Calendar Spread Strategy

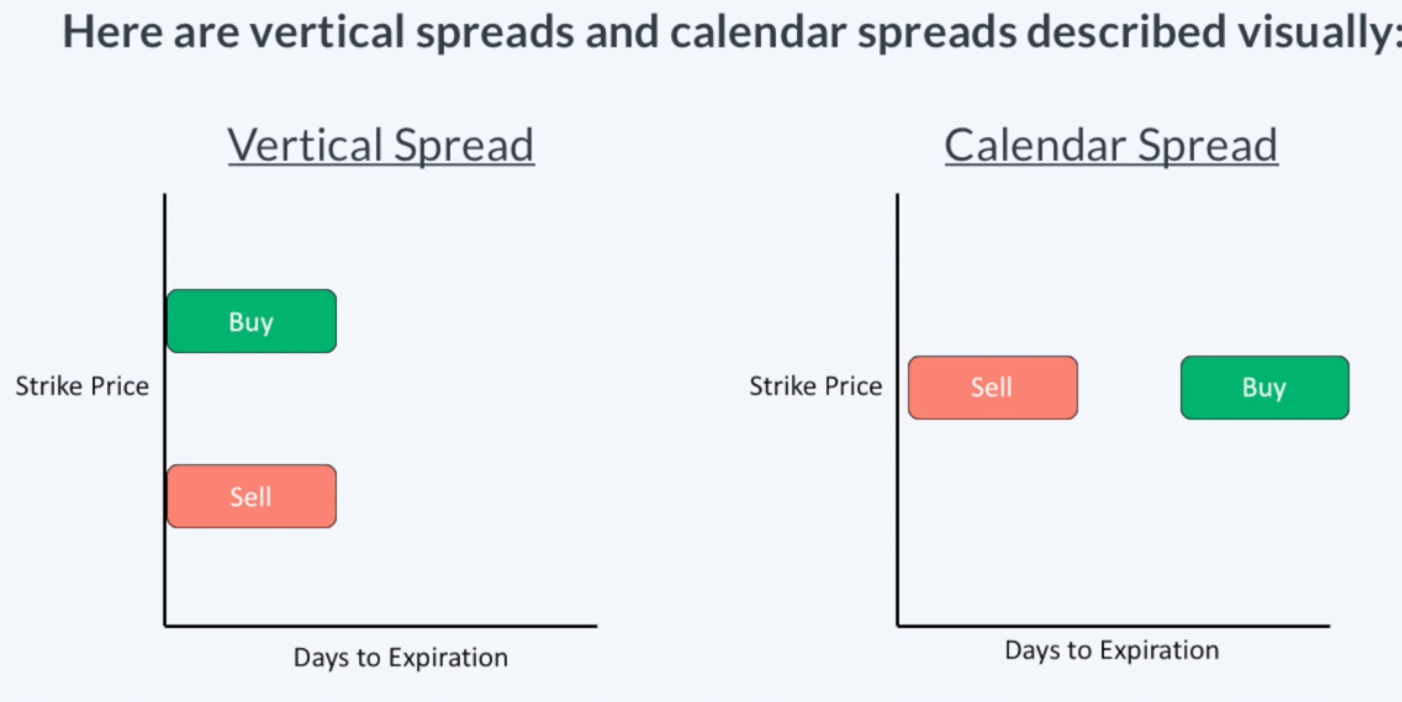

Calendar Spread Strategy - They are also called time spreads, horizontal. Web in diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie sie sie für sich gewinnbringend einsetzen können. Web calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’. Web how to set up a call calendar spread. Web in this article, we’ll review how to collect weekly or monthly income using long call option calendar spreads. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. Web what is a calendar spread? A calendar spread is a type of horizontal spread. If you’re unfamiliar with a horizontal spread, it’s an options strategy that involves. At the heart of calendar spreads lies the strategic use of options with different expiration dates but the same strike price.

Web in this article, we’ll review how to collect weekly or monthly income using long call option calendar spreads. Web in diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie sie sie für sich gewinnbringend einsetzen können. Web learn how to use calendar spreads, a net debit options strategy that capitalizes on time decay and volatility, with or without a directional bias. At the heart of calendar spreads lies the strategic use of options with different expiration dates but the same strike price. Web what is a calendar spread? A calendar spread is a type of horizontal spread. Web calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’. Web calendar spreads are considered an advanced option trading strategy, so it’s important to have a handle on how they work and the potential risks. Web mechanics of calendar spreads. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike.

Web learn how to use calendar spreads, a net debit options strategy that capitalizes on time decay and volatility, with or without a directional bias. Web calendar spreads are considered an advanced option trading strategy, so it’s important to have a handle on how they work and the potential risks. They are also called time spreads, horizontal. Web how to set up a call calendar spread. If you’re unfamiliar with a horizontal spread, it’s an options strategy that involves. At the heart of calendar spreads lies the strategic use of options with different expiration dates but the same strike price. Web in this article, we’ll review how to collect weekly or monthly income using long call option calendar spreads. Web a calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or. Web calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’. Web in diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie sie sie für sich gewinnbringend einsetzen können.

How to Trade Options Calendar Spreads (Visuals and Examples)

A calendar spread is a type of horizontal spread. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. Web what is a calendar spread? Web learn how to use calendar spreads, a net debit options strategy that capitalizes on time decay and.

Calendar Spread Option Strategy 2024 Easy to Use Calendar App 2024

Web what is a calendar spread? Web in diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie sie sie für sich gewinnbringend einsetzen können. Web calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’. Web mechanics of calendar spreads. Web how to set up a call calendar spread.

Calendar Spreads Option Trading Strategies Beginner's Guide to the

If you’re unfamiliar with a horizontal spread, it’s an options strategy that involves. Web mechanics of calendar spreads. They are also called time spreads, horizontal. At the heart of calendar spreads lies the strategic use of options with different expiration dates but the same strike price. Web in diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie.

Long Calendar Spreads for Beginner Options Traders projectfinance

Web in this article, we’ll review how to collect weekly or monthly income using long call option calendar spreads. A calendar spread is a type of horizontal spread. At the heart of calendar spreads lies the strategic use of options with different expiration dates but the same strike price. Web how to set up a call calendar spread. Web calendar.

How Calendar Spreads Work (Best Explanation) projectoption

If you’re unfamiliar with a horizontal spread, it’s an options strategy that involves. Web how to set up a call calendar spread. Web what is a calendar spread? A calendar spread is a type of horizontal spread. Web learn how to use calendar spreads, a net debit options strategy that capitalizes on time decay and volatility, with or without a.

Long Calendar Spread with Puts Strategy With Example

Web how to set up a call calendar spread. Web learn how to use calendar spreads, a net debit options strategy that capitalizes on time decay and volatility, with or without a directional bias. Web mechanics of calendar spreads. They are also called time spreads, horizontal. Web a calendar spread, also known as a time spread, is an options trading.

Calendar Spread Options Trading Strategy In Python

Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. At the heart of calendar spreads lies the strategic use of options with different expiration dates but the same strike price. In the options strategy version, calendar spreads are set up within the.

Everything You Need to Know about Calendar Spreads

At the heart of calendar spreads lies the strategic use of options with different expiration dates but the same strike price. Web in this article, we’ll review how to collect weekly or monthly income using long call option calendar spreads. Web a calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling.

Calendar Spreads Option Trading Strategies Beginner's Guide to the

If you’re unfamiliar with a horizontal spread, it’s an options strategy that involves. Web in diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie sie sie für sich gewinnbringend einsetzen können. A calendar spread is a type of horizontal spread. Web calendar spreads are considered an advanced option trading strategy, so it’s important to have a handle.

Calendar Spread Options Strategy VantagePoint

In the options strategy version, calendar spreads are set up within the same. Web learn how to use calendar spreads, a net debit options strategy that capitalizes on time decay and volatility, with or without a directional bias. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type.

Web In Diesem Artikel Erfahren Sie, Was Die Calendar Spread Optionsstrategie Ist, Und Wie Sie Sie Für Sich Gewinnbringend Einsetzen Können.

Web calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. Web what is a calendar spread? If you’re unfamiliar with a horizontal spread, it’s an options strategy that involves.

Web A Calendar Spread, Also Known As A Time Spread, Is An Options Trading Strategy That Involves Buying And Selling Two Options Of The Same Type (Either Calls Or.

Web in this article, we’ll review how to collect weekly or monthly income using long call option calendar spreads. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. They are also called time spreads, horizontal. Web learn how to use calendar spreads, a net debit options strategy that capitalizes on time decay and volatility, with or without a directional bias.

Web How To Set Up A Call Calendar Spread.

Web calendar spreads are considered an advanced option trading strategy, so it’s important to have a handle on how they work and the potential risks. In the options strategy version, calendar spreads are set up within the same. Web mechanics of calendar spreads. A calendar spread is a type of horizontal spread.