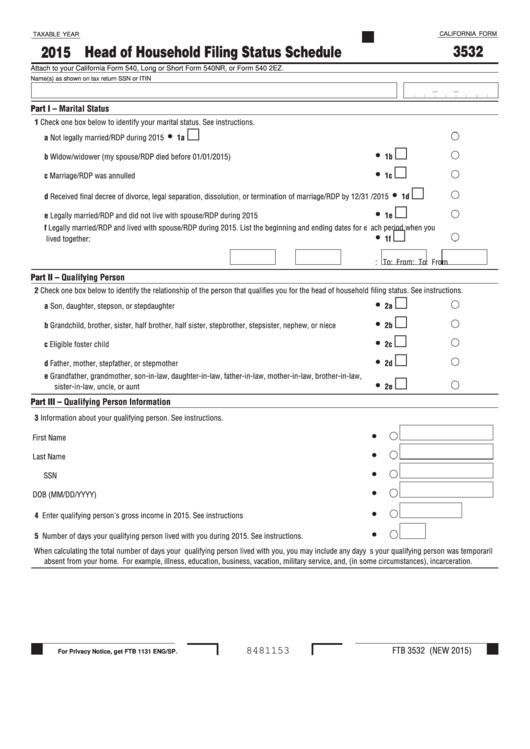

Ca Form 3532

Ca Form 3532 - Web 3532 attach to your california form 540, long or short form 540nr, or form 540 2ez. Name(s) as shown on tax return ssn or itin. For privacy notice, get ftb 1131 eng/sp. Web description of error: 2022 head of household filing status schedule. Web what is california form ftb 3532? Check one box below to identify your marital status. Web we last updated the head of household filing status schedule in january 2023, so this is the latest version of form 3532, fully updated for tax year 2022. Web in order to attach form 3532 (head of household) to your california return, you will have to select filing status 4, head of household, in the basic information section of the. Check one box below to identify your marital status.

For privacy notice, get ftb 1131 eng/sp. Web california individual income tax forms supported in taxslayer pro: 2016 head of household filing status schedule. 2022 head of household filing status schedule. Beginning in tax year 2018, if you do not attach a completed form ftb. Form 568, limited liability co. California requires taxpayers who use head of household (hoh) filing status to file form ftb 3532, head of household filing status. Web what is california form ftb 3532? Your california return could not be processed electronically due to incomplete or invalid information on form 3532, head of household. Web california individual form availability.

2022 head of household filing status schedule. Web we last updated california form 3532 in january 2023 from the california franchise tax board. Web attach the completed form ftb 3532, to your form 540, california resident income tax return, long or short form 540nr, california. Web what is california form ftb 3532? Check one box below to identify your marital status. Web california individual form availability. Web 2018 head of household filing status schedule 3532 attach to your california form 540, long or short form 540nr, or form 540 2ez. Web 3532 attach to your california form 540, long or short form 540nr, or form 540 2ez. Form 540 schedule ca ins. California requires taxpayers who use head of household (hoh) filing status to file form ftb 3532, head of household filing status.

3532 La Mancha Dr, Brea, CA 92823 MLS PW18023101 Redfin

Web california individual form availability. For privacy notice, get ftb 1131 eng/sp. Beginning in tax year 2018, if you do not attach a completed form ftb. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated the head of household filing status schedule in january 2023, so this is the.

Can you no longer claim parents living abroad (Canada or Mexico) for

Web for taxable years beginning on or after january 1, 2015, california requires taxpayers who use head of household (hoh) filing status to file form ftb 3532, head of household. 2022 head of household filing status schedule. Web what is california form ftb 3532? Web what is california form ftb 3532? Web california individual income tax forms supported in taxslayer.

748 California Franchise Tax Board Forms And Templates free to download

Web attach the completed form ftb 3532, to your form 540, california resident income tax return, long or short form 540nr, california. Check one box below to identify your marital status. Your california return could not be processed electronically due to incomplete or invalid information on form 3532, head of household. Web description of error: Web what is california form.

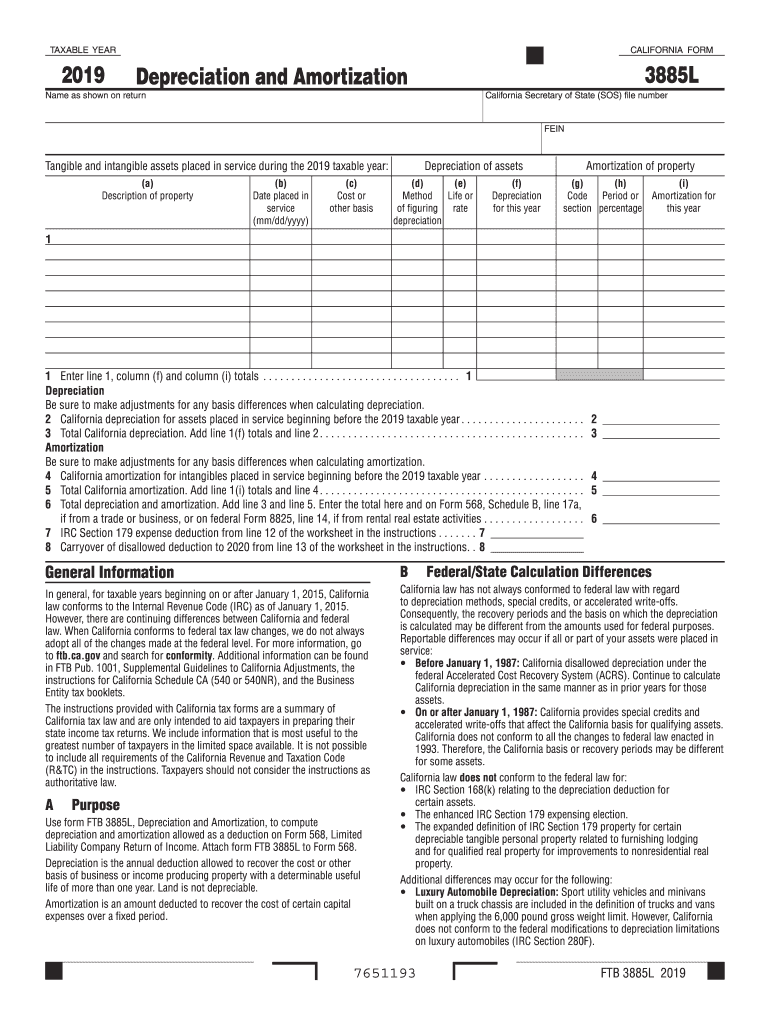

CA Form 3885L 2019 Fill out Tax Template Online US Legal Forms

Web 3 years ago california is the ca form 3532 head of household schedule required for electronic filing? Beginning in tax year 2018, if you do not attach a completed form ftb. Web for taxable years beginning on or after january 1, 2015, california requires taxpayers who use head of household (hoh) filing status to file form ftb 3532, head.

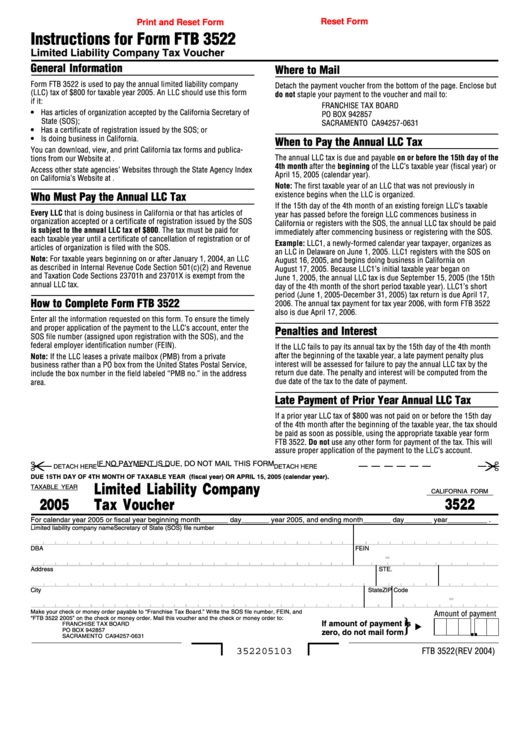

Fillable California Form 3522 Limited Liability Company Tax Voucher

Web what is california form ftb 3532? Name(s) as shown on tax return. Web 3532 attach to your california form 540, long or short form 540nr, or form 540 2ez. Web 2018 head of household filing status schedule 3532 attach to your california form 540, long or short form 540nr, or form 540 2ez. Name(s) as shown on tax return.

California Form 3538 (565) Payment Voucher For Automatic Extension

Web 2018 head of household filing status schedule 3532 attach to your california form 540, long or short form 540nr, or form 540 2ez. Web attach the completed form ftb 3532, to your form 540, california resident income tax return, long or short form 540nr, california. Web we last updated california form 3532 in january 2023 from the california franchise.

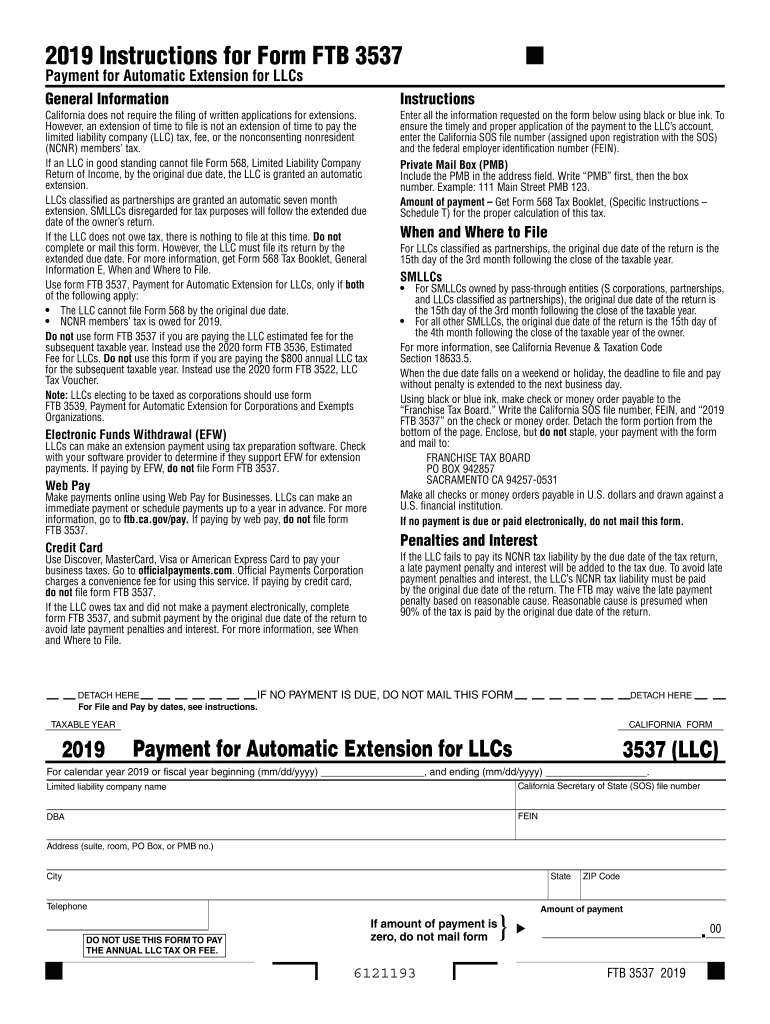

California Form 3537 LLC Payment For Automatic Extension For LLCs

Name(s) as shown on tax return. Web description of error: Name(s) as shown on tax return. Check one box below to identify your marital status. Web 2018 head of household filing status schedule 3532 attach to your california form 540, long or short form 540nr, or form 540 2ez.

3532 Conner Way, Oceanside, CA 92056 MLS SW23032710 Redfin

Beginning in tax year 2018, if you do not attach a completed form ftb. For privacy notice, get ftb 1131 eng/sp. Web california individual income tax forms supported in taxslayer pro: Web what is california form ftb 3532? Web we last updated california form 3532 in january 2023 from the california franchise tax board.

CA Form CA182 A Download Printable PDF or Fill Online Application for

Name(s) as shown on tax return. Form 540 schedule ca ins. Web california individual form availability. California requires taxpayers who use head of household (hoh) filing status to file form ftb 3532, head of household filing status. This form is for income earned in tax year 2022, with tax returns due in april.

Form 3532 California Head Of Household Filing Status Schedule 2015

Your california return could not be processed electronically due to incomplete or invalid information on form 3532, head of household. 2022 instructions and forms for schedule ca (540) get form 540. Web in order to attach form 3532 (head of household) to your california return, you will have to select filing status 4, head of household, in the basic information.

Web California Individual Form Availability.

Beginning in tax year 2018, if you do not attach a completed form ftb. 2022 head of household filing status schedule. 2016 head of household filing status schedule. Web california individual form availability.

Name(S) As Shown On Tax Return Ssn Or Itin.

Web 3532 attach to your california form 540, long or short form 540nr, or form 540 2ez. Check one box below to identify your marital status. For privacy notice, get ftb 1131 eng/sp. Check one box below to identify your marital status.

Form 540 Schedule Ca Ins.

Form 568, limited liability co. Web description of error: Web the california franchise tax board (ftb) requires taxpayers filing as head of household to attach form 3532, head of household filing status schedule. Web attach the completed form ftb 3532, to your form 540, california resident income tax return, long or short form 540nr, california.

Web California Individual Income Tax Forms Supported In Taxslayer Pro:

Name(s) as shown on tax return. California requires taxpayers who use head of household (hoh) filing status to file form ftb 3532, head of household filing status. Name(s) as shown on tax return. This form is for income earned in tax year 2022, with tax returns due in april.