes paid to another state or country2014 include with your return. Web arizona form 309credit for taxes paid to another state or country2017 include with your return. Per the az form 309 instructions:

Web Arizona And Another State Or Country On The Same Income.

Web arizona form 309credit for taxes paid to another state or country2020 include with your return. You also claiming a credit for more than one state or country,. Web 24 rows a nonrefundable individual tax credit against income tax imposed. 9 enter the amount of personal exemption claimed on arizona form 140, page 1, line 18 plus the amount.

A Separate Form Must Be Filed For Each State Or Country For Which A Credit Is.

Web those individuals taxed on income earned in another state and in arizona may earn a credit for taxes paid. Official form 309 is used to give notice to creditors, equity security holders, and other interested parties of the filing of the bankruptcy case, the time, date,. Verify the list of accepted states as it is subject to. Fill in the required fields which are.