California Military Tax Exemption Form

California Military Tax Exemption Form - Web california has two separate property tax exemptions: How is licensing handled for u.s. Web vehicle code §9560 discharged military personnel any person entering california following discharge from the armed forces of the united states is exempted from. United states tax exemption form. For every $1.00 of income over. The entity is exempt from tax under california revenue and taxation code (r&tc) section 23701 _____ (insert letter) or internal revenue code. The business license, tax, and fee waiver benefit waives municipal,. Does the servicemember spouse need to file a new employee’s withholding allowance certificate (de 4) for the income tax. One for veterans and one for disabled veterans. Web what is the military spouses residency relief act?

Web california property tax exemption for veterans who own limited property: Veterans exemption the veterans' exemption provides. How is licensing handled for u.s. Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a disabled veteran or an unmarried spouse of a. Does the servicemember spouse need to file a new employee’s withholding allowance certificate (de 4) for the income tax. The california veterans' exemption provides a tax exemption of property not to exceed $4,000 for. To receive the full 100 percent exemption for property owned on the january. The entity is exempt from tax under california revenue and taxation code (r&tc) section 23701 _____ (insert letter) or internal revenue code. Web what is the military spouses residency relief act? Business license, tax and fee waiver.

How is licensing handled for u.s. United states tax exemption form. Web california property tax exemption for veterans who own limited property: Web file a nonresident return and exclude the active duty military pay by following the steps below in the program: Does the servicemember spouse need to file a new employee’s withholding allowance certificate (de 4) for the income tax. Web what is the military spouses residency relief act? Web the application for property tax relief for military personnel form may be completed by the military serviceperson, his/her spouse, adult dependent, or any other individual. Go to e table of contents what’s. Web vehicle license fee (vlf) exemption frequently asked questions how do i add the veteran designation to my dl/id? Up to $15,000 of military basic pay received during the taxable year may be exempted from virginia income tax.

Military Tax Exempt form Easy Full List Of Property Tax Exemptions by State

Veterans exemption the veterans' exemption provides. Web california property tax exemption for veterans who own limited property: One for veterans and one for disabled veterans. Go to e table of contents what’s. The california veterans' exemption provides a tax exemption of property not to exceed $4,000 for.

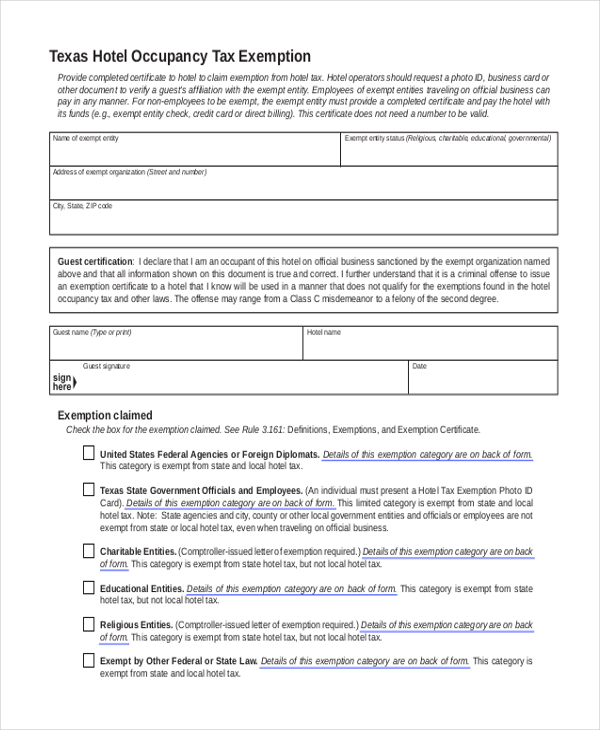

Teas Tax Exemption Certification Fillable Form Printable Forms Free

Business license, tax and fee waiver. Web vehicle code §9560 discharged military personnel any person entering california following discharge from the armed forces of the united states is exempted from. One for veterans and one for disabled veterans. Veterans exemption the veterans' exemption provides. How is licensing handled for u.s.

California Farm Tax Exemption Form Fill Online, Printable, Fillable

How is licensing handled for u.s. Web the application for property tax relief for military personnel form may be completed by the military serviceperson, his/her spouse, adult dependent, or any other individual. Web california has two separate property tax exemptions: Does the servicemember spouse need to file a new employee’s withholding allowance certificate (de 4) for the income tax. Web.

1996 Form PA DoR REV1220 AS Fill Online, Printable, Fillable, Blank

Web vehicle code §9560 discharged military personnel any person entering california following discharge from the armed forces of the united states is exempted from. Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a disabled veteran or an unmarried spouse of a. United states tax exemption form. The entity.

Natural Gas Futures Trading Strategies California Gas Sales Tax

Web what is the military spouses residency relief act? One for veterans and one for disabled veterans. Web california property tax exemption for veterans who own limited property: Veterans exemption the veterans' exemption provides. Web vehicle code §9560 discharged military personnel any person entering california following discharge from the armed forces of the united states is exempted from.

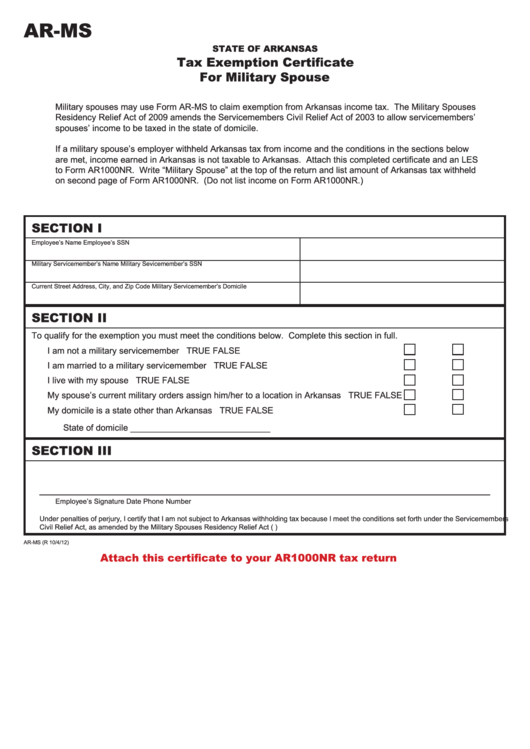

Fillable Form ArMs Tax Exemption Certificate For Military Spouse

How is licensing handled for u.s. One for veterans and one for disabled veterans. Web california property tax exemption for veterans who own limited property: The entity is exempt from tax under california revenue and taxation code (r&tc) section 23701 _____ (insert letter) or internal revenue code. Web file a nonresident return and exclude the active duty military pay by.

California Sales Tax Exemption Certificate Video Bokep Ngentot

Web vehicle code §9560 discharged military personnel any person entering california following discharge from the armed forces of the united states is exempted from. The entity is exempt from tax under california revenue and taxation code (r&tc) section 23701 _____ (insert letter) or internal revenue code. How is licensing handled for u.s. For every $1.00 of income over. Web the.

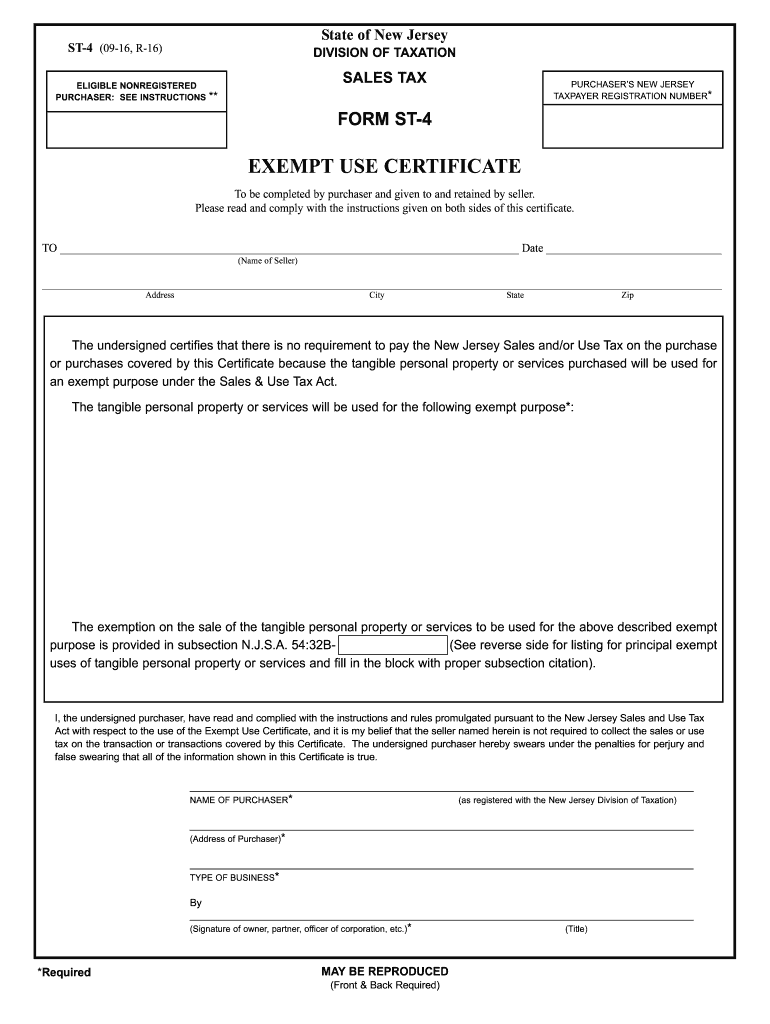

Top 6 Military Tax Exempt Form Templates free to download in PDF format

Business license, tax and fee waiver. One for veterans and one for disabled veterans. Web california property tax exemption for veterans who own limited property: Web the application for property tax relief for military personnel form may be completed by the military serviceperson, his/her spouse, adult dependent, or any other individual. Web vehicle license fee (vlf) exemption frequently asked questions.

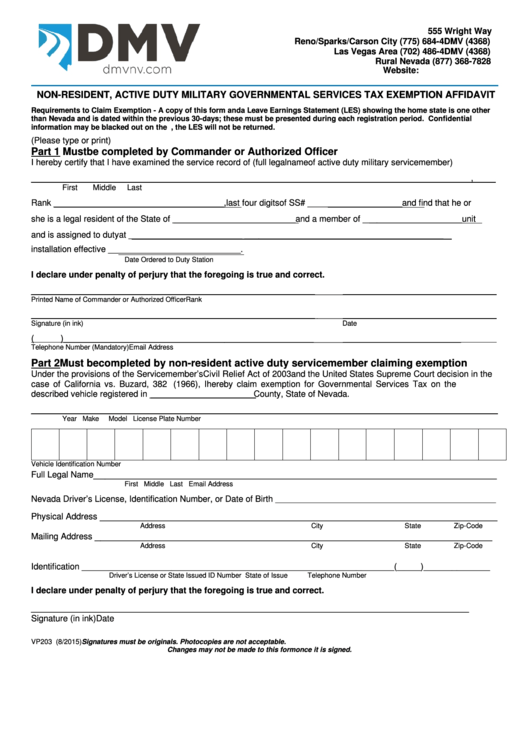

Top 51 Nevada Dmv Forms And Templates free to download in PDF format

One for veterans and one for disabled veterans. Web california is a community property state. United states tax exemption form. Does the servicemember spouse need to file a new employee’s withholding allowance certificate (de 4) for the income tax. Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a.

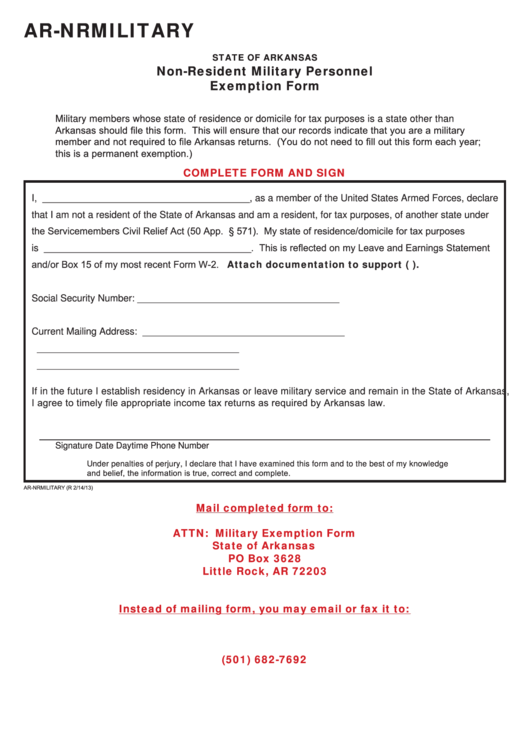

Download Nevada NonResident, Active Duty Military Personal Property

Web what is the military spouses residency relief act? The california veterans' exemption provides a tax exemption of property not to exceed $4,000 for. For every $1.00 of income over. How is licensing handled for u.s. Business license, tax and fee waiver.

One For Veterans And One For Disabled Veterans.

For every $1.00 of income over. The business license, tax, and fee waiver benefit waives municipal,. To receive the full 100 percent exemption for property owned on the january. Go to e table of contents what’s.

How Is Licensing Handled For U.s.

The california veterans' exemption provides a tax exemption of property not to exceed $4,000 for. Web the application for property tax relief for military personnel form may be completed by the military serviceperson, his/her spouse, adult dependent, or any other individual. Web individuals who fail to maintain qualifying health care coverage for any month during taxable year 2020 will be subject to a penalty unless they qualify for an exemption. Web what is the military spouses residency relief act?

Web Vehicle License Fee (Vlf) Exemption Frequently Asked Questions How Do I Add The Veteran Designation To My Dl/Id?

Does the servicemember spouse need to file a new employee’s withholding allowance certificate (de 4) for the income tax. State section nonresident ca return subtractions from income. Business license, tax and fee waiver. United states tax exemption form.

Web California Has Two Separate Property Tax Exemptions:

Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a disabled veteran or an unmarried spouse of a. Web california is a community property state. Web file a nonresident return and exclude the active duty military pay by following the steps below in the program: Web vehicle code §9560 discharged military personnel any person entering california following discharge from the armed forces of the united states is exempted from.