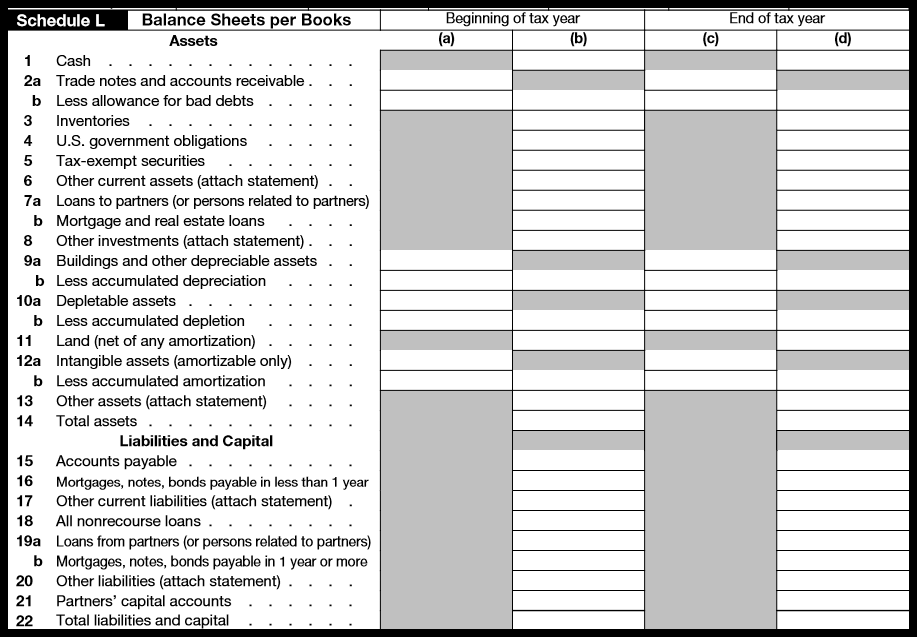

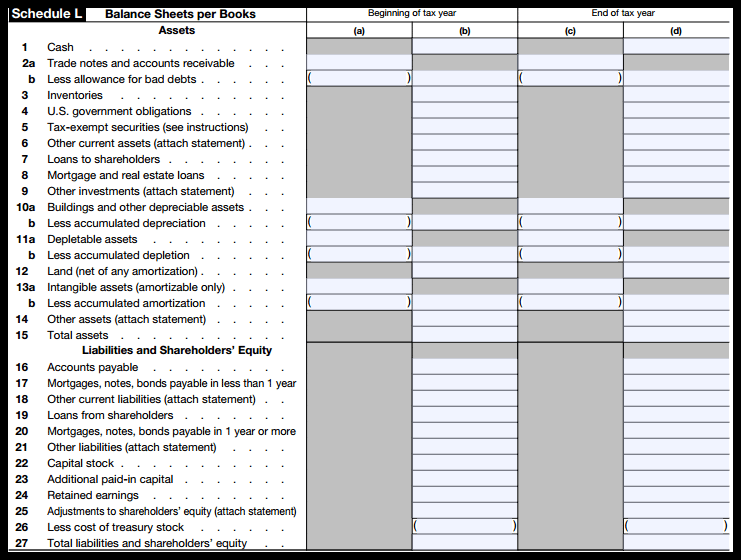

Balance Sheet Schedule L

Balance Sheet Schedule L - If your corporation's total receipts for the tax year. Reconciliation of income (loss) per books. Income tax return for an s corporation where the. First, make sure you actually have to file schedule l.

Income tax return for an s corporation where the. Reconciliation of income (loss) per books. If your corporation's total receipts for the tax year. First, make sure you actually have to file schedule l.

First, make sure you actually have to file schedule l. If your corporation's total receipts for the tax year. Income tax return for an s corporation where the. Reconciliation of income (loss) per books.

Form 7 Analysis Of Net Five Secrets About Form 7 Analysis Of Net

If your corporation's total receipts for the tax year. Reconciliation of income (loss) per books. Income tax return for an s corporation where the. First, make sure you actually have to file schedule l.

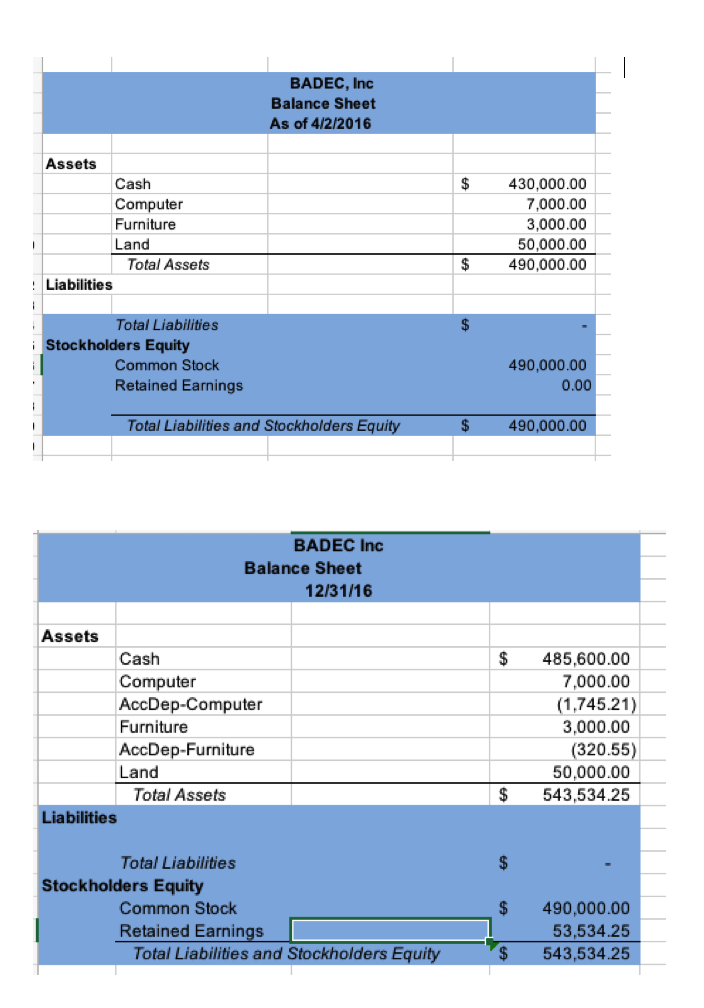

Jeune femme Ponctualité Prélude provisions balance sheet Ouaip

Income tax return for an s corporation where the. First, make sure you actually have to file schedule l. If your corporation's total receipts for the tax year. Reconciliation of income (loss) per books.

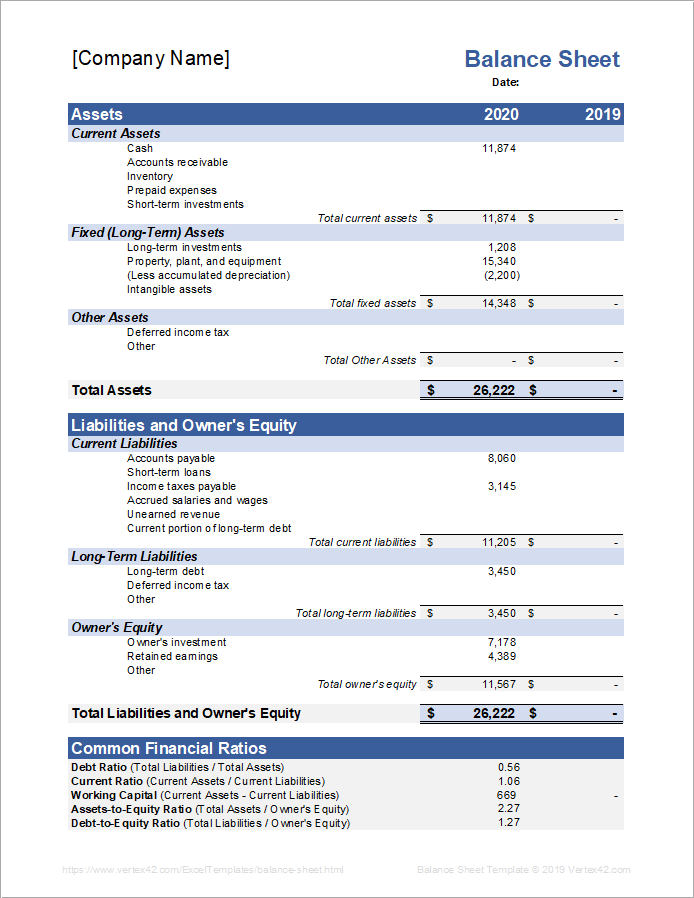

Pin on Free Templates Designs

If your corporation's total receipts for the tax year. Income tax return for an s corporation where the. Reconciliation of income (loss) per books. First, make sure you actually have to file schedule l.

How To Complete Form 1065 US Return of Partnership

Income tax return for an s corporation where the. If your corporation's total receipts for the tax year. First, make sure you actually have to file schedule l. Reconciliation of income (loss) per books.

How to track your business finances all year long? GA advisor

First, make sure you actually have to file schedule l. Income tax return for an s corporation where the. Reconciliation of income (loss) per books. If your corporation's total receipts for the tax year.

Solved Form complete Schedule L for the balance sheet

If your corporation's total receipts for the tax year. Reconciliation of income (loss) per books. First, make sure you actually have to file schedule l. Income tax return for an s corporation where the.

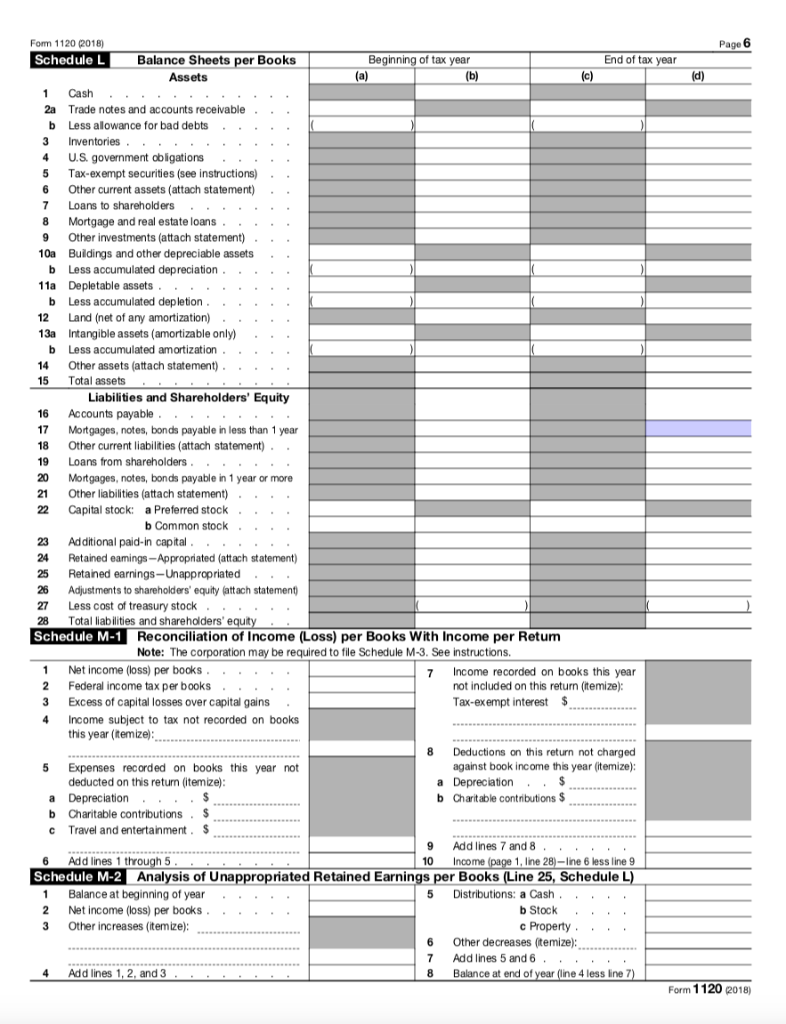

How to Complete Form 1120S Tax Return for an S Corp

If your corporation's total receipts for the tax year. First, make sure you actually have to file schedule l. Reconciliation of income (loss) per books. Income tax return for an s corporation where the.

1120 EF Message 0042 Schedule M2 is out of Balance (M1, M2, ScheduleL)

If your corporation's total receipts for the tax year. Income tax return for an s corporation where the. First, make sure you actually have to file schedule l. Reconciliation of income (loss) per books.

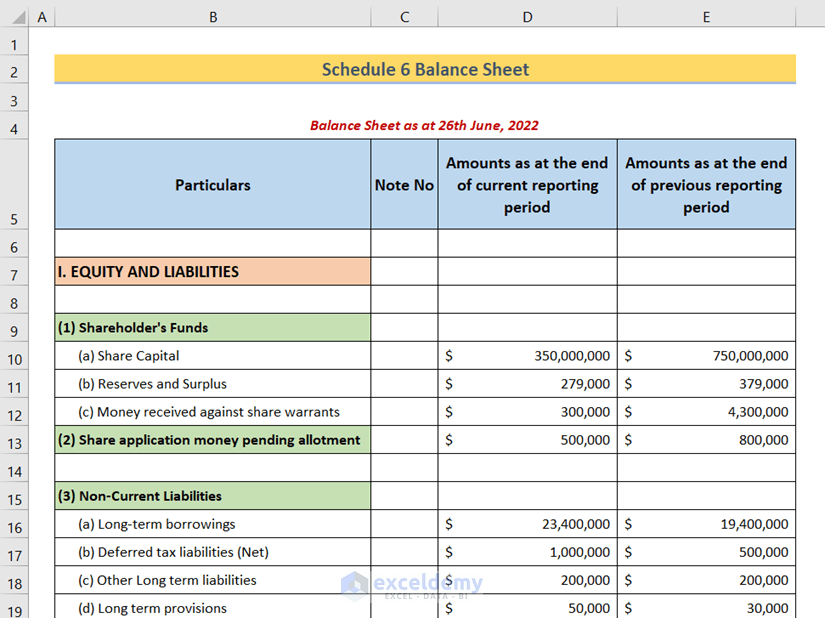

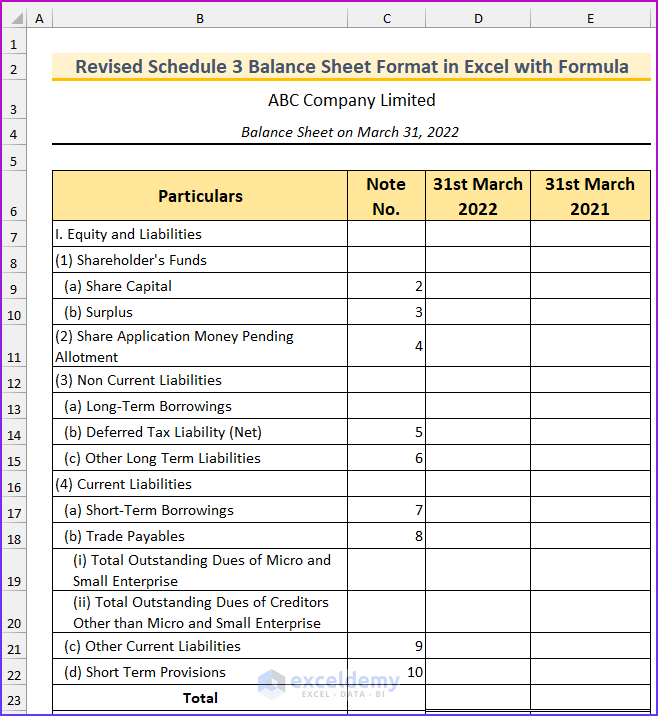

Revised Schedule 3 Balance Sheet Format in Excel with Formula

Reconciliation of income (loss) per books. First, make sure you actually have to file schedule l. Income tax return for an s corporation where the. If your corporation's total receipts for the tax year.

If Your Corporation's Total Receipts For The Tax Year.

Reconciliation of income (loss) per books. First, make sure you actually have to file schedule l. Income tax return for an s corporation where the.