Can Form 3520 Be Filed Electronically

Can Form 3520 Be Filed Electronically - Person to file a form 3520 to report the transactions. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web foreign trust with a u.s. Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically. The forms are available at irs.gov and through professional tax software. Owner to satisfy its annual information reporting requirements under section 6048(b). Does it cause any issues with reconciling form 3520 with one's income tax return? Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. The heading at the top of the late. Send form 3520 to the.

Ad talk to our skilled attorneys by scheduling a free consultation today. Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Owner to satisfy its annual information reporting requirements under section 6048(b). Person to file a form 3520 to report the transactions. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. There are certain filing threshold. Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts; Form 8802, application for u.s. Web form 3520 does not have to be filed to report the following transactions.

Form 8802, application for u.s. Web foreign trust with a u.s. Person to file a form 3520 to report the transactions. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically. Does it cause any issues with reconciling form 3520 with one's income tax return? Ad talk to our skilled attorneys by scheduling a free consultation today. Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a. Person receives a gift from a foreign person, the irs may require the u.s.

Form 3520 Edit, Fill, Sign Online Handypdf

Send form 3520 to the. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. There are certain filing threshold. Owner to satisfy its annual information reporting requirements under section 6048(b). Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a.

Which IRS Form Can Be Filed Electronically?

Web foreign trust with a u.s. Ad talk to our skilled attorneys by scheduling a free consultation today. The forms are available at irs.gov and through professional tax software. Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically. Send form 3520 to.

2020 Form IRS 3520 Fill Online, Printable, Fillable, Blank pdfFiller

Form 8802, application for u.s. Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts; Owner to satisfy its annual information reporting requirements under section 6048(b). Send form 3520 to the. The heading at the top of the late.

Forms 3520 and 3520A What You Need to Know

Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a. Web foreign trust with a u.s. Web form 3520 does not have to be filed to report the.

Form 3520 Blank Sample to Fill out Online in PDF

Person receives a gift from a foreign person, the irs may require the u.s. Person to file a form 3520 to report the transactions. There are certain filing threshold. The forms are available at irs.gov and through professional tax software. Web can i file income tax return electronically and mail form 3520?

Filing 20686047 Electronically Filed 11/18/2014 114328 AM

Person to file a form 3520 to report the transactions. There are certain filing threshold. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. The forms are available at irs.gov and through professional tax software. Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts;

IRS Form 4868 Online File 2020 IRS 4868

Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Web form 3520 does not have to be filed to report the following transactions. Person receives a gift from.

What is IRS Form 3520A? When is it required? How is one filed? YouTube

There are certain filing threshold. Does it cause any issues with reconciling form 3520 with one's income tax return? Person to file a form 3520 to report the transactions. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Web to help.

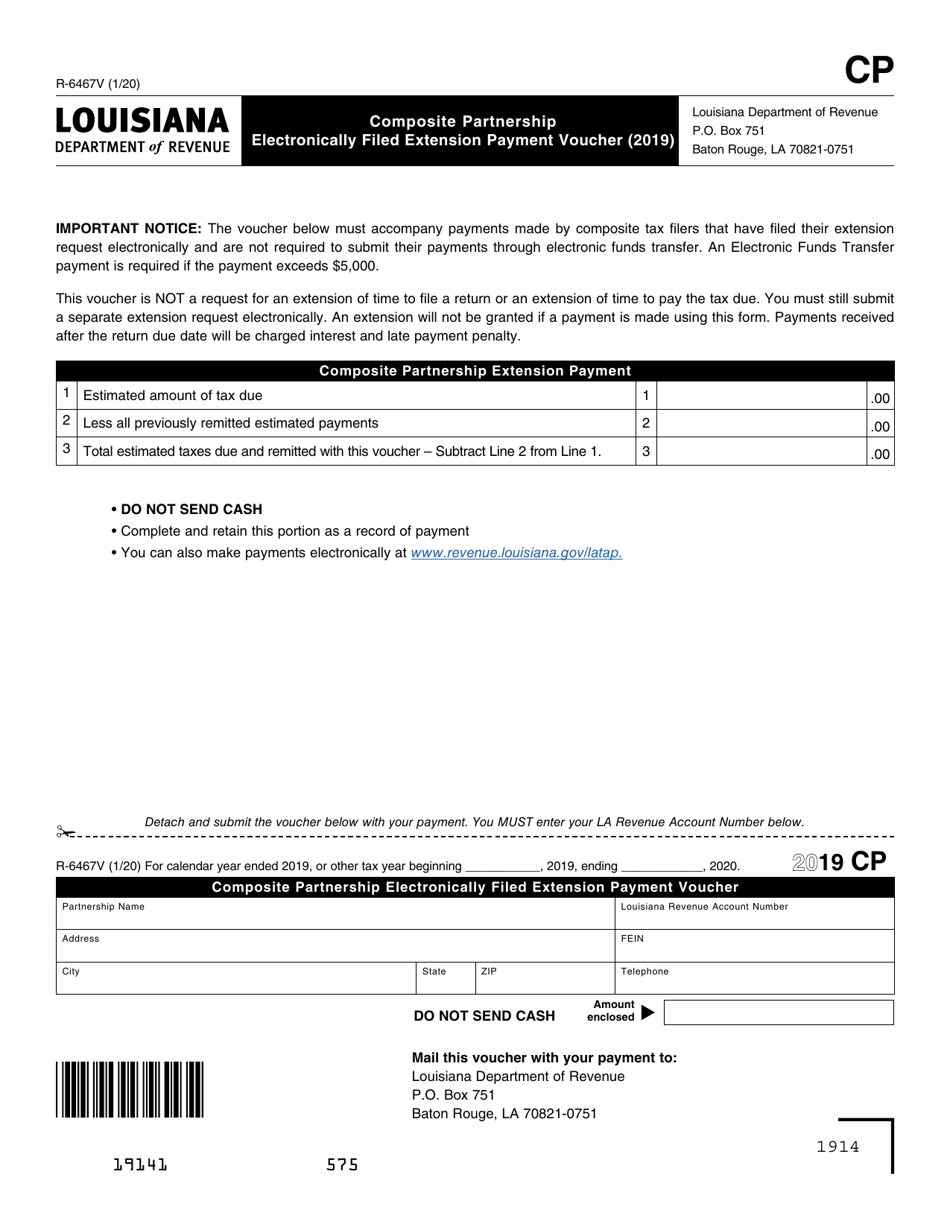

Form R6467V Download Fillable PDF or Fill Online Composite Partnership

Send form 3520 to the. Web can i file income tax return electronically and mail form 3520? Web foreign trust with a u.s. Person to file a form 3520 to report the transactions. Ad talk to our skilled attorneys by scheduling a free consultation today.

Form 3520A Annual Information Return of Foreign Trust with a U.S

Person receives a gift from a foreign person, the irs may require the u.s. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. The heading at the top of the late. Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a. Web form 3520, annual return to report transactions with foreign trusts.

Form 8802, Application For U.s.

Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically. Web form 3520 does not have to be filed to report the following transactions. Send form 3520 to the. Owner to satisfy its annual information reporting requirements under section 6048(b).

Person To File A Form 3520 To Report The Transactions.

Does it cause any issues with reconciling form 3520 with one's income tax return? Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Web foreign trust with a u.s. The heading at the top of the late.

Web Can I File Income Tax Return Electronically And Mail Form 3520?

Ad talk to our skilled attorneys by scheduling a free consultation today. Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts; The forms are available at irs.gov and through professional tax software. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues.

There Are Certain Filing Threshold.

Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a. Person receives a gift from a foreign person, the irs may require the u.s. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the.