Calendar Year Vs Fiscal Year

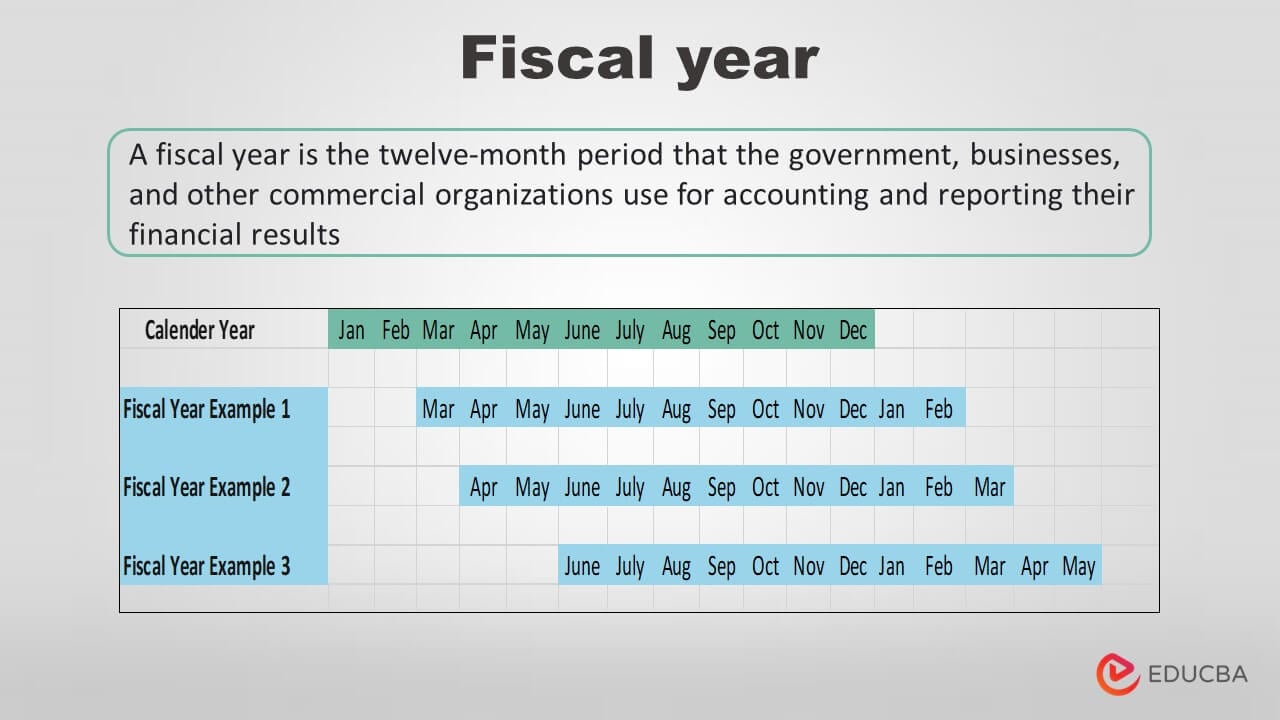

Calendar Year Vs Fiscal Year - Web learn the definition and key differences between fiscal year and calendar year for financial reporting and tax purposes. Web the fiscal year can differ from the calendar year, which ends dec. Instead, a fiscal year ends 12 months after it. Generally, taxpayers filing a version of form 1040 use the calendar year. Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not align with the. Find out the advantages and disadvantages. Find out how to choose the best system for your. Web a calendar year runs from january 1 to december 31, whereas a fiscal year can start and end at any point within the year, as long as it covers a full 12 months. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Web a fiscal year is different from a calendar year because it does not begin on january 1 and end on december 31.

Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not align with the. Web the fiscal year can differ from the calendar year, which ends dec. Web the irs uses the calendar year as a default. Learn how fiscal years differ. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Find out how to choose the best system for your. Web learn the definition and key differences between fiscal year and calendar year for financial reporting and tax purposes. Find out how they are defined, when. Web calendar year is the period from january 1st to december 31st.

Web a geschäftsjahr (financial year) that differs from the normal calendar year allows entrepreneurs to prepare their annual accounts at a time of their choosing, rather. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Learn how fiscal years differ. Businesses have to specify when their fiscal years start and conclude if they do not wish to use traditional calendar. A period that is set from january 1 to december 31 is called a calendar year. 31, and is chosen by the company when it incorporates based on its needs and the seasonality of. Remember, this isn’t just a tax consideration: Web the irs uses the calendar year as a default. Find out how they are defined, when. Learn when you should use each.

Fiscal Year vs Calendar Year Difference and Comparison

Web learn the difference between a fiscal year and a calendar year, and how they affect accounting, tax and budgeting. Find out the advantages and disadvantages. 31, and is chosen by the company when it incorporates based on its needs and the seasonality of. Web the irs uses the calendar year as a default. Web a fiscal year is different.

Difference Between Fiscal Year and Calendar Year Difference Between

Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Businesses have to specify when their fiscal years start and conclude if they do not wish to use traditional calendar. Web a fiscal year is 12 months chosen by a business or organization for.

What is the Difference Between Fiscal Year and Calendar Year

A period that is set from january 1 to december 31 is called a calendar year. Remember, this isn’t just a tax consideration: Learn when you should use each. Find out how they are defined, when. Web the fiscal year can differ from the calendar year, which ends dec.

Calendar Year vs Fiscal Year Top 6 Differences You Should Know

Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web a geschäftsjahr (financial year) that differs from the normal calendar year allows entrepreneurs to prepare their annual accounts at a time of their choosing, rather. Web learn the definition and key differences between.

How to Convert a Date into Fiscal Year ExcelNotes

Web calendar year is the period from january 1st to december 31st. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal.

Calendar Vs Fiscal Year Difference Nina Teresa

31, and is chosen by the company when it incorporates based on its needs and the seasonality of. Learn how fiscal years differ. Businesses have to specify when their fiscal years start and conclude if they do not wish to use traditional calendar. Web a fiscal year is different from a calendar year because it does not begin on january.

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

Web a geschäftsjahr (financial year) that differs from the normal calendar year allows entrepreneurs to prepare their annual accounts at a time of their choosing, rather. Instead, a fiscal year ends 12 months after it. Find out how they are defined, when. Learn when you should use each. Find out the advantages and disadvantages.

Fiscal Year vs Calendar Year What’s Right for Your Business?

Web if the end of your natural business year isn’t obvious, a fiscal year might still be better than the standard calendar year. Web a calendar year runs from january 1 to december 31, whereas a fiscal year can start and end at any point within the year, as long as it covers a full 12 months. Web the fiscal.

Fiscal Year Definition for Business Bookkeeping

Web a calendar year runs from january 1 to december 31, whereas a fiscal year can start and end at any point within the year, as long as it covers a full 12 months. Learn how fiscal years differ. Web learn the difference between a fiscal year and a calendar year, and how they affect accounting, tax and budgeting. Web.

What is a Fiscal year? Benefits, IRS Guidelines, & Examples

Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not align with the. Web if the end of your natural business year isn’t obvious, a fiscal year might still be better than the standard calendar year. Web a fiscal year differs from a calendar year.

Find Out The Advantages And Disadvantages.

Web learn the difference between fiscal year and calendar year, two terms that are frequently used in business and accounting. Businesses have to specify when their fiscal years start and conclude if they do not wish to use traditional calendar. Web the fiscal year can differ from the calendar year, which ends dec. Web a fiscal year is different from a calendar year because it does not begin on january 1 and end on december 31.

Learn How Fiscal Years Differ.

Web a calendar year runs from january 1 to december 31, whereas a fiscal year can start and end at any point within the year, as long as it covers a full 12 months. Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not align with the. A period that is set from january 1 to december 31 is called a calendar year. Find out how they are defined, when.

An Individual Can Adopt A Fiscal Year.

Web if the end of your natural business year isn’t obvious, a fiscal year might still be better than the standard calendar year. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web the irs uses the calendar year as a default. Learn when you should use each.

Web A Fiscal Year Differs From A Calendar Year In That It Doesn't Coincide With The Weeks, Months, And Quarters A Calendar Year Uses.

Web a geschäftsjahr (financial year) that differs from the normal calendar year allows entrepreneurs to prepare their annual accounts at a time of their choosing, rather. Web learn the difference between a fiscal year and a calendar year, and how they affect accounting, tax and budgeting. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Remember, this isn’t just a tax consideration: