Call Calendar

Call Calendar - Web ios 18 brings new ways to customize the iphone experience, relive special moments, and stay connected. Web a calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or. Web zinger key points. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. View the results using flipcharts: Web a long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. Web a calendar call is a scheduled court session where the judge or a court official reviews the status of cases set for trial. Web what is a calendar spread? General mills reported adjusted eps of $1.07, beating estimates, but net sales fell 1% amid rising costs and lower profits. Meanwhile, a put calendar spread utilizes two puts.

A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but. Web what is a call calendar spread? View the results using flipcharts: Web load a saved screener: Select a previously saved set of screener filters to view today's results. Learn how to optimize this. Web what is a calendar spread? Web ein long call calendar spread (auch: Web ios 18 brings new ways to customize the iphone experience, relive special moments, and stay connected. Web a long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates.

Web a long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time. A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but. Learn how to optimize this. Web ein long call calendar spread (auch: Meanwhile, a put calendar spread utilizes two puts. Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations. Web a calendar call is a scheduled court session where the judge or a court official reviews the status of cases set for trial. General mills reported adjusted eps of $1.07, beating estimates, but net sales fell 1% amid rising costs and lower profits. Web ios 18 brings new ways to customize the iphone experience, relive special moments, and stay connected. Web what is a call calendar spread?

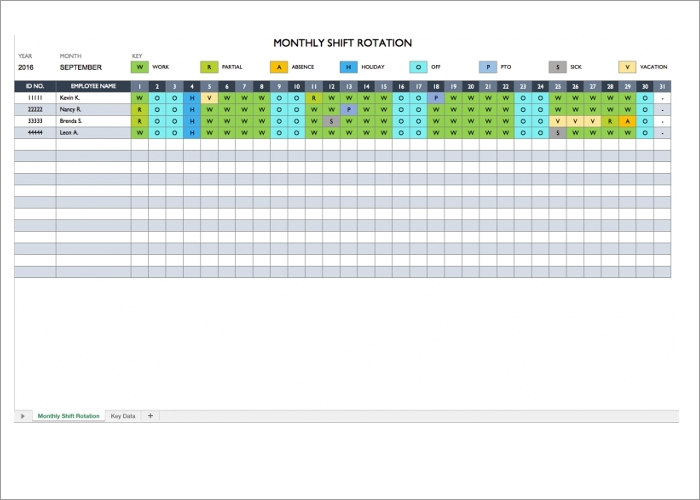

How To On Call Rotation Calendar Template Get Your Ca vrogue.co

You may go long or short. Web load a saved screener: Page through charts of the. Web ios 18 brings new ways to customize the iphone experience, relive special moments, and stay connected. Web a long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates.

On Call Schedule Template Excel Inspirational Call Calendar Template

You may go long or short. Select a previously saved set of screener filters to view today's results. Learn how to optimize this. Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Web ein long call calendar spread (auch:

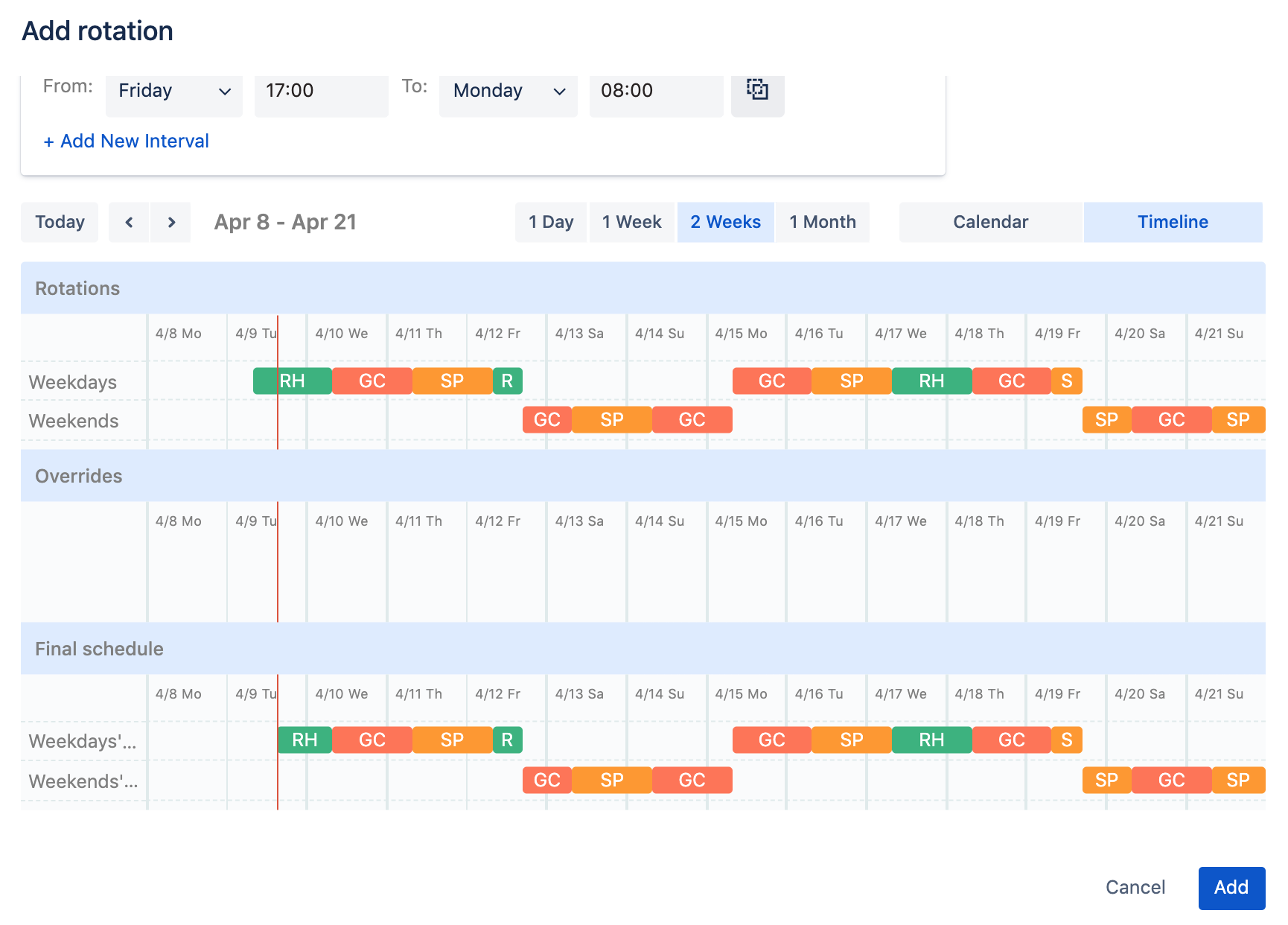

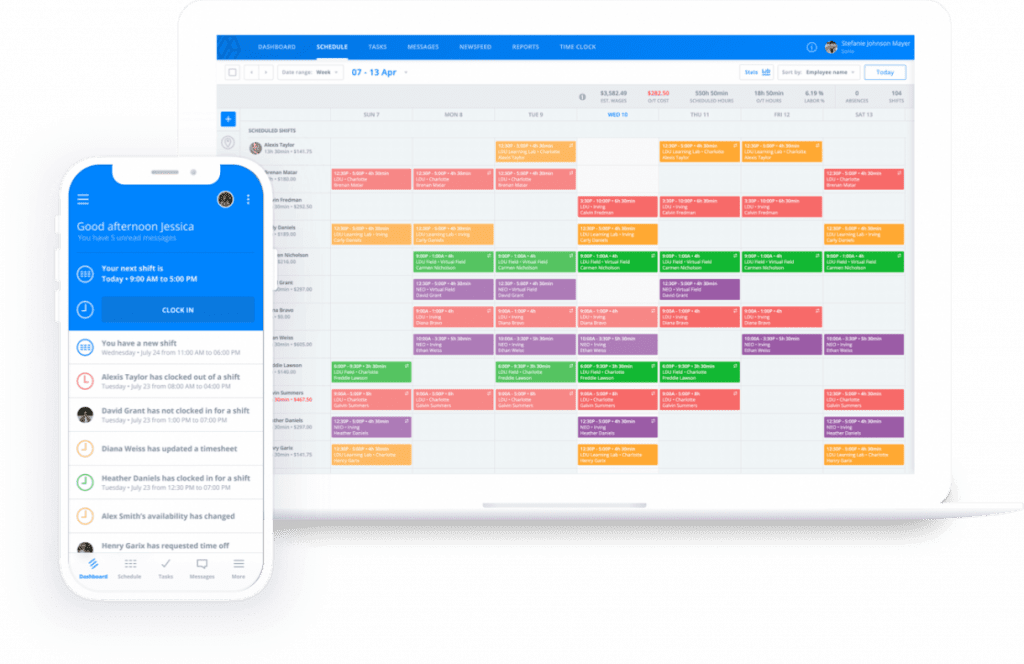

How To Create An OnCall Schedule That Won’t Frustrate Employees Sling

Web a long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time. Page through charts of the. Web load a saved screener: During this session, attorneys and. Web a calendar spread, also known as a time spread, is an.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web ein long call calendar spread (auch: Meanwhile, a put calendar spread utilizes two puts. Web what is a call calendar spread? Web load a saved screener: Customize your iphone further by arranging your home.

Calendar Call Definition, Purpose, Advantages, and Disadvantages 7

Web zinger key points. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Web what is a call calendar spread? Web what is a calendar spread? Select a previously saved set of screener filters to.

10+ On Call Schedule Templates Free Word, PDF, Excel Formats

Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations. Customize your iphone further by arranging your home. View the results using flipcharts: Web load a saved screener: Web what is a call calendar spread?

What Is a Call Calendar Spread YouTube

Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Page through charts of the. Web a long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time. Summed.

Long Call Calendar Long call calendar Spread Calendar Spread YouTube

Select a previously saved set of screener filters to view today's results. Web a long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time. Web ein long call calendar spread (auch: Web what is a calendar spread? Learn how.

Managing Calls in the Salesforce Calendar

Web ein long call calendar spread (auch: Web load a saved screener: You may go long or short. Web a calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or. Learn how to optimize this.

10+ On Call Schedule Templates Free Word, PDF, Excel Formats

Customize your iphone further by arranging your home. Web what is a calendar spread? During this session, attorneys and. Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations. Summed up, a call calendar spread utilizes two calls.

Web A Calendar Spread, Also Known As A Time Spread, Is An Options Trading Strategy That Involves Buying And Selling Two Options Of The Same Type (Either Calls Or.

Web zinger key points. Web a long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy profits from time. Summed up, a call calendar spread utilizes two calls. Customize your iphone further by arranging your home.

Web What Is A Call Calendar Spread?

Web a calendar call is a scheduled court session where the judge or a court official reviews the status of cases set for trial. Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Web ein long call calendar spread (auch: Meanwhile, a put calendar spread utilizes two puts.

Web This Article Provides A Comprehensive Understanding Of Calendar Spreads, Including Their Purpose, Execution, Potential Profits, And Key Considerations.

Web a long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. Learn how to optimize this. You may go long or short. During this session, attorneys and.

View The Results Using Flipcharts:

Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but. Select a previously saved set of screener filters to view today's results. Web what is a calendar spread?

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)