Beneficial Ownership Form

Beneficial Ownership Form - Web specifically, the proposed rule would require reporting companies to file reports with fincen that identify two categories of individuals: Web the form includes identity information about your organization's beneficial owners that have a 25% ownership interest, identity information about one individual with managerial control and a signature of the person providing and certifying this information. Generally, you can treat the payee as a u.s. (1) the beneficial owners of the entity; Under the beneficial ownership rule, 1. And (2) individuals who have filed an application with specified governmental or tribal authorities to form the entity or register it to do business. A bank must establish and maintain written procedures Beneficial ownership information will not be accepted prior to january 1, 2024. Web the rule describes who must file a boi report, what information must be reported, and when a report is due. Specifically, the rule requires reporting companies to file reports with fincen that identify two categories of individuals:

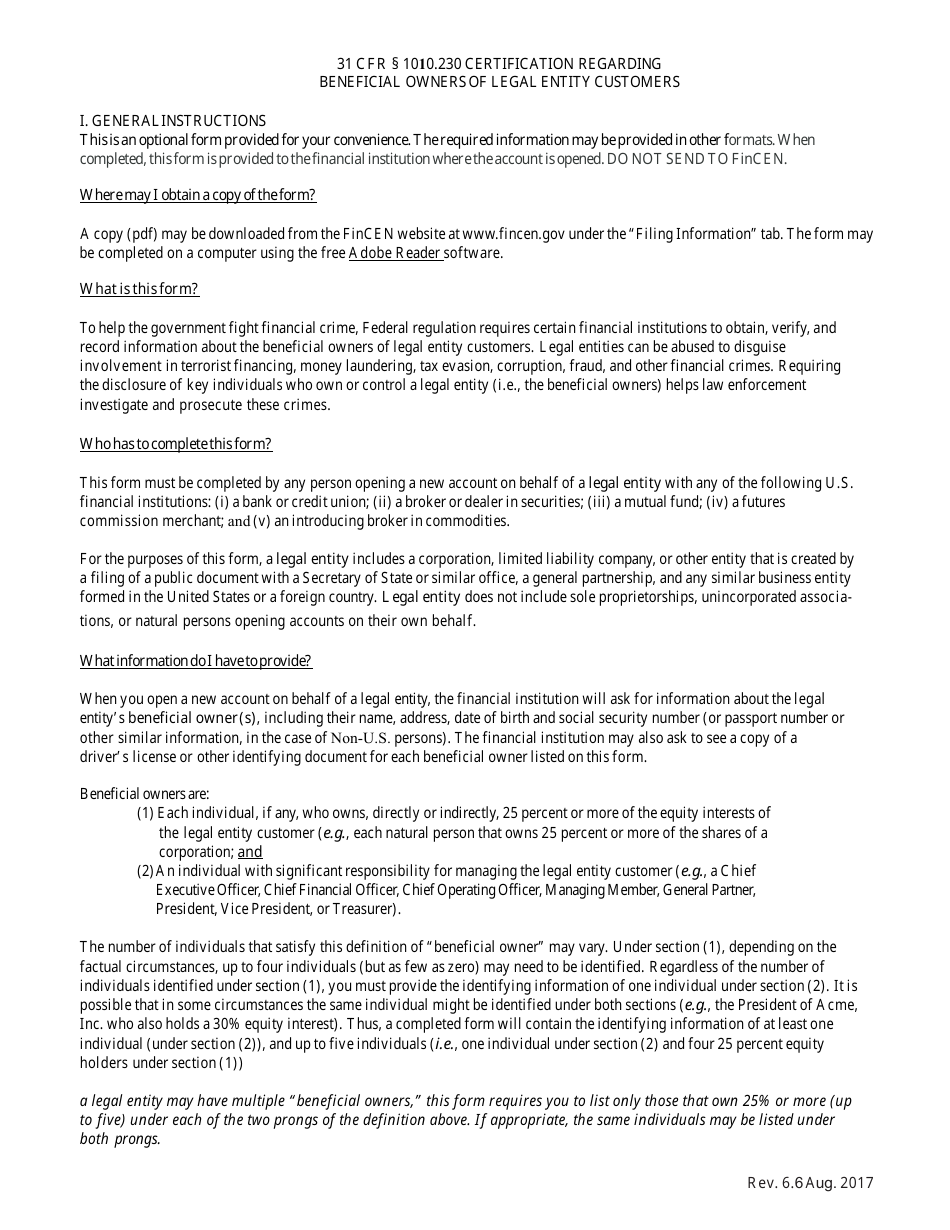

A bank must establish and maintain written procedures And (2) the company applicants of the entity. (1) the beneficial owners of the entity; Generally, you can treat the payee as a u.s. To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. And (2) individuals who have filed an application with specified governmental or tribal authorities to form the entity or register it to do business. A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. Beneficial ownership information will not be accepted prior to january 1, 2024. To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. If you (the withholding agent) make a payment to joint owners, you need to obtain documentation from each.

(1) the beneficial owners of the entity; To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. Web what is this form? Beneficial ownership information will not be accepted prior to january 1, 2024. And (2) the company applicants of the entity. A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. Web what is this form? These regulations go into effect on january 1, 2024. To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. Web beneficial owners and documentation joint owner.

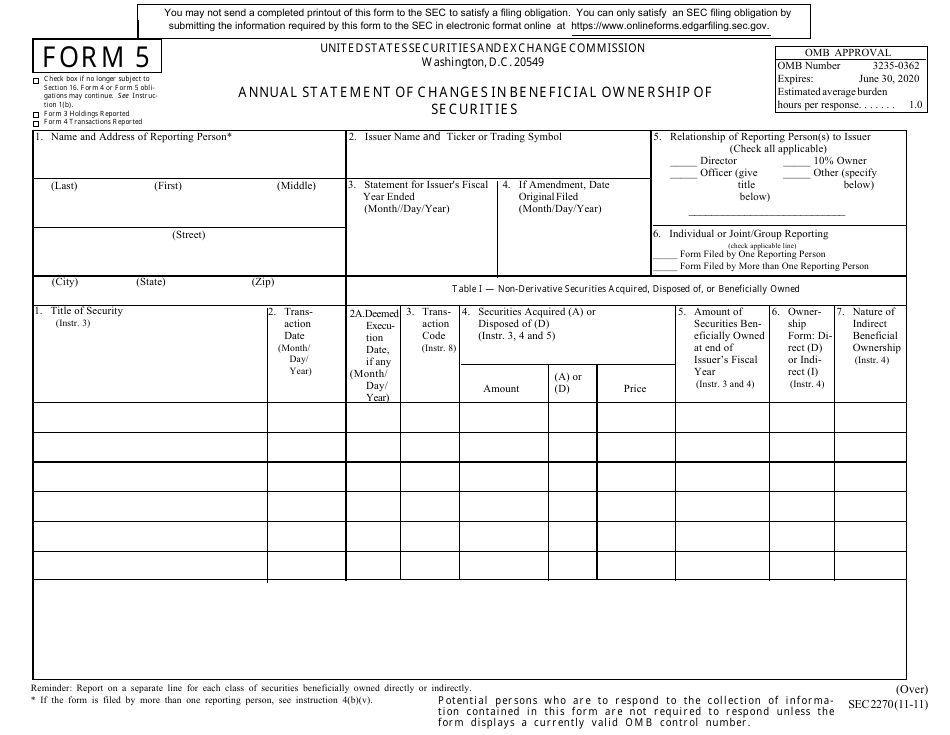

SEC Form 2270 (5) Download Printable PDF or Fill Online Annual

Web beneficial ownership information reporting. And (2) individuals who have filed an application with specified governmental or tribal authorities to form the entity or register it to do business. (1) the beneficial owners of the entity; Web what is this form? (1) the beneficial owners of the entity;

Certification of Beneficial Owner(S) Download Fillable PDF Templateroller

To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. Web specifically, the proposed rule would.

2021 Form UK Axis Bank Declaration of Beneficial Ownership for

Web the form includes identity information about your organization's beneficial owners that have a 25% ownership interest, identity information about one individual with managerial control and a signature of the person providing and certifying this information. Beneficial ownership information will not be accepted prior to january 1, 2024. Specifically, the rule requires reporting companies to file reports with fincen that.

FinCen's Customer Due Diligence Rule Certification Regarding

To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. Web what is this form? Web the form includes identity information about your organization's beneficial owners that have a 25% ownership interest, identity information about one individual with managerial control and a signature.

Affidavit of Beneficial Ownership Declaration of Claim of Title

Generally, you can treat the payee as a u.s. And (2) individuals who have filed an application with specified governmental or tribal authorities to form the entity or register it to do business. Beneficial ownership information will not be accepted prior to january 1, 2024. And (2) the company applicants of the entity. Web what is this form?

Federal Register Customer Due Diligence Requirements for Financial

Web what is this form? These regulations go into effect on january 1, 2024. Web beneficial ownership information reporting. Web the rule describes who must file a boi report, what information must be reported, and when a report is due. Web specifically, the proposed rule would require reporting companies to file reports with fincen that identify two categories of individuals:

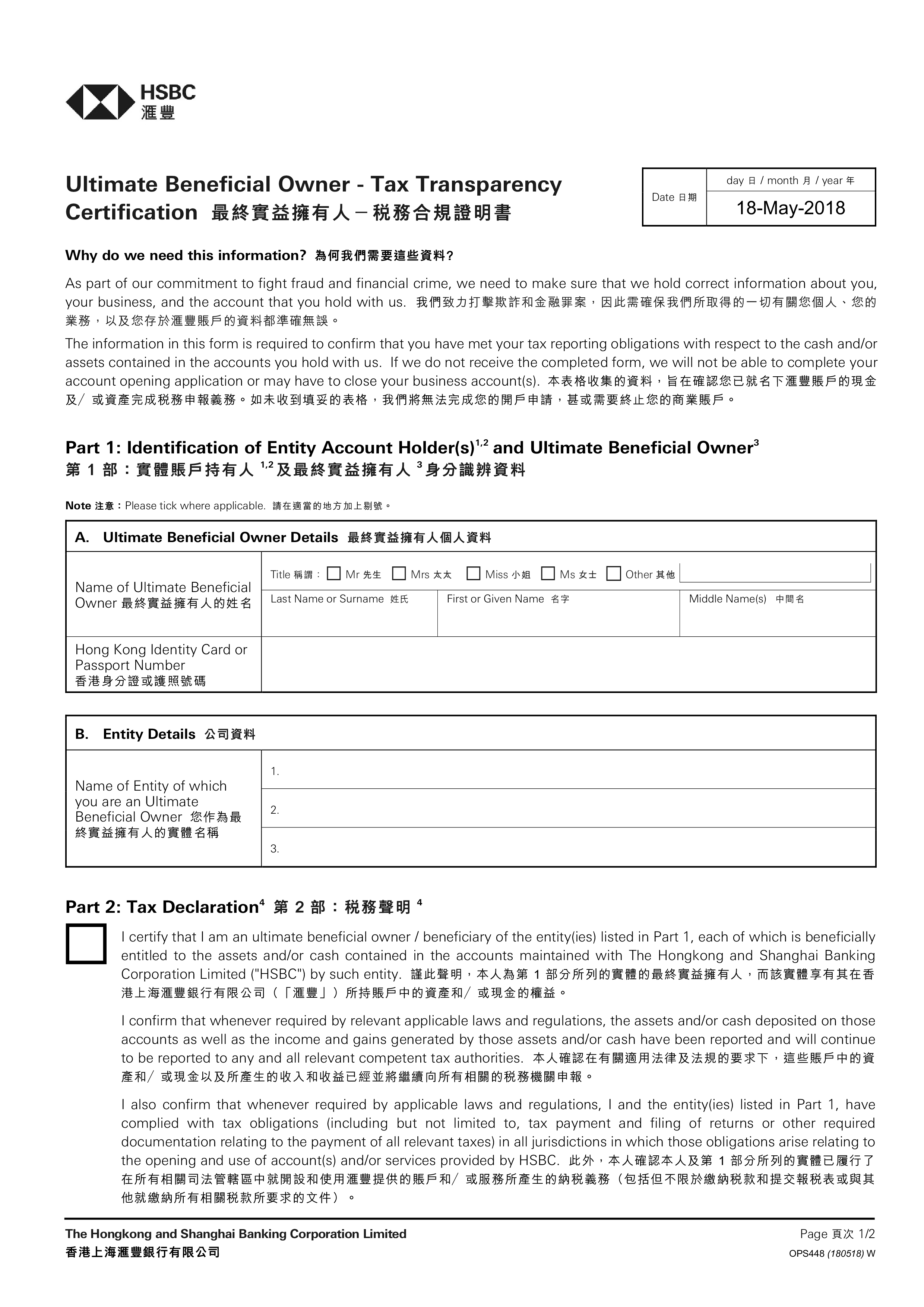

Beneficial Owner Tax Transparency Certification Templates at

To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. Web the form includes identity information about your organization's beneficial owners that have a 25% ownership interest, identity information about one individual with managerial control and a signature of the person providing and.

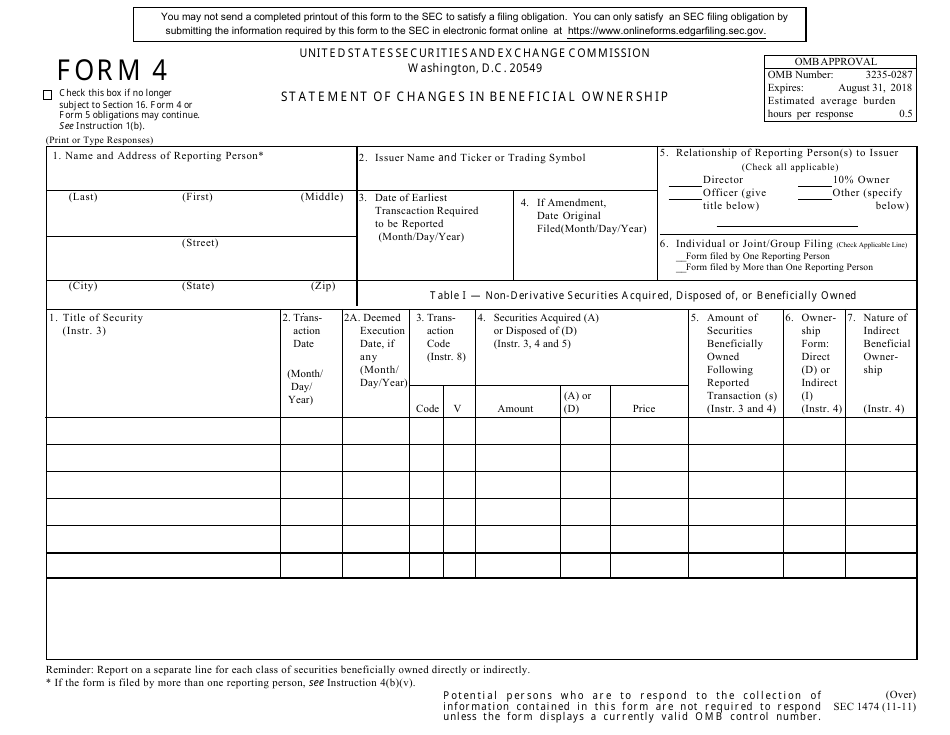

SEC Form 1474 (4) Download Printable PDF or Fill Online Statement of

And (2) individuals who have filed an application with specified governmental or tribal authorities to form the entity or register it to do business. Generally, you can treat the payee as a u.s. Web beneficial owners and documentation joint owner. To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about.

Beneficial Ownership Form Blank Fill Online, Printable, Fillable

Web what is this form? Web the rule describes who must file a boi report, what information must be reported, and when a report is due. To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. (1) the beneficial owners of the entity;.

Beneficial Ownership Form Fill Out and Sign Printable PDF Template

(1) the beneficial owners of the entity; To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. Beneficial ownership information will not be accepted prior to january 1, 2024. Web the rule describes who must file a boi report, what information must be.

To Help The Government Fight Financial Crime, Federal Regulation Requires Certain Financial Institutions To Obtain, Verify, And Record Information About The Beneficial Owners Of Legal Entity Customers.

Web what is this form? (1) the beneficial owners of the entity; To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. And (2) the company applicants of the entity.

Web The Form Includes Identity Information About Your Organization's Beneficial Owners That Have A 25% Ownership Interest, Identity Information About One Individual With Managerial Control And A Signature Of The Person Providing And Certifying This Information.

A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. (1) the beneficial owners of the entity; And (2) individuals who have filed an application with specified governmental or tribal authorities to form the entity or register it to do business. Business name business address or primary residence address date of birth social security number (as applicable) the name of the issuing state or country passport or driver’s license number for the beneficial owners and control person as applicable beneficial ownership information is required:

If You (The Withholding Agent) Make A Payment To Joint Owners, You Need To Obtain Documentation From Each.

Web the rule describes who must file a boi report, what information must be reported, and when a report is due. Web what is this form? Generally, you can treat the payee as a u.s. Web beneficial owners and documentation joint owner.

Web What Is This Form?

Assess the bank’s written procedures and overall compliance with regulatory requirements for identifying and verifying beneficial owner(s) of legal entity customers. Beneficial ownership information will not be accepted prior to january 1, 2024. Web specifically, the proposed rule would require reporting companies to file reports with fincen that identify two categories of individuals: These regulations go into effect on january 1, 2024.