Can You File Form 8862 Electronically

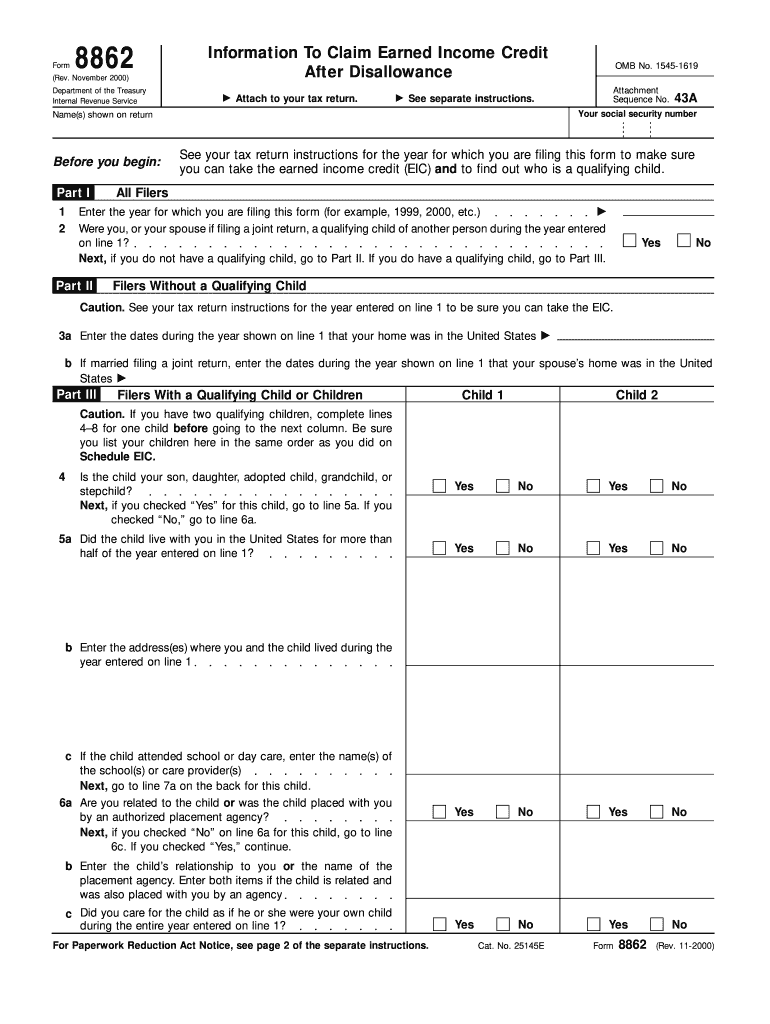

Can You File Form 8862 Electronically - Web you must complete form 8862 and attach it to your tax return only if both of the following apply; 1=one, 2=two, 3=three, 4=none (mandatory for eic claim). You can download form 8862 from the irs website, and can file it electronically or by mail. (2) you now want to claim. That's the only way to send it. Click on eic/ctc/aoc after disallowances (8862). Meaning, the 8862 should be electronically filed with the 2020 tax return. Here's how to file form 8862 in turbotax. And don't send an amended return unless the letter tells you to. Web schedule eic schedule eic, which is used to claim the earned income credit with a qualifying child, must be completed prior to filling out form 8862.

Web satisfied 119 votes what makes the form 8862 pdf legally binding? Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit (aptc) on form 8962, premium tax credit (ptc), but does not attach the form to the tax return. Enter the appropriate number in qualifying children: Retain generated forms according to the standards specified in 8. That's the only way to send it. Get form experience a faster way to fill out and sign forms on the web. You can download form 8862 from the irs website, and can file it electronically or by mail. Ad access irs tax forms. For more information, please click this link: (1) your eic was reduced or disallowed for any reason other than a math or clerical error for a year after 1996;

Web generally, you must attach the form 8862 to your 2020 tax return for the eic. Access the most extensive library of templates available. Ad register and subscribe now to work on your irs form 8862 & more fillable forms. The irs form 8862 isn’t an exception. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Ad access irs tax forms. Allocation of refund (including savings bond purchases) form 8889: Complete any other applicable information on this screen. Information to claim certain refundable credits. You'll come to the earned income credit section.

Form 8862 Edit, Fill, Sign Online Handypdf

Get form experience a faster way to fill out and sign forms on the web. Usually they say not to amend your return. Web generally, you must attach the form 8862 to your 2020 tax return for the eic. What’s new age requirements for taxpayers without a qualifying child. Form 8862 is required when the irs has previously disallowed one.

Form 8862 Edit, Fill, Sign Online Handypdf

Web you must complete form 8862 and attach it to your tax return only if both of the following apply; For more information, please click this link: Select search, enter form 8862, and select jump to form 8862; (1) your eic was reduced or disallowed for any reason other than a math or clerical error for a year after 1996;.

8862 Form Fill Out and Sign Printable PDF Template signNow

Submitting irs 8862 does not really have to be confusing any longer. That's the only way to send it. Web you do not need to file form 8862 in the year the credit was disallowed or reduced. 596 for more information on when to use. Access the most extensive library of templates available.

1040 (2022) Internal Revenue Service

Click on eic/ctc/aoc after disallowances (8862). Allocation of refund (including savings bond purchases) form 8889: Retain generated forms according to the standards specified in 8. December 2012) department of the treasury internal revenue service information to claim earned income credit after disallowance a attach to your tax return. 43a name(s) shown on return your social security.

Form 8862Information to Claim Earned Credit for Disallowance

Form 8862 is required when the irs has previously disallowed one or more specific tax credits. Filing this form allows you to reclaim credits for which you are now eligible. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Web starting with tax year.

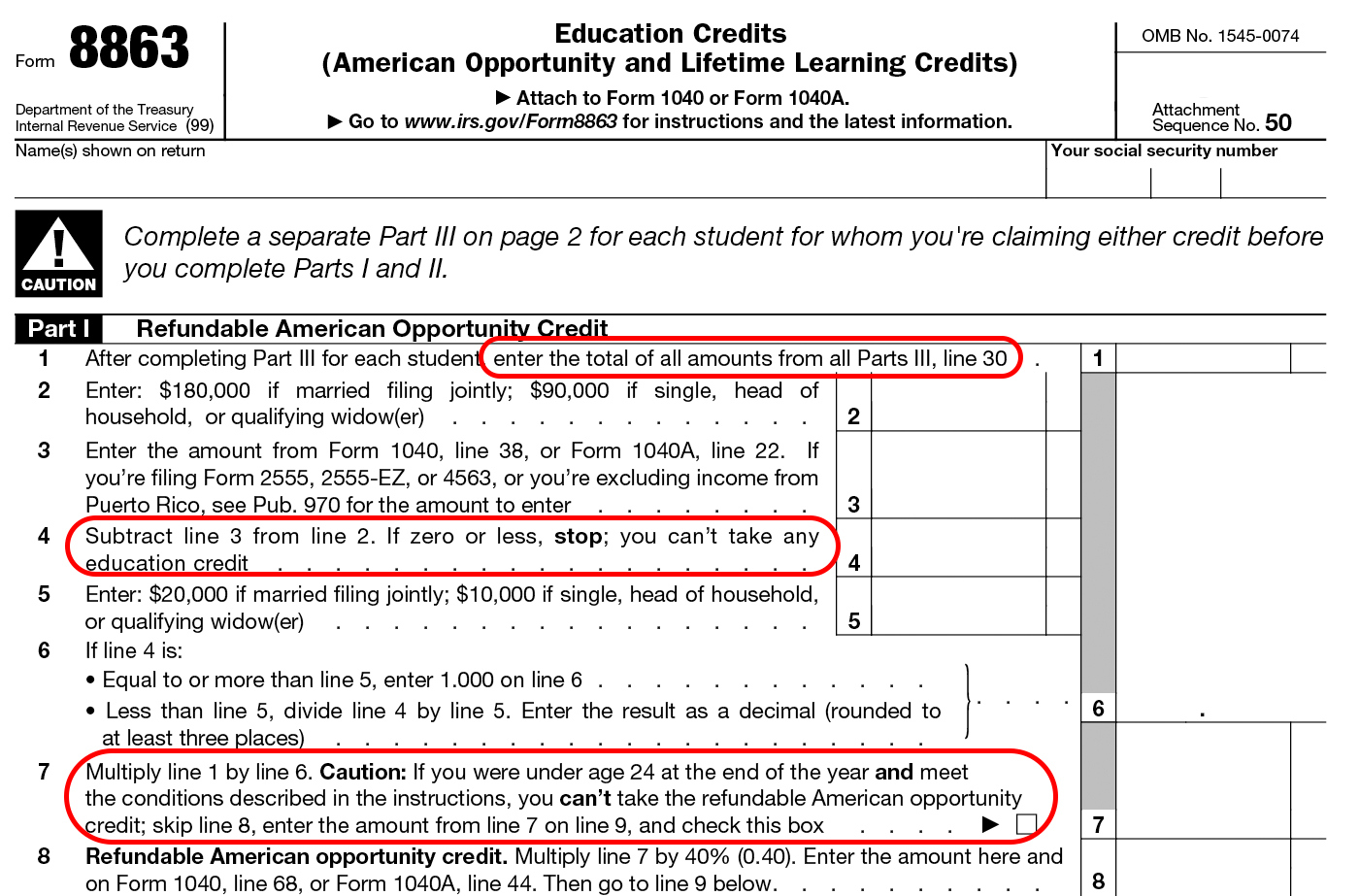

Form 8863 Instructions Information On The Education 1040 Form Printable

Ainformation about form 8862 and its instructions is at www.irs.gov/form8862. Ad register and subscribe now to work on your irs form 8862 & more fillable forms. Information to claim certain refundable credits. Ask your own tax question Filing this form allows you to reclaim credits for which you are now eligible.

Form 8862 Earned Tax Credit Government Finances

The irs defines a qualifying child as the child, an eligible foster child, brother, sister or descendant of the taxpayer's child, brother or sister. Select search, enter form 8862, and select jump to form 8862; Form 8862 is required when the irs has previously disallowed one or more specific tax credits. June 4, 2019 4:12 pm. Usually they say not.

Top 14 Form 8862 Templates free to download in PDF format

Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits; Web schedule eic schedule eic, which is used to claim the earned income credit with a qualifying child, must be completed prior to filling out form 8862. Meaning, the 8862 should be electronically filed with the 2020 tax return. June 4, 2019.

Inst 8865Instructions for Form 8865, Return of U.S. Persons With Res…

Do not make changes to the name, content, or sequence of the data elements and instructions we provide on our website; June 4, 2019 4:12 pm. (1) your eic was reduced or disallowed for any reason other than a math or clerical error for a year after 1996; Get ready for tax season deadlines by completing any required tax forms.

37 INFO PRINTABLE TAX FORM 8862 PDF ZIP DOCX PRINTABLE DOWNLOAD * Tax

Web generally, you must attach the form 8862 to your 2020 tax return for the eic. You can download form 8862 from the irs website, and can file it electronically or by mail. And don't send an amended return unless the letter tells you to. Allocation of refund (including savings bond purchases) form 8889: Filing this form allows you to.

Web Satisfied 119 Votes What Makes The Form 8862 Pdf Legally Binding?

Filing this form allows you to reclaim credits for which you are now eligible. June 4, 2019 4:12 pm. Ask your own tax question Complete, edit or print tax forms instantly.

43A Name(S) Shown On Return Your Social Security.

(1) your eic was reduced or disallowed for any reason other than a math or clerical error for a year after 1996; Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits; (2) you now want to claim. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862.

Submitting Irs 8862 Does Not Really Have To Be Confusing Any Longer.

Click on eic/ctc/aoc after disallowances (8862). Usually they say not to amend your return. Form 8862 is required when the irs has previously disallowed one or more specific tax credits. And don't send an amended return unless the letter tells you to.

The Irs Form 8862 Isn’t An Exception.

You'll come to the earned income credit section. You can download form 8862 from the irs website, and can file it electronically or by mail. For more information, please click this link: The irs defines a qualifying child as the child, an eligible foster child, brother, sister or descendant of the taxpayer's child, brother or sister.