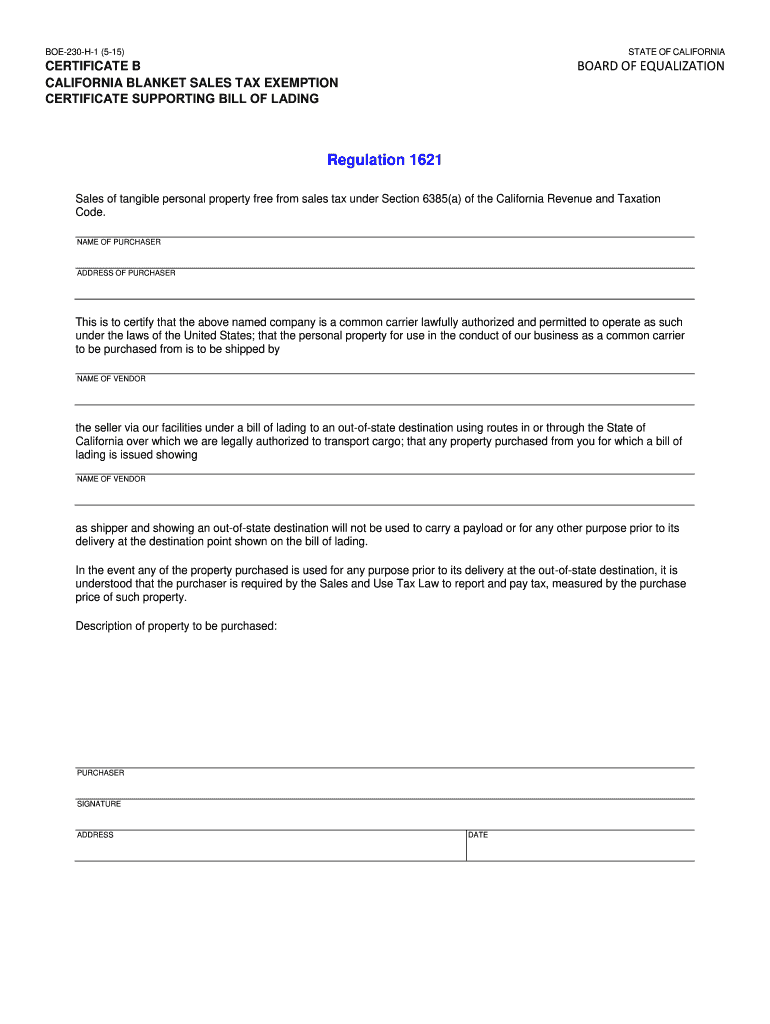

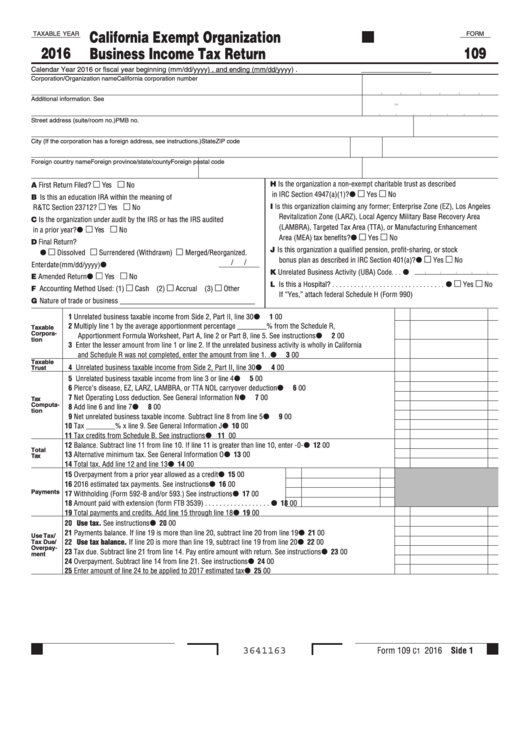

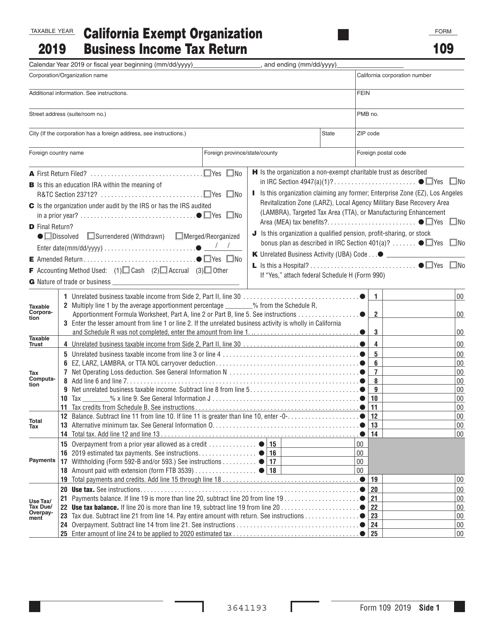

California Form 109

California Form 109 - You fill in the name and street address of the court that issued. Web file form 109 for taxable years beginning in 2000. Filing form 109 does not. Web use form 109, california exempt organization business income tax return, to figure the tax on the unrelated business income of the organization. Try it for free now! Web use form 109, california exempt organization business income tax return, to figure the tax on the unrelated business income of the organization. January 1, 2023, mandatory form family code, §§ 242, 6320.5 approved by doj. Web form adopted for mandatory use notice of hearing—emancipation of minor family code, § 7000 et seq. Filing form 109 does not. Try it for free now!

Upload, modify or create forms. If you are serving a document. It did not adequately or consistently address some allegations of sexual harassment (release date: 2021 california exempt organization business income tax return. Web this form is only for providing proof that a document has been served (delivered) in a proceeding in the superior court appellate division. , and ending (mm/dd/yyyy) corporation/organization name. Web we last updated california form 109 in february 2023 from the california franchise tax board. January 1, 2023, mandatory form family code, §§ 242, 6320.5 approved by doj. Filing form 109 does not. Calendar year 2021 or fiscal year beginning (mm/dd/yyyy) , and ending.

Filing form 109 does not. Web file form 109 for taxable years beginning in 2000. This form is for income earned in tax year 2022, with tax returns due in april. Try it for free now! Web this form is only for providing proof that a document has been served (delivered) in a proceeding in the superior court appellate division. You fill in the name and street address of the court that issued. Web use form 109, california exempt organization business income tax return, to figure the tax on the unrelated business income of the organization. Upload, modify or create forms. Fill in the taxable year information including the month, day, and year in the spaces provided at the top of side€1. Filing form 109 does not.

Fillable Form 109 California Exempt Organization Business Tax

You fill in the name and street address of the court that issued. Try it for free now! New january 1, 2017, optional form. Try it for free now! Web use form 109, california exempt organization business income tax return, to figure the tax on the unrelated business income of the organization.

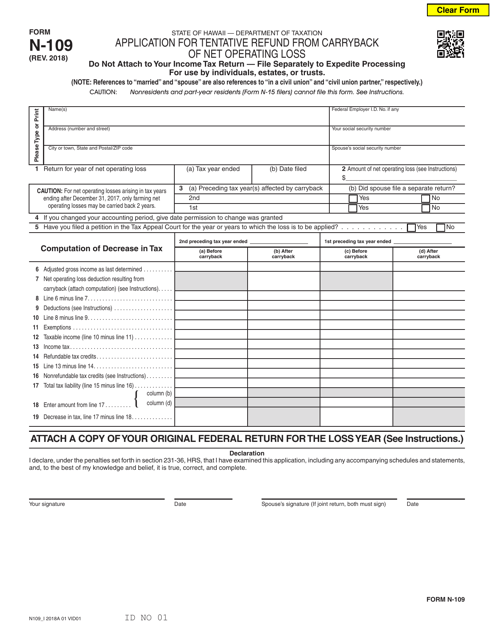

Form N109 Download Fillable PDF or Fill Online Application for

Web use form 109, california exempt organization business income tax return, to figure the tax on the unrelated business income of the organization. Web 2022 california exempt organization business income tax return form 109. 2021 california exempt organization business income tax return. Web use form 109, california exempt organization business income tax return, to figure the tax on the unrelated.

Fillable Form 109 California Exempt Organization Business Tax

Upload, modify or create forms. Web we last updated california form 109 in february 2023 from the california franchise tax board. Web we last updated the exempt organization business income tax return in february 2023, so this is the latest version of form 109, fully updated for tax year 2022. Upload, modify or create forms. Filing form 109 does not.

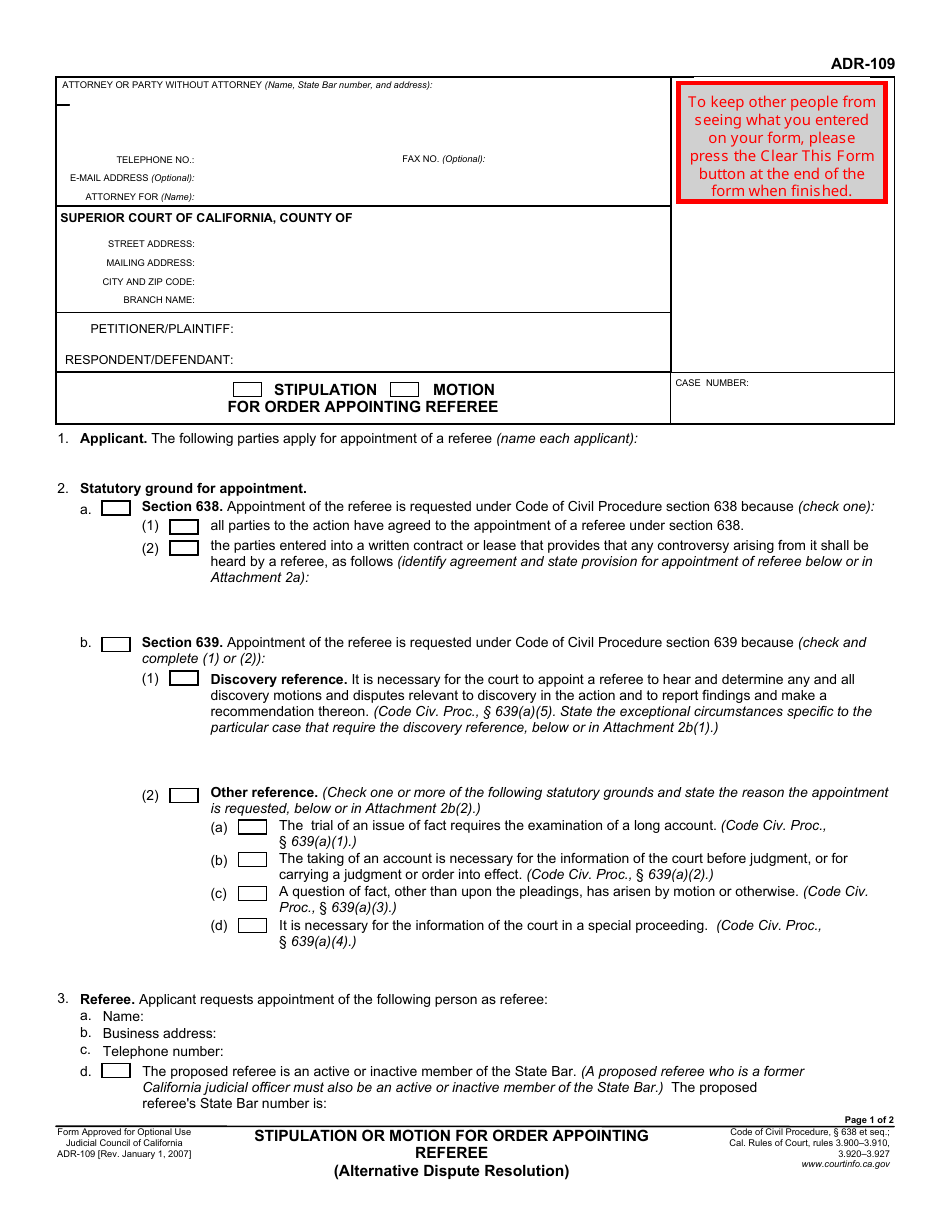

Form ADR109 Download Fillable PDF or Fill Online Stipulation or Motion

Or, ask the court for. Upload, modify or create forms. 2021 california exempt organization business income tax return. This form is for income earned in tax year 2022, with tax returns due in april. Filing form 109 does not.

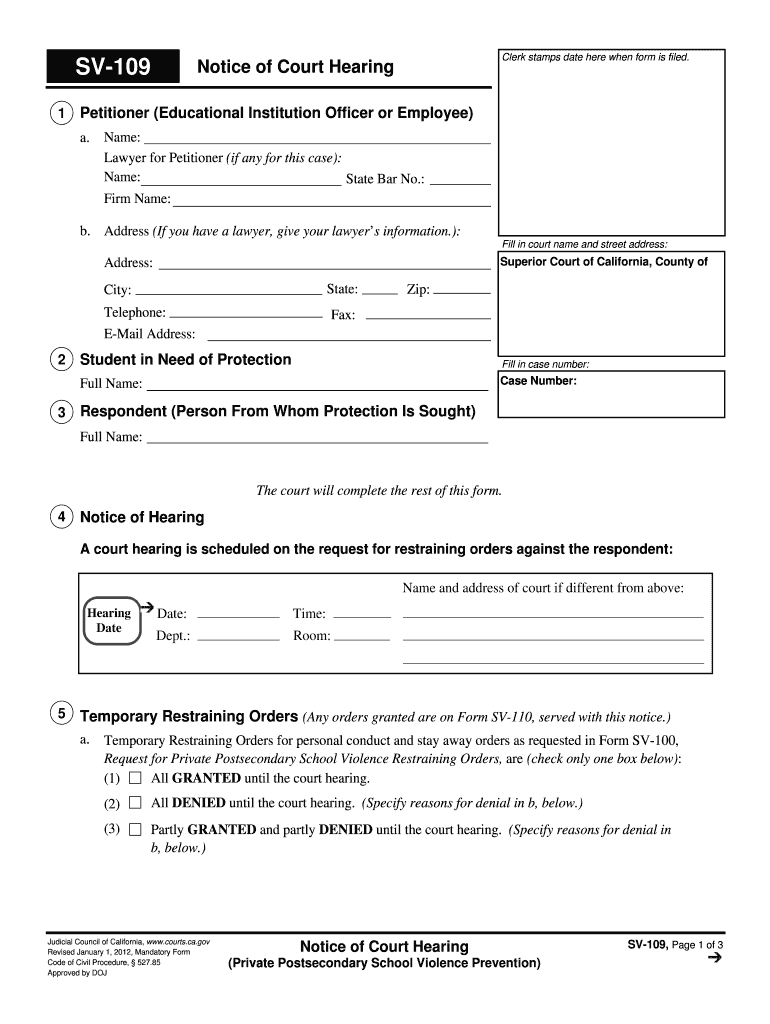

Sv Court Fill Out and Sign Printable PDF Template signNow

New january 1, 2017, optional form. Filing form 109 does not. Web judicial council of california, www.courts.ca.gov. , and ending (mm/dd/yyyy) corporation/organization name. January 1, 2023, mandatory form family code, §§ 242, 6320.5 approved by doj.

California Fundraising Registration

Filing form 109 does not. • 1 00 2 multiply line 1 by the average apportionment percentage _____% from the. New january 1, 2017, optional form. , and ending (mm/dd/yyyy) corporation/organization name. Filing form 109 does not.

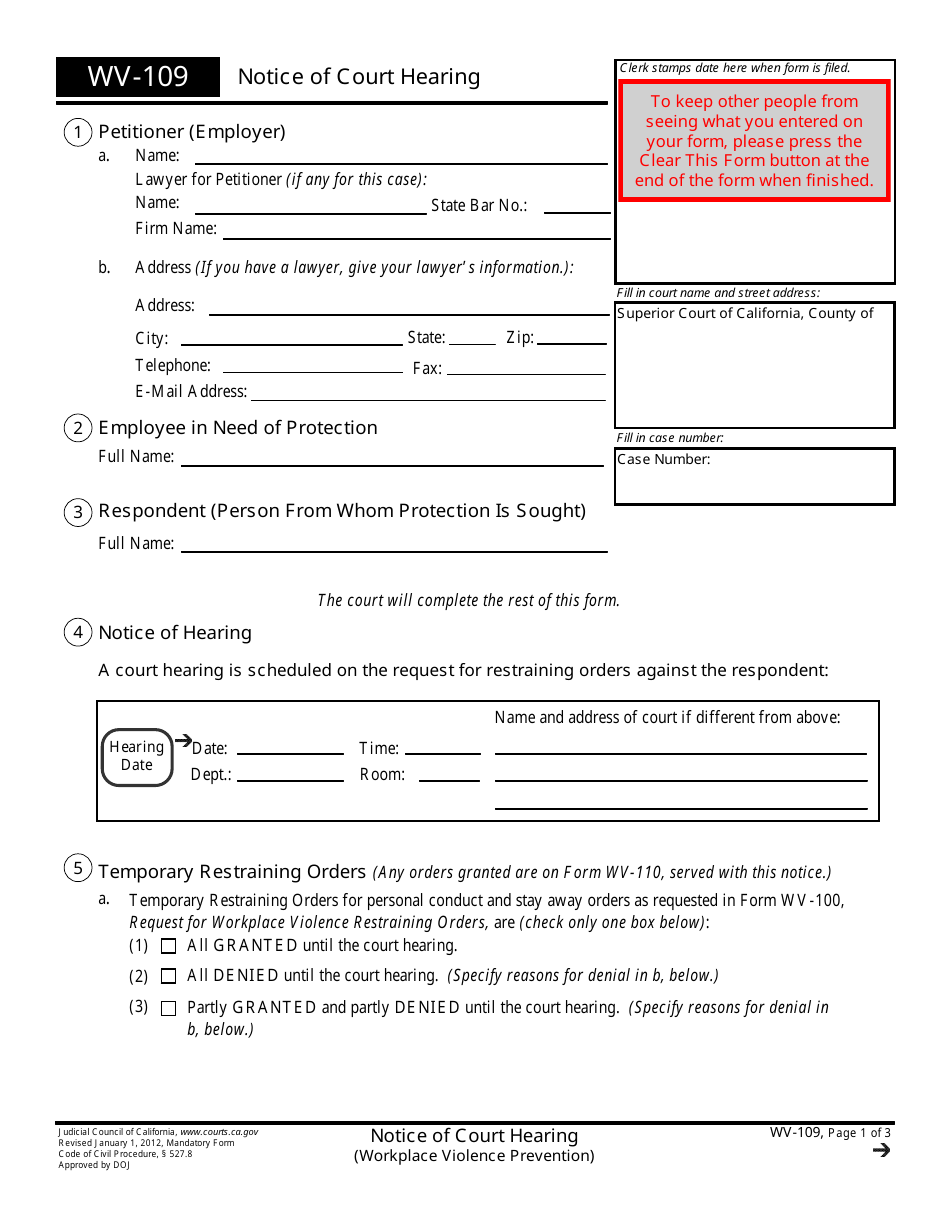

Form WV109 Download Fillable PDF or Fill Online Notice of Court

Web judicial council of california, www.courts.ca.gov. Web we last updated the exempt organization business income tax return in february 2023, so this is the latest version of form 109, fully updated for tax year 2022. Or, ask the court for. It did not adequately or consistently address some allegations of sexual harassment (release date: Web use form 109, california exempt.

SC109 Authorization to Appear on Behalf of Party Free Download

2021 california exempt organization business income tax return. Filing form 109 does not. New january 1, 2017, optional form. Web use form 109, california exempt organization business income tax return, to figure the tax on the unrelated business income of the organization. Try it for free now!

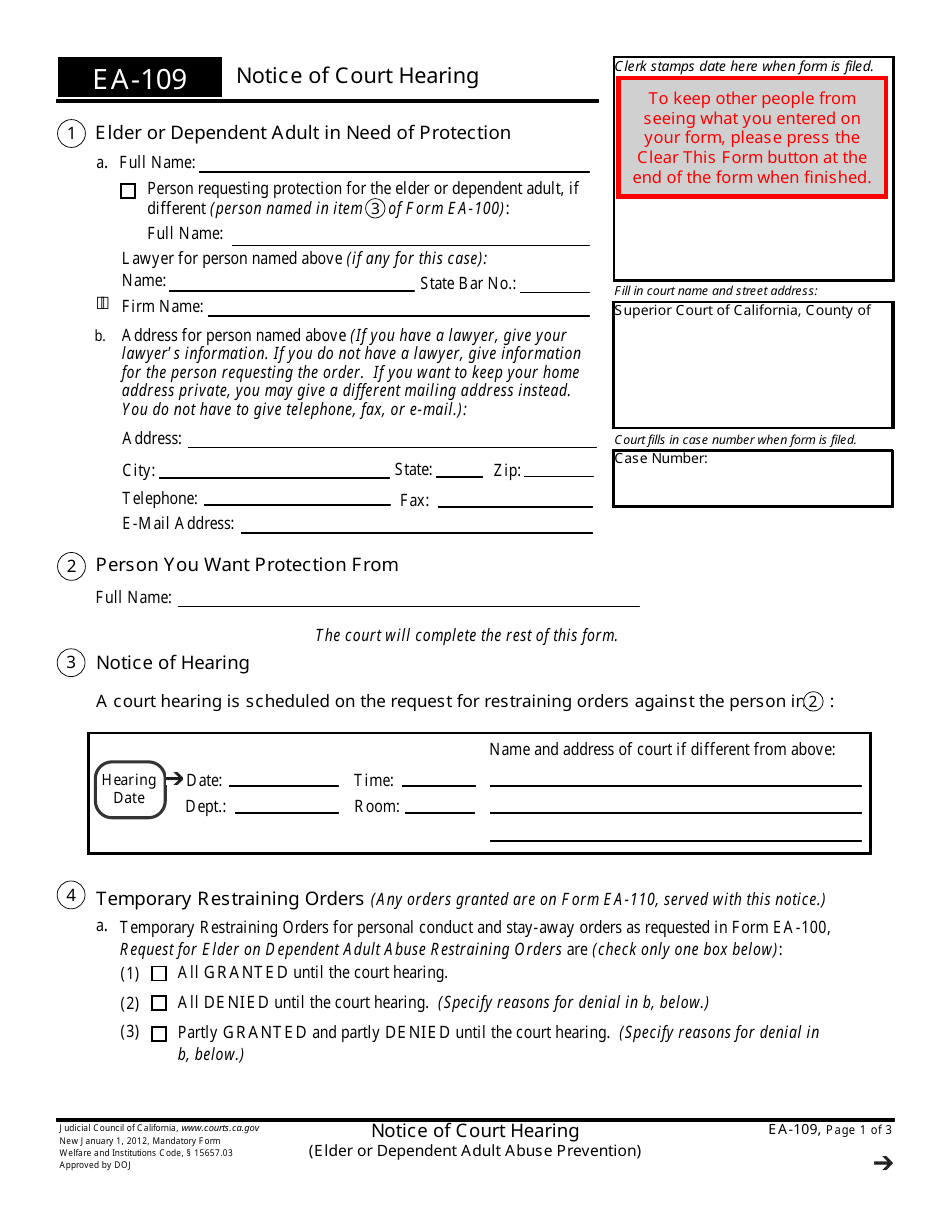

Form EA109 Download Fillable PDF or Fill Online Notice of Court

Web this form is only for providing proof that a document has been served (delivered) in a proceeding in the superior court appellate division. Filing form 109 does not. , and ending (mm/dd/yyyy) corporation/organization name. Web use form 109, california exempt organization business income tax return, to figure the tax on the unrelated business income of the organization. New january.

Form 109 Download Fillable PDF or Fill Online California Exempt

Upload, modify or create forms. Filing form 109 does not. If you are serving a document. Web this form is only for providing proof that a document has been served (delivered) in a proceeding in the superior court appellate division. Web we last updated california form 109 in february 2023 from the california franchise tax board.

You Fill In The Name And Street Address Of The Court That Issued.

Filing form 109 does not. Filing form 109 does not. Upload, modify or create forms. Calendar year 2021 or fiscal year beginning (mm/dd/yyyy) , and ending.

Try It For Free Now!

Filing form 109 does not. 2021 california exempt organization business income tax return. , and ending (mm/dd/yyyy) corporation/organization name. Web form 109 2022 side 1 1 unrelated business taxable income from side 2, part ii, line 30.

Web Use Form 109, California Exempt Organization Business Income Tax Return, To Figure The Tax On The Unrelated Business Income Of The Organization.

Upload, modify or create forms. Web file form 109 for taxable years beginning in 2000. Web form adopted for mandatory use notice of hearing—emancipation of minor family code, § 7000 et seq. Web use form 109, california exempt organization business income tax return, to figure the tax on the unrelated business income of the organization.

Filing Form 109 Does Not.

This form is for income earned in tax year 2022, with tax returns due in april. Web 2022 california exempt organization business income tax return form 109. Web use form 109, california exempt organization business income tax return, to figure the tax on the unrelated business income of the organization. Web this form is only for providing proof that a document has been served (delivered) in a proceeding in the superior court appellate division.