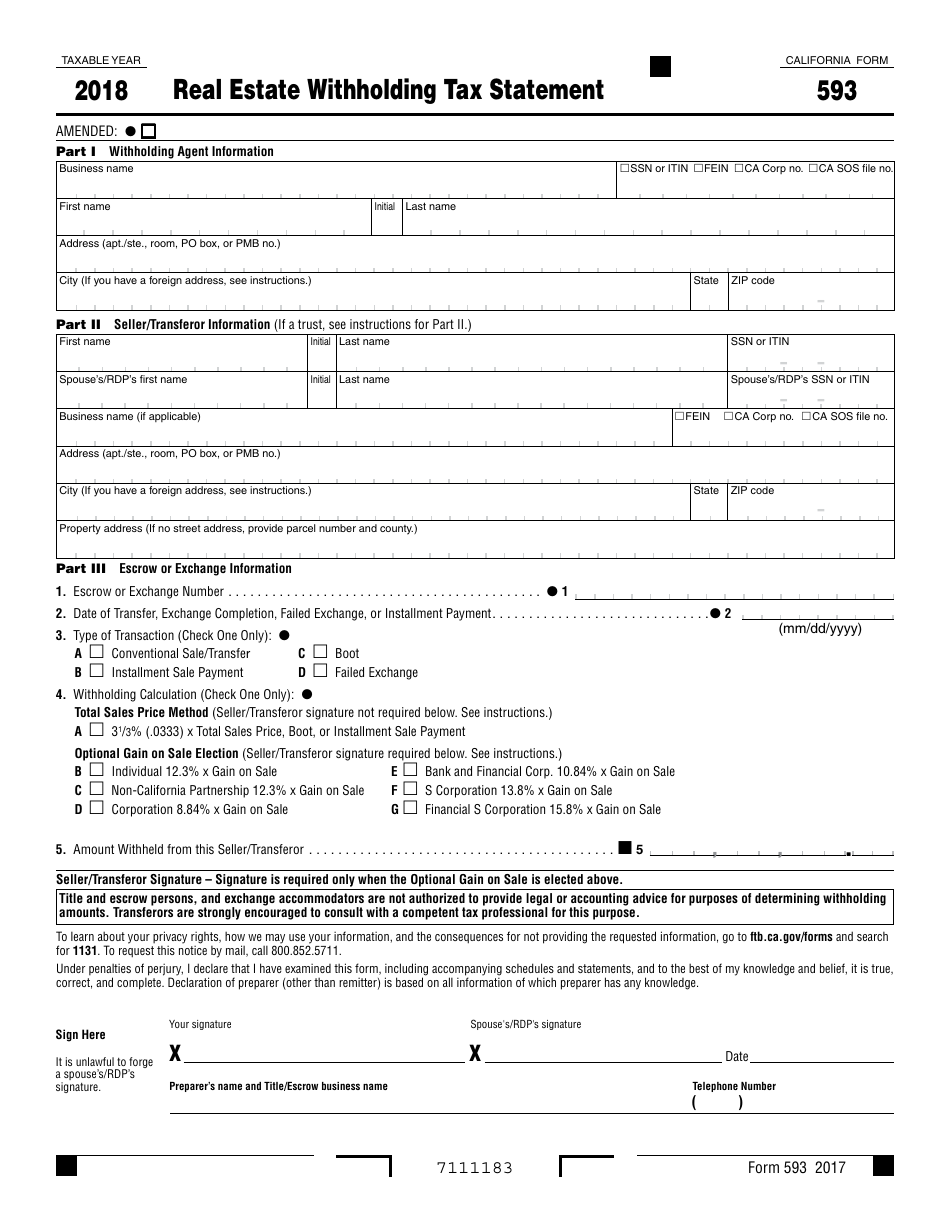

California Form 593 Instructions

California Form 593 Instructions - The seller is to complete. Web taxformfinder.org california income tax forms california form 593 california real estate withholding tax statement tax day has passed, and refunds are being. Web your california real estate withholding has to be entered on both the state and the federal return. Web instructions for form 593; Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: • complete form 593, and verify it is accurate. Enter the amount reported on form 593, box 5 in the amount withheld from seller field. Web 3 rows find california form 593 instructions at esmart tax today. Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the rmc at resale closing) at the time of. Web a seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593.

Web your california real estate withholding has to be entered on both the state and the federal return. • complete form 593, and verify it is accurate. Enter the amount reported on form 593, box 5 in the amount withheld from seller field. • provide a copy of form 593. When california real estate is sold on an. Any remitter (individual, business entity, trust, estate, or reep) who withheld on the. Web 3 rows find california form 593 instructions at esmart tax today. Web a seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. Web see the following links for form instructions: Web instructions for form 593;

Complete ftb form 593 when withholding is done. Enter the amount reported on form 593, box 5 in the amount withheld from seller field. Web taxformfinder.org california income tax forms california form 593 california real estate withholding tax statement tax day has passed, and refunds are being. When california real estate is sold on an. The seller is to complete. Web 3 rows find california form 593 instructions at esmart tax today. Web 2019593 real estate withholding forms booklet this booklet contains: Web instructions for form 593; Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the rmc at resale closing) at the time of. Web a seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593.

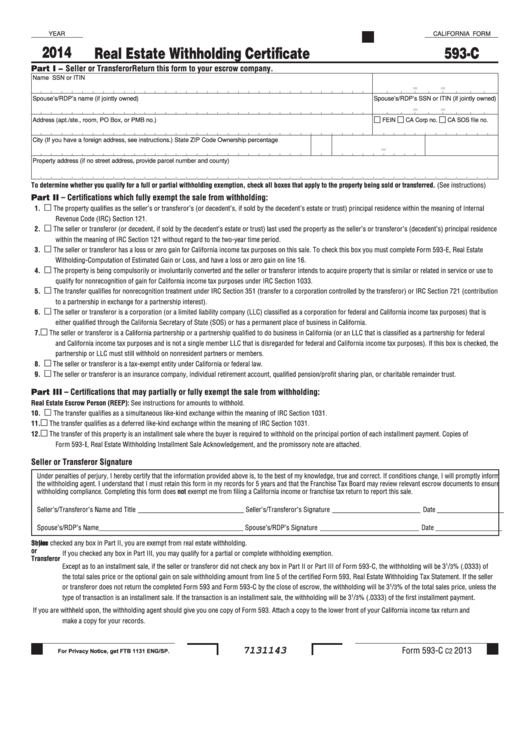

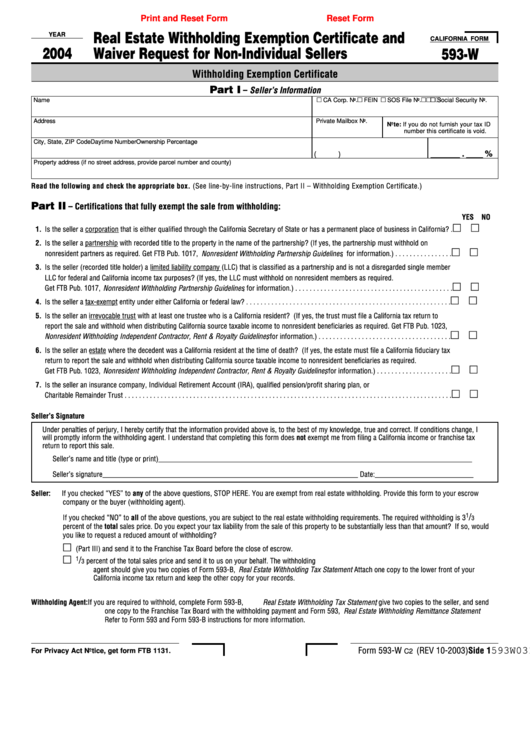

Fillable California Form 593C Real Estate Withholding Certificate

The seller is to complete. Web instructions for form 593; Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: Web 2019593 real estate withholding forms booklet this booklet contains: Ca form 568, limited liability.

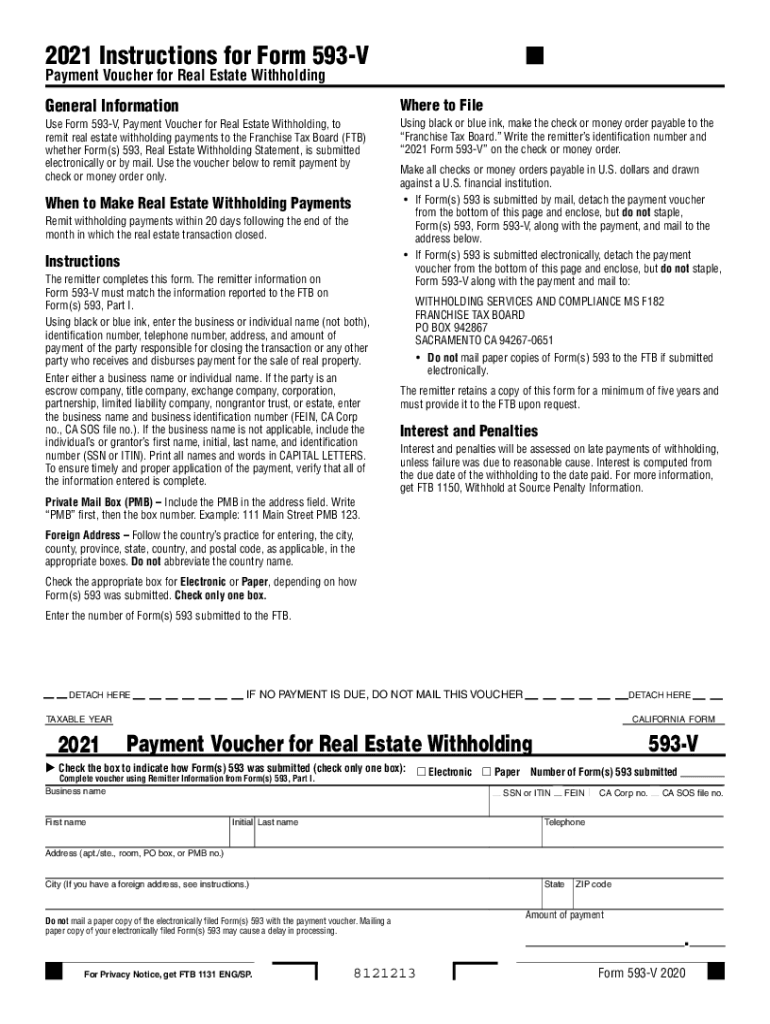

2021 Form 593 Instructions Fill Out and Sign Printable PDF Template

The seller is to complete. When california real estate is sold on an. Web instructions for form 593; When you reach take a look at. Web 3 rows find california form 593 instructions at esmart tax today.

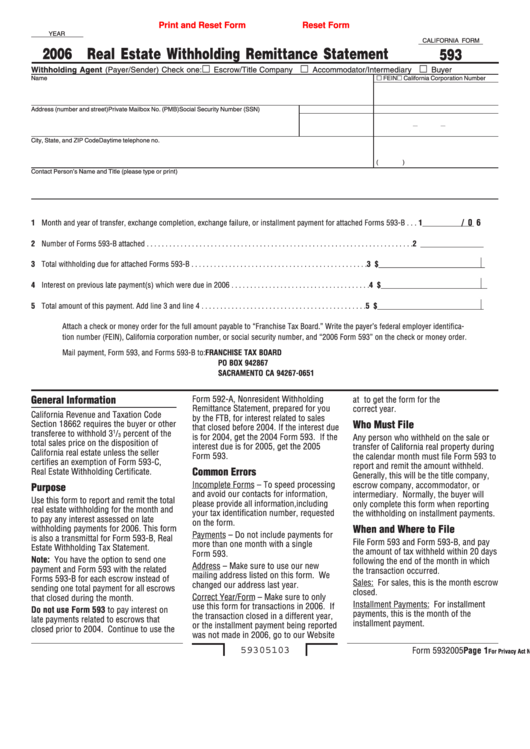

Fillable California Form 593 Real Estate Withholding Remittance

Web for any withholding payments after escrow closes, the buyer becomes the remitter and is required to: When california real estate is sold on an. • complete form 593, and verify it is accurate. Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the rmc at resale.

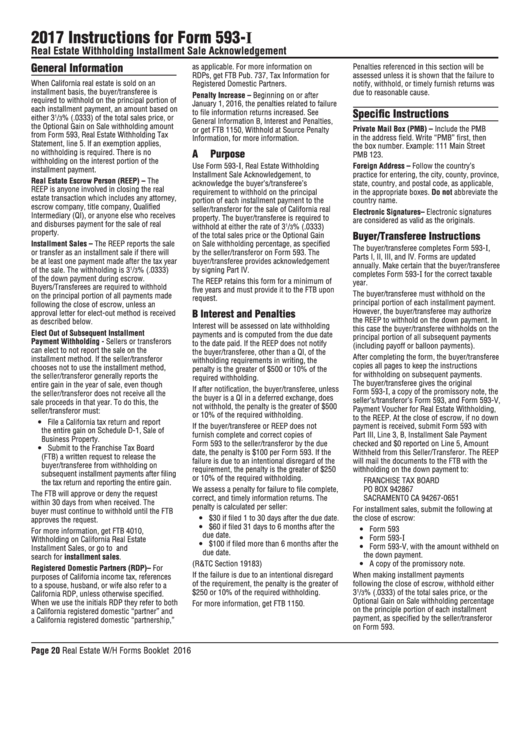

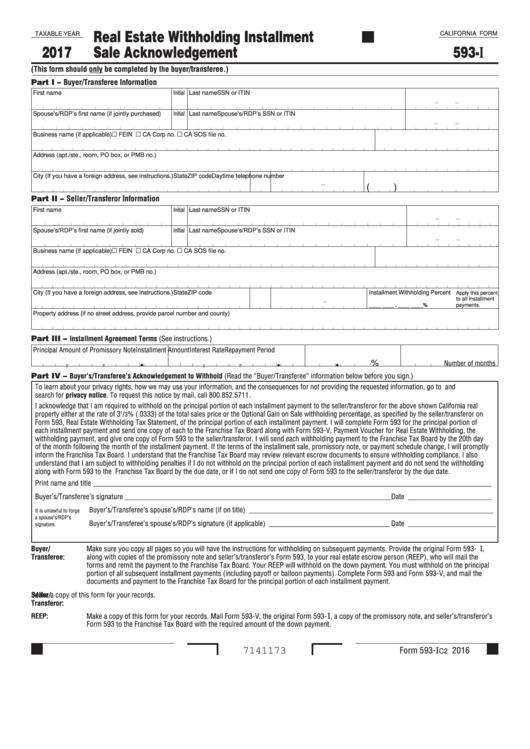

Instructions For Form 593I Real Estate Withholding Installment Sale

• provide a copy of form 593. Ca form 568, limited liability. Web 2019593 real estate withholding forms booklet this booklet contains: Web instructions for form 593; Web for withholding on a sale, the remitter will need the original completed form 593 and two copies:

Form 593 Download Fillable PDF or Fill Online Real Estate Withholding

Web instructions for form 593; The seller is to complete. Ca form 568, limited liability. Any remitter (individual, business entity, trust, estate, or reep) who withheld on the. • provide a copy of form 593.

Fillable California Form 593W Real Estate Withholding Exemption

The seller is to complete. When you reach take a look at. • provide a copy of form 593. Web for any withholding payments after escrow closes, the buyer becomes the remitter and is required to: Web instructions for form 593;

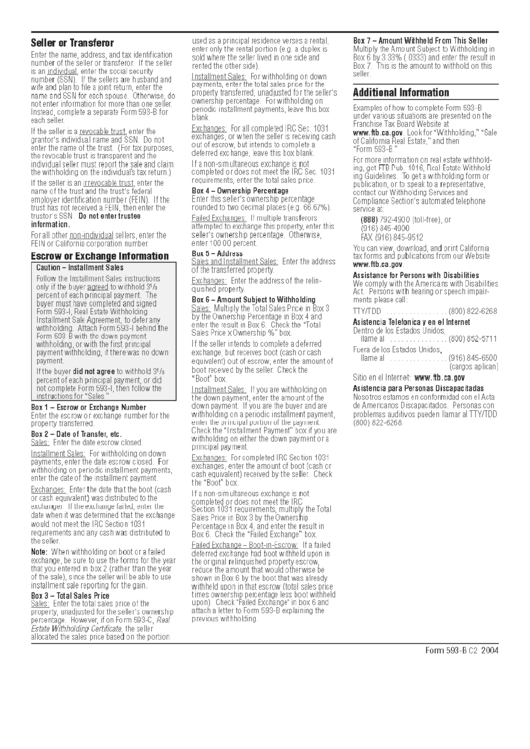

Form 593B Instructions For Real Estate Withholding Tax Statement

• provide a copy of form 593. The seller is to complete. Ca form 568, limited liability. Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: Web instructions for form 593;

Fillable California Form 593I Real Estate Withholding Installment

Web your california real estate withholding has to be entered on both the state and the federal return. Web instructions for form 593; Complete ftb form 593 when withholding is done. • provide a copy of form 593. The seller is to complete.

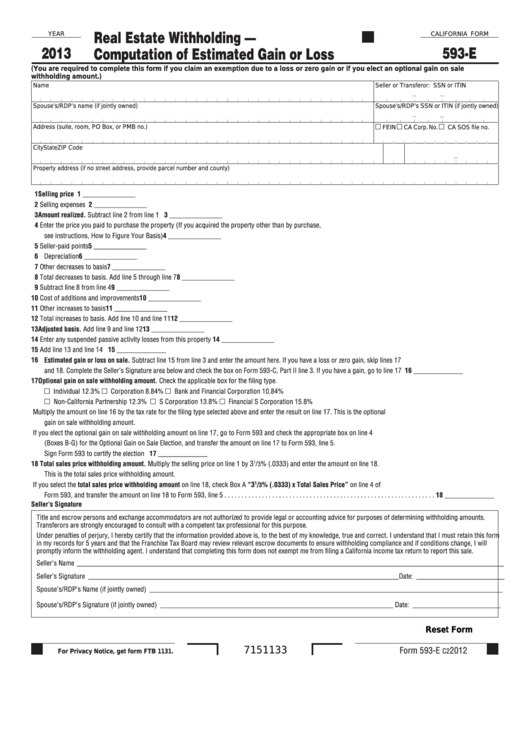

Fillable California Form 593E Real Estate Withholding Computation

Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the rmc at resale closing) at the time of. Enter the amount reported on form 593, box 5 in the amount withheld from seller field. Ca form 568, limited liability. When you reach take a look at. •.

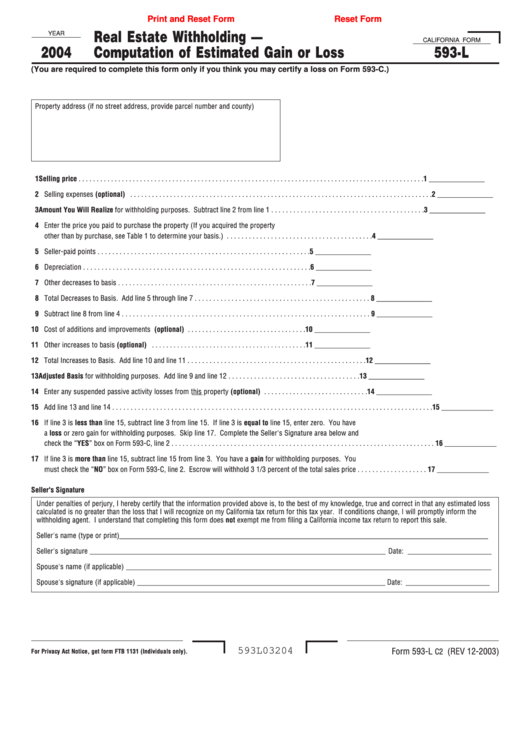

Fillable California Form 593L Real Estate Withholding Computation

Web 3 rows find california form 593 instructions at esmart tax today. When california real estate is sold on an. Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: • provide a copy of form 593. Web the ftb instructions state that the completed form 593 is to be sent to.

Web The Ftb Instructions State That The Completed Form 593 Is To Be Sent To The Seller (The Transferee At Acquisition And The Rmc At Resale Closing) At The Time Of.

Web taxformfinder.org california income tax forms california form 593 california real estate withholding tax statement tax day has passed, and refunds are being. Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: • complete form 593, and verify it is accurate. Web 2019593 real estate withholding forms booklet this booklet contains:

Web For Any Withholding Payments After Escrow Closes, The Buyer Becomes The Remitter And Is Required To:

When california real estate is sold on an. Ca form 568, limited liability. • provide a copy of form 593. The seller is to complete.

Web Instructions For Form 593;

Web 3 rows find california form 593 instructions at esmart tax today. Web your california real estate withholding has to be entered on both the state and the federal return. Complete ftb form 593 when withholding is done. Any remitter (individual, business entity, trust, estate, or reep) who withheld on the.

Enter The Amount Reported On Form 593, Box 5 In The Amount Withheld From Seller Field.

Web a seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. When you reach take a look at. First, complete your state return. Web see the following links for form instructions: