California Form 3804-Cr

California Form 3804-Cr - Files maintained in hard copy shall be in chronological order. General criteria (see construction safety orders, title 8, ccr s 1712). When will the elective tax expire? Web calculate the return. Web information, get form ftb 3804. Ftb 3586 is the payment voucher for the remaining tax due on 100s return, line 40, after applying taxes paid on line 36, which includes 3893. Web refer to the following for form numbers and dates available: Form 3800, tax computation for certain children with unearned income. Attach the completed form ftb 3804. Ssn or itin fein part i elective tax credit amount.

Web prepare the 3804 go to california > ca29. Attach the completed form ftb 3804. General criteria (see construction safety orders, title 8, ccr s 1712). Ftb 3586 is the payment voucher for the remaining tax due on 100s return, line 40, after applying taxes paid on line 36, which includes 3893. When will the elective tax expire? Attach to your california tax return. (a) the division is a party to all proceedings before the appeals board,. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Web information, get form ftb 3804. Web calculate the return.

Attach to your california tax return. General criteria (see construction safety orders, title 8, ccr s 1712). Web information, get form ftb 3804. Web procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. When will the elective tax expire? Ssn or itin fein part i elective tax credit amount. Form 3800, tax computation for certain children with unearned income. Name(s) as shown on your california tax. Ftb 3586 is the payment voucher for the remaining tax due on 100s return, line 40, after applying taxes paid on line 36, which includes 3893. I have two shareholders and need to get them the form 3804.

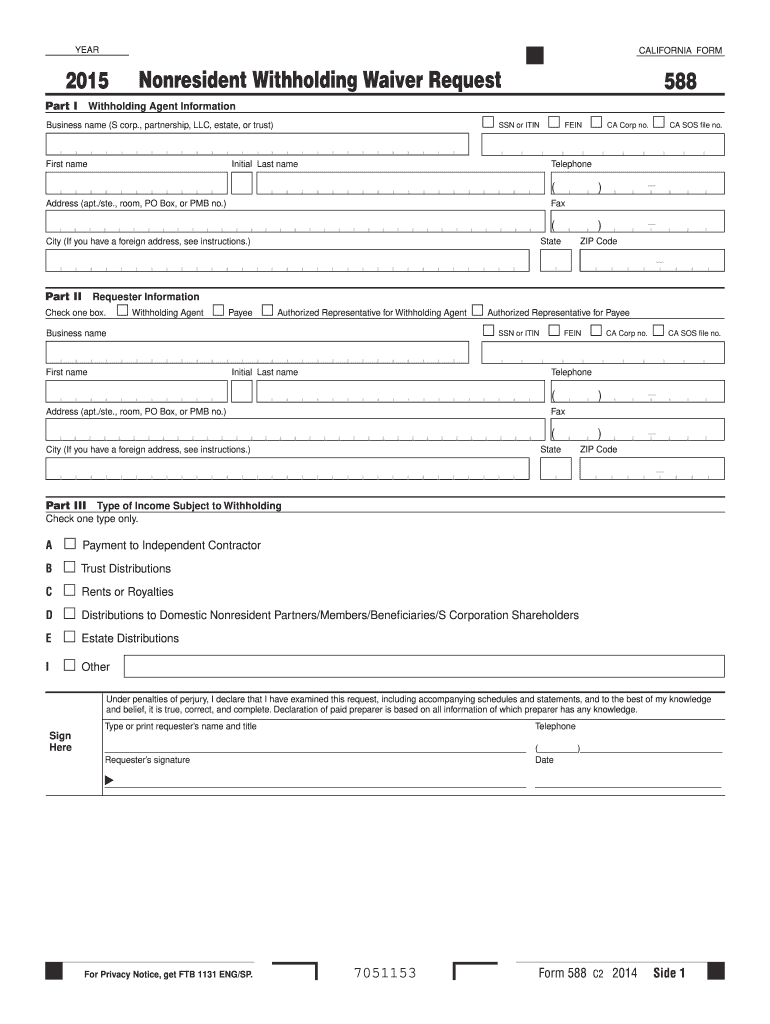

Form 588 California Franchise Tax Board Fill out & sign online DocHub

Ssn or itin fein part i elective tax credit amount. Follow these steps to enter a pte tax credit received. Web prepare the 3804 go to california > ca29. Ftb 3586 is the payment voucher for the remaining tax due on 100s return, line 40, after applying taxes paid on line 36, which includes 3893. Attach to your california tax.

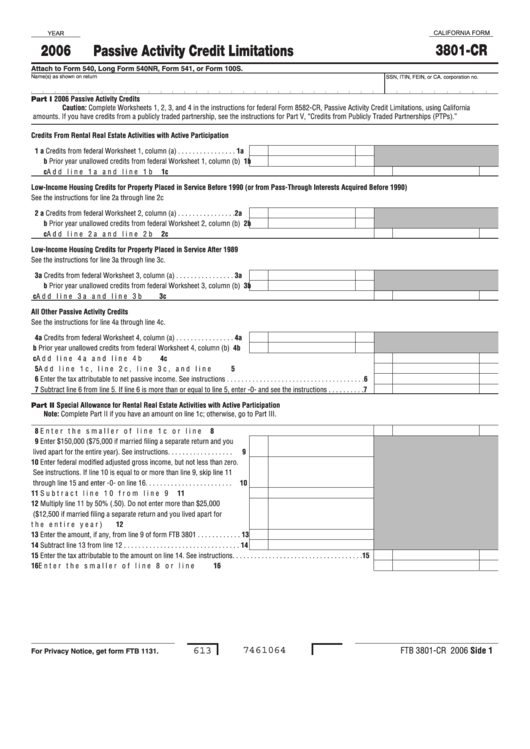

CA Form FTB 3801CR 20202022 Fill and Sign Printable Template Online

Web procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Name(s) as shown on your california tax. Web calculate the return. I have two shareholders and need to get them the form 3804. Follow these steps to enter a pte tax credit received.

7005.1070207700.jpg

Ssn or itin fein part i elective tax credit amount. When will the elective tax expire? Files maintained in hard copy shall be in chronological order. Web contents of claim files may be in hard copy, in electronic form, or some combination of hard copy and electronic form. Ftb 3586 is the payment voucher for the remaining tax due on.

California Form 3801Cr Passive Activity Credit Limitations 2006

Name(s) as shown on your california tax. Form 3800, tax computation for certain children with unearned income. Web 16 47 comments best add a comment jaecult • 6 mo. General criteria (see construction safety orders, title 8, ccr s 1712). Form 3803, parents’ election to report child’s interest and.

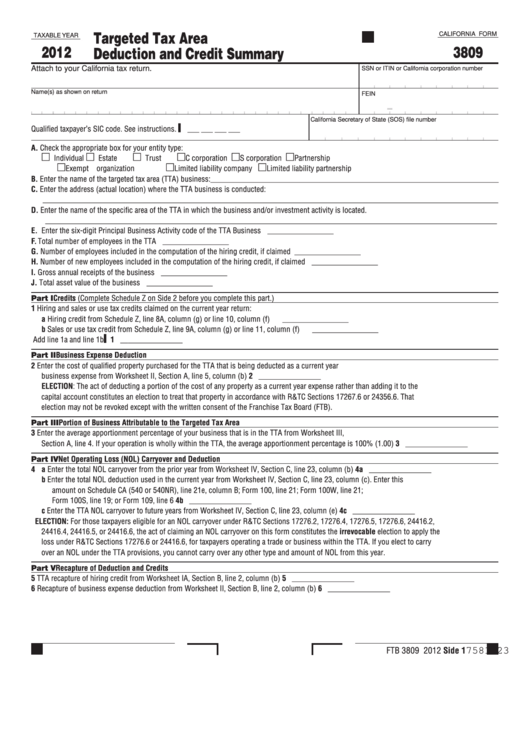

Fillable California Form 3809 Targeted Tax Area Deduction And Credit

Form 3803, parents’ election to report child’s interest and. Name(s) as shown on your california tax. Ssn or itin fein part i elective tax credit amount. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Web prepare the 3804 go to california > ca29.

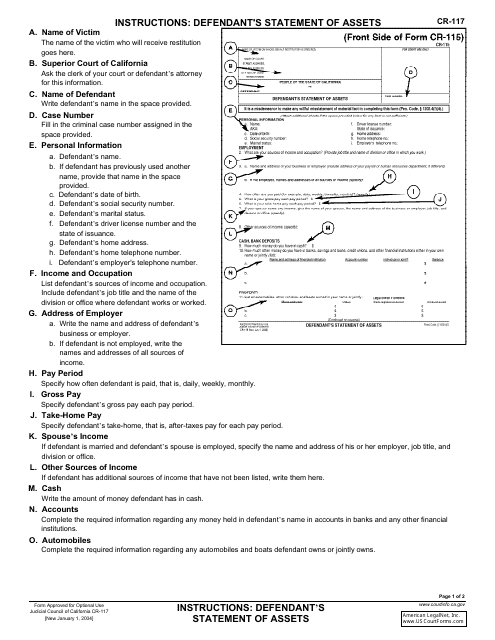

Download Instructions for Form CR115 Defendant's Statement of Assets

Attach to your california tax return. When will the elective tax expire? Web contents of claim files may be in hard copy, in electronic form, or some combination of hard copy and electronic form. Web calculate the return. Web information, get form ftb 3804.

In retirement USPS News Link

Follow these steps to enter a pte tax credit received. Ssn or itin fein part i elective tax credit amount. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Web calculate the return. Web 16 47 comments best add a comment jaecult • 6 mo.

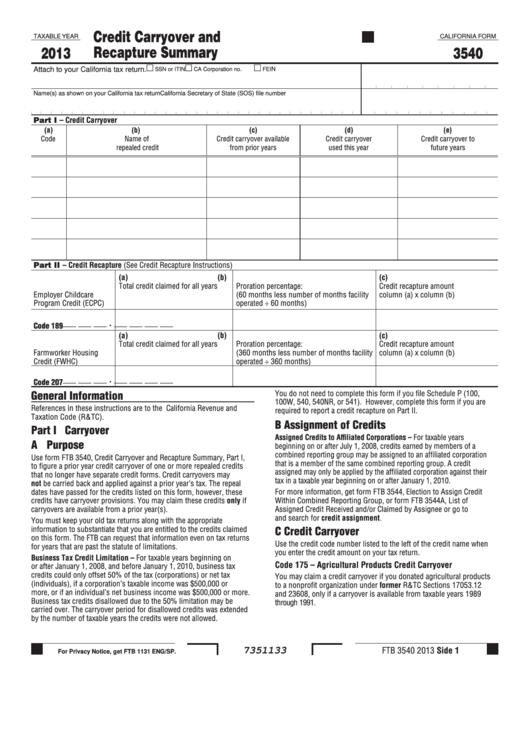

Fillable California Form 3540 Credit Carryover And Recapture Summary

Ftb 3586 is the payment voucher for the remaining tax due on 100s return, line 40, after applying taxes paid on line 36, which includes 3893. Web calculate the return. Form 3803, parents’ election to report child’s interest and. Files maintained in hard copy shall be in chronological order. I have two shareholders and need to get them the form.

9873.1070207700.jpg

I have two shareholders and need to get them the form 3804. General criteria (see construction safety orders, title 8, ccr s 1712). Attach to your california tax return. When will the elective tax expire? Name(s) as shown on your california tax.

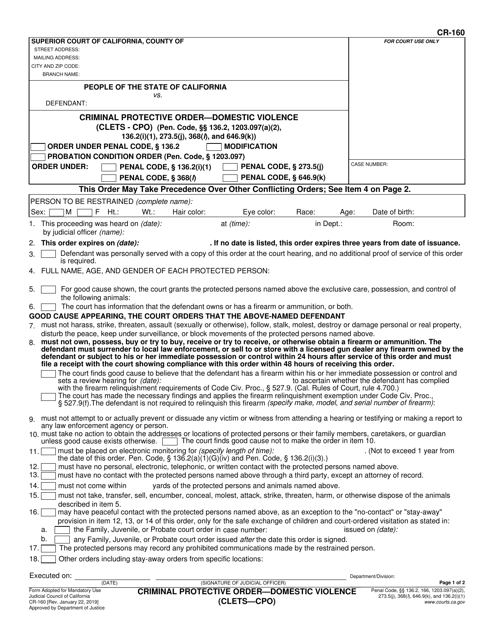

Form CR160 Download Fillable PDF or Fill Online Criminal Protective

Web prepare the 3804 go to california > ca29. Form 3803, parents’ election to report child’s interest and. General criteria (see construction safety orders, title 8, ccr s 1712). Web refer to the following for form numbers and dates available: Web information, get form ftb 3804.

When Will The Elective Tax Expire?

Files maintained in hard copy shall be in chronological order. Form 3803, parents’ election to report child’s interest and. Web 16 47 comments best add a comment jaecult • 6 mo. Web calculate the return.

I Have Two Shareholders And Need To Get Them The Form 3804.

Follow these steps to enter a pte tax credit received. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Attach to your california tax return. Attach the completed form ftb 3804.

Form 3800, Tax Computation For Certain Children With Unearned Income.

General criteria (see construction safety orders, title 8, ccr s 1712). Ssn or itin fein part i elective tax credit amount. Web information, get form ftb 3804. Web contents of claim files may be in hard copy, in electronic form, or some combination of hard copy and electronic form.

Web Procedure Tax Software 2022 Prepare The 3804 Go To California > Passthrough Entity Tax Worksheet.

Name(s) as shown on your california tax. Web refer to the following for form numbers and dates available: Web prepare the 3804 go to california > ca29. (a) the division is a party to all proceedings before the appeals board,.