Arkansas Miller Trust Form

Arkansas Miller Trust Form - Web download miller county arkansas deed of trust and promissory note forms | available for immediate download from deeds.com Web arkansas miller trust forms for medicaid category: Web the dhs provides an explanation and resource guide for miller trusts, also known as irrevocable income trust. State placed cap on the amount of income an individual can receive and still execute a miller trust. Arkansas change state control #: Web the purpose of this trust is to hold and distribute income for those over the income limit. Many people are forced to seek medicaid eligibility. Web updated june 01, 2022 the arkansas living trust is a form that allows a grantor to transfer their assets and property to a separate entity to be distributed to a. Rich text instant download buy. Web medicaid introduction paying for nursing home care can be hard for many arkansans.

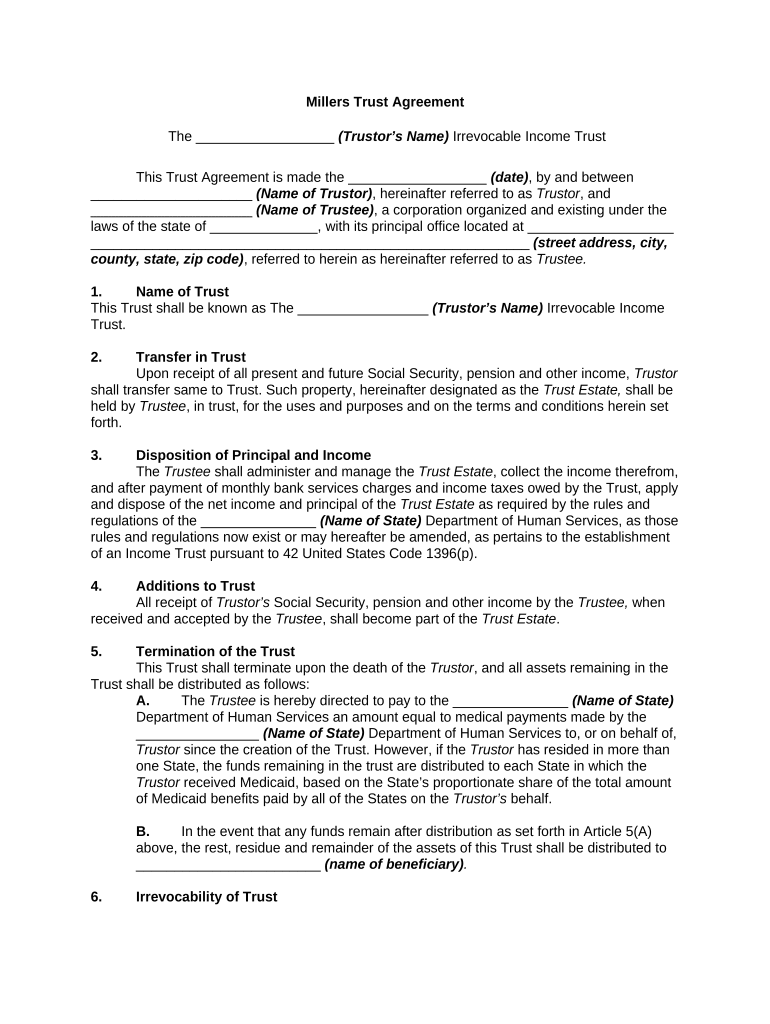

The individual’s income flows into the trust each month,. Web arkansas miller trust forms for medicaid category: Rich text instant download buy. Web how to fill out arkansas qualified income miller trust? Web updated june 01, 2022 the arkansas living trust is a form that allows a grantor to transfer their assets and property to a separate entity to be distributed to a. Web arkansas miller trust form the forms professionals trust! Web miller trust resources helpful forms and resources the dhs provides an explanation and resource guide for miller trusts, also known as irrevocable income trust. Many people are forced to seek medicaid eligibility. Web the purpose of this trust is to hold and distribute income for those over the income limit. Web miller trusts, also called qualified income trusts, provide a way for nursing home medicaid and medicaid waiver applicants who have income over medicaid’s limit.

Web what is the arkansas satisfaction of deed of trust? Web how to fill out arkansas qualified income miller trust? Web arkansas miller trust forms for medicaid category: Web arkansas miller trust form the forms professionals trust! Rich text instant download buy. Web updated june 01, 2022 the arkansas living trust is a form that allows a grantor to transfer their assets and property to a separate entity to be distributed to a. Web miller trusts, also called qualified income trusts, provide a way for nursing home medicaid and medicaid waiver applicants who have income over medicaid’s limit. Many people are forced to seek medicaid eligibility. Web the current income limit in arkansas is $2,382. State placed cap on the amount of income an individual can receive and still execute a miller trust.

Should I Use A Miller Trust For Medicaid Qualification? The Elder Law

Web medicaid introduction paying for nursing home care can be hard for many arkansans. (the trustee of a deed of trust or a person employed by the trustee shall reconvey all or any part of the property. Web miller trust resources helpful forms and resources the dhs provides an explanation and resource guide for miller trusts, also known as irrevocable.

Miller Trust Long Term Assurance

Web the dhs provides an explanation and resource guide for miller trusts, also known as irrevocable income trust. Web to provide for a qualified income trust, also known as a miller trust. Web updated june 01, 2022 the arkansas living trust is a form that allows a grantor to transfer their assets and property to a separate entity to be.

Miller Trust Alaska Fill Out and Sign Printable PDF Template signNow

Web miller trusts, also called qualified income trusts, provide a way for nursing home medicaid and medicaid waiver applicants who have income over medicaid’s limit. The individual’s income flows into the trust each month,. State placed cap on the amount of income an individual can receive and still execute a miller trust. Web the dhs provides an explanation and resource.

Miller Trust Form Fill Out and Sign Printable PDF Template signNow

Web miller trust resources helpful forms and resources the dhs provides an explanation and resource guide for miller trusts, also known as irrevocable income trust. Web arkansas miller trust forms for medicaid category: Web arkansas miller trust form the forms professionals trust! Web to provide for a qualified income trust, also known as a miller trust. Many people are forced.

How are Miller Trust or QIT Funds Spent?

Be it enacted by the general assembly of the state of. The individual’s income flows into the trust each month,. Web the current income limit in arkansas is $2,382. Web download miller county arkansas deed of trust and promissory note forms | available for immediate download from deeds.com Web miller trusts, also called qualified income trusts, provide a way for.

What is a Miller Trust? YouTube

Web the current income limit in arkansas is $2,382. Web what is the arkansas satisfaction of deed of trust? State placed cap on the amount of income an individual can receive and still execute a miller trust. Web arkansas miller trust form the forms professionals trust! Arkansas change state control #:

Miller Trust Fort Pierce, FL for Sale

Web updated june 01, 2022 the arkansas living trust is a form that allows a grantor to transfer their assets and property to a separate entity to be distributed to a. Web how to fill out arkansas qualified income miller trust? It allows a medicaid applicant with more than the allowable amount of. Many people are forced to seek medicaid.

Arkansas Miller Trust Form US Legal Forms

Web miller trusts, also called qualified income trusts, provide a way for nursing home medicaid and medicaid waiver applicants who have income over medicaid’s limit. Web what is the arkansas satisfaction of deed of trust? State placed cap on the amount of income an individual can receive and still execute a miller trust. It allows a medicaid applicant with more.

Arkansas Miller Trust Form US Legal Forms

(the trustee of a deed of trust or a person employed by the trustee shall reconvey all or any part of the property. Web the dhs provides an explanation and resource guide for miller trusts, also known as irrevocable income trust. Rich text instant download buy. Web to provide for a qualified income trust, also known as a miller trust..

Do Miller Trusts have to File Tax Returns?

Get the document you require in the library of legal. Web miller trusts, also called qualified income trusts, provide a way for nursing home medicaid and medicaid waiver applicants who have income over medicaid’s limit. Web to provide for a qualified income trust, also known as a miller trust. Web medicaid introduction paying for nursing home care can be hard.

Many People Are Forced To Seek Medicaid Eligibility.

Web how to fill out arkansas qualified income miller trust? Web updated june 01, 2022 the arkansas living trust is a form that allows a grantor to transfer their assets and property to a separate entity to be distributed to a. Web arkansas miller trust form the forms professionals trust! Arkansas change state control #:

Web Medicaid Introduction Paying For Nursing Home Care Can Be Hard For Many Arkansans.

Web the dhs provides an explanation and resource guide for miller trusts, also known as irrevocable income trust. It allows a medicaid applicant with more than the allowable amount of. Web the purpose of this trust is to hold and distribute income for those over the income limit. Web download miller county arkansas deed of trust and promissory note forms | available for immediate download from deeds.com

Web Miller Trust Resources Helpful Forms And Resources The Dhs Provides An Explanation And Resource Guide For Miller Trusts, Also Known As Irrevocable Income Trust.

State placed cap on the amount of income an individual can receive and still execute a miller trust. Get the document you require in the library of legal. Web arkansas miller trust forms for medicaid category: Web what is the arkansas satisfaction of deed of trust?

Web The Current Income Limit In Arkansas Is $2,382.

Be it enacted by the general assembly of the state of. Web to provide for a qualified income trust, also known as a miller trust. Web miller trusts, also called qualified income trusts, provide a way for nursing home medicaid and medicaid waiver applicants who have income over medicaid’s limit. The individual’s income flows into the trust each month,.