Back Door Roth Form

Back Door Roth Form - Web in a traditional ira and 401 (k), retirees need to withdraw distributions each year by april 1 of the year they turn 72 years of age. Do you need a backdoor roth? Web the backdoor roth ira strategy is a legal way to get around the income limits that usually prevent high earners from owning roth iras. Rather, it’s a strategy that helps you move money into a roth ira even though your annual income would. Web let's learn more about the backdoor roth ira and the role that form 8606 plays in making it a reality. Contribute money to a traditional ira account, making sure your brokerage offers roth conversions (most do). (if you have an existing ira, consider how the ira aggregation rule, mentioned above, will affect the conversion.) The steps for setting up a backdoor roth ira are relatively straightforward: Web definitions first, there are three terms which need to be understood when doing backdoor roths: Until 2010, income restrictions kept some people out of roth.

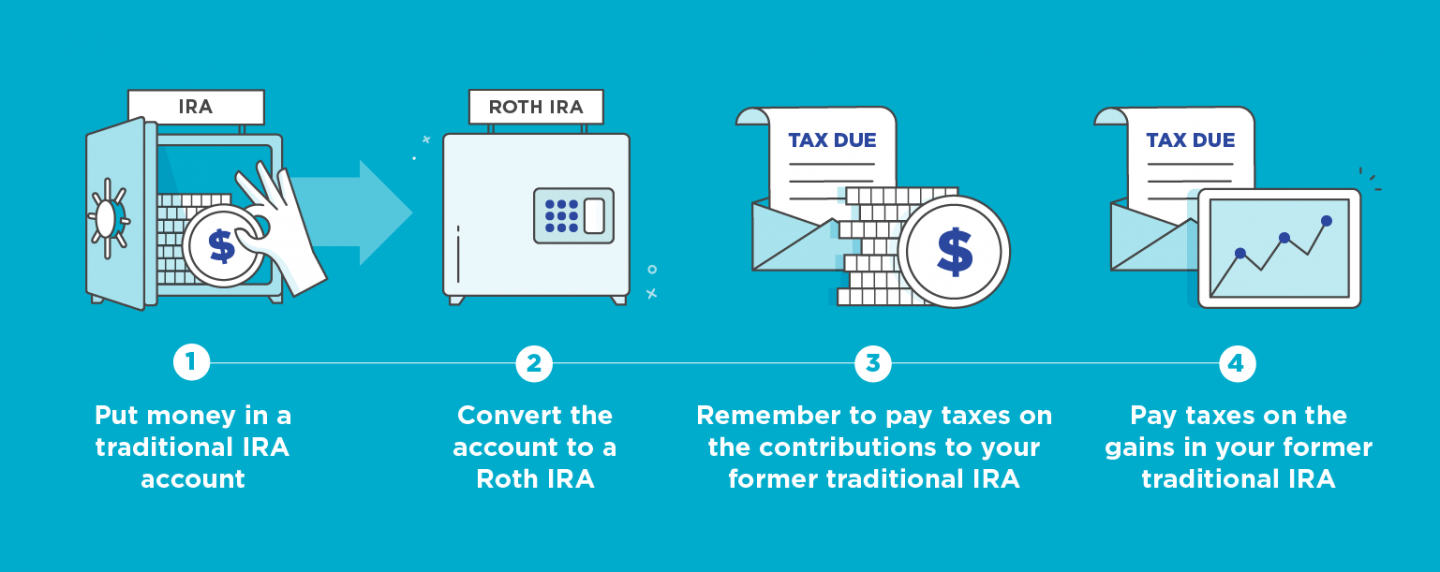

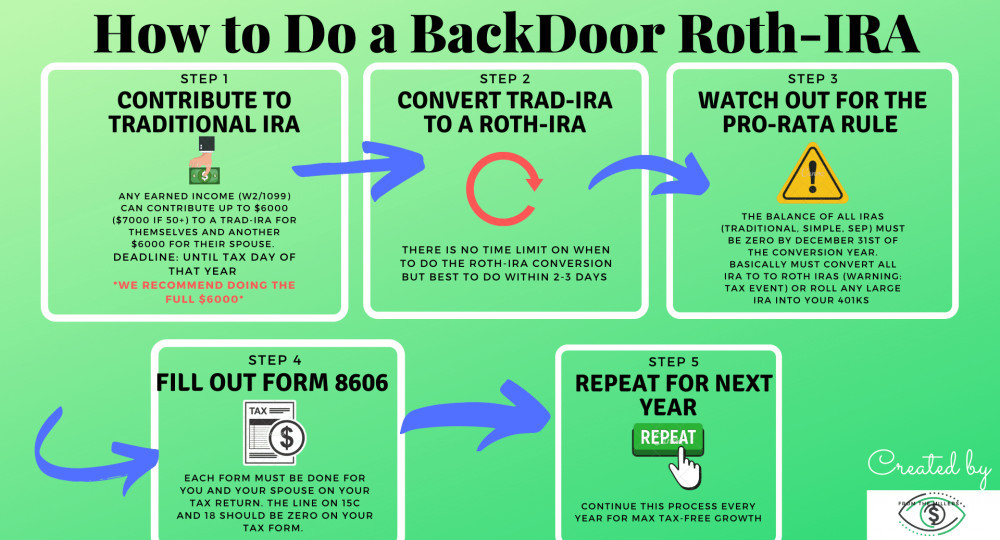

The steps for setting up a backdoor roth ira are relatively straightforward: Web the backdoor roth ira method is pretty easy. (if you have an existing ira, consider how the ira aggregation rule, mentioned above, will affect the conversion.) Contribute money to a traditional ira account, making sure your brokerage offers roth conversions (most do). Web what is a backdoor roth ira? Web how to set up a roth ira to make a backdoor contribution. Web definitions first, there are three terms which need to be understood when doing backdoor roths: The backdoor roth ira strategy is not a tax dodge—in. Web in a traditional ira and 401 (k), retirees need to withdraw distributions each year by april 1 of the year they turn 72 years of age. Do you need a backdoor roth?

Contribute money to a traditional ira account, making sure your brokerage offers roth conversions (most do). The backdoor roth ira strategy is not a tax dodge—in. Web definitions first, there are three terms which need to be understood when doing backdoor roths: Web in a traditional ira and 401 (k), retirees need to withdraw distributions each year by april 1 of the year they turn 72 years of age. Do you need a backdoor roth? Web let's learn more about the backdoor roth ira and the role that form 8606 plays in making it a reality. A backdoor roth ira isn’t a special type of account. Until 2010, income restrictions kept some people out of roth. Web how to set up a roth ira to make a backdoor contribution. Web what is a backdoor roth ira?

When BackDoor Roth IRAs Cause More Harm Than Good Wrenne Financial

Rather, it’s a strategy that helps you move money into a roth ira even though your annual income would. The backdoor roth ira strategy is not a tax dodge—in. Do you need a backdoor roth? (if you have an existing ira, consider how the ira aggregation rule, mentioned above, will affect the conversion.) Web the backdoor roth ira method is.

Mega BackDoor Roth Conversion A Great Option for Supercharging

Rather, it’s a strategy that helps you move money into a roth ira even though your annual income would. Contribute money to a traditional ira account, making sure your brokerage offers roth conversions (most do). The steps for setting up a backdoor roth ira are relatively straightforward: Web a backdoor roth can be created by first contributing to a traditional.

Back Door Roth IRA H&R Block

Until 2010, income restrictions kept some people out of roth. Web in a traditional ira and 401 (k), retirees need to withdraw distributions each year by april 1 of the year they turn 72 years of age. Web let's learn more about the backdoor roth ira and the role that form 8606 plays in making it a reality. Contribute money.

How to Set Up a Backdoor Roth IRA NerdWallet

Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or having earnings that put you. Web definitions first, there are three terms which need to be understood when doing backdoor roths: Contribute money to a traditional ira account, making.

The Mega Back Door Roth Using a Solo 401k Plan My Solo 401k Financial

A backdoor roth ira isn’t a special type of account. The steps for setting up a backdoor roth ira are relatively straightforward: Web in a traditional ira and 401 (k), retirees need to withdraw distributions each year by april 1 of the year they turn 72 years of age. Web definitions first, there are three terms which need to be.

What Is A Backdoor Roth IRA? How Does It Work In 2021? Personal

A backdoor roth ira isn’t a special type of account. Rather, it’s a strategy that helps you move money into a roth ira even though your annual income would. Web the backdoor roth ira strategy is a legal way to get around the income limits that usually prevent high earners from owning roth iras. The backdoor roth ira strategy is.

BackDoor Roth IRAs Premier Tax And Finance

Web definitions first, there are three terms which need to be understood when doing backdoor roths: Until 2010, income restrictions kept some people out of roth. Web let's learn more about the backdoor roth ira and the role that form 8606 plays in making it a reality. Rather, it’s a strategy that helps you move money into a roth ira.

Back Door Roth Conversion Strategy Back doors, Strategies, Tall

Web what is a backdoor roth ira? A backdoor roth ira isn’t a special type of account. Web the backdoor roth ira method is pretty easy. Web definitions first, there are three terms which need to be understood when doing backdoor roths: (if you have an existing ira, consider how the ira aggregation rule, mentioned above, will affect the conversion.)

Backdoor Roth IRA A HowTo Guide Biglaw Investor

Web in a traditional ira and 401 (k), retirees need to withdraw distributions each year by april 1 of the year they turn 72 years of age. You are free to withdraw your funds as per your convenience and there is no restriction on the amount of money that can be withdrawn from a roth ira. The steps for setting.

Back Door Roth IRA Driven Wealth Management San Diego Certified

Web in a traditional ira and 401 (k), retirees need to withdraw distributions each year by april 1 of the year they turn 72 years of age. The backdoor roth ira strategy is not a tax dodge—in. Web the backdoor roth ira method is pretty easy. A backdoor roth ira isn’t a special type of account. Until 2010, income restrictions.

Web In A Traditional Ira And 401 (K), Retirees Need To Withdraw Distributions Each Year By April 1 Of The Year They Turn 72 Years Of Age.

Until 2010, income restrictions kept some people out of roth. You are free to withdraw your funds as per your convenience and there is no restriction on the amount of money that can be withdrawn from a roth ira. Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or having earnings that put you. Web what is a backdoor roth ira?

The Steps For Setting Up A Backdoor Roth Ira Are Relatively Straightforward:

Web how to set up a roth ira to make a backdoor contribution. Web let's learn more about the backdoor roth ira and the role that form 8606 plays in making it a reality. The backdoor roth ira strategy is not a tax dodge—in. Contribute money to a traditional ira account, making sure your brokerage offers roth conversions (most do).

Web The Backdoor Roth Ira Strategy Is A Legal Way To Get Around The Income Limits That Usually Prevent High Earners From Owning Roth Iras.

Web definitions first, there are three terms which need to be understood when doing backdoor roths: (if you have an existing ira, consider how the ira aggregation rule, mentioned above, will affect the conversion.) Rather, it’s a strategy that helps you move money into a roth ira even though your annual income would. Do you need a backdoor roth?

A Backdoor Roth Ira Isn’t A Special Type Of Account.

Web the backdoor roth ira method is pretty easy.